Philadelphia Postnuptial Property Agreement in Pennsylvania is a legal document created by married couples who wish to establish and define their property rights and financial obligations in the event of a separation, divorce, or death. This agreement helps couples determine the division of assets, spousal support, and property distribution, thus protecting their individual interests and avoiding potential conflicts in the future. The Philadelphia Postnuptial Property Agreement is particularly important in Pennsylvania, as it is an equitable distribution state. This means that marital property is not automatically divided equally, but rather in a fair and just manner based on various factors determined by the court. By creating a postnuptial agreement, couples have more control over how their property will be divided, allowing them to tailor the agreement to their specific needs and preferences. There are different types of Philadelphia Postnuptial Property Agreements that couples may consider based on their unique circumstances: 1. Property Division Agreement: This type of agreement mostly focuses on the distribution of assets, including real estate properties, bank accounts, investments, and personal belongings. It outlines how these assets will be divided between the spouses and may specify if any separate property should be excluded from the division. 2. Spousal Support Agreement: In some cases, couples may wish to establish spousal support or alimony provisions in their postnuptial agreement. This agreement outlines the type, amount, and duration of spousal support payments one spouse may provide to the other in the event of a separation or divorce. 3. Debt Allocation Agreement: A postnuptial agreement can also address the allocation of debts in case of divorce or separation. This includes mortgages, credit card debts, student loans, and any outstanding loans owned by either spouse. The agreement can specify how these debts will be apportioned, ensuring that each spouse takes responsibility for their fair share. 4. Inheritance Agreement: Pennsylvania is an inheritance and estate tax state, meaning certain assets may be subject to taxation upon the death of a spouse. A postnuptial agreement can include provisions that protect the inheritance rights of each spouse, stipulating what assets will be transferred to the surviving spouse and how the estate will be distributed among beneficiaries. Overall, a Philadelphia Postnuptial Property Agreement is an essential legal tool for married couples in Pennsylvania to protect their interests and efficiently navigate potential property division issues. Consulting with an experienced attorney is highly recommended when drafting such agreements to ensure compliance with state laws and address all relevant concerns effectively.

Philadelphia Property

State:

Pennsylvania

County:

Philadelphia

Control #:

PA-01713-AZ

Format:

Word;

Rich Text

Instant download

Description

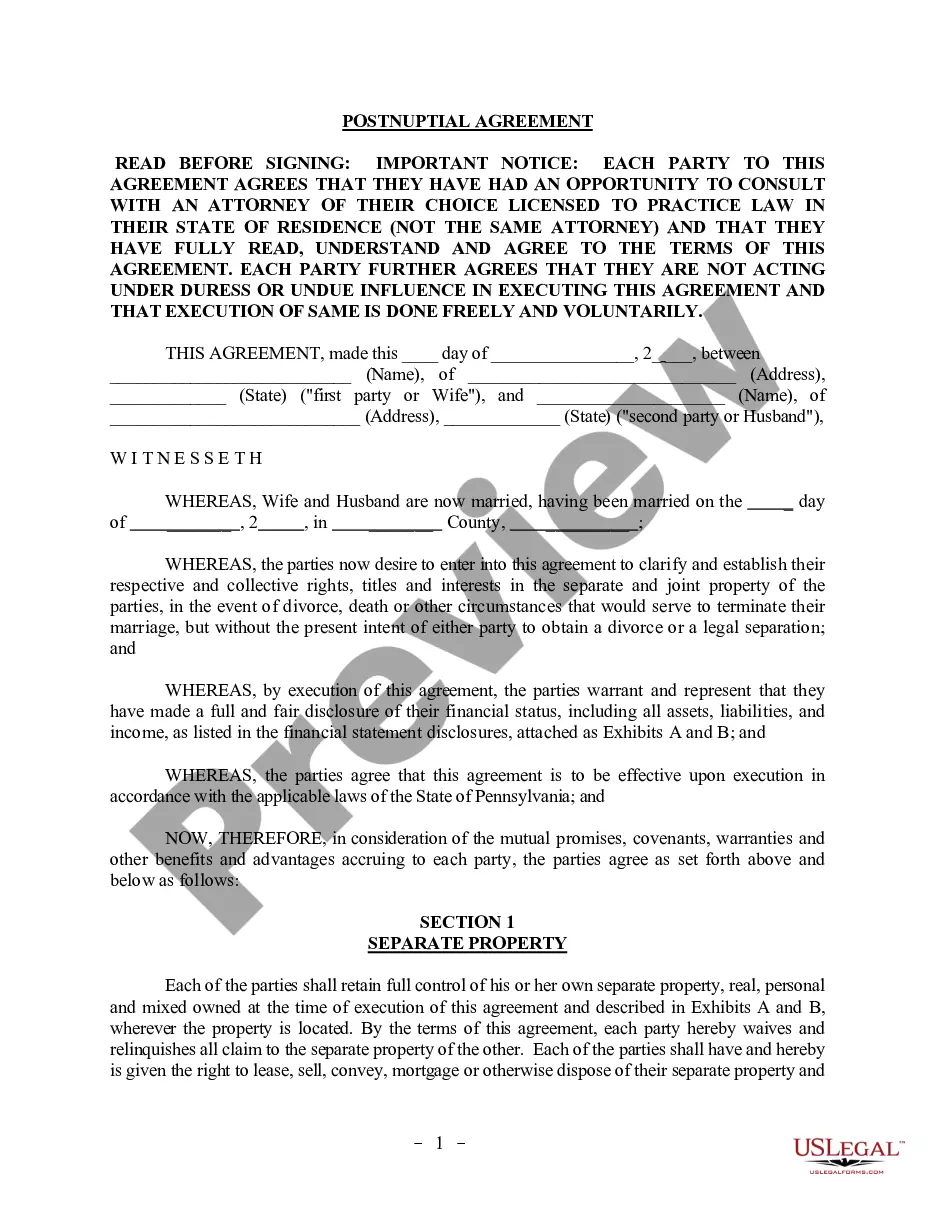

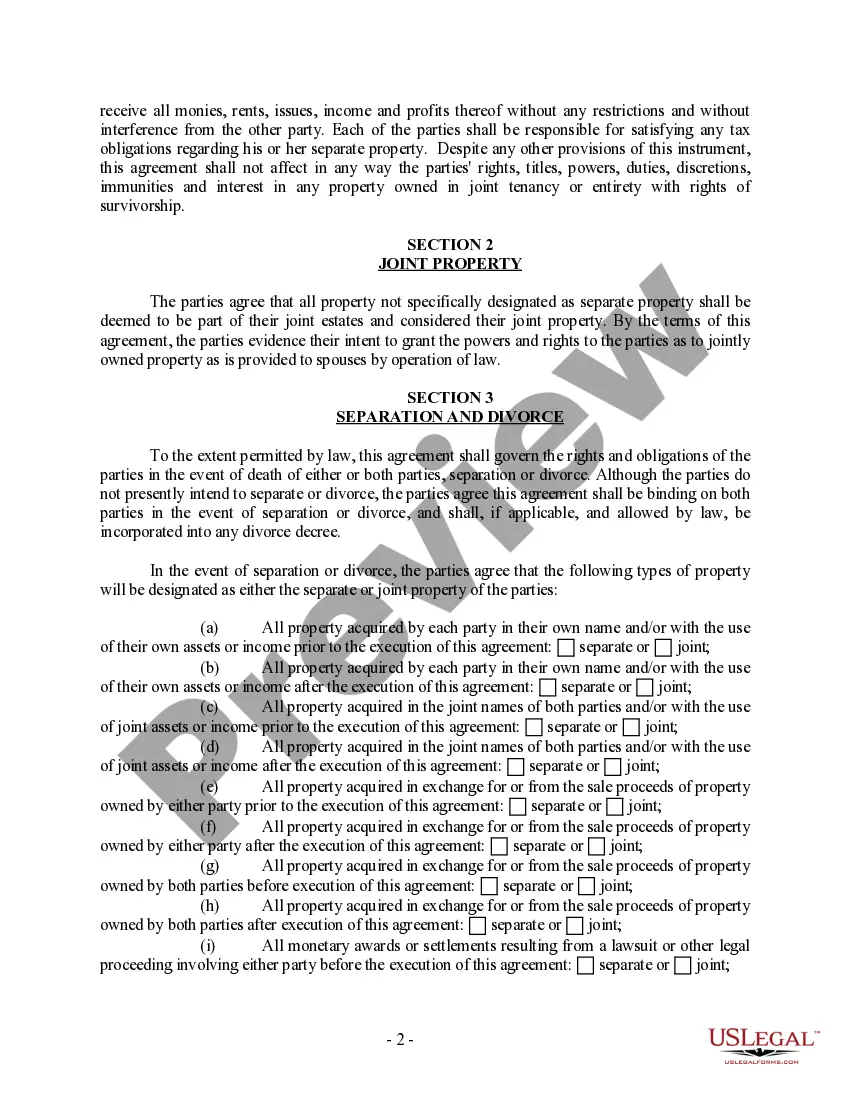

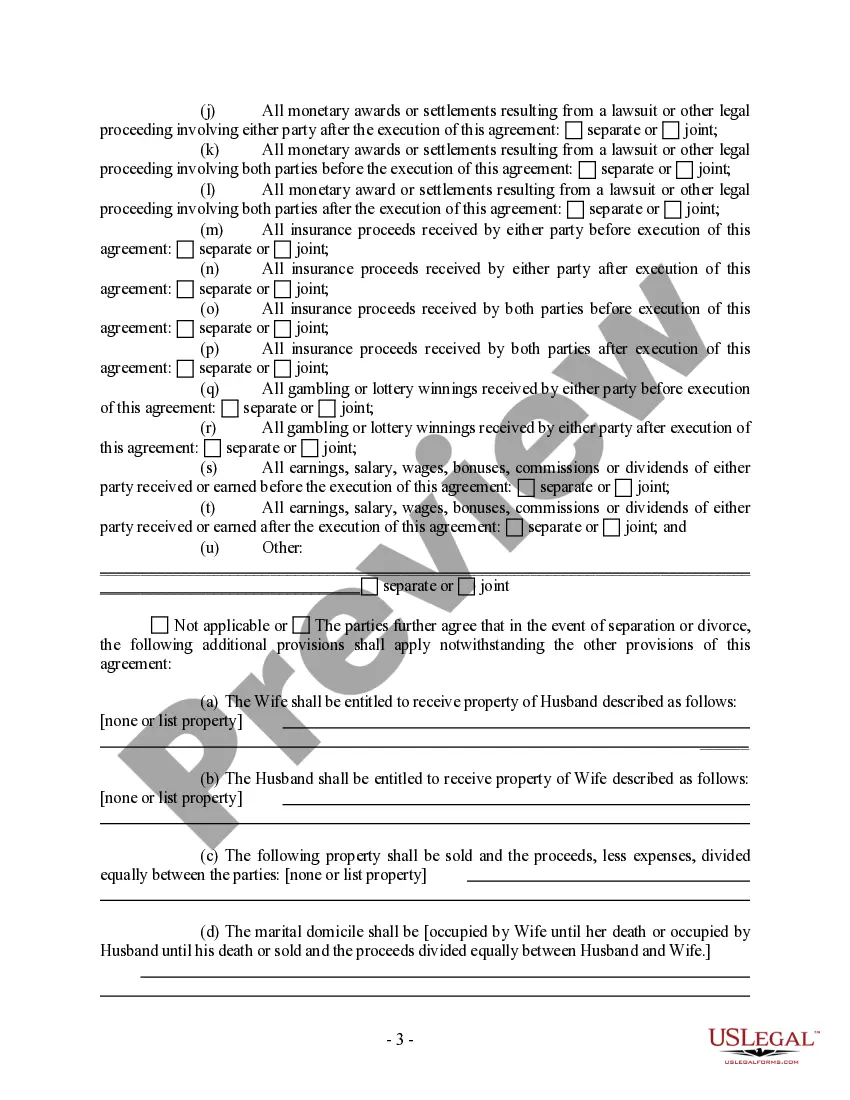

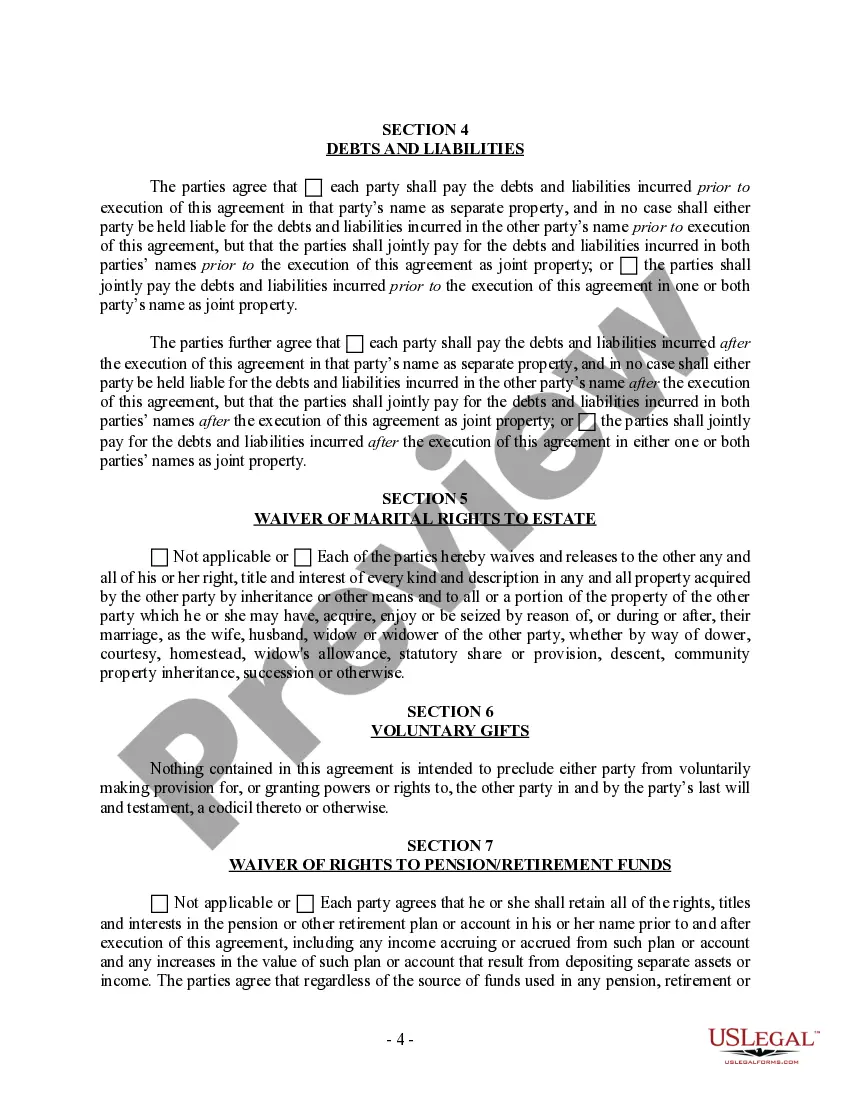

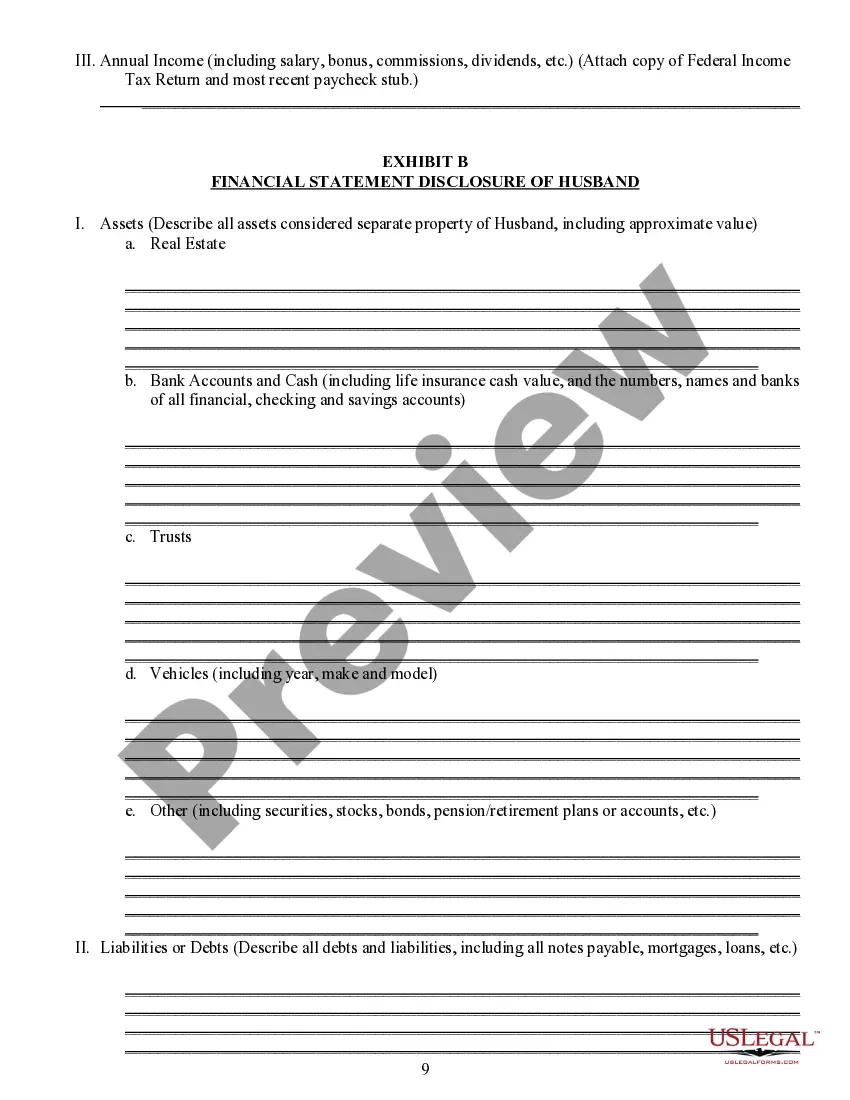

This Postnuptial Property Agreement is made with the intent to define and specify the respective and collective rights of the parties in the separate and joint property of the parties. The parties acknowledge that they were represented by counsel during the negotiations of the agreement and the legal consequences of the agreement have been fully explained.

Philadelphia Postnuptial Property Agreement in Pennsylvania is a legal document created by married couples who wish to establish and define their property rights and financial obligations in the event of a separation, divorce, or death. This agreement helps couples determine the division of assets, spousal support, and property distribution, thus protecting their individual interests and avoiding potential conflicts in the future. The Philadelphia Postnuptial Property Agreement is particularly important in Pennsylvania, as it is an equitable distribution state. This means that marital property is not automatically divided equally, but rather in a fair and just manner based on various factors determined by the court. By creating a postnuptial agreement, couples have more control over how their property will be divided, allowing them to tailor the agreement to their specific needs and preferences. There are different types of Philadelphia Postnuptial Property Agreements that couples may consider based on their unique circumstances: 1. Property Division Agreement: This type of agreement mostly focuses on the distribution of assets, including real estate properties, bank accounts, investments, and personal belongings. It outlines how these assets will be divided between the spouses and may specify if any separate property should be excluded from the division. 2. Spousal Support Agreement: In some cases, couples may wish to establish spousal support or alimony provisions in their postnuptial agreement. This agreement outlines the type, amount, and duration of spousal support payments one spouse may provide to the other in the event of a separation or divorce. 3. Debt Allocation Agreement: A postnuptial agreement can also address the allocation of debts in case of divorce or separation. This includes mortgages, credit card debts, student loans, and any outstanding loans owned by either spouse. The agreement can specify how these debts will be apportioned, ensuring that each spouse takes responsibility for their fair share. 4. Inheritance Agreement: Pennsylvania is an inheritance and estate tax state, meaning certain assets may be subject to taxation upon the death of a spouse. A postnuptial agreement can include provisions that protect the inheritance rights of each spouse, stipulating what assets will be transferred to the surviving spouse and how the estate will be distributed among beneficiaries. Overall, a Philadelphia Postnuptial Property Agreement is an essential legal tool for married couples in Pennsylvania to protect their interests and efficiently navigate potential property division issues. Consulting with an experienced attorney is highly recommended when drafting such agreements to ensure compliance with state laws and address all relevant concerns effectively.

Free preview

How to fill out Philadelphia Pennsylvania Postnuptial Property Agreement?

If you’ve already used our service before, log in to your account and save the Philadelphia Postnuptial Property Agreement - Pennsylvania on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple steps to obtain your document:

- Make certain you’ve found the right document. Look through the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t suit you, utilize the Search tab above to obtain the appropriate one.

- Buy the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Obtain your Philadelphia Postnuptial Property Agreement - Pennsylvania. Pick the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to every piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to quickly locate and save any template for your individual or professional needs!