Philadelphia Pennsylvania Quitclaim Deed from Corporation to LLC

Description

How to fill out Pennsylvania Quitclaim Deed From Corporation To LLC?

Are you in need of a reliable and cost-effective provider of legal forms to purchase the Philadelphia Pennsylvania Quitclaim Deed from Corporation to LLC? US Legal Forms is your ideal solution.

Whether you need a simple agreement to establish rules for living with your partner or a set of documents to facilitate your divorce or separation through the court system, we can assist you. Our platform provides over 85,000 current legal document templates for both personal and business use. All templates we supply are tailored to comply with the laws of specific states and counties.

To download the form, you must Log In to your account, locate the required form, and click the Download button beside it. Please remember that you can retrieve your previously purchased document templates at any time from the My documents tab.

Is this your first visit to our site? No problem. You can create an account in just a few minutes, but before proceeding, ensure you do the following.

Now you can proceed to create your account. Then select your subscription option and continue to payment. After completing the payment, download the Philadelphia Pennsylvania Quitclaim Deed from Corporation to LLC in any supported file format. You can return to the website whenever you need to redownload the form at no additional cost.

Finding current legal documents has never been simpler. Try US Legal Forms today and say goodbye to spending hours searching for legal paperwork online.

- Verify if the Philadelphia Pennsylvania Quitclaim Deed from Corporation to LLC meets the regulations of your state and locality.

- Examine the form's specifics (if available) to understand who it is intended for and what it covers.

- Restart your search if the form does not fit your legal needs.

Form popularity

FAQ

One disadvantage of putting a property in an LLC is the potential for increased scrutiny from lenders. They may require personal guarantees or limit financing options for LLC-held properties. Additionally, transferring property can trigger transfer taxes and fees that should be considered. Despite these factors, using a Philadelphia Pennsylvania Quitclaim Deed from Corporation to LLC remains a viable option for many looking to safeguard their assets.

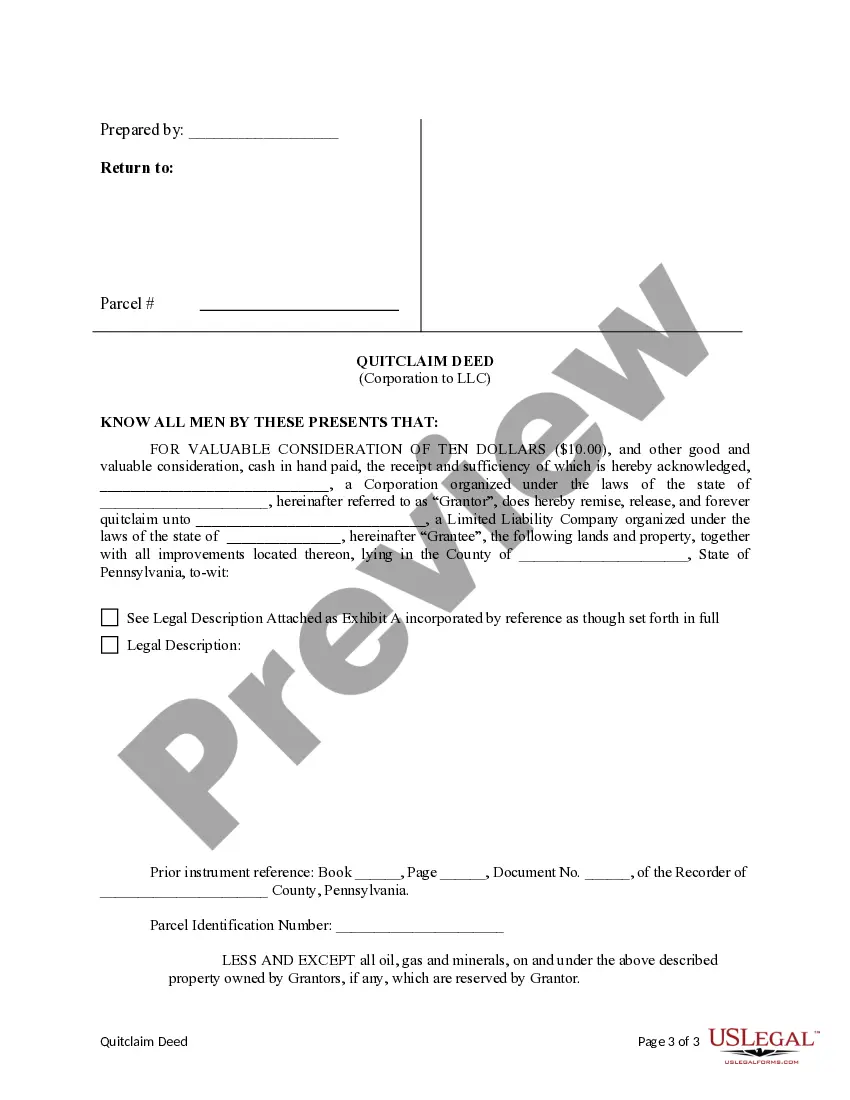

To quitclaim property to an LLC, you need to prepare a quitclaim deed and include the LLC as the grantee. It's important to ensure that you accurately describe the property and provide signatures from all current owners. This deed will serve as a Philadelphia Pennsylvania Quitclaim Deed from Corporation to LLC. Using a platform like uslegalforms can simplify the process, offering templates and guidance that help ensure you complete everything correctly.

Transferring property title to an LLC typically involves filing a quitclaim deed that reflects the corporation's intent to assign real estate assets. In a Philadelphia Pennsylvania Quitclaim Deed from Corporation to LLC, you'll need to provide accurate details about both entities involved. After completing the deed, ensure it is signed and recorded with the appropriate county office. Additionally, using resources like uslegalforms can simplify this process, ensuring you meet all legal requirements effectively.

One significant issue with a quitclaim deed is that it does not guarantee clear title to the property. Unlike other deed types, a Philadelphia Pennsylvania Quitclaim Deed from Corporation to LLC only transfers the interest the grantor has, which could be limited or disputed. This lack of warranty means that if there are existing liens or claims against the property, the new owner might face unexpected challenges. Always consider consulting legal advice or using platforms like uslegalforms to understand potential risks.

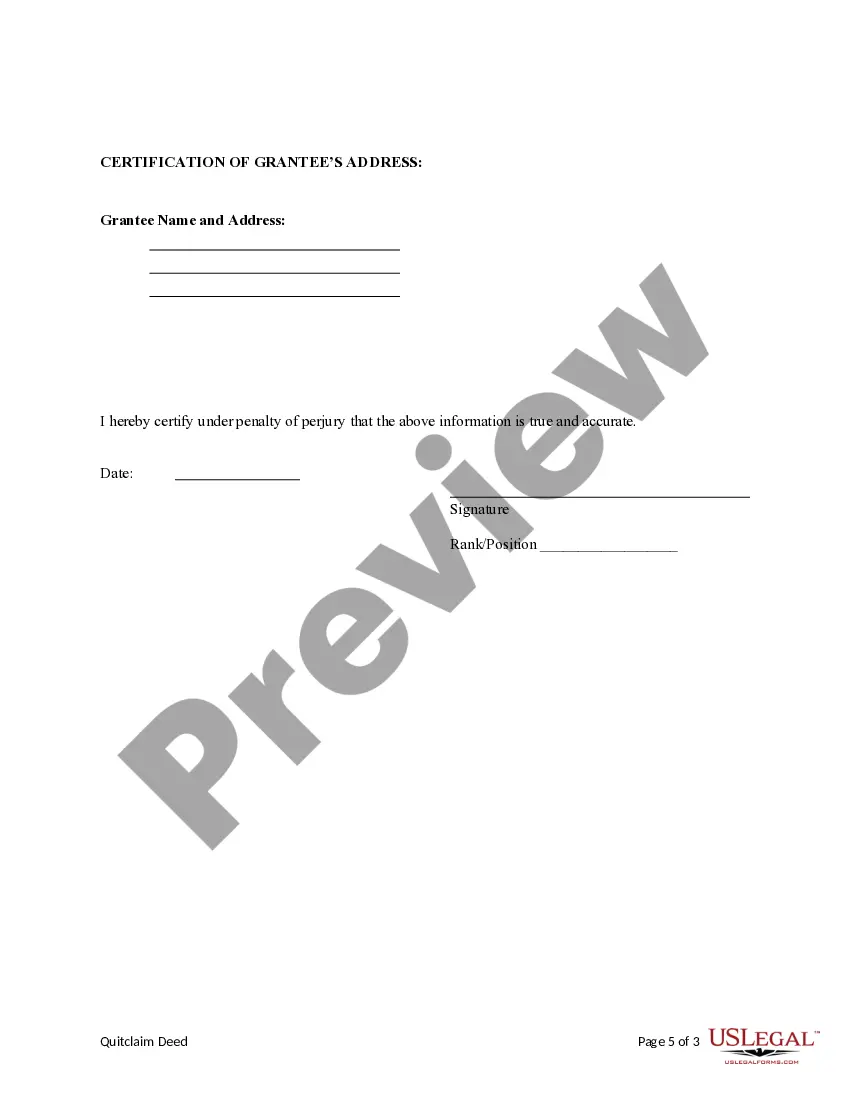

Filling out a quitclaim deed form requires careful attention to detail. First, ensure you include the full names of both the grantor and the grantee, with their roles clearly defined. Next, specify the property being transferred using its address and description. Finally, in the context of a Philadelphia Pennsylvania Quitclaim Deed from Corporation to LLC, make sure to validate and sign the document according to state requirements, as these can vary.

Individuals and entities involved in transferring property ownership often benefit the most from a quitclaim deed. Specifically, a Philadelphia Pennsylvania Quitclaim Deed from Corporation to LLC serves those looking to streamline the transfer of assets with minimal effort. It provides a straightforward way for corporations to transfer property to an LLC, especially when there are no complicated titles or disputes involved. Consequently, this process can save time and reduce potential legal costs.

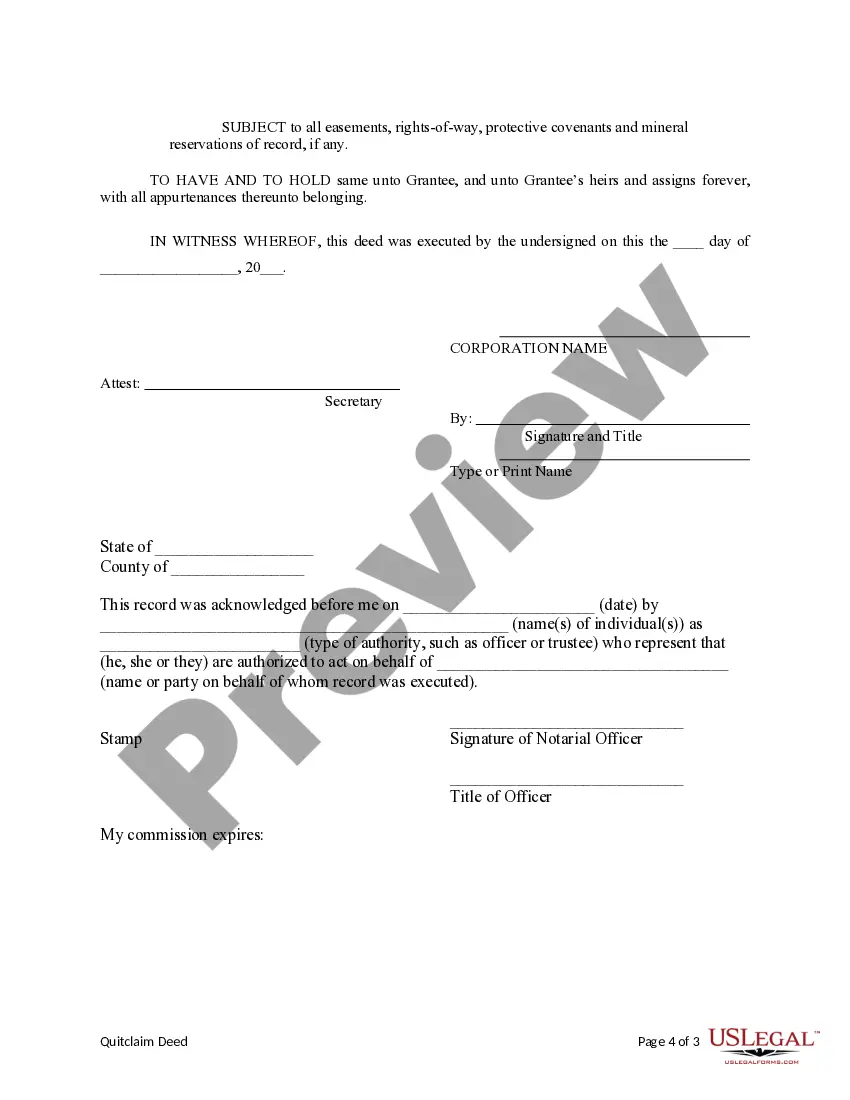

Filing a quitclaim deed in Pennsylvania requires you to first complete the deed form with all relevant details. Next, have the deed notarized to confirm the legitimacy of the signatures. Finally, submit the notarized deed to the appropriate county office for recording to finalize the transfer of property.

To file a quitclaim deed in Pennsylvania, you first need to prepare the deed with the correct property details. After signing it in the presence of a notary public, take the completed deed to the county recorder's office. The filing will officially transfer ownership and record the Philadelphia Pennsylvania Quitclaim Deed from Corporation to LLC.

One downside of a quitclaim deed is that it does not guarantee clear title or ownership; if issues arise, the grantee may face risks. Additionally, unlike warranty deeds, quitclaim deeds do not provide any warranties or protections against future claims on the property. Therefore, understanding these risks is essential before proceeding with a quitclaim deed in Philadelphia.

Transferring your property from your name to an LLC involves drafting a quitclaim deed that identifies both you and your LLC. It’s important to include accurate legal descriptions and signatures. Using comprehensive resources, such as US Legal Forms, can simplify the process and guide you through the Philadelphia Pennsylvania Quitclaim Deed from Corporation to LLC.