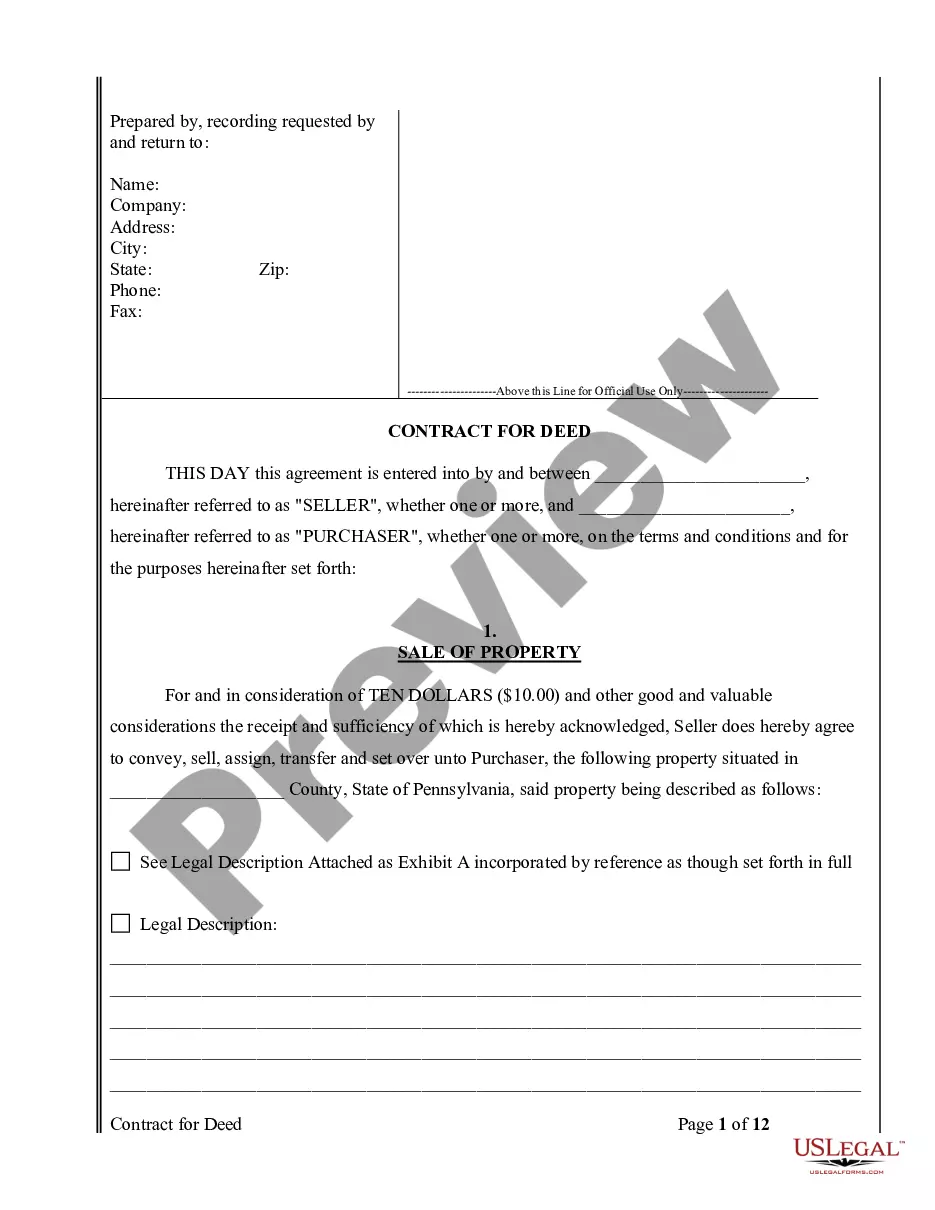

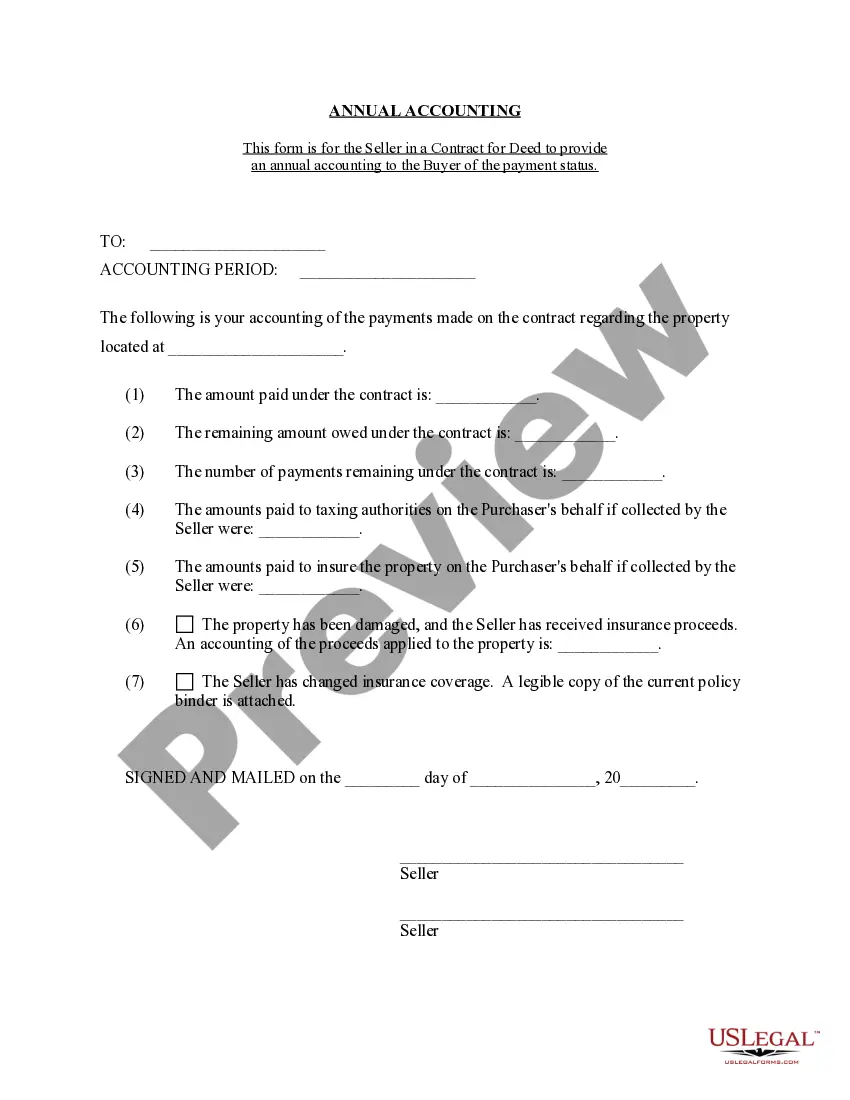

The Allegheny Pennsylvania Contract for Deed Seller's Annual Accounting Statement is a legal document aimed at providing a comprehensive financial overview for sellers and buyers involved in a contract for deed transaction in Allegheny County, Pennsylvania. This statement is crucial for maintaining transparency and documenting the financial activities related to the property's sale. The Allegheny Pennsylvania Contract for Deed Seller's Annual Accounting Statement contains various essential sections and information that guarantee a clear understanding of the financial aspects of the contract. The statement typically includes the following key details: 1. Parties Involved: Clearly identifies the seller (also known as the vendor) and the buyer (also known as the Vendée) in the contract for deed agreement. Additional information such as addresses and contact details may also be included. 2. Property Description: Outlines the specific details of the property subject to the contract for deed, including its address, legal description, and any other relevant identifying information. 3. Payment Summary: Presents a detailed breakdown of all the payments made by the buyer to the seller during the accounting period. This may include installment payments, interest charges, any penalties, or other fees associated with late or missed payments. 4. Principal Balance: Specifies the outstanding principal amount owed by the buyer to the seller at the end of the accounting period. This balance may decrease over time as the buyer makes regular payments. 5. Interest Accrued: Indicates the interest accrued on the principal balance during the accounting period. It reflects the interest rate agreed upon in the contract for deed and is typically calculated based on the remaining balance. 6. Additional Charges and Expenses: Details any additional charges or expenses incurred by the buyer, such as property taxes, insurance premiums, maintenance fees, or other agreed-upon costs. These charges, if applicable, are included to give a complete picture of the financial obligations associated with the property. 7. Disclosure of Default: Informs both parties about any defaults, breaches, or violations of the contract for deed terms. This disclosure ensures transparency and enables resolution of any issues that may arise. Different types or variations of the Allegheny Pennsylvania Contract for Deed Seller's Annual Accounting Statement may exist based on specific contract modifications or additional clauses included by the parties involved. For instance, some contracts may include provisions for the seller to provide a more comprehensive breakdown of expenses and charges, or additional performance metrics specific to the property or the parties' agreement. Overall, the Allegheny Pennsylvania Contract for Deed Seller's Annual Accounting Statement is a critical document that enables transparency and accountability in contract for deed transactions. It helps both the buyer and seller maintain an accurate record of their financial dealings and serves as a reference point for potential dispute resolution.

Allegheny Pennsylvania Contract for Deed Seller's Annual Accounting Statement

Description

How to fill out Allegheny Pennsylvania Contract For Deed Seller's Annual Accounting Statement?

We always want to reduce or avoid legal damage when dealing with nuanced legal or financial matters. To do so, we apply for legal services that, as a rule, are very expensive. However, not all legal matters are equally complex. Most of them can be dealt with by ourselves.

US Legal Forms is a web-based collection of updated DIY legal forms covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your matters into your own hands without the need of using services of legal counsel. We offer access to legal form templates that aren’t always openly accessible. Our templates are state- and area-specific, which significantly facilitates the search process.

Benefit from US Legal Forms whenever you need to find and download the Allegheny Pennsylvania Contract for Deed Seller's Annual Accounting Statement or any other form quickly and securely. Simply log in to your account and click the Get button next to it. If you happened to lose the form, you can always download it again from within the My Forms tab.

The process is equally easy if you’re unfamiliar with the website! You can register your account within minutes.

- Make sure to check if the Allegheny Pennsylvania Contract for Deed Seller's Annual Accounting Statement complies with the laws and regulations of your your state and area.

- Also, it’s imperative that you check out the form’s description (if provided), and if you notice any discrepancies with what you were looking for in the first place, search for a different template.

- As soon as you’ve ensured that the Allegheny Pennsylvania Contract for Deed Seller's Annual Accounting Statement would work for your case, you can choose the subscription option and proceed to payment.

- Then you can download the form in any suitable format.

For more than 24 years of our presence on the market, we’ve helped millions of people by offering ready to customize and up-to-date legal forms. Make the most of US Legal Forms now to save efforts and resources!