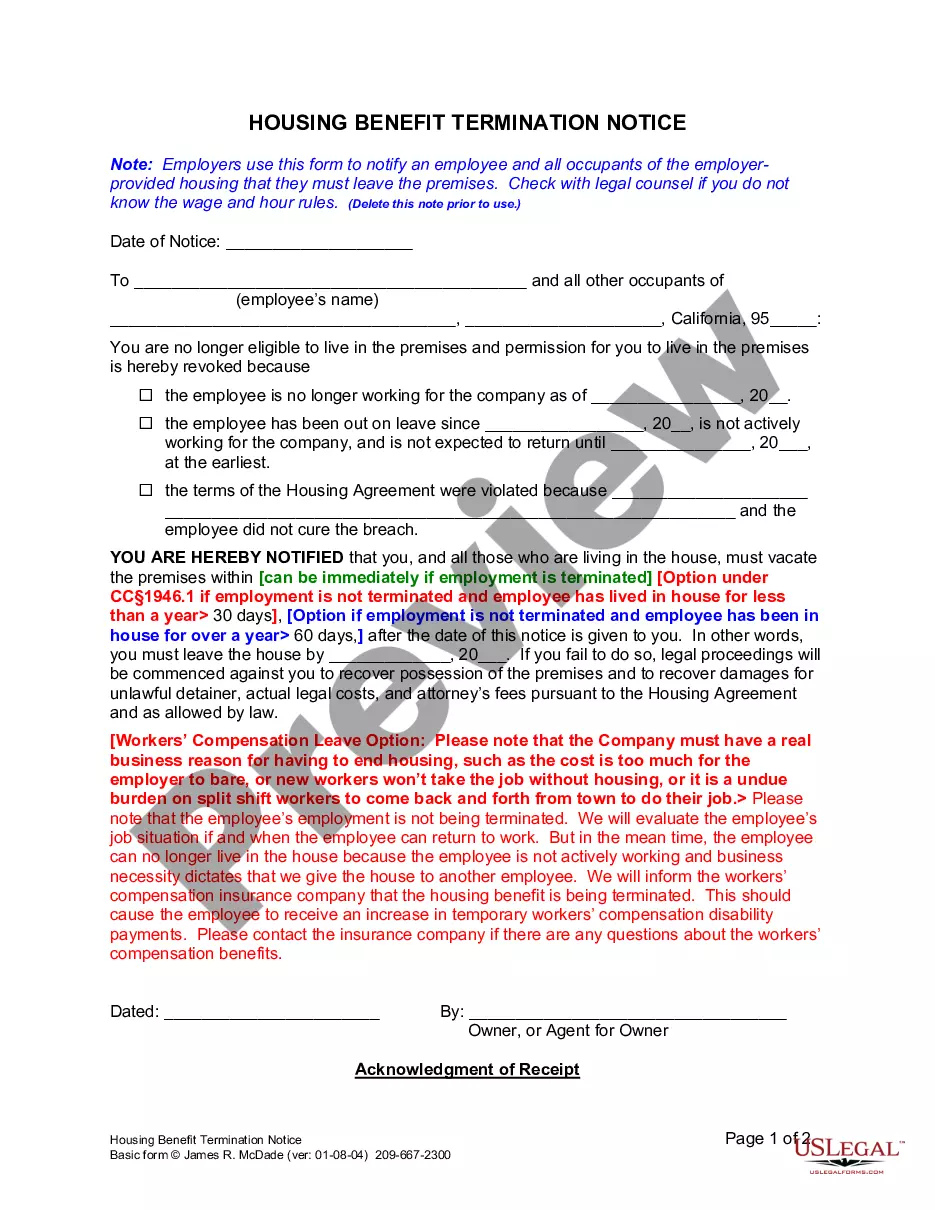

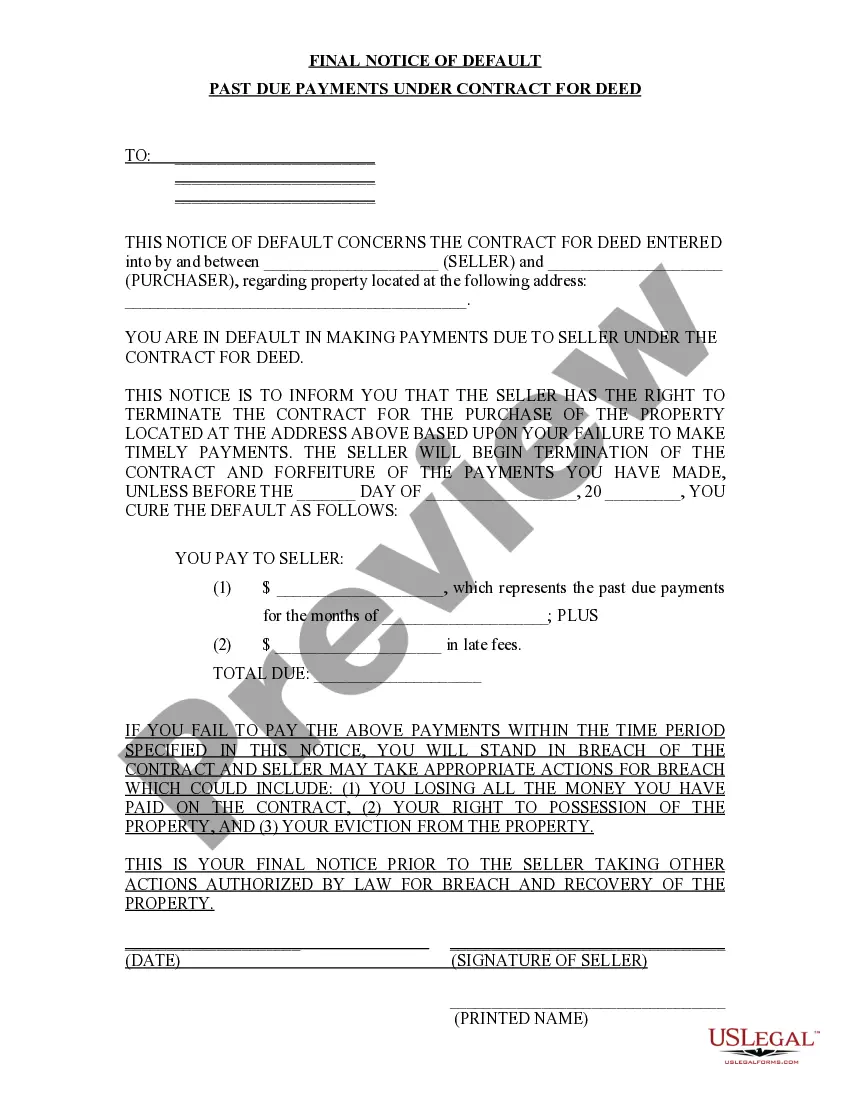

Allegheny Pennsylvania Final Notice of Default for Past Due Payments in connection with Contract for Deed is a legal document sent to a borrower who has failed to make the required payments under a Contract for Deed agreement. This notice serves as a formal warning that the borrower is in breach of the contract and has a specified period to cure the default before further legal action is initiated. In Allegheny County, Pennsylvania, there may be different types of Final Notice of Default for Past Due Payments in connection with Contract for Deed, including: 1) Residential Contract for Deed Default Notice: This notice is specific to residential properties where a buyer agrees to purchase a property through installments, with the seller maintaining legal ownership until the full payment is made. If the buyer fails to make the required payments, this notice is sent to inform them of the default. 2) Commercial Contract for Deed Default Notice: Similar to the residential notice, this type of notice concerns commercial properties where a buyer and seller enter into a Contract for Deed agreement. If the buyer fails to make timely payments, this notice is issued, indicating the default and providing an opportunity to cure it. 3) Land Contract for Deed Default Notice: This notice applies to cases where a buyer agrees to purchase land through periodic payments governed by the terms of a Contract for Deed. If the buyer defaults on the payments, this notice is sent to the buyer as a warning of the consequences of the default. The Allegheny Pennsylvania Final Notice of Default for Past Due Payments in connection with Contract for Deed contains essential information, including: a) Identification of the parties involved in the Contract for Deed. b) Details of the property or land covered by the agreement. c) Specific terms and conditions of the Contract for Deed, including the payment schedule, interest rate, and consequences for default. d) Mention of the past-due payments and the amount overdue. e) A warning that failure to cure the default within a specified timeframe will result in further legal action, which may include foreclosure proceedings. f) Instructions on how the borrower can cure the default and bring the contract back into good standing. g) Contact information for the lender or seller for any inquiries or to discuss the default. It is crucial for recipients of a Final Notice of Default for Past Due Payments in connection with Contract for Deed to carefully review the notice, seek legal advice if necessary, and take prompt action to rectify the default to avoid more severe consequences, such as foreclosure or litigation.

Allegheny Pennsylvania Final Notice of Default for Past Due Payments in connection with Contract for Deed

Description

How to fill out Allegheny Pennsylvania Final Notice Of Default For Past Due Payments In Connection With Contract For Deed?

We always want to minimize or avoid legal damage when dealing with nuanced legal or financial affairs. To accomplish this, we sign up for legal solutions that, usually, are extremely costly. Nevertheless, not all legal matters are equally complex. Most of them can be taken care of by ourselves.

US Legal Forms is an online library of up-to-date DIY legal forms addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your affairs into your own hands without the need of turning to legal counsel. We offer access to legal form templates that aren’t always openly available. Our templates are state- and area-specific, which considerably facilitates the search process.

Benefit from US Legal Forms whenever you need to get and download the Allegheny Pennsylvania Final Notice of Default for Past Due Payments in connection with Contract for Deed or any other form easily and securely. Simply log in to your account and click the Get button next to it. If you happened to lose the form, you can always re-download it in the My Forms tab.

The process is just as easy if you’re unfamiliar with the platform! You can create your account within minutes.

- Make sure to check if the Allegheny Pennsylvania Final Notice of Default for Past Due Payments in connection with Contract for Deed adheres to the laws and regulations of your your state and area.

- Also, it’s imperative that you go through the form’s description (if available), and if you notice any discrepancies with what you were looking for in the first place, search for a different form.

- As soon as you’ve made sure that the Allegheny Pennsylvania Final Notice of Default for Past Due Payments in connection with Contract for Deed is suitable for your case, you can pick the subscription option and make a payment.

- Then you can download the form in any available format.

For over 24 years of our presence on the market, we’ve served millions of people by providing ready to customize and up-to-date legal forms. Take advantage of US Legal Forms now to save efforts and resources!