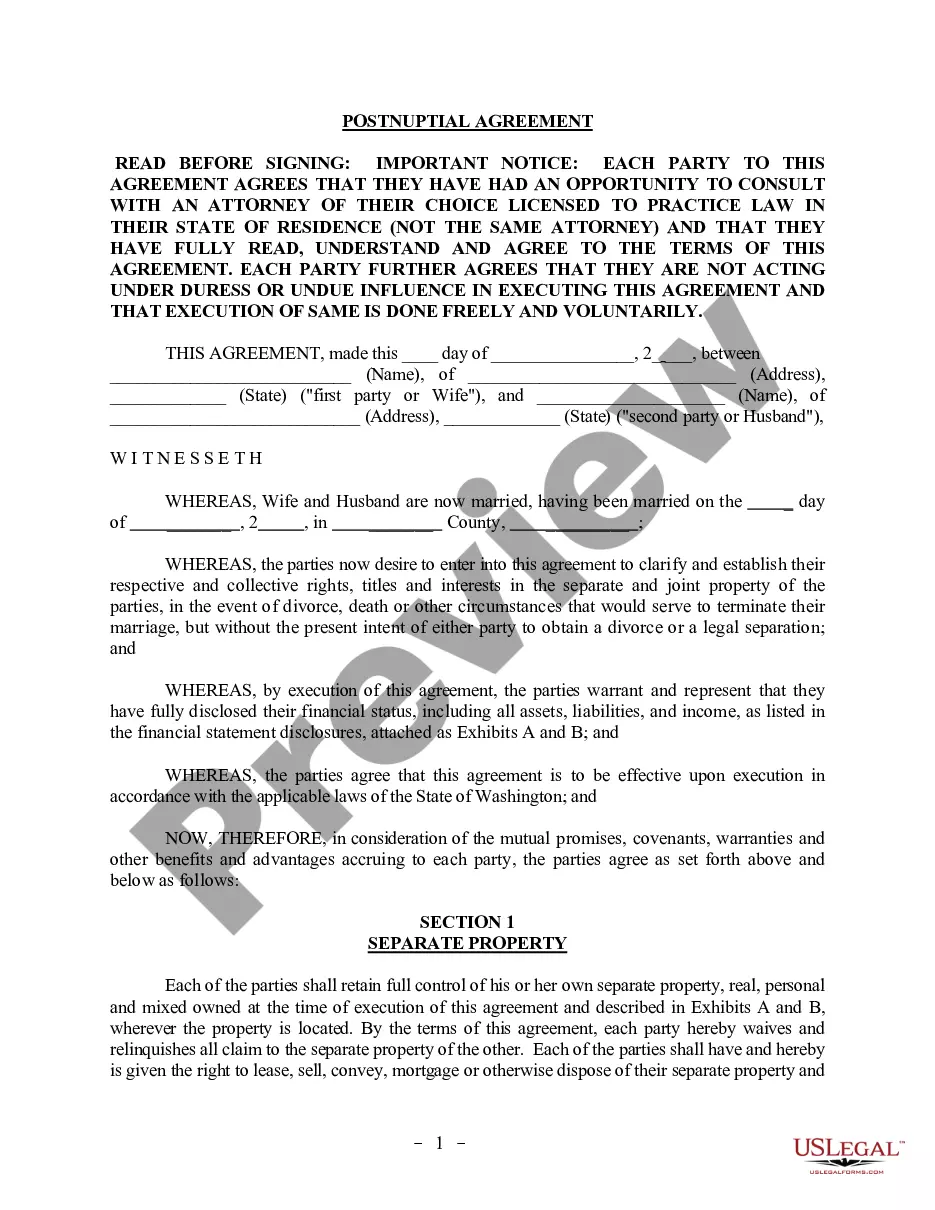

Philadelphia Pennsylvania Professional Limited Liability Company (LLC) Formation Package is a comprehensive service specifically designed to assist professionals in establishing a legal entity in the city of Philadelphia, Pennsylvania. This package includes all the necessary documents, filings, and guidance needed to form an LLC, ensuring compliance with state regulations and requirements. By availing this package, professionals can protect themselves from personal liability, maintain a professional image, and gain access to various benefits. The Philadelphia Pennsylvania Professional Limited Liability Company Formation Package comprises several essential components to simplify and expedite the process. These include: 1. Preparation and Filing of Articles of Organization: Experienced professionals will prepare the necessary legal document required to establish an LLC in Philadelphia. This includes providing relevant information about the company, such as its name, principal address, registered agent details, and purpose. 2. Registered Agent Service: The package offers registered agent services, ensuring that a reliable representative is designated to receive legal documents and notifications on behalf of the LLC. This ensures that essential communications from the state government, courts, or other parties are promptly received and responded to. 3. Operating Agreement: A customized operating agreement will be crafted to outline the internal operations of the LLC. This document determines the rights and responsibilities of the members, the company's financial structure, voting procedures, profit distribution, and decision-making processes. 4. Federal Employer Identification Number (EIN) Application: The package provides assistance with acquiring an EIN from the Internal Revenue Service (IRS). An EIN is necessary for tax purposes, opening bank accounts, hiring employees, and conducting various business transactions. 5. Compliance Assistance: Experts will guide professionals through various compliance procedures, including state and local licenses, permits, and ongoing compliance requirements. This ensures that the LLC operates legally and avoids penalties or legal complications. 6. Entity Management Tools: Access to specialized software or tools that facilitate efficient management and administration of the LLC. This may include features like bookkeeping, tax filing, document storage, or other management capabilities. 7. Corporate Kit: Some packages may offer a corporate kit containing custom-designed binders, corporate seals, stock certificates, and other essential documentation tools. These items help professionals maintain a professional image and keep their records organized. Different types of Philadelphia Pennsylvania Professional Limited Liability Company LLC Formation Packages may cater to specific professional industries or services. For instance, there may be specialized packages available for lawyers, doctors, accountants, engineers, consultants, or other licensed professionals. These packages may include additional features relevant to the specific industry, such as industry-specific compliance guidance or customized templates for professional services agreements. In conclusion, the Philadelphia Pennsylvania Professional Limited Liability Company LLC Formation Package provides a comprehensive solution for professionals seeking to establish an LLC in the city. By availing this package, professionals can navigate the legal complexities of forming an LLC efficiently and effectively, ensuring compliance, minimizing personal liability, and enabling them to focus on their professional practice.

Philadelphia Pennsylvania Professional Limited Liability Company PLLC Formation Package

Description

How to fill out Pennsylvania Professional Limited Liability Company PLLC Formation Package?

We consistently strive to reduce or avert legal repercussions when engaging with complex legal or financial issues.

To achieve this, we seek legal assistance that is typically very expensive.

Nevertheless, not every legal matter is equally intricate.

Many can be managed by ourselves.

Utilize US Legal Forms whenever you wish to obtain and download the Philadelphia Pennsylvania Professional Limited Liability Company PLLC Formation Package or any other document swiftly and securely. Simply Log In to your account and click the Get button beside it. If you happen to misplace the document, you can always re-download it in the My documents section. The procedure is equally straightforward if you're unfamiliar with the platform! You can set up your account in just a few minutes.

- US Legal Forms is an online repository of current DIY legal documents ranging from wills and powers of attorney to incorporation articles and dissolution petitions.

- Our service empowers you to handle your issues independently without needing to consult legal advisors.

- We offer access to legal document templates that are not always readily accessible.

- Our templates are specific to states and regions, making the search process significantly easier.

Form popularity

FAQ

The primary distinction between a PLLC and an LLC lies in ownership requirements. A Philadelphia Pennsylvania Professional Limited Liability Company PLLC is specifically designed for licensed professionals, whereas an LLC can be formed by any individuals or entities without specific licensing requirements. Additionally, PLLCs must adhere to regulations that pertain to licensed professions, providing an extra layer of compliance. Choosing the right formation package ensures that you meet all legal obligations for your specific business needs.

While the Philadelphia Pennsylvania Professional Limited Liability Company PLLC offers many benefits, it does come with certain disadvantages. For instance, some states impose additional fees or stricter regulatory requirements on PLLCs compared to standard LLCs. Moreover, all members must be licensed professionals, which can limit ownership options and may not suit every business model. Understanding these aspects will help you make an informed choice.

No, a certificate of formation is not the same as an LLC; rather, it is an essential document that you file to create a Philadelphia Pennsylvania Professional Limited Liability Company PLLC. The certificate establishes your PLLC’s existence in the eyes of the law. Once this document is approved, your business gains legal status as a PLLC, distinguishing it from other types of business entities.

A Philadelphia Pennsylvania Professional Limited Liability Company PLLC is owned by one or more professionals, such as doctors, lawyers, or accountants. This structure allows licensed individuals to provide their services while managing personal liability effectively. By using the PLLC formation package, owners can benefit from both the protection of limited liability and the tax flexibility typically associated with partnerships.

The quickest method to establish a Philadelphia Pennsylvania Professional Limited Liability Company PLLC Formation Package is to file your application online through the Pennsylvania Department of State's website. By utilizing an online service, you can expedite the formation process significantly. Additionally, consider using platforms like US Legal Forms, which simplify the application process further, ensuring that all forms are correctly completed and submitted promptly.

Determining when an LLC becomes worthwhile typically depends on a range of factors, including business profits, liability concerns, and tax benefits. Generally, if your business consistently earns above a certain threshold, the legal protections and flexibility an LLC offers can be beneficial. By reviewing the Philadelphia Pennsylvania Professional Limited Liability Company PLLC Formation Package, entrepreneurs can better evaluate when incorporating as an LLC aligns with their financial goals.

Filling out an LLC operating agreement involves detailing the management structure, ownership percentages, and operational procedures. Start with the basic information of your LLC, then outline roles for members and how profits will be distributed. For those forming a business, utilizing a Philadelphia Pennsylvania Professional Limited Liability Company PLLC Formation Package can provide templates and guidance to ensure all critical elements are addressed.

While there is no specified minimum income for an LLC, it's crucial to consider your business expenses and potential profitability. A successful LLC should generate enough income to cover costs and provide some return for the owners. For those exploring benefits and financial viability, the Philadelphia Pennsylvania Professional Limited Liability Company PLLC Formation Package offers insights into setting realistic income expectations.

Determining a reasonable salary for an LLC owner varies based on factors like industry standards, business revenue, and the owner's role in operations. Generally, it should align with what similar positions earn within your field. If you need assistance navigating salary structures within your Philadelphia Pennsylvania Professional Limited Liability Company PLLC Formation Package, resources like uslegalforms can help clarify what to consider.

To start an LLC in Pennsylvania, first select a name that is distinct and complies with state regulations. Next, file the Articles of Organization, and consider creating an operating agreement to outline the management structure. Opting for the Philadelphia Pennsylvania Professional Limited Liability Company PLLC Formation Package may help simplify this process and provide valuable insights as you establish your business.

Interesting Questions

More info

Stephanie D. Dufresne, Esq. Business attorney and law firm owner. In Pennsylvania, no annual filing requirements for the entity (unless it's a professional LLC);; can elect to be taxed as s-corporation. Mary E. Fer tel, Esq. Attorney and business leader. In Nevada is legal organization with no annual filing;; can elect to be taxed as s-corporation. Mary P. Grubs, Esq. Assistant counsel at the Arizona attorney general's office, also served 10 years as a public defender in Maricopa County, Arizona. In Arizona, is legal organization with no annual filing;; can elect to be taxed as s-corporation. Marcela R. Guevara, Esq. Attorney who serves as chair of the National Association of Attorney Assistants, an affiliate to the ABA on the ABA Task Force on Lawyer Regulation in Arizona and the Federal Bar Association on its committee on the rules of practice for attorneys. Served on the Arizona Association of Attorneys General's Committee on Rules of Practice.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.