Allegheny Pennsylvania Prenuptial Premarital Agreement with Financial Statements is a legal document designed to protect the assets and financial interests of individuals entering into a marriage or civil partnership in Allegheny County, Pennsylvania. This agreement allows the couple to establish clear guidelines regarding the division of property, assets, and debts in the event of a divorce, separation, or death. The Allegheny Pennsylvania Prenuptial Premarital Agreement ensures that each party's rights, obligations, and expectations are clearly defined and agreed upon before entering into a marital union. It provides a comprehensive framework for addressing financial matters, thus preventing potential disputes and disagreements in the future. This agreement can be especially beneficial to individuals with significant assets, family businesses, or children from previous relationships. The key elements covered in the Allegheny Pennsylvania Prenuptial Premarital Agreement include: 1. Division of Property: This agreement outlines how the couple's assets, including real estate, bank accounts, investments, and personal property, will be divided upon divorce or separation. It establishes the terms governing the distribution of property to ensure fairness and clarity. 2. Marital Debts and Liabilities: The agreement defines how existing debts, such as mortgages, loans, and credit card debts, will be allocated between the parties. It specifies who will be responsible for these debts, and to what extent, during and after the marriage. 3. Alimony and Support: The agreement may include provisions regarding spousal support or alimony, stating whether it will be awarded or waived in the event of a divorce or separation. It may also establish the duration and amount of support, considering factors such as income, earning capacity, and financial needs. 4. Inheritance and Estate Planning: This agreement permits parties to address inheritance rights and establish provisions for the distribution of assets upon death. It clarifies how the assets will be passed on to children, heirs, or other designated beneficiaries, ensuring that the protection of each party's intended beneficiaries is upheld. 5. Financial Statements: The Allegheny Pennsylvania Prenuptial Premarital Agreement requires both parties to disclose their respective financial statements, including income, existing assets, debts, and future financial plans. These financial statements not only serve as a reference point for establishing the terms of the agreement but also aid in developing a comprehensive understanding of each party's financial standing. It is important to note that there may be variations of the Allegheny Pennsylvania Prenuptial Premarital Agreement tailored to specific circumstances, including: 1. Prenuptial Agreement for High Net Worth Individuals: This type of agreement is designed for individuals with substantial assets or complex financial portfolios, such as business owners, executives, or those with significant investments. It may include provisions regarding business ownership, intellectual property rights, and the distribution of wealth accumulated during the marriage. 2. Prenuptial Agreement with Child Custody and Support: This variation caters to couples who have children or are expecting children from a prior relationship or from the current relationship. It can cover matters related to child custody, visitation rights, and child support. This type of agreement ensures that the children's best interests are protected while providing financial security for both parents. In summary, the Allegheny Pennsylvania Prenuptial Premarital Agreement with Financial Statements is a crucial legal document that allows couples to establish a clear framework for financial matters, property division, and potential spousal support. It ensures transparency and protection for both parties involved, promoting a more equitable marriage or civil partnership and minimizing financial conflicts in the future.

Allegheny Pennsylvania Prenuptial Premarital Agreement with Financial Statements

State:

Pennsylvania

County:

Allegheny

Control #:

PA-00590

Format:

Word;

Rich Text

Instant download

Description

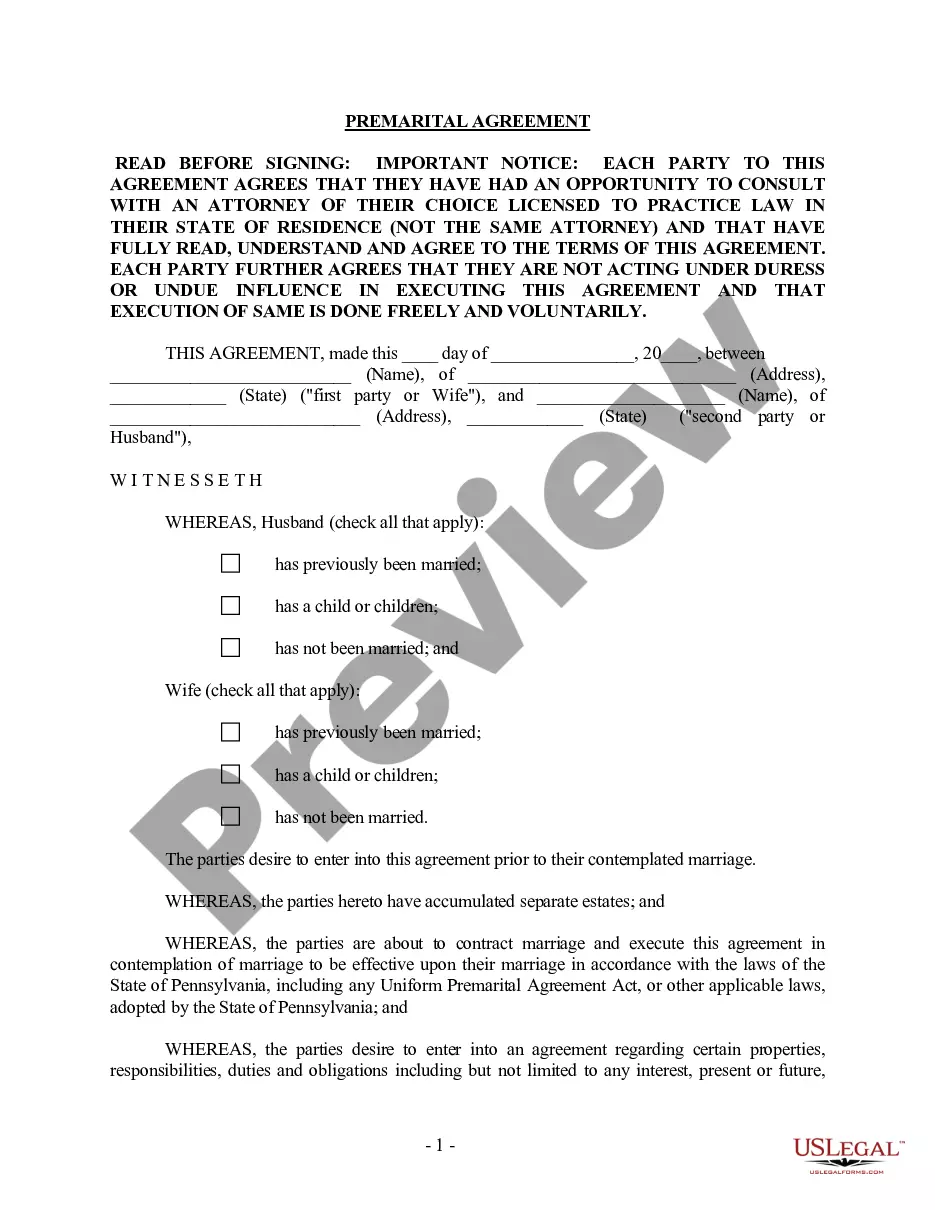

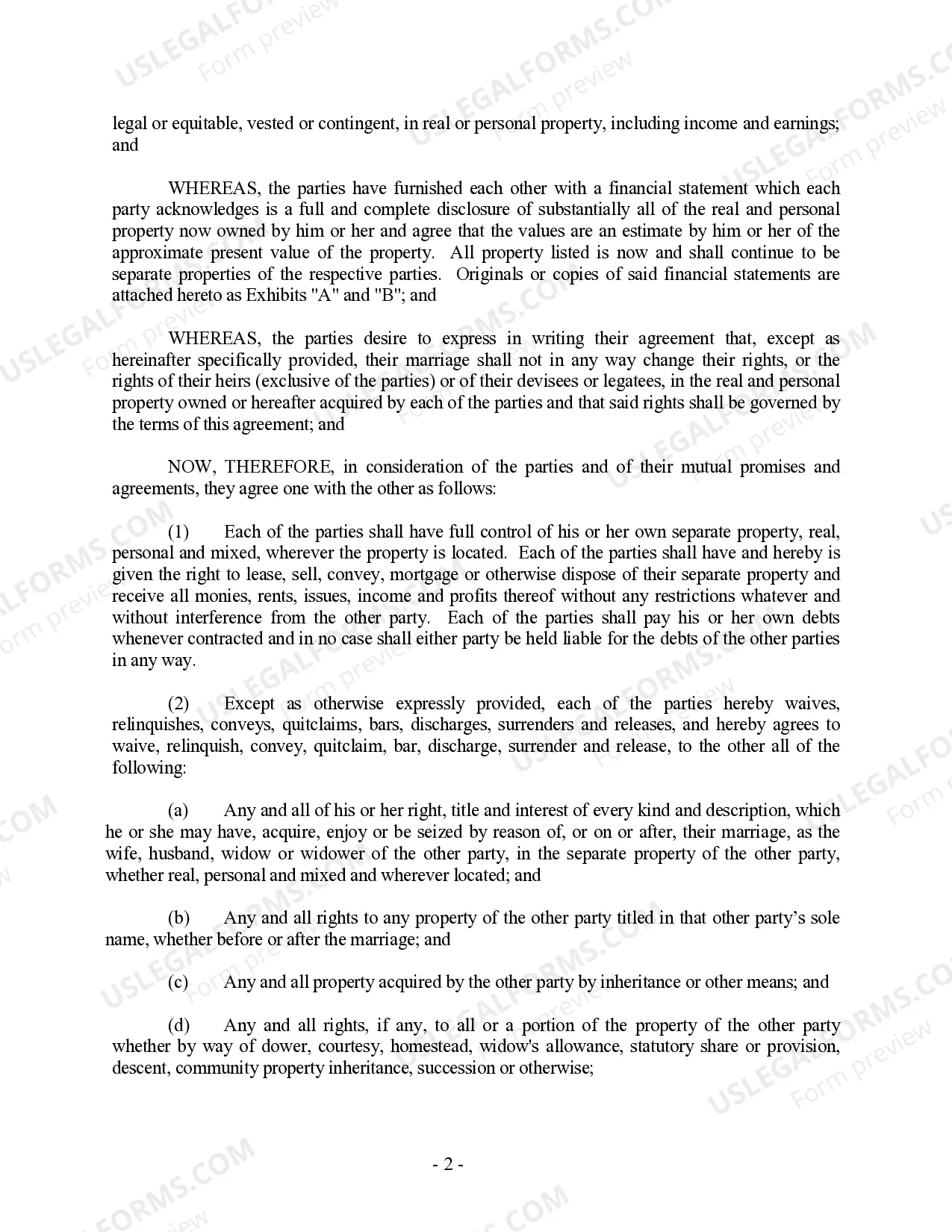

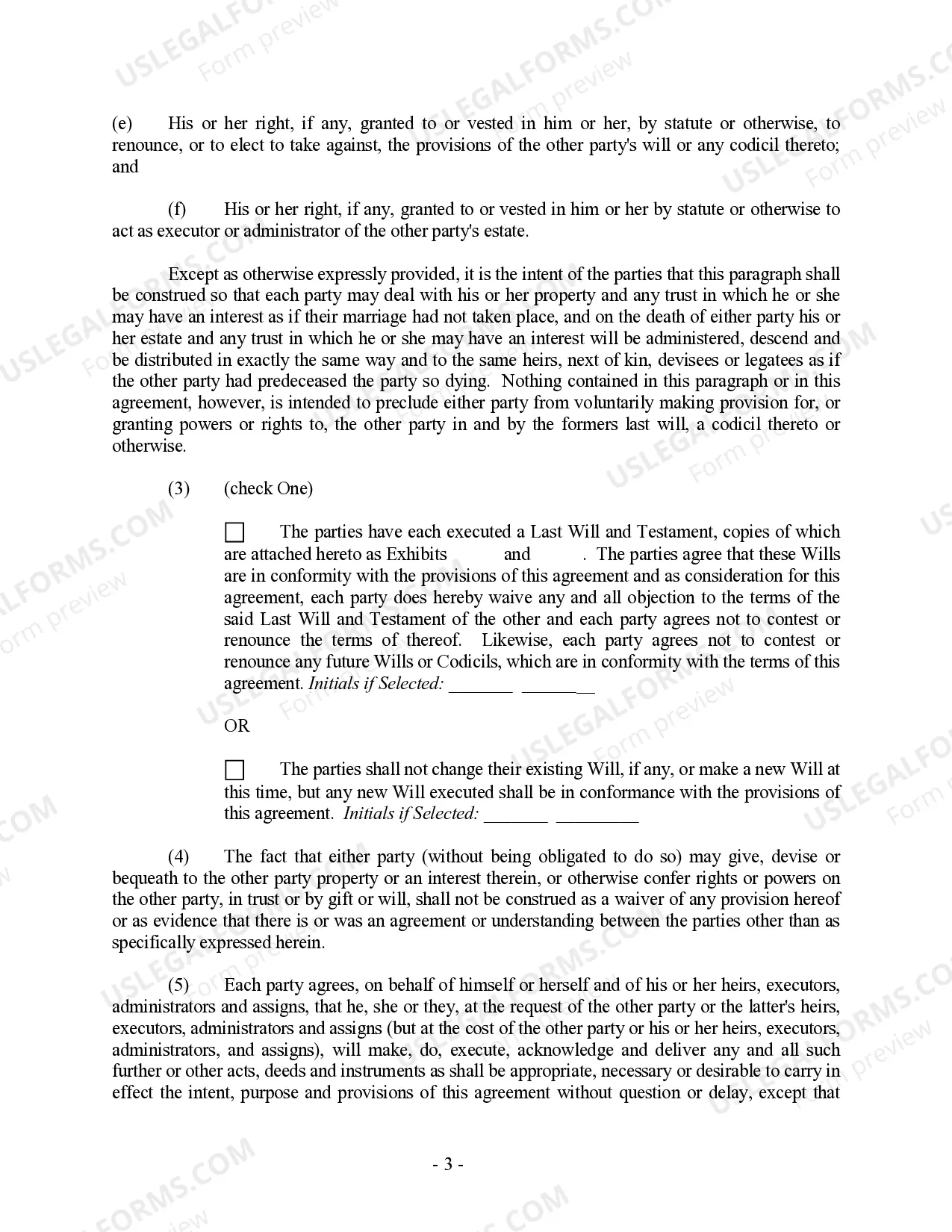

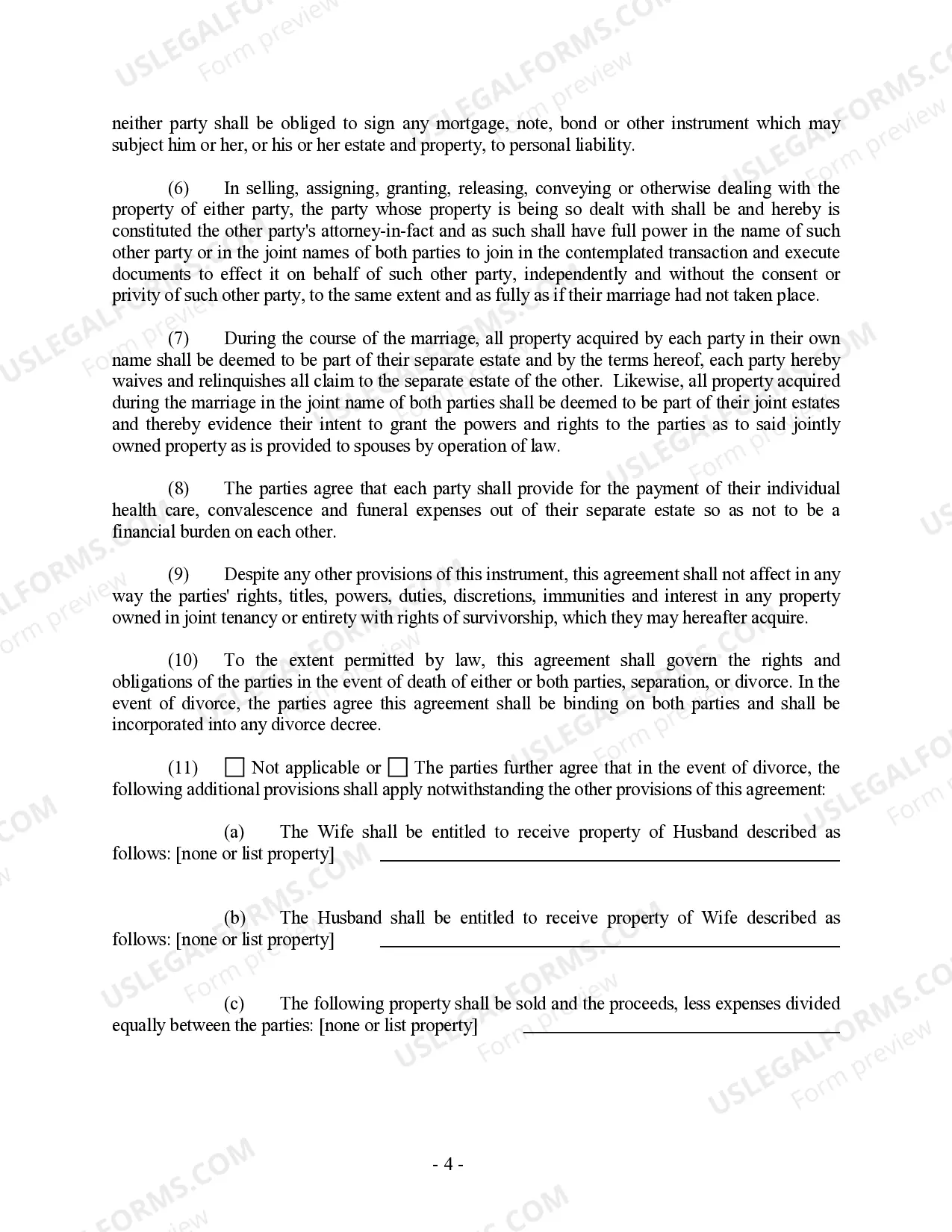

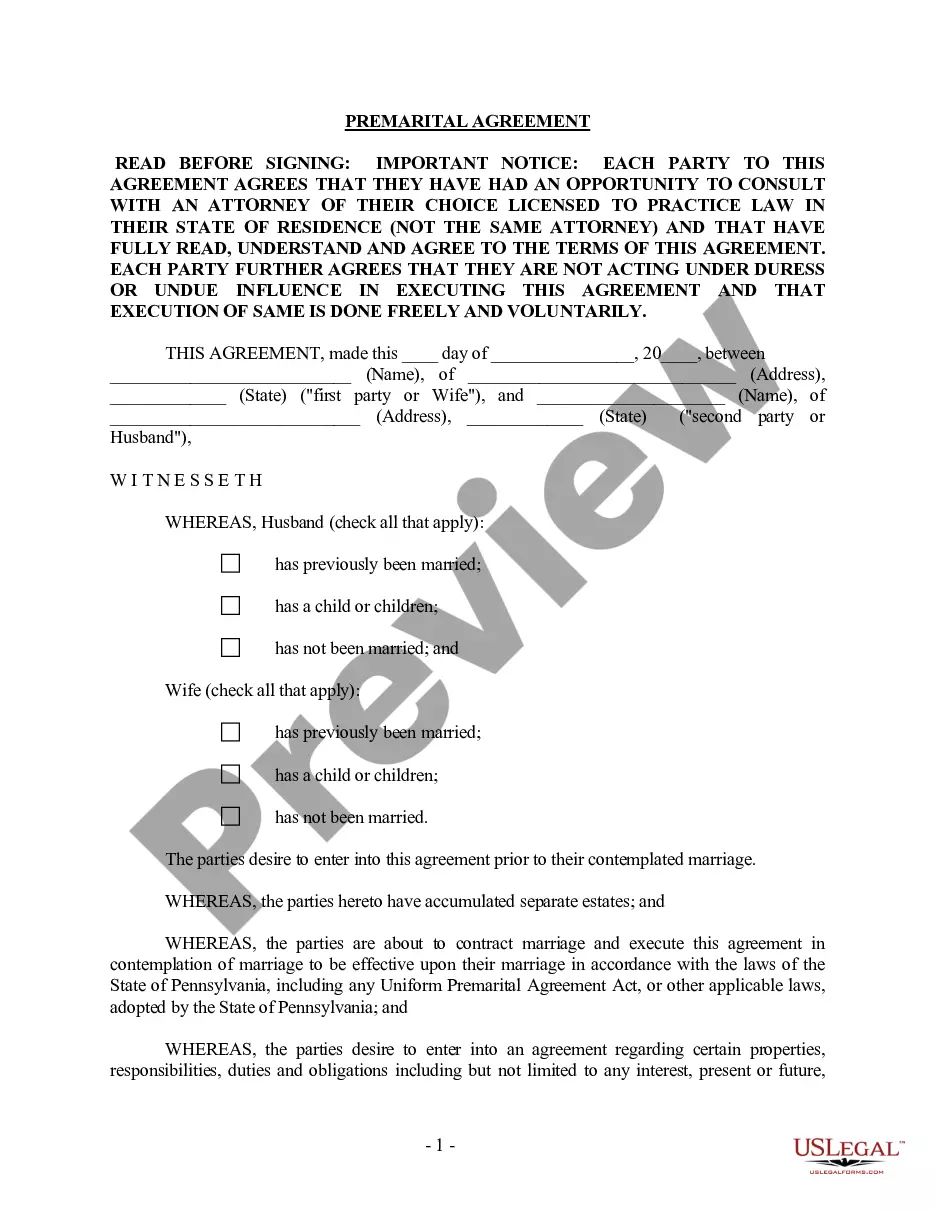

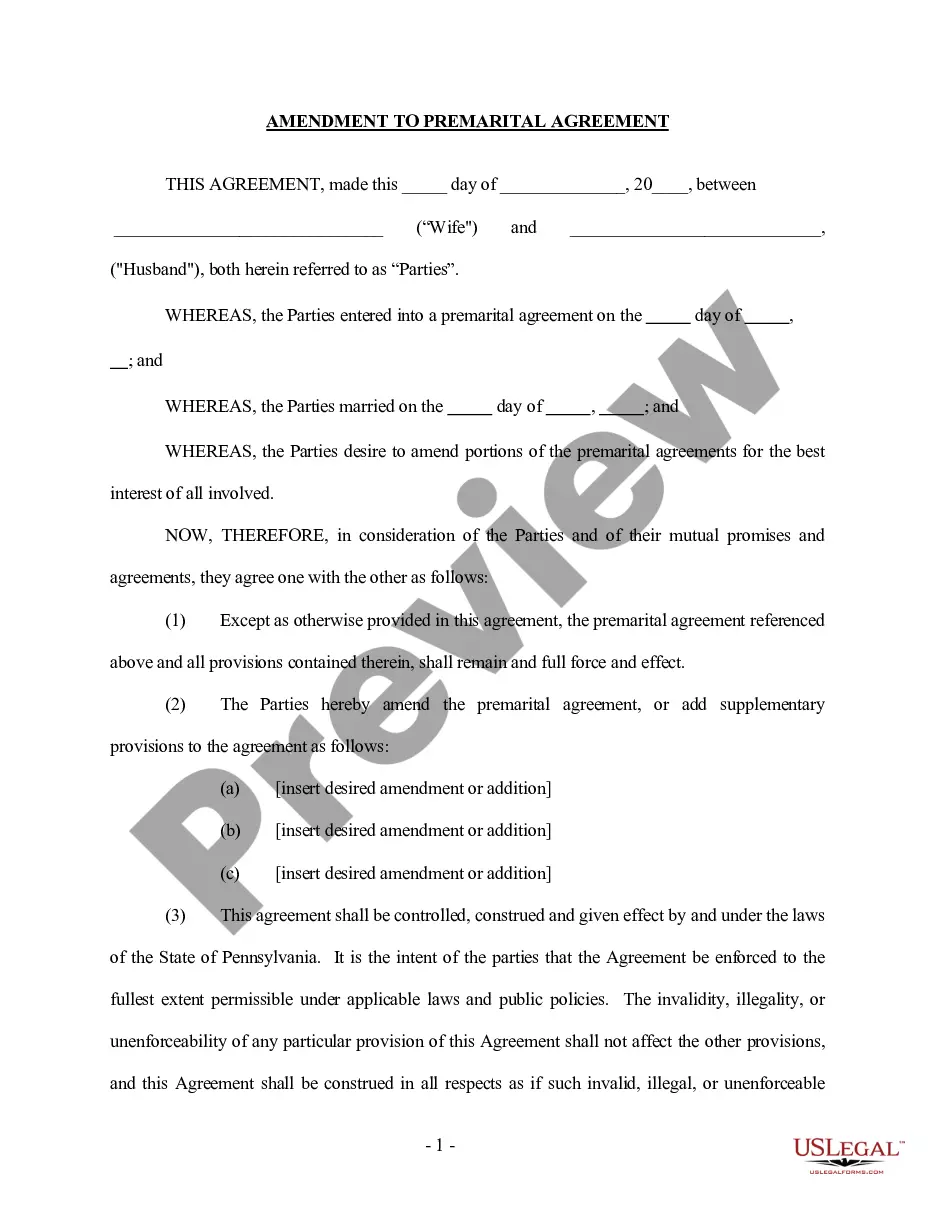

This Prenuptial Premarital Agreement with Financial Statements form package contains a premarital agreement and financial statements for your state. The agreement can be used by persons who have been previously married, or by persons who have never been married. It includes provisions regarding the contemplated marriage, assets and debts disclosure and property rights after the marriage. The agreement describes the rights, duties and obligations of prospective parties during and upon termination of marriage through death or divorce. These contracts are often used by individuals who want to ensure the proper and organized disposition of their assets in the event of death or divorce. Among the benefits that prenuptial agreements provide are avoidance of costly litigation, protection of family and/or business assets, protection against creditors and assurance that the marital property will be disposed of properly.

Allegheny Pennsylvania Prenuptial Premarital Agreement with Financial Statements is a legal document designed to protect the assets and financial interests of individuals entering into a marriage or civil partnership in Allegheny County, Pennsylvania. This agreement allows the couple to establish clear guidelines regarding the division of property, assets, and debts in the event of a divorce, separation, or death. The Allegheny Pennsylvania Prenuptial Premarital Agreement ensures that each party's rights, obligations, and expectations are clearly defined and agreed upon before entering into a marital union. It provides a comprehensive framework for addressing financial matters, thus preventing potential disputes and disagreements in the future. This agreement can be especially beneficial to individuals with significant assets, family businesses, or children from previous relationships. The key elements covered in the Allegheny Pennsylvania Prenuptial Premarital Agreement include: 1. Division of Property: This agreement outlines how the couple's assets, including real estate, bank accounts, investments, and personal property, will be divided upon divorce or separation. It establishes the terms governing the distribution of property to ensure fairness and clarity. 2. Marital Debts and Liabilities: The agreement defines how existing debts, such as mortgages, loans, and credit card debts, will be allocated between the parties. It specifies who will be responsible for these debts, and to what extent, during and after the marriage. 3. Alimony and Support: The agreement may include provisions regarding spousal support or alimony, stating whether it will be awarded or waived in the event of a divorce or separation. It may also establish the duration and amount of support, considering factors such as income, earning capacity, and financial needs. 4. Inheritance and Estate Planning: This agreement permits parties to address inheritance rights and establish provisions for the distribution of assets upon death. It clarifies how the assets will be passed on to children, heirs, or other designated beneficiaries, ensuring that the protection of each party's intended beneficiaries is upheld. 5. Financial Statements: The Allegheny Pennsylvania Prenuptial Premarital Agreement requires both parties to disclose their respective financial statements, including income, existing assets, debts, and future financial plans. These financial statements not only serve as a reference point for establishing the terms of the agreement but also aid in developing a comprehensive understanding of each party's financial standing. It is important to note that there may be variations of the Allegheny Pennsylvania Prenuptial Premarital Agreement tailored to specific circumstances, including: 1. Prenuptial Agreement for High Net Worth Individuals: This type of agreement is designed for individuals with substantial assets or complex financial portfolios, such as business owners, executives, or those with significant investments. It may include provisions regarding business ownership, intellectual property rights, and the distribution of wealth accumulated during the marriage. 2. Prenuptial Agreement with Child Custody and Support: This variation caters to couples who have children or are expecting children from a prior relationship or from the current relationship. It can cover matters related to child custody, visitation rights, and child support. This type of agreement ensures that the children's best interests are protected while providing financial security for both parents. In summary, the Allegheny Pennsylvania Prenuptial Premarital Agreement with Financial Statements is a crucial legal document that allows couples to establish a clear framework for financial matters, property division, and potential spousal support. It ensures transparency and protection for both parties involved, promoting a more equitable marriage or civil partnership and minimizing financial conflicts in the future.

Free preview

How to fill out Allegheny Pennsylvania Prenuptial Premarital Agreement With Financial Statements?

If you’ve already used our service before, log in to your account and save the Allegheny Pennsylvania Prenuptial Premarital Agreement with Financial Statements on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple steps to obtain your file:

- Make certain you’ve found the right document. Read the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t fit you, utilize the Search tab above to get the appropriate one.

- Purchase the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Get your Allegheny Pennsylvania Prenuptial Premarital Agreement with Financial Statements. Opt for the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to each piece of paperwork you have bought: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to rapidly find and save any template for your individual or professional needs!