A Detailed Description of Allegheny Pennsylvania Quitclaim Deed from Corporation to Individual A Quitclaim Deed is a legal document used to transfer ownership or interest in a property from one party to another. In the state of Pennsylvania, specifically in Allegheny County, a Quitclaim Deed can be utilized when a corporation wants to transfer ownership of a property to an individual. This type of transfer often occurs when a company decides to sell or gift a property to an individual for various reasons. The Allegheny Pennsylvania Quitclaim Deed serves as official proof of the property transfer, ensuring that the individual receiving the property is the new legal owner. It is essential to understand that a Quitclaim Deed only transfers the interest or ownership rights that the corporation may have in the property. It does not provide any guarantee or warranty regarding the title or potential liens attached to the property. Consequently, the individual receiving the property assumes all risks associated with the property's title and any existing encumbrances. Keywords: Allegheny Pennsylvania Quitclaim Deed, Corporation to Individual, property transfer, ownership, legal document, interest, seller, buyer, Allegheny County, warranty, guarantee, title, encumbrances. Types of Allegheny Pennsylvania Quitclaim Deed from Corporation to Individual: 1. Allegheny Pennsylvania Corporation to Individual Voluntary Quitclaim Deed: This type of Quitclaim Deed occurs when a corporation willingly transfers ownership of a property to an individual without any legal obligation or requirement. It often represents a gift or a voluntary sale. 2. Allegheny Pennsylvania Corporation to Individual Quitclaim Deed as part of a Merger or Acquisition: In cases where a corporation merges with another company or is acquired by another entity, a Quitclaim Deed may be utilized to transfer ownership of a property to an individual as part of the overall business transaction. 3. Allegheny Pennsylvania Corporation to Individual Quitclaim Deed to Settle a Legal Dispute: Sometimes, a Quitclaim Deed is executed to resolve a legal dispute between a corporation and an individual. This type of Quitclaim Deed is used to transfer ownership of a property to the individual, as agreed upon during the settlement negotiation. 4. Allegheny Pennsylvania Corporation to Individual Quitclaim Deed in cases of Bankruptcy: When a corporation goes bankrupt, it may need to transfer ownership of its assets, including properties, to individual creditors or stakeholders. A Quitclaim Deed may be used in such situations to facilitate the transfer of property ownership. It is crucial to consult with legal professionals or real estate experts when dealing with Allegheny Pennsylvania Quitclaim Deeds to ensure proper adherence to legal procedures and address any specific circumstances or requirements.

Allegheny Pennsylvania Quitclaim Deed from Corporation to Individual

Description

How to fill out Allegheny Pennsylvania Quitclaim Deed From Corporation To Individual?

Regardless of social or professional status, filling out law-related documents is an unfortunate necessity in today’s professional environment. Too often, it’s practically impossible for a person with no legal education to draft this sort of paperwork from scratch, mostly because of the convoluted terminology and legal subtleties they entail. This is where US Legal Forms can save the day. Our service offers a massive collection with over 85,000 ready-to-use state-specific documents that work for almost any legal situation. US Legal Forms also serves as an excellent asset for associates or legal counsels who want to save time utilizing our DYI forms.

Whether you need the Allegheny Pennsylvania Quitclaim Deed from Corporation to Individual or any other paperwork that will be good in your state or county, with US Legal Forms, everything is at your fingertips. Here’s how to get the Allegheny Pennsylvania Quitclaim Deed from Corporation to Individual in minutes using our trustworthy service. In case you are already a subscriber, you can proceed to log in to your account to download the appropriate form.

Nevertheless, in case you are new to our library, ensure that you follow these steps prior to obtaining the Allegheny Pennsylvania Quitclaim Deed from Corporation to Individual:

- Ensure the template you have found is good for your area since the regulations of one state or county do not work for another state or county.

- Preview the document and read a quick description (if provided) of cases the paper can be used for.

- If the one you chosen doesn’t suit your needs, you can start over and search for the necessary form.

- Click Buy now and pick the subscription option that suits you the best.

- Log in to your account credentials or register for one from scratch.

- Pick the payment gateway and proceed to download the Allegheny Pennsylvania Quitclaim Deed from Corporation to Individual once the payment is done.

You’re all set! Now you can proceed to print the document or complete it online. If you have any issues locating your purchased documents, you can easily find them in the My Forms tab.

Regardless of what case you’re trying to solve, US Legal Forms has got you covered. Give it a try today and see for yourself.

Form popularity

FAQ

Payments can be remitted online at myPATH.pa.gov via ACH withdrawal using your routing number and account number. myPATH allows you to make payments for Realty Transfer Tax directly from the homepage without the need to create an account.

First and foremost, you'll have your conveyancing fees, which will be calculated on many factors; such as your property's value or whether or not you need to re-mortgage. In most cases, the fees will amount to between £100 and £500 +VAT.

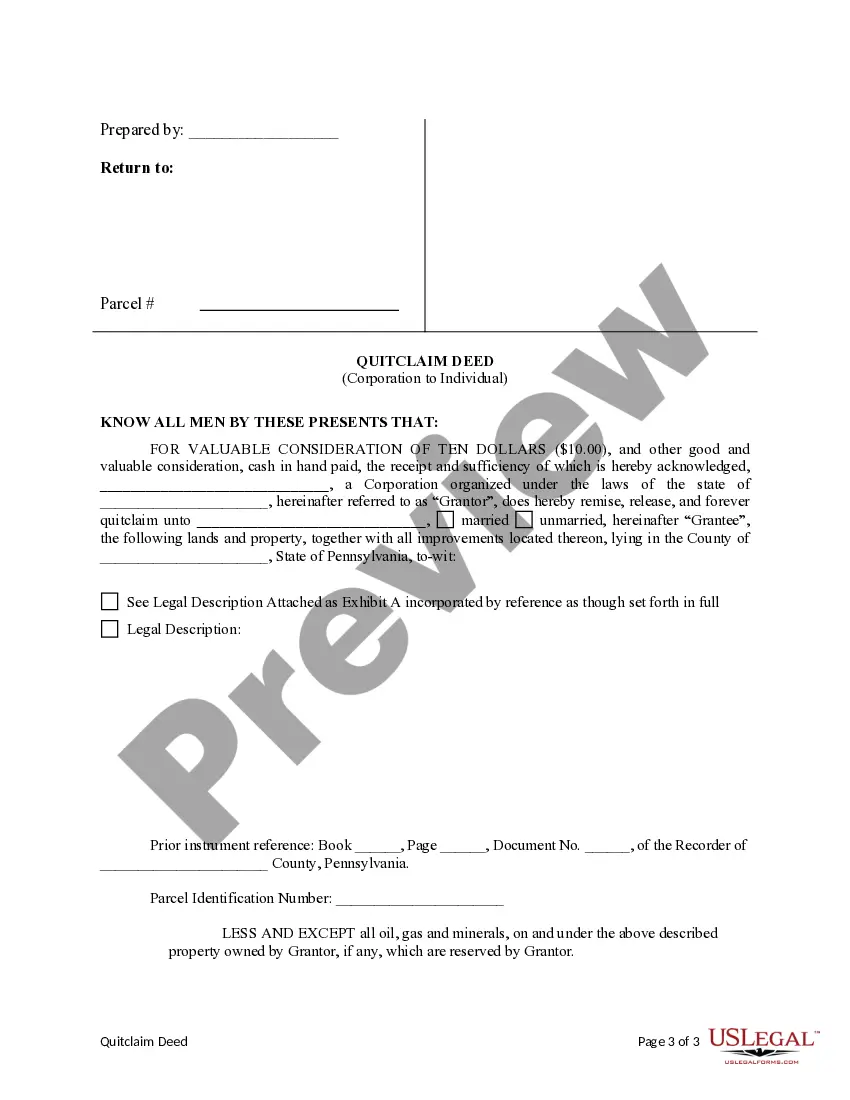

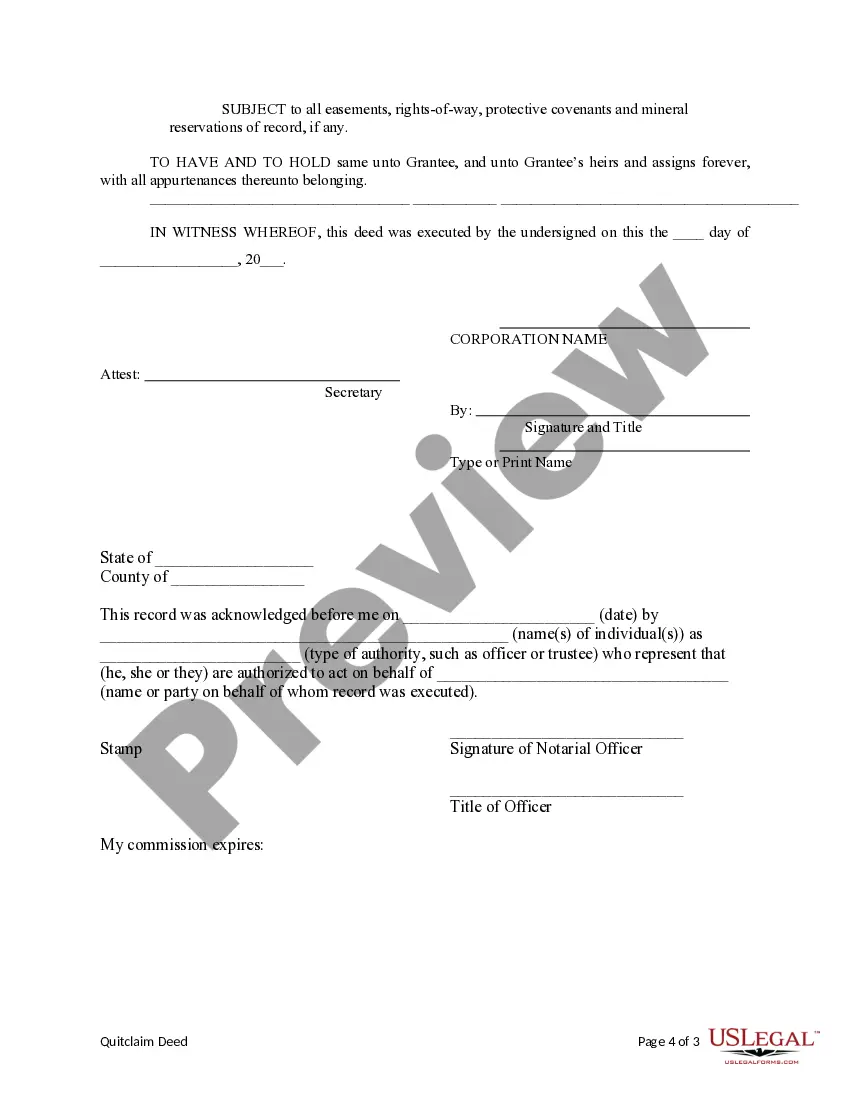

Under Pennsylvania law, a quitclaim deed must contain specific language and be signed by the grantor. To record the deed, the grantor's signature must be acknowledged. Before recording the deed, you will need to pay a recording fee and a transfer tax.

In Pennsylvania, an agreement to transfer a real property interest is only enforceable if made in writing (33 P.S. § 1). Parties use deeds to transfer interests in real property in Pennsylvania. The most common types of deeds in Pennsylvania are: Quitclaim deeds.

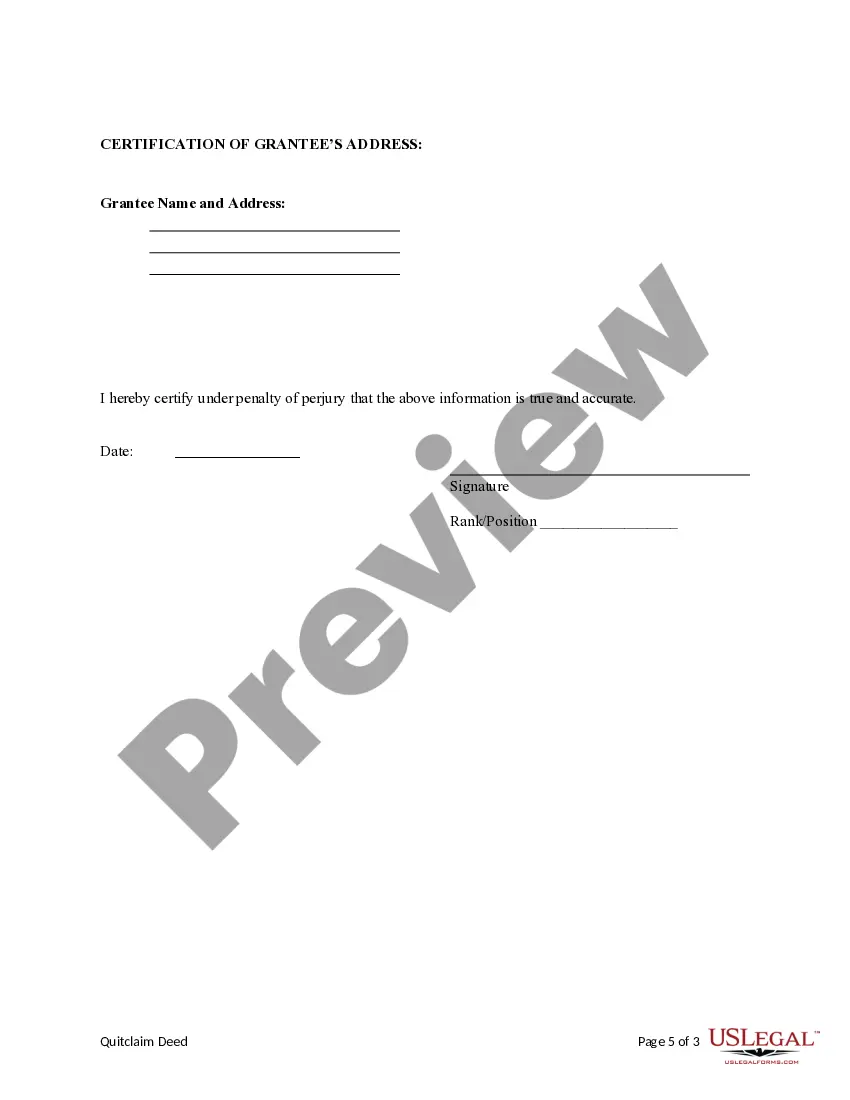

Checklist: Preparing and Recording Your Quitclaim Deed Fill in the deed form. Print it out. Have the grantor(s) and grantee(s) sign and get the signature(s) notarized. Fill out a Statement of Value form, if necessary. Get the Uniform Parcel Number (UPI) on the deed certified, if required by your county.

To transfer property in Pennsylvania, you'll need to prepare and execute a deed and record it in the county where the property is located. If the transfer was in exchange for money, you'll have to pay transfer tax.

Some transactions are exempt from Transfer Tax. Some examples would be conveyances between husband and wife, parents and child, grandparent and grandchild, brothers and sisters. A one-time transfer is allowed between former spouses. Other exemptions are allowed in certain situations.

The tax is usually split evenly between the buyer and the seller, but this is not a legal requirement. The City has the right to collect 100% of the tax from either party, so it's in the best interest of the buyer to make sure the tax is paid in full at the closing of the sale.

The recording charge is set by the county and we charge a administative fee. For counties from Erie, Elk, Franklin and Centre to Bucks, Berks, and Butler, the charge for a deed transfer across Pennsylvania is $700, with the sole exception of Philadelphia, which is $800. How long does it take?