Philadelphia Pennsylvania Quitclaim Deed from Corporation to Corporation

Description

How to fill out Pennsylvania Quitclaim Deed From Corporation To Corporation?

If you've previously utilized our service, Log In to your account and store the Philadelphia Pennsylvania Quitclaim Deed from Corporation to Corporation on your device by clicking the Download button. Ensure that your subscription is current. If it isn't, renew it according to your payment plan.

If this is your initial interaction with our service, follow these straightforward steps to obtain your document.

You have continuous access to each document you have purchased: you can find it in your profile under the My documents menu whenever you wish to use it again. Utilize the US Legal Forms service to effortlessly locate and save any template for your personal or professional requirements!

- Confirm that you've found the correct document. Review the description and use the Preview option, if available, to determine if it fits your needs. If it doesn't meet your expectations, use the Search tab above to locate the appropriate one.

- Acquire the template. Click the Buy Now button and select a monthly or yearly subscription plan.

- Create an account and process your payment. Use your credit card information or the PayPal option to finalize the transaction.

- Receive your Philadelphia Pennsylvania Quitclaim Deed from Corporation to Corporation. Choose the file format for your document and save it to your device.

- Finish your document. Print it or utilize professional online editors to complete and sign it electronically.

Form popularity

FAQ

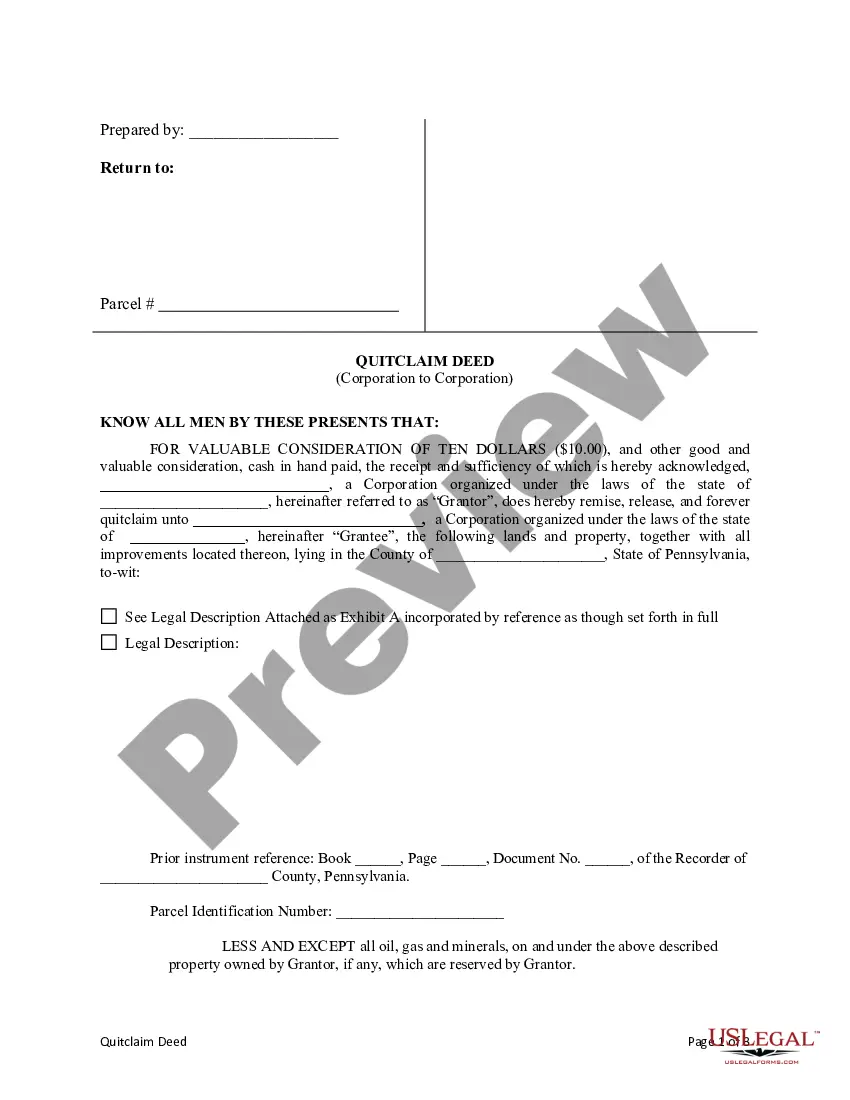

To quitclaim your property to an LLC, you must draft a Quitclaim Deed that declares the property’s transfer. Make sure to identify yourself as the grantor and the LLC as the grantee accurately. After signing the deed, it’s important to file it with your local county recorder’s office. This action finalizes your intent and supports the establishment of a Philadelphia Pennsylvania Quitclaim Deed from Corporation to Corporation.

To quitclaim property to an LLC, you first need to prepare a Quitclaim Deed, which states your intention to transfer ownership. You must include the LLC's name as the grantee and ensure all legal requirements are met. It's advisable to record the deed with the appropriate county office in Philadelphia to formalize the transaction. This process is crucial for a successful Philadelphia Pennsylvania Quitclaim Deed from Corporation to Corporation.

One disadvantage of putting a property in an LLC is the potential for double taxation. When the LLC generates income, it may be taxed at the corporate level, and then members could face personal taxation when distributions are made. Additionally, real estate owned by an LLC may not qualify for certain residential tax exemptions. Therefore, it’s essential to consider these factors when executing a Philadelphia Pennsylvania Quitclaim Deed from Corporation to Corporation.

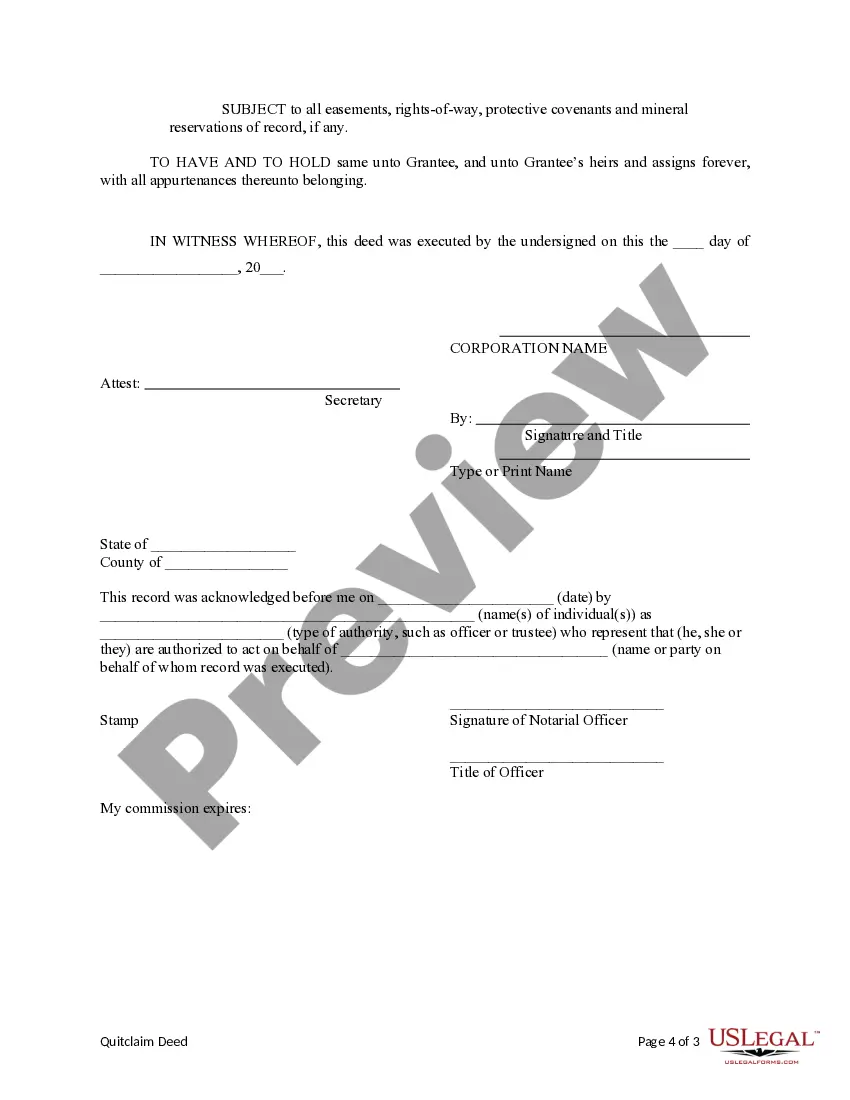

Changing your deed in Philadelphia involves drafting a new deed that reflects the desired changes, such as transferring ownership from one corporation to another. This process requires careful attention to the details, which is why using tools from USLegalForms can simplify creating a precise Philadelphia Pennsylvania Quitclaim Deed from Corporation to Corporation. After preparing the new deed, you should execute it in front of a notary public and then file the adjusted deed with the Philadelphia Department of Records. This officially updates the public record to reflect the new ownership.

To obtain a quitclaim deed in Pennsylvania, you must first prepare the document, including the names of the parties involved, a legal description of the property, and signature lines. You can do this through legal software or services like USLegalForms, which offer templates specifically for a Philadelphia Pennsylvania Quitclaim Deed from Corporation to Corporation. Once the deed is prepared, you should have it signed in front of a notary public. Finally, file the deed with the appropriate county office to officially record the transfer.

Certain entities, including the Commonwealth of Pennsylvania and specific non-profit organizations, may be exempt from transfer tax. Additionally, transactions involving a Philadelphia Pennsylvania Quitclaim Deed from Corporation to Corporation may qualify for exemptions under specific circumstances. Always verify your eligibility for exemptions and consult legal resources to navigate the complexities of tax obligations accurately.

To file a quitclaim deed in Pennsylvania, you should prepare the deed with the necessary details of the property and the parties involved. Once you have completed your Philadelphia Pennsylvania Quitclaim Deed from Corporation to Corporation, you will need to sign it in front of a notary and submit it to the local county recorder’s office. It’s advisable to check the specific filing requirements that may vary by county and ensure that you understand any applicable fees.

A quitclaim deed in Pennsylvania serves as a legal instrument that transfers any ownership interest one corporation may have in a property to another corporation. When you use a Philadelphia Pennsylvania Quitclaim Deed from Corporation to Corporation, the transferring entity relinquishes its claim without guaranteeing the property’s title. This type of deed is useful for straightforward transactions among corporations where trust exists between the parties involved.

To transfer property without incurring taxes, you can utilize a Philadelphia Pennsylvania Quitclaim Deed from Corporation to Corporation. This legal document allows corporations to transfer ownership of property without triggering a transfer tax in certain situations. However, it is essential to understand the specific requirements and exemptions that apply. Consulting with a legal expert can help ensure you comply with tax regulations during the transfer.

While quitclaim deeds provide a quick way to transfer property, they come with disadvantages. For instance, they do not offer any guarantees regarding the ownership's validity, which can lead to disputes. Understanding these risks is vital before proceeding, and using US Legal Forms can guide you through the nuances of a Philadelphia Pennsylvania Quitclaim Deed from Corporation to Corporation.