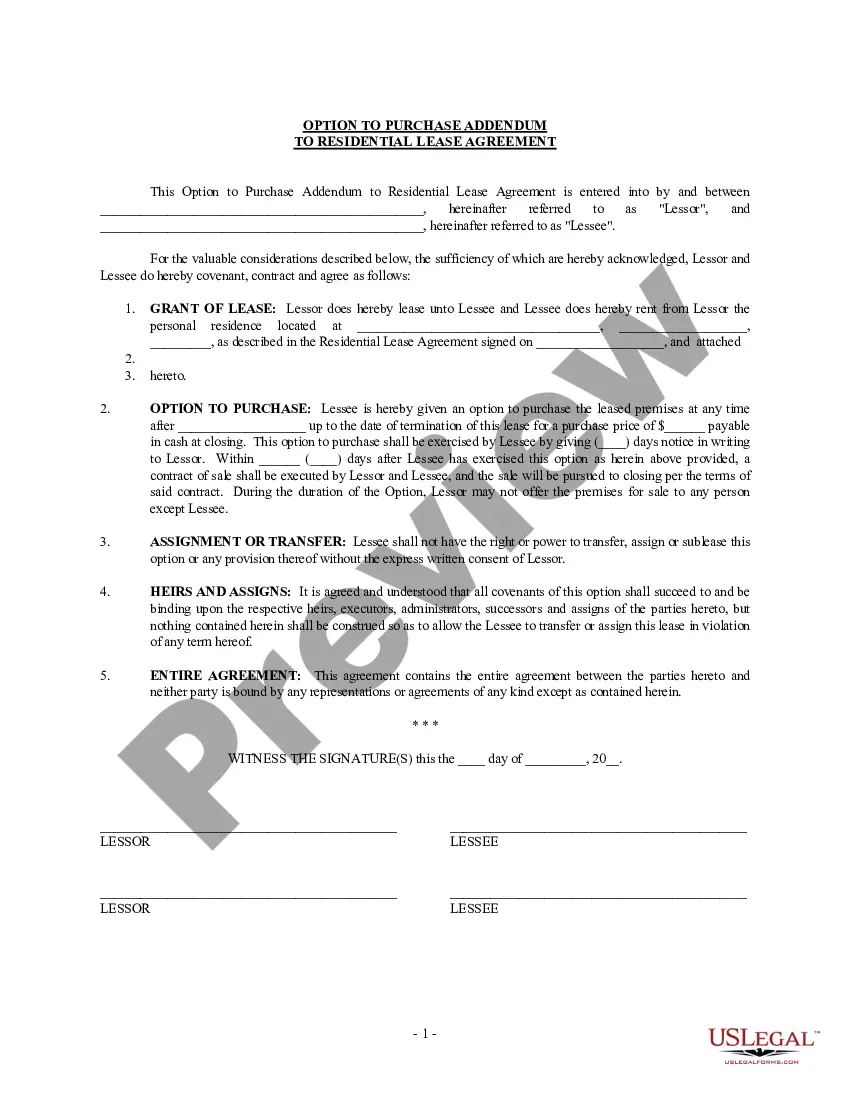

This Option to Purchase Addendum to Residential and Lease Agreement is entered into by and between the lessor and the lessee. The lessor agrees not to offer the residence for sale to anyone during the term of the lease, and to give the lessee (tenant) the option to purchase the residence at any time prior to the expiration of the lease, provided the lessee gives notice of intent to purchase in accordance with the provisions of the Addendum. At that point, a separate contract of sale will be executed and the sale will proceed as any sale would.

Please note: This Addendum form is NOT a lease agreement. You will need a separate Residential Lease Agreement. The Addendum would be attached to that Agreement

A Philadelphia Pennsylvania Option to Purchase Addendum to Residential Lease — Lease or Rent to Own is a legal document that offers tenants an opportunity to potentially purchase the property they are currently leasing at a later date. This addendum functions as an amendment to the original residential lease agreement, outlining the terms and conditions of this lease-to-own arrangement. There are various types of Philadelphia Pennsylvania Option to Purchase Addendum to Residential Lease — Lease or Rent to Own, such as: 1. Fixed Purchase Price Addendum: This type of addendum specifies a predetermined purchase price for the property, which remains constant throughout the lease term. Both the tenant and landlord agree on this fixed price upfront, eliminating any ambiguity or uncertainties regarding the property's value at the end of the lease. 2. Adjustable Purchase Price Addendum: Unlike the fixed purchase price addendum, this type allows for adjustments in the purchase price based on certain criteria. These criteria might include changes in the market value of the property or agreed-upon appraisal methods. It provides flexibility for both parties to negotiate and align the purchase price with market fluctuations. 3. Percentage of Rent Credit Addendum: This addendum outlines the portion of monthly rent payments that will be credited towards the eventual purchase of the property. For example, if the agreed percentage is 25% and the monthly rent is $1,000, then $250 will be accumulated as credit towards the property's down payment or final purchase price. This addendum enables the tenant to build equity slowly while renting. 4. Option Fee Addendum: This type of lease-to-own agreement requires the tenant to pay an upfront fee, known as an option fee, for the right to purchase the property at a later date. The option fee is usually non-refundable and serves as compensation to the landlord for taking the property off the market during the lease term. It also secures the tenant's exclusive option to buy the property within a specified timeframe. When considering a Philadelphia Pennsylvania Option to Purchase Addendum to Residential Lease — Lease or Rent to Own, it is crucial for both tenants and landlords to seek legal advice to understand their rights and obligations. This addendum should clearly outline the purchase price, terms of the lease arrangement, and any additional conditions, such as maintenance responsibilities, repairs, or potential penalties for defaulting on the agreement. In conclusion, a Philadelphia Pennsylvania Option to Purchase Addendum to Residential Lease — Lease or Rent to Own provides a unique opportunity for tenants to become homeowners while offering landlords a potential exit strategy.A Philadelphia Pennsylvania Option to Purchase Addendum to Residential Lease — Lease or Rent to Own is a legal document that offers tenants an opportunity to potentially purchase the property they are currently leasing at a later date. This addendum functions as an amendment to the original residential lease agreement, outlining the terms and conditions of this lease-to-own arrangement. There are various types of Philadelphia Pennsylvania Option to Purchase Addendum to Residential Lease — Lease or Rent to Own, such as: 1. Fixed Purchase Price Addendum: This type of addendum specifies a predetermined purchase price for the property, which remains constant throughout the lease term. Both the tenant and landlord agree on this fixed price upfront, eliminating any ambiguity or uncertainties regarding the property's value at the end of the lease. 2. Adjustable Purchase Price Addendum: Unlike the fixed purchase price addendum, this type allows for adjustments in the purchase price based on certain criteria. These criteria might include changes in the market value of the property or agreed-upon appraisal methods. It provides flexibility for both parties to negotiate and align the purchase price with market fluctuations. 3. Percentage of Rent Credit Addendum: This addendum outlines the portion of monthly rent payments that will be credited towards the eventual purchase of the property. For example, if the agreed percentage is 25% and the monthly rent is $1,000, then $250 will be accumulated as credit towards the property's down payment or final purchase price. This addendum enables the tenant to build equity slowly while renting. 4. Option Fee Addendum: This type of lease-to-own agreement requires the tenant to pay an upfront fee, known as an option fee, for the right to purchase the property at a later date. The option fee is usually non-refundable and serves as compensation to the landlord for taking the property off the market during the lease term. It also secures the tenant's exclusive option to buy the property within a specified timeframe. When considering a Philadelphia Pennsylvania Option to Purchase Addendum to Residential Lease — Lease or Rent to Own, it is crucial for both tenants and landlords to seek legal advice to understand their rights and obligations. This addendum should clearly outline the purchase price, terms of the lease arrangement, and any additional conditions, such as maintenance responsibilities, repairs, or potential penalties for defaulting on the agreement. In conclusion, a Philadelphia Pennsylvania Option to Purchase Addendum to Residential Lease — Lease or Rent to Own provides a unique opportunity for tenants to become homeowners while offering landlords a potential exit strategy.