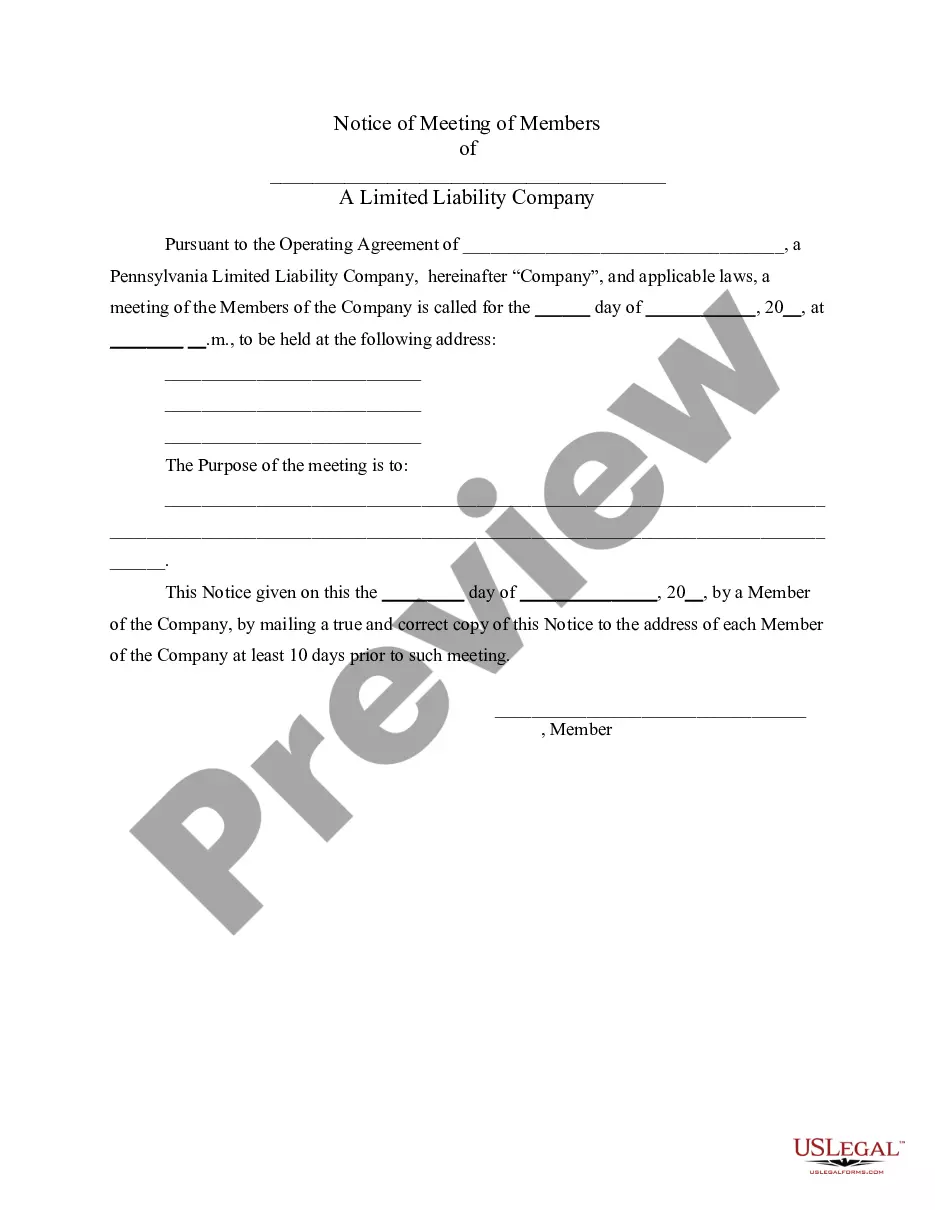

Philadelphia Pennsylvania Limited Liability Company (LLC) Operating Agreement is a legal document that outlines the internal structure, management, and operations of a limited liability company based in Philadelphia, Pennsylvania. It serves as a foundational document that governs the relationships among the LLC's members and helps ensure smooth functioning of the business. The Philadelphia Pennsylvania LLC Operating Agreement typically contains several key provisions, including: 1. Formation Information: This section provides details about the formation of the LLC, such as the name and address of the company, the purpose for which it was established, and the effective date of the agreement. 2. Membership: This portion of the agreement outlines the rights and responsibilities of the LLC's members, including their capital contributions, voting rights, profit-sharing arrangements, and procedures for admitting or removing members. 3. Management Structure: The operating agreement specifies whether the LLC will be member-managed or manager-managed. In a member-managed LLC, all members have the authority to make decisions on behalf of the company. In a manager-managed LLC, members appoint one or more managers to handle day-to-day operations. 4. Meetings and Voting: This section details how meetings will be conducted, how voting rights are exercised, and the decision-making process within the LLC. It may include provisions for both regular and special meetings, as well as methods for voting on important matters. 5. Allocation of Profits and Losses: The operating agreement outlines how profits and losses will be allocated among members. This may be based on their contributions, ownership percentages, or other agreed-upon methods. 6. Capital Contributions: This provision establishes the capital contributions required from each member, specifying the amount and timing of the contributions. 7. Dissolution and Termination: The agreement includes provisions for the dissolution and termination of the LLC, including the procedures to be followed and the distribution of assets among members. The Philadelphia Pennsylvania LLC Operating Agreement may also have various types or variations, depending on the specific needs and preferences of the LLC. Some examples might include: — Single-Member Operating Agreement: This type of agreement is used when an LLC has only one member. It outlines the rights and responsibilities of the single member and addresses issues such as profit allocation and decision-making authority. — Multi-Member Operating Agreement: This agreement is suitable when an LLC has two or more members. It provides a comprehensive framework for the governance and operations of the LLC, taking into account the collective interests of all members. — Series Operating Agreement: In some instances, an LLC may have separate series of members, each with its own distinct rights and liabilities. A series operating agreement is used to address the unique requirements and considerations of each series within the LLC structure. — Amended and Restated Operating Agreement: This type of agreement is created when modifications or amendments are made to an existing operating agreement. It consolidates all the changes into a single document. In summary, Philadelphia Pennsylvania Limited Liability Company (LLC) Operating Agreement is a vital legal document that governs the operations and internal relationships of an LLC based in Philadelphia. It establishes the rights, responsibilities, and procedures for the members and ensures the smooth functioning of the business. Different types or variations may exist depending on the specific circumstances and needs of the LLC.

Philadelphia Limited

Description

How to fill out Philadelphia Pennsylvania Limited Liability Company LLC Operating Agreement?

We always strive to minimize or avoid legal damage when dealing with nuanced law-related or financial affairs. To do so, we sign up for attorney services that, usually, are extremely expensive. However, not all legal issues are equally complex. Most of them can be dealt with by ourselves.

US Legal Forms is an online catalog of updated DIY legal documents addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your affairs into your own hands without the need of using services of legal counsel. We provide access to legal document templates that aren’t always publicly available. Our templates are state- and area-specific, which significantly facilitates the search process.

Take advantage of US Legal Forms whenever you need to find and download the Philadelphia Pennsylvania Limited Liability Company LLC Operating Agreement or any other document easily and securely. Simply log in to your account and click the Get button next to it. If you happened to lose the form, you can always download it again from within the My Forms tab.

The process is just as easy if you’re unfamiliar with the platform! You can register your account in a matter of minutes.

- Make sure to check if the Philadelphia Pennsylvania Limited Liability Company LLC Operating Agreement adheres to the laws and regulations of your your state and area.

- Also, it’s imperative that you check out the form’s outline (if available), and if you notice any discrepancies with what you were looking for in the first place, search for a different template.

- As soon as you’ve ensured that the Philadelphia Pennsylvania Limited Liability Company LLC Operating Agreement is suitable for you, you can select the subscription plan and proceed to payment.

- Then you can download the form in any available format.

For more than 24 years of our existence, we’ve served millions of people by offering ready to customize and up-to-date legal documents. Take advantage of US Legal Forms now to save time and resources!