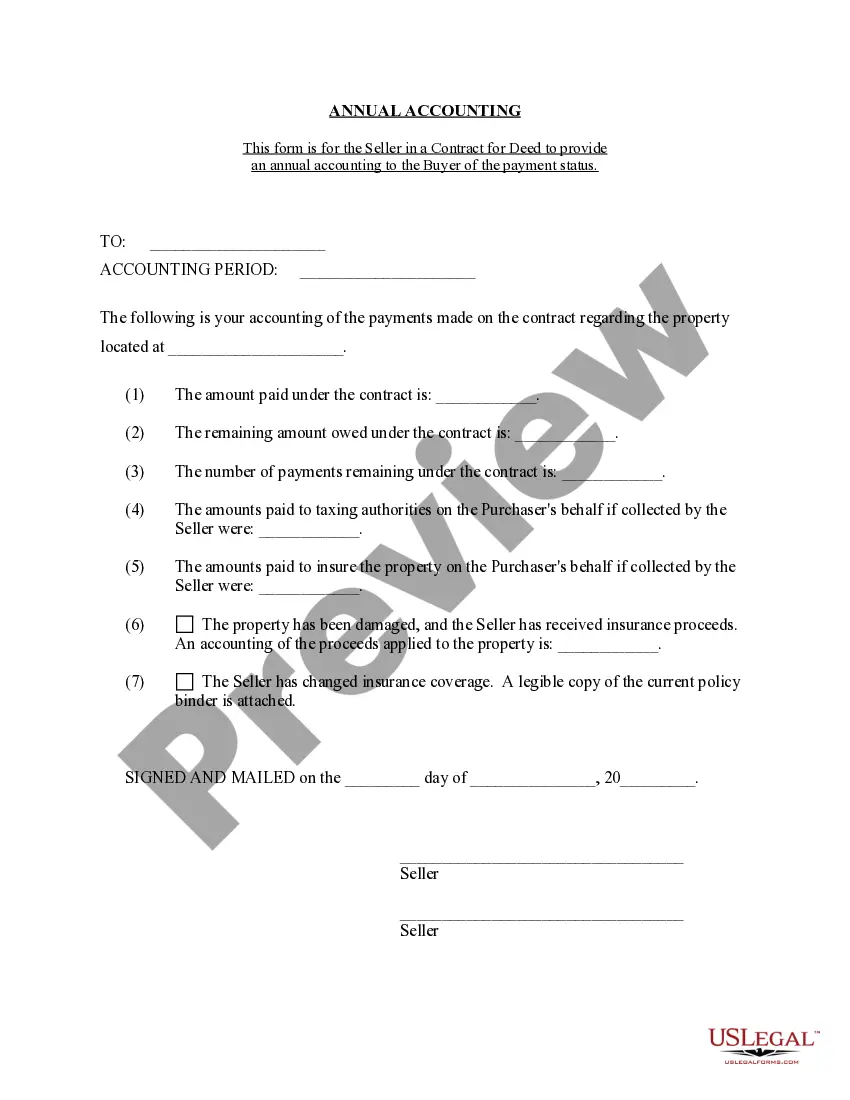

The Philadelphia Pennsylvania Contract for Deed Seller's Annual Accounting Statement is a crucial document that outlines the financial transactions and records related to contracts for deeds in Philadelphia, Pennsylvania. This statement provides a detailed breakdown of the financial activities and transactions between the seller and buyer regarding the contract for deed. This accounting statement serves as a comprehensive summary of the financial obligations, payments, receipts, and any other financial matters pertaining to the contract for deed. It is essential for both the seller and the buyer to maintain accurate and up-to-date records to ensure transparency and accountability. The Philadelphia Pennsylvania Contract for Deed Seller's Annual Accounting Statement encompasses various key elements and information. It typically includes details of the payments received from the buyer, such as principal, interest, and any additional fees or charges. It also outlines any expenses incurred by the seller, such as taxes, insurance, and maintenance costs related to the property under the contract for deed. Furthermore, this accounting statement may include a breakdown of any escrow funds held by the seller or a designated third party. It should specify the purpose of these funds, such as property taxes or insurance premiums paid on behalf of the buyer. Different types of Philadelphia Pennsylvania Contract for Deed Seller's Annual Accounting Statements may vary based on the specific terms and conditions outlined in the contract for deed agreement. For instance, some contracts may include provisions for additional expenses, such as repairs or improvements made to the property. In such cases, the annual accounting statement may reflect these additional costs and adjustments. Keywords: Philadelphia Pennsylvania, Contract for Deed, Seller's Annual Accounting Statement, financial transactions, records, payments, receipts, financial obligations, transparency, accountability, principal, interest, fees, charges, expenses, taxes, insurance, maintenance costs, property, escrow funds, terms and conditions, provisions, repairs, improvements.

Philadelphia Annual

Description

How to fill out Philadelphia Pennsylvania Contract For Deed Seller's Annual Accounting Statement?

Benefit from the US Legal Forms and have instant access to any form you need. Our beneficial platform with thousands of document templates makes it easy to find and obtain almost any document sample you need. You are able to download, complete, and certify the Philadelphia Pennsylvania Contract for Deed Seller's Annual Accounting Statement in just a matter of minutes instead of browsing the web for hours attempting to find a proper template.

Using our library is a wonderful strategy to raise the safety of your record filing. Our experienced lawyers on a regular basis check all the records to make certain that the forms are appropriate for a particular state and compliant with new laws and polices.

How do you get the Philadelphia Pennsylvania Contract for Deed Seller's Annual Accounting Statement? If you have a subscription, just log in to the account. The Download option will appear on all the documents you look at. Moreover, you can find all the previously saved records in the My Forms menu.

If you don’t have an account yet, stick to the tips below:

- Find the form you need. Make certain that it is the form you were hoping to find: check its headline and description, and use the Preview feature if it is available. Otherwise, use the Search field to look for the appropriate one.

- Launch the downloading procedure. Click Buy Now and select the pricing plan that suits you best. Then, sign up for an account and process your order using a credit card or PayPal.

- Export the file. Choose the format to get the Philadelphia Pennsylvania Contract for Deed Seller's Annual Accounting Statement and modify and complete, or sign it according to your requirements.

US Legal Forms is probably the most significant and reliable document libraries on the internet. We are always happy to help you in virtually any legal procedure, even if it is just downloading the Philadelphia Pennsylvania Contract for Deed Seller's Annual Accounting Statement.

Feel free to take advantage of our platform and make your document experience as efficient as possible!