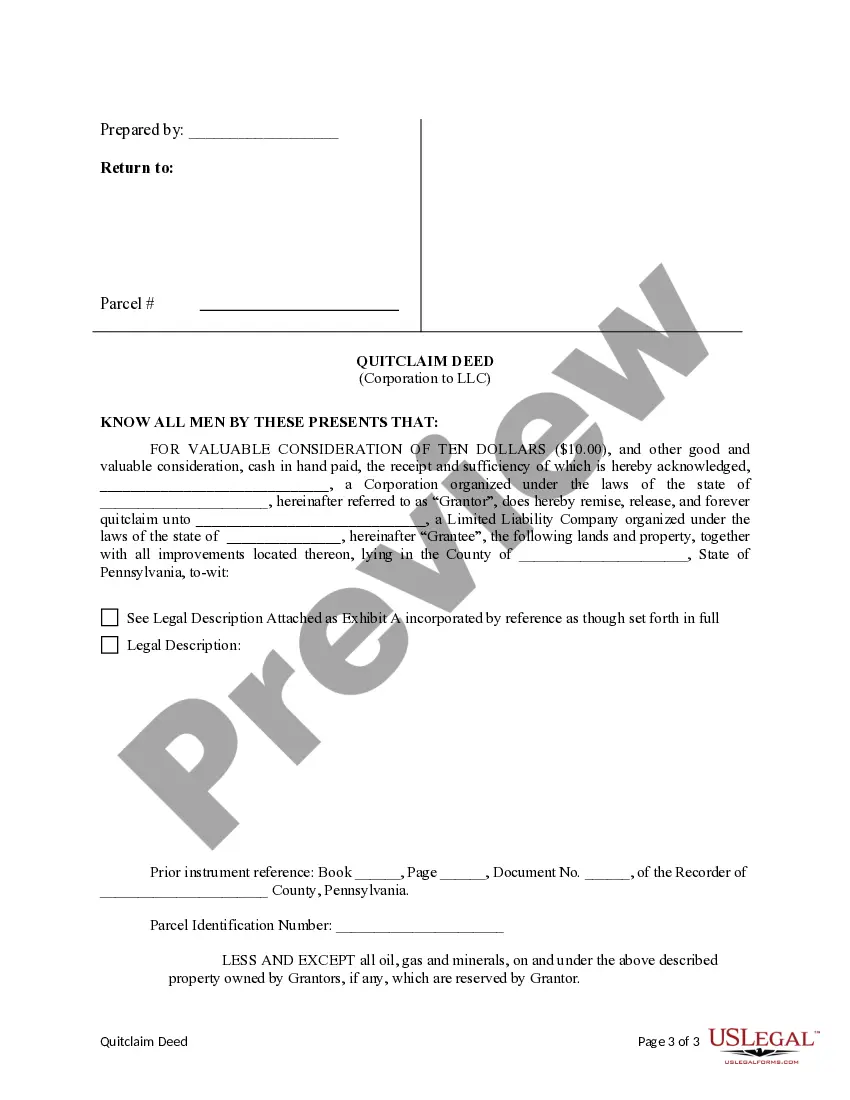

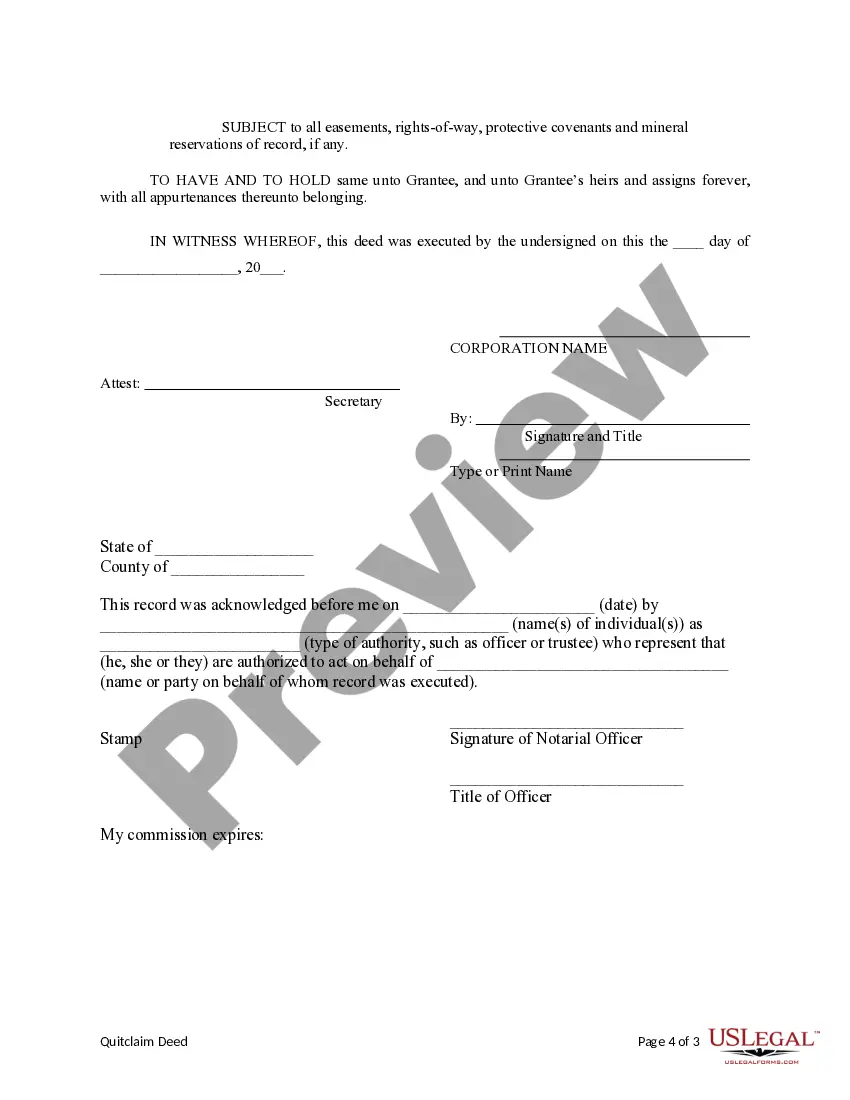

A Quitclaim Deed from Corporation to LLC is a legal document used to transfer ownership of a piece of property located in Allegheny, Pennsylvania, from a corporation to a limited liability company (LLC). This type of transfer is often carried out when a corporation wants to restructure its ownership or consolidate its assets under an LLC structure. One common type of Allegheny Pennsylvania Quitclaim Deed from Corporation to LLC is the "General Quitclaim Deed." This document transfers the corporation's interest in the property to the LLC without making any specific warranties or guarantees about the property title. It simply conveys whatever interest the corporation has, if any, in the property to the LLC. Another type of Quitclaim Deed commonly used in Allegheny, Pennsylvania, is the "Special Quitclaim Deed." This document is typically utilized when there are certain conditions or restrictions associated with the property. By using a Special Quitclaim Deed, the corporation can transfer the property to the LLC while specifying any limitations or restrictions the property may have, such as easements or encumbrances. The process of completing a Quitclaim Deed from Corporation to LLC starts with drafting the document, which will include: 1. Property Details: The deed will provide a detailed description of the property being transferred, such as its address, parcel number, and any other identifying information necessary. 2. Granter and Grantee Information: The deed will identify the corporation (granter) transferring the property and the LLC (grantee) receiving the property. 3. Consideration: Although the consideration for the transfer may be nominal, it is still customary to mention it in the deed to indicate that there is an exchange of value between the corporation and the LLC. 4. Legal Description: The deed will contain a legal description of the property, which may include metes and bounds, lot numbers, or any other legally acceptable description method. 5. Signatures and Notarization: The granter (corporation) must sign the deed, and their signature must be notarized to ensure its authenticity. Once the Allegheny Pennsylvania Quitclaim Deed from Corporation to LLC is drafted and executed, it should be filed with the appropriate county office, such as the Allegheny County Recorder of Deeds. Filing the deed provides a public record of the property transfer and ensures that the ownership change is legally recognized. It is advisable to consult with an experienced real estate attorney or legal professional to ensure the smooth transfer of property ownership and to comply with all legal requirements when dealing with Quitclaim Deeds from Corporation to LLC in Allegheny, Pennsylvania.

Allegheny Pennsylvania Quitclaim Deed from Corporation to LLC

State:

Pennsylvania

County:

Allegheny

Control #:

PA-012-77

Format:

Word;

Rich Text

Instant download

Description

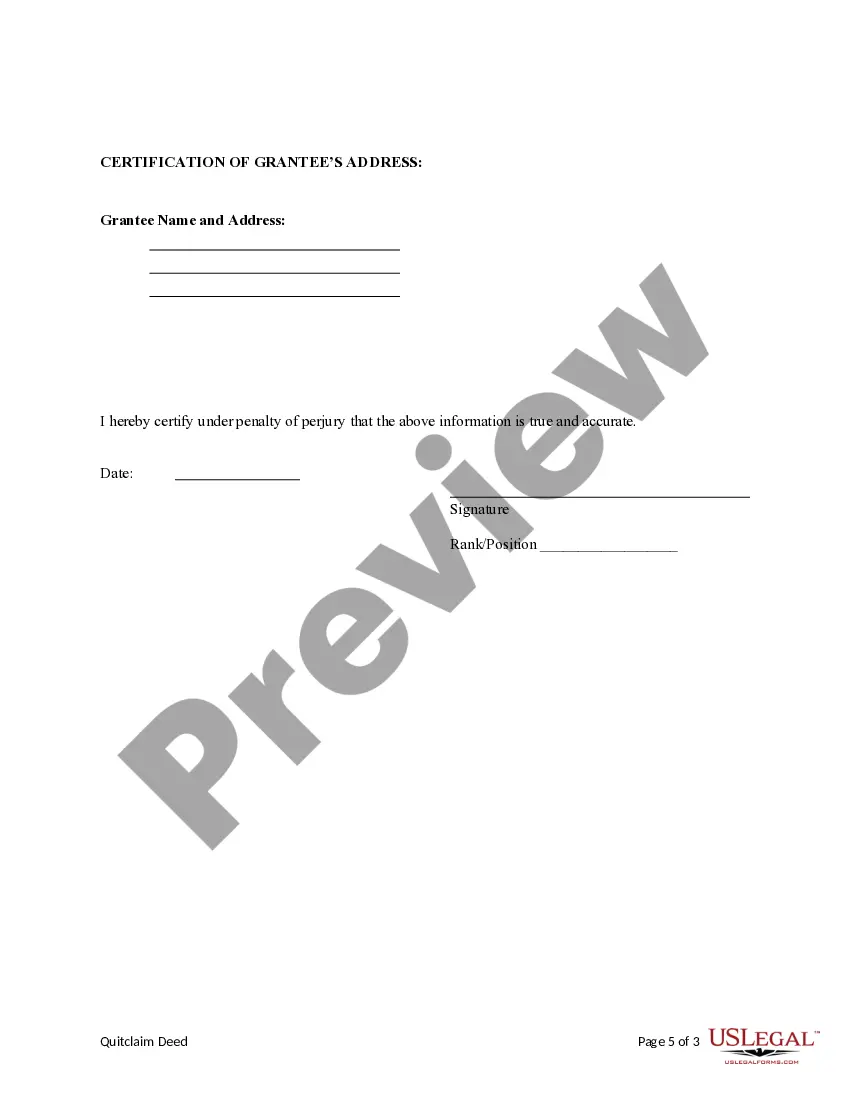

This Quitclaim Deed from Corporation to LLC form is a Quitclaim Deed where the Grantor is a corporation and the Grantee is a limited liability company. Grantor conveys and quitclaims the described property to Grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

A Quitclaim Deed from Corporation to LLC is a legal document used to transfer ownership of a piece of property located in Allegheny, Pennsylvania, from a corporation to a limited liability company (LLC). This type of transfer is often carried out when a corporation wants to restructure its ownership or consolidate its assets under an LLC structure. One common type of Allegheny Pennsylvania Quitclaim Deed from Corporation to LLC is the "General Quitclaim Deed." This document transfers the corporation's interest in the property to the LLC without making any specific warranties or guarantees about the property title. It simply conveys whatever interest the corporation has, if any, in the property to the LLC. Another type of Quitclaim Deed commonly used in Allegheny, Pennsylvania, is the "Special Quitclaim Deed." This document is typically utilized when there are certain conditions or restrictions associated with the property. By using a Special Quitclaim Deed, the corporation can transfer the property to the LLC while specifying any limitations or restrictions the property may have, such as easements or encumbrances. The process of completing a Quitclaim Deed from Corporation to LLC starts with drafting the document, which will include: 1. Property Details: The deed will provide a detailed description of the property being transferred, such as its address, parcel number, and any other identifying information necessary. 2. Granter and Grantee Information: The deed will identify the corporation (granter) transferring the property and the LLC (grantee) receiving the property. 3. Consideration: Although the consideration for the transfer may be nominal, it is still customary to mention it in the deed to indicate that there is an exchange of value between the corporation and the LLC. 4. Legal Description: The deed will contain a legal description of the property, which may include metes and bounds, lot numbers, or any other legally acceptable description method. 5. Signatures and Notarization: The granter (corporation) must sign the deed, and their signature must be notarized to ensure its authenticity. Once the Allegheny Pennsylvania Quitclaim Deed from Corporation to LLC is drafted and executed, it should be filed with the appropriate county office, such as the Allegheny County Recorder of Deeds. Filing the deed provides a public record of the property transfer and ensures that the ownership change is legally recognized. It is advisable to consult with an experienced real estate attorney or legal professional to ensure the smooth transfer of property ownership and to comply with all legal requirements when dealing with Quitclaim Deeds from Corporation to LLC in Allegheny, Pennsylvania.

Free preview

How to fill out Allegheny Pennsylvania Quitclaim Deed From Corporation To LLC?

If you’ve already utilized our service before, log in to your account and download the Allegheny Pennsylvania Quitclaim Deed from Corporation to LLC on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple actions to get your file:

- Ensure you’ve located the right document. Look through the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t fit you, utilize the Search tab above to obtain the proper one.

- Purchase the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Get your Allegheny Pennsylvania Quitclaim Deed from Corporation to LLC. Select the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to every piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to rapidly find and save any template for your individual or professional needs!