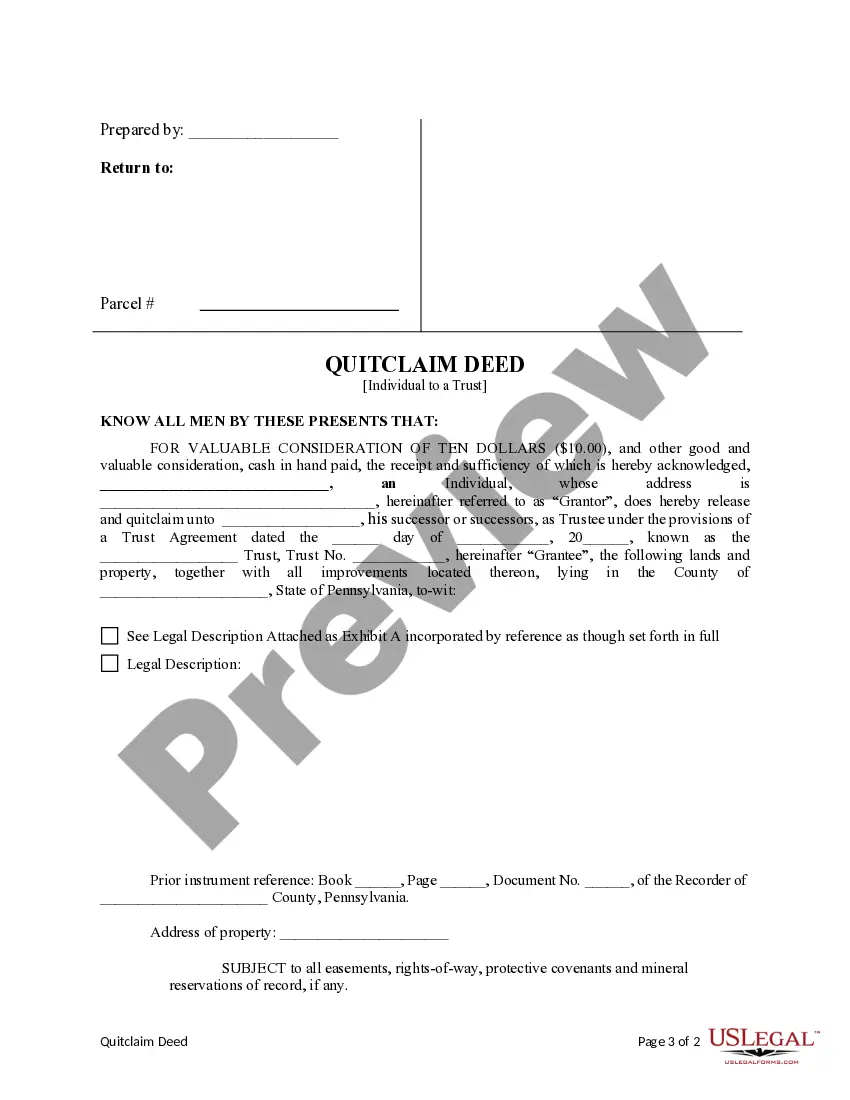

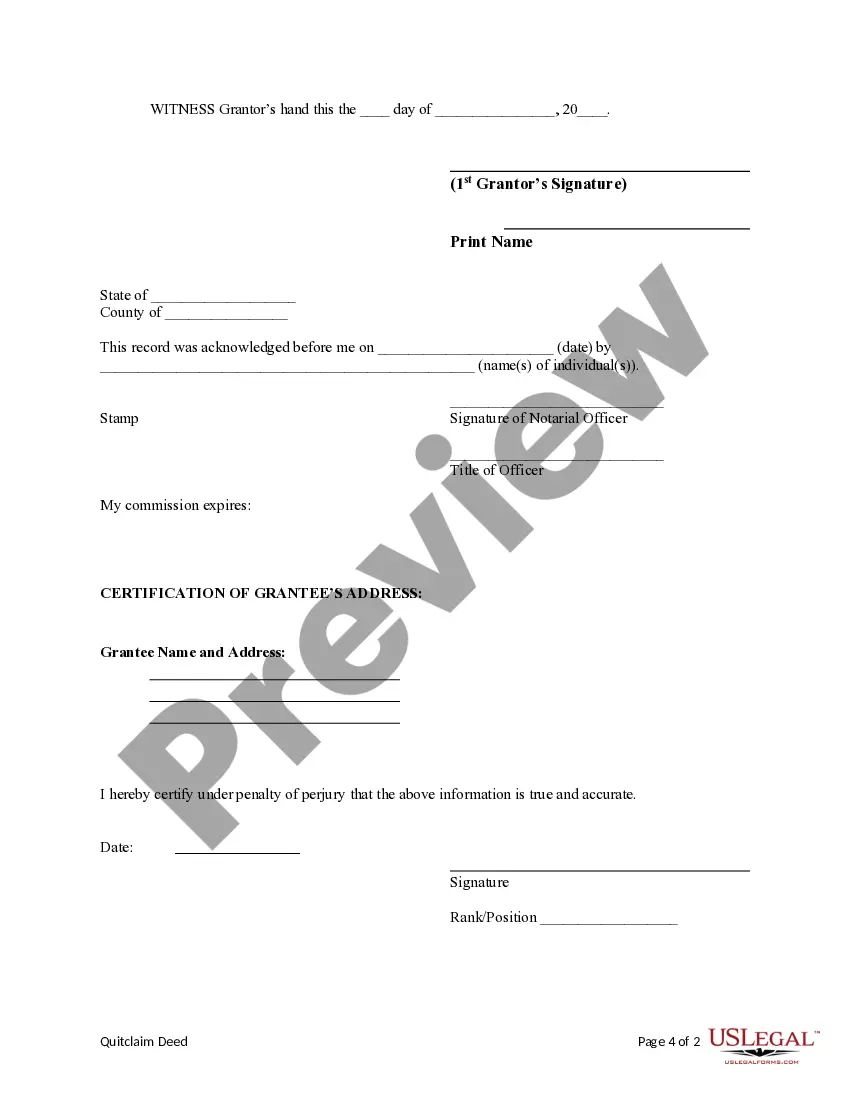

This form is a Quitclaim Deed where the grantor is an individual and the grantee is a trust. Grantor conveys and quitclaims the described property to grantee. This deed complies with all state statutory laws.

A Philadelphia Pennsylvania Quitclaim Deed — Individual to a Trust is a legal document used to transfer real estate ownership from an individual to a trust. This type of deed is commonly used when an individual wants to transfer their property to a trust they have established. By doing so, the individual effectively transfers ownership of the property to the trust, enabling them to maintain control and management over the property while enjoying the benefits of trust ownership. Here are some relevant keywords to notice: Philadelphia Pennsylvania, Quitclaim Deed, individual, trust, legal document, transfer, real estate ownership, property, control, management, benefits. There are a few types of Philadelphia Pennsylvania Quitclaim Deed — Individual to a Trust that are worth mentioning: 1. Philadelphia Pennsylvania Revocable Living Trust Quitclaim Deed: This type of deed is used when the individual transfers ownership of their property to a revocable living trust they have created. A revocable living trust allows the individual to have full control over the property during their lifetime and designate beneficiaries who will inherit the property upon their death. 2. Philadelphia Pennsylvania Irrevocable Trust Quitclaim Deed: In contrast to a revocable living trust, an irrevocable trust cannot be altered, modified, or revoked by the individual after the property transfer. This type of deed is utilized when the individual wants to protect their assets, minimize estate taxes, or preserve eligibility for government benefits. 3. Philadelphia Pennsylvania Family Trust Quitclaim Deed: This type of deed is commonly used when an individual wants to transfer their property to a trust that is specifically set up for the benefit of their family members. The family trust can provide asset protection, tax benefits, and continuity in the management of the property for future generations. It's essential to consult with a real estate attorney or a qualified professional when dealing with Philadelphia Pennsylvania Quitclaim Deeds — Individual to a Trust. They can provide proper legal advice and guidance to ensure that the transfer of property is executed correctly in accordance with state laws and individual circumstances.A Philadelphia Pennsylvania Quitclaim Deed — Individual to a Trust is a legal document used to transfer real estate ownership from an individual to a trust. This type of deed is commonly used when an individual wants to transfer their property to a trust they have established. By doing so, the individual effectively transfers ownership of the property to the trust, enabling them to maintain control and management over the property while enjoying the benefits of trust ownership. Here are some relevant keywords to notice: Philadelphia Pennsylvania, Quitclaim Deed, individual, trust, legal document, transfer, real estate ownership, property, control, management, benefits. There are a few types of Philadelphia Pennsylvania Quitclaim Deed — Individual to a Trust that are worth mentioning: 1. Philadelphia Pennsylvania Revocable Living Trust Quitclaim Deed: This type of deed is used when the individual transfers ownership of their property to a revocable living trust they have created. A revocable living trust allows the individual to have full control over the property during their lifetime and designate beneficiaries who will inherit the property upon their death. 2. Philadelphia Pennsylvania Irrevocable Trust Quitclaim Deed: In contrast to a revocable living trust, an irrevocable trust cannot be altered, modified, or revoked by the individual after the property transfer. This type of deed is utilized when the individual wants to protect their assets, minimize estate taxes, or preserve eligibility for government benefits. 3. Philadelphia Pennsylvania Family Trust Quitclaim Deed: This type of deed is commonly used when an individual wants to transfer their property to a trust that is specifically set up for the benefit of their family members. The family trust can provide asset protection, tax benefits, and continuity in the management of the property for future generations. It's essential to consult with a real estate attorney or a qualified professional when dealing with Philadelphia Pennsylvania Quitclaim Deeds — Individual to a Trust. They can provide proper legal advice and guidance to ensure that the transfer of property is executed correctly in accordance with state laws and individual circumstances.