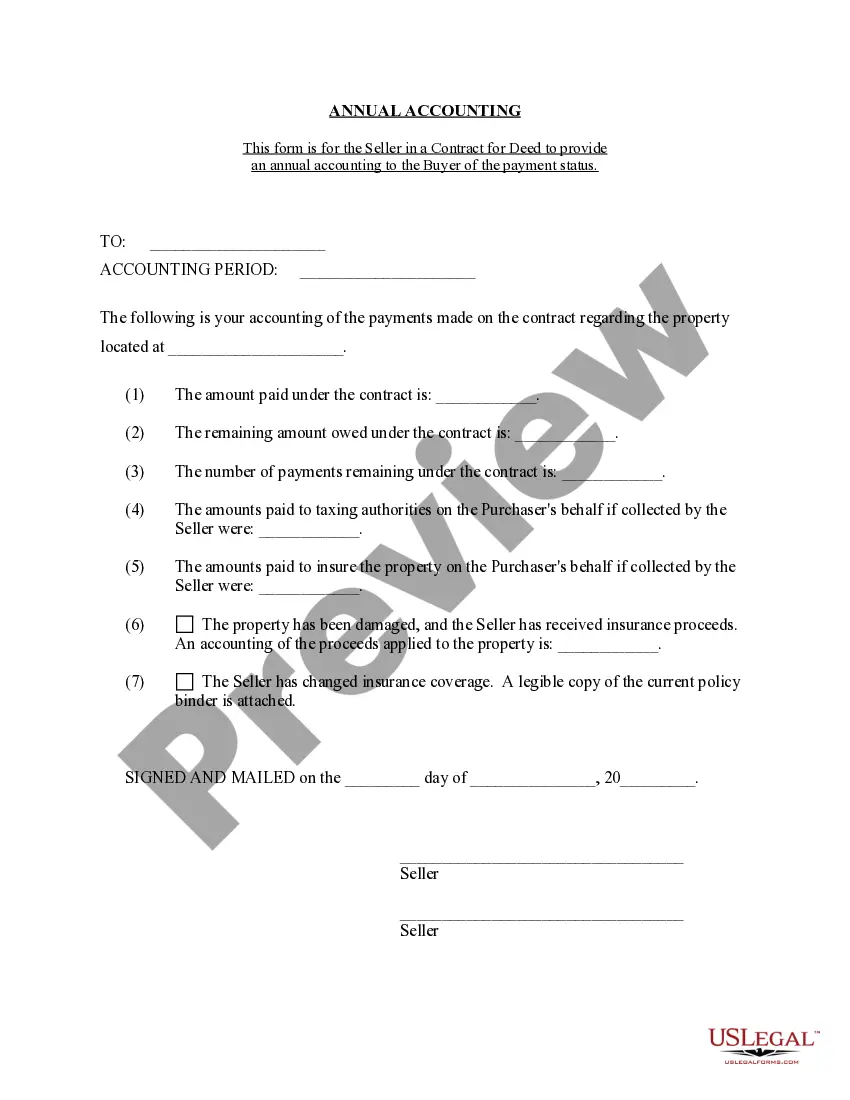

The Allentown Pennsylvania Contract for Deed Seller's Annual Accounting Statement is an essential document that outlines the financial transactions and records of a seller in a contract for deed agreement in Allentown, Pennsylvania. This statement provides a detailed breakdown of income, expenses, and other financial information pertaining to the sale of property under a contract for deed arrangement. The primary purpose of the Allentown Pennsylvania Contract for Deed Seller's Annual Accounting Statement is to offer transparency and accountability between the seller and buyer. It ensures that the seller provides an accurate and comprehensive report of the financial activities related to the contract for deed, allowing the buyer to assess the property's financial performance. Typically, the Allentown Pennsylvania Contract for Deed Seller's Annual Accounting Statement includes the following key elements: 1. Property Information: This section includes details about the property subject to the contract for deed, such as the address, legal description, and parcel number. 2. Seller's Income: Here, the seller lists all income generated from the contract for deed, including monthly installments, late fees, interest charges, and any additional payments received. 3. Seller's Expenses: This section outlines all expenses incurred by the seller related to the property, such as property taxes, insurance, maintenance costs, utilities, and repairs. It provides a comprehensive breakdown of the funds spent to maintain the property during the accounting period. 4. Outstanding Balances: If there are outstanding balances due from the buyer, this section includes a clear record of any outstanding payments, penalties, or interest owed. It helps track and reconcile the buyer's account with the seller. 5. Tax Information: This part includes relevant tax information, such as property tax payments made by the seller or any tax liabilities associated with the property. 6. Additional Notes: The Allentown Pennsylvania Contract for Deed Seller's Annual Accounting Statement may include a space for the seller to provide any additional notes or explanations regarding the financial transactions throughout the accounting period. The Allentown Pennsylvania Contract for Deed Seller's Annual Accounting Statement helps establish transparency and trust between the seller and buyer, ensuring an accurate representation of the property's financial performance. It is crucial for both parties to review and retain copies of the statement regularly. While there may not be different types of Allentown Pennsylvania Contract for Deed Seller's Annual Accounting Statement, variations may exist depending on specific contractual arrangements or additional requirements outlined within the contract for deed agreement. It is essential for both the buyer and seller to consult their legal advisors to ensure compliance with relevant legal regulations and create a tailored accounting statement that suits their specific needs.

Allentown Pennsylvania Contract for Deed Seller's Annual Accounting Statement

Description

How to fill out Allentown Pennsylvania Contract For Deed Seller's Annual Accounting Statement?

We always want to minimize or prevent legal issues when dealing with nuanced legal or financial matters. To do so, we apply for attorney services that, usually, are very costly. However, not all legal issues are as just complex. Most of them can be taken care of by ourselves.

US Legal Forms is a web-based collection of up-to-date DIY legal forms covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your matters into your own hands without using services of a lawyer. We provide access to legal form templates that aren’t always openly accessible. Our templates are state- and area-specific, which significantly facilitates the search process.

Benefit from US Legal Forms whenever you need to get and download the Allentown Pennsylvania Contract for Deed Seller's Annual Accounting Statement or any other form easily and securely. Simply log in to your account and click the Get button next to it. In case you lose the form, you can always download it again from within the My Forms tab.

The process is just as effortless if you’re new to the platform! You can create your account within minutes.

- Make sure to check if the Allentown Pennsylvania Contract for Deed Seller's Annual Accounting Statement adheres to the laws and regulations of your your state and area.

- Also, it’s crucial that you check out the form’s description (if available), and if you spot any discrepancies with what you were looking for in the first place, search for a different form.

- Once you’ve ensured that the Allentown Pennsylvania Contract for Deed Seller's Annual Accounting Statement is proper for your case, you can pick the subscription plan and proceed to payment.

- Then you can download the form in any available file format.

For more than 24 years of our existence, we’ve helped millions of people by offering ready to customize and up-to-date legal forms. Take advantage of US Legal Forms now to save efforts and resources!