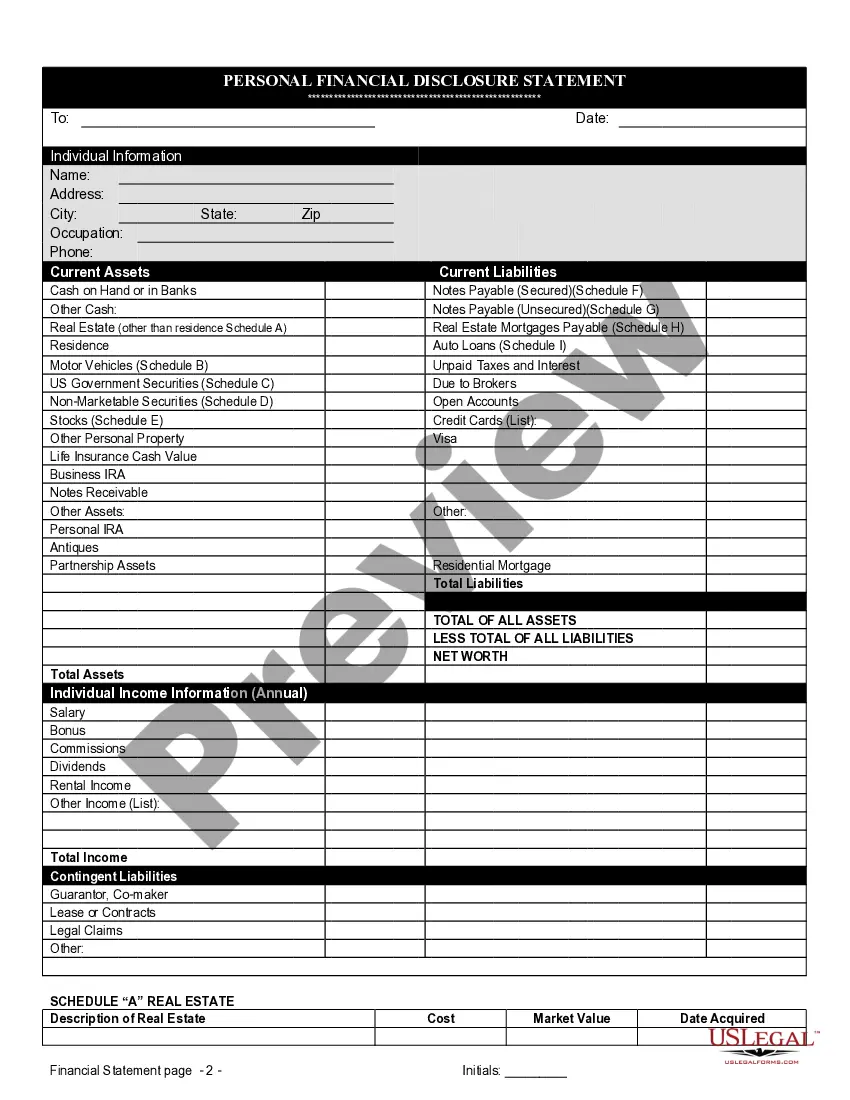

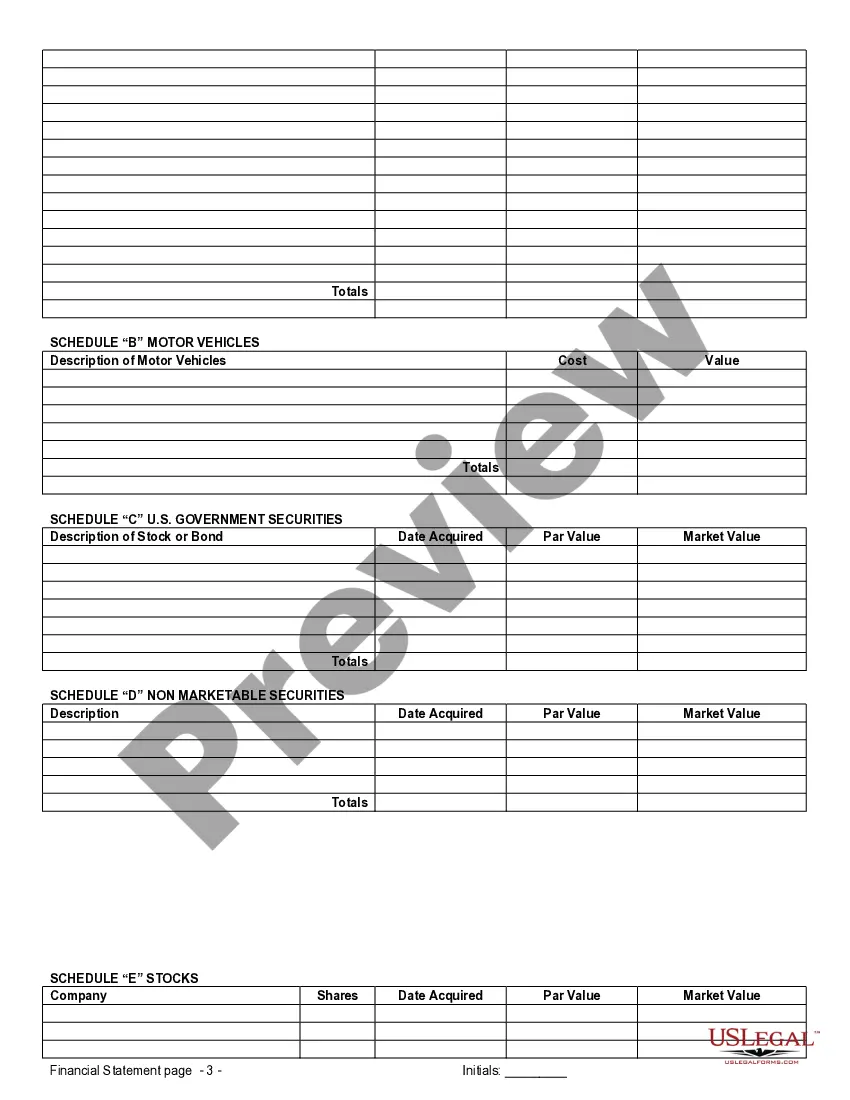

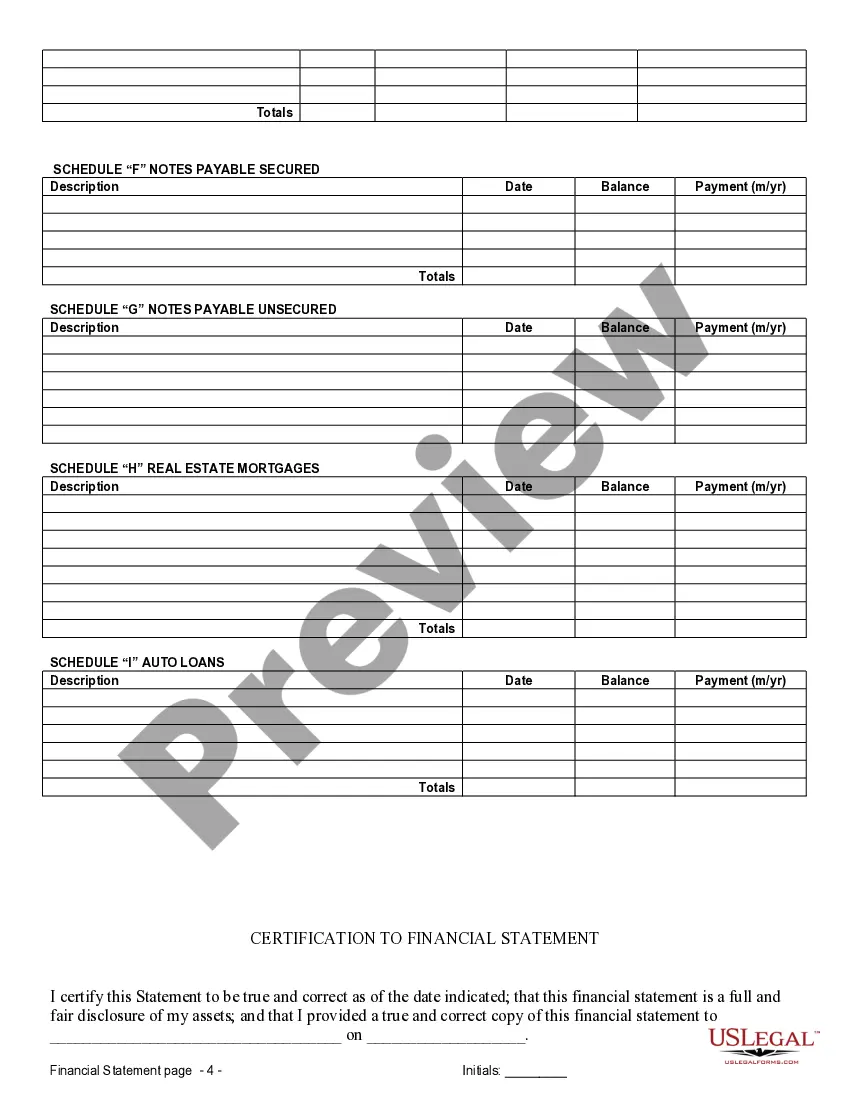

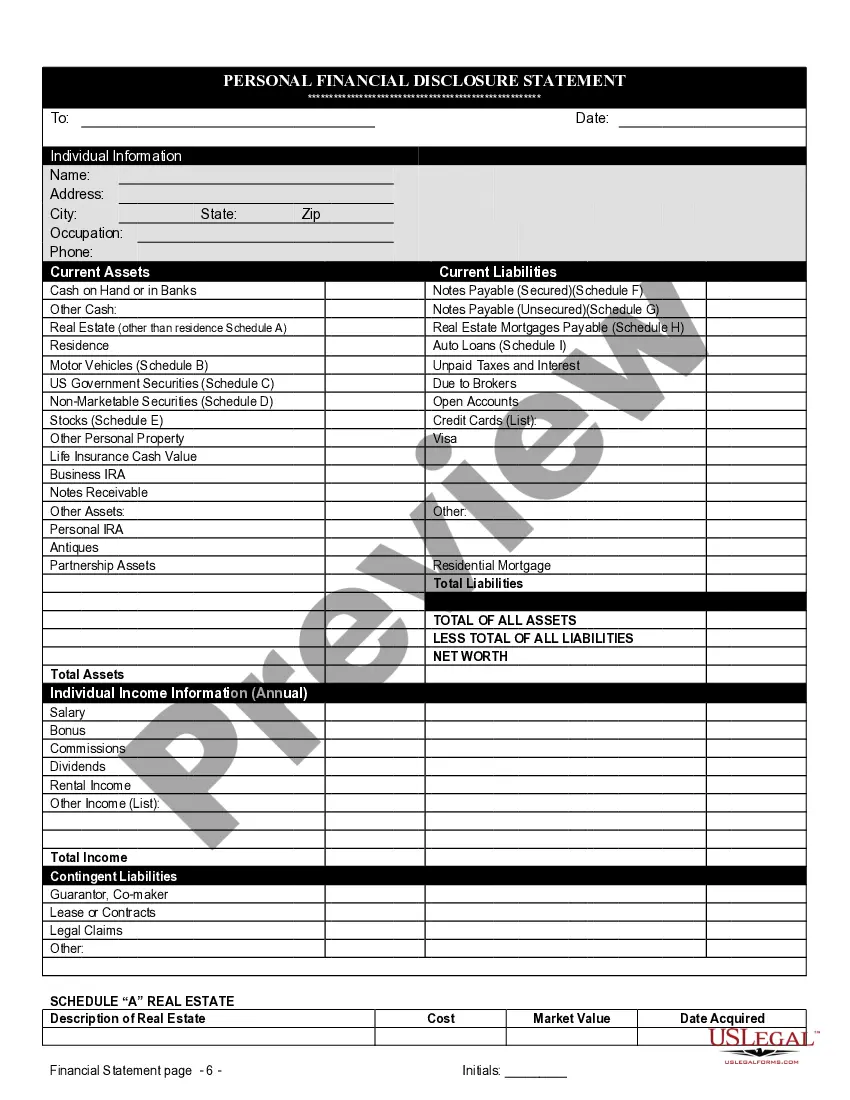

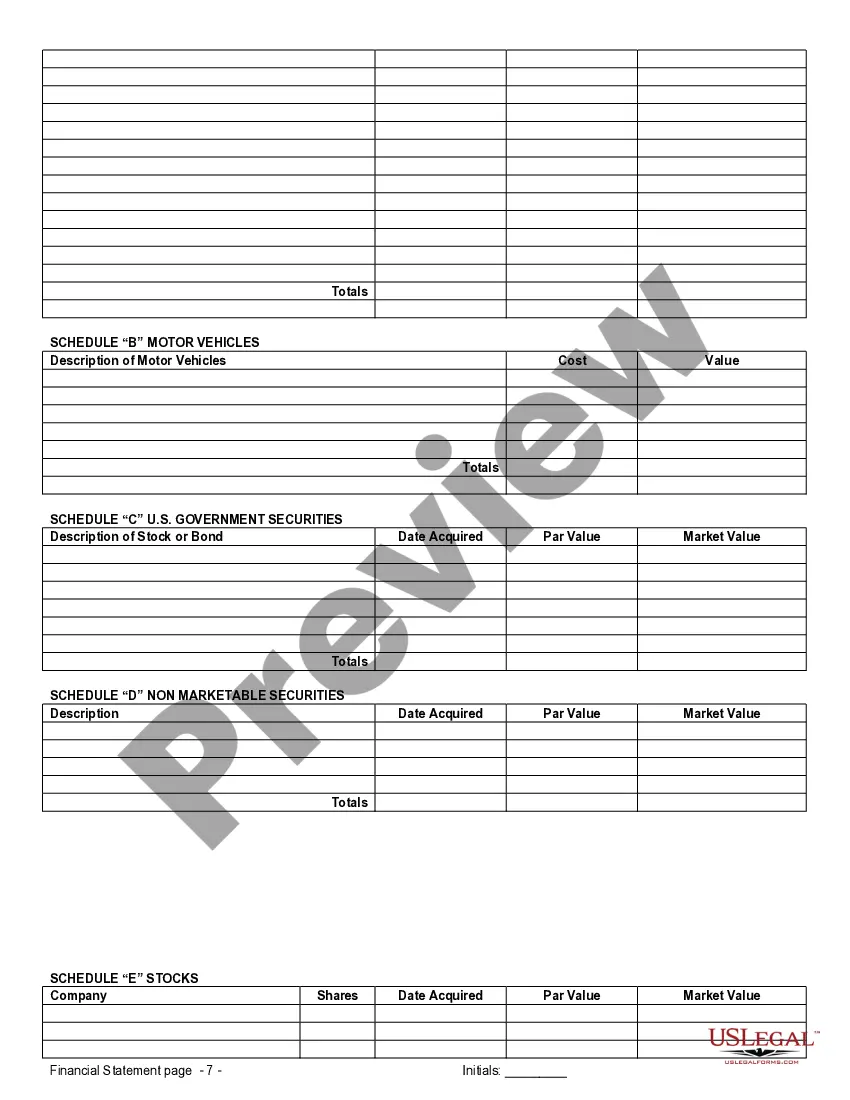

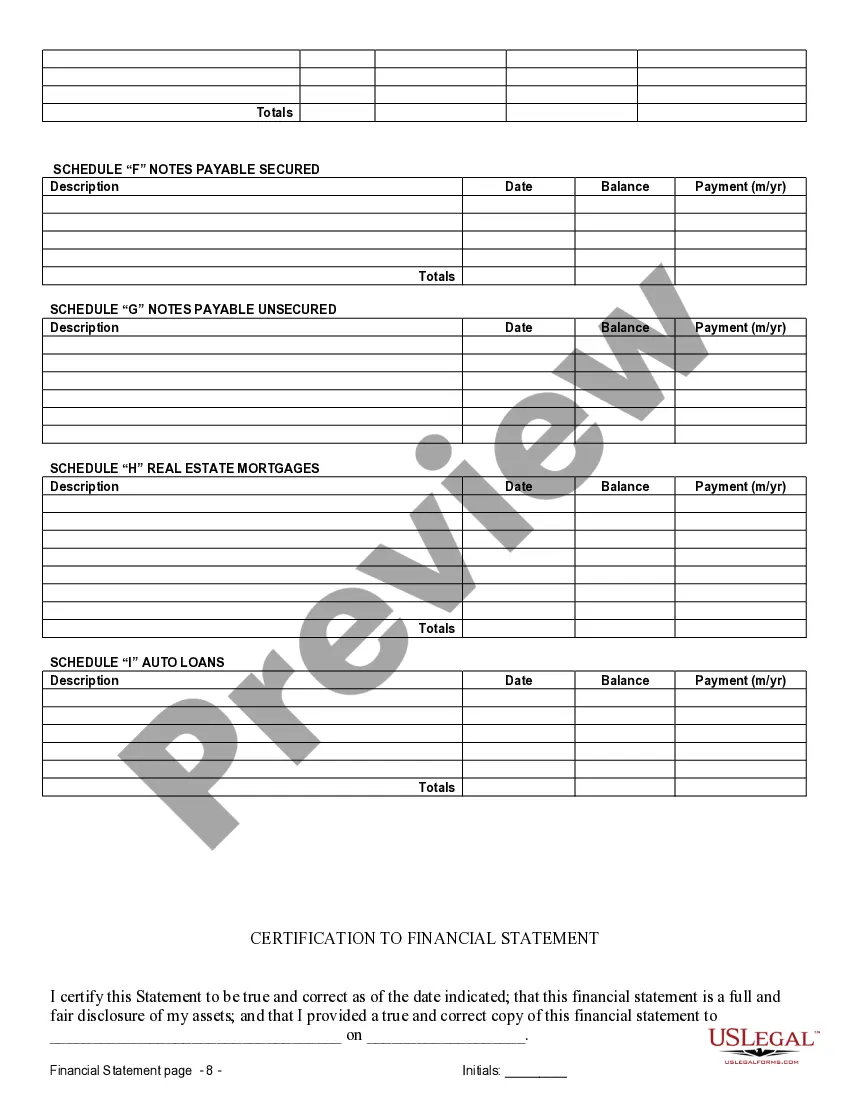

When entering into a prenuptial or premarital agreement in Philadelphia, Pennsylvania, it is important to include accurate and comprehensive financial statements to ensure transparency and protection for both parties involved. These financial statements explicitly document the financial assets, liabilities, income, and expenses of each individual before marriage, providing a holistic overview of their financial profiles. These statements play a crucial role in determining the division of property and assets in case of separation or divorce, establishing a fair and equitable agreement. There are several types of Philadelphia Pennsylvania Financial Statements only in connection with prenuptial or premarital agreements. Let's explore these different variations: 1. Personal Financial Statement: This document outlines an individual's financial position, including cash and bank accounts, investments, real estate holdings, retirement plans, and any outstanding debts. It may also include information regarding income, tax returns, and expenses. 2. Business Financial Statement: If one or both parties own a business, this statement provides details about its financial status, including the company's assets, liabilities, income, and expenses. It may also encompass information on business partnerships, loans, and any pending lawsuits or legal obligations. 3. Real Estate Financial Statement: If real estate properties are involved, this statement lists all properties owned individually or jointly by the parties. It includes details like the property's market value, outstanding mortgages or loans, rental income, property taxes, and any maintenance or repair expenses. 4. Retirement Account Statement: This statement focuses on retirement accounts, such as individual retirement accounts (IRAs), 401(k)s, pensions, or other investment plans. It provides information on the current balance, contributions, investment performance, and any outstanding loans or withdrawal restrictions. 5. Bank and Investment Account Statements: This category includes statements from all bank accounts, investment accounts, mutual funds, stocks, or bonds owned by the parties. These statements offer insights into the liquidity and value of these financial assets. 6. Debt and Liability Statement: This statement discloses any outstanding debts or liabilities, such as credit card debt, loans (student, car, or mortgage), or personal guarantees. It outlines the individual's obligations and financial responsibilities that the other party needs to be aware of before entering into the agreement. It is important to note that these financial statements require utmost accuracy and honesty, as they form the basis for the prenuptial or premarital agreement. Furthermore, it is advisable to seek professional assistance from a financial advisor or attorney to ensure that these statements are legally sound, comprehensive, and tailored to the specific requirements of the involved parties. In conclusion, Philadelphia Pennsylvania Financial Statements only in connection with prenuptial or premarital agreements offer an in-depth understanding of each individual's financial situation before marriage. These statements play a vital role in establishing fair distribution and protection of assets, debts, and liabilities in the unfortunate event of separation or divorce.

Philadelphia Pennsylvania Financial Statements only in Connection with Prenuptial Premarital Agreement

Description

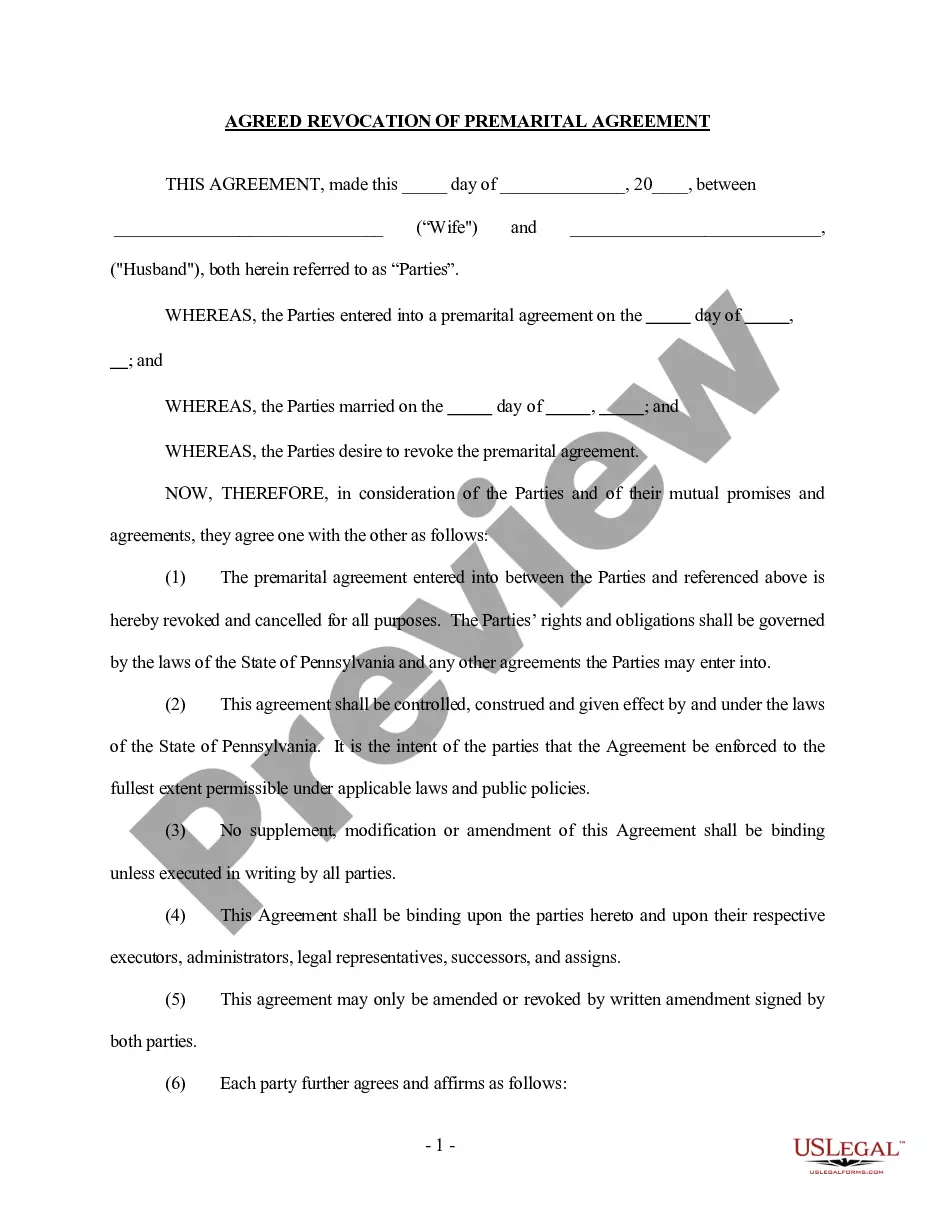

How to fill out Philadelphia Pennsylvania Financial Statements Only In Connection With Prenuptial Premarital Agreement?

We always strive to reduce or prevent legal damage when dealing with nuanced legal or financial affairs. To do so, we sign up for attorney services that, as a rule, are very costly. However, not all legal matters are as just complex. Most of them can be dealt with by ourselves.

US Legal Forms is an online library of up-to-date DIY legal forms addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your affairs into your own hands without the need of using services of legal counsel. We offer access to legal document templates that aren’t always openly available. Our templates are state- and area-specific, which significantly facilitates the search process.

Benefit from US Legal Forms whenever you need to find and download the Philadelphia Pennsylvania Financial Statements only in Connection with Prenuptial Premarital Agreement or any other document quickly and securely. Simply log in to your account and click the Get button next to it. If you happened to lose the document, you can always download it again in the My Forms tab.

The process is just as straightforward if you’re unfamiliar with the website! You can create your account in a matter of minutes.

- Make sure to check if the Philadelphia Pennsylvania Financial Statements only in Connection with Prenuptial Premarital Agreement adheres to the laws and regulations of your your state and area.

- Also, it’s imperative that you check out the form’s description (if available), and if you spot any discrepancies with what you were looking for in the first place, search for a different form.

- As soon as you’ve ensured that the Philadelphia Pennsylvania Financial Statements only in Connection with Prenuptial Premarital Agreement is proper for your case, you can select the subscription plan and make a payment.

- Then you can download the document in any available format.

For more than 24 years of our presence on the market, we’ve served millions of people by providing ready to customize and up-to-date legal forms. Take advantage of US Legal Forms now to save efforts and resources!