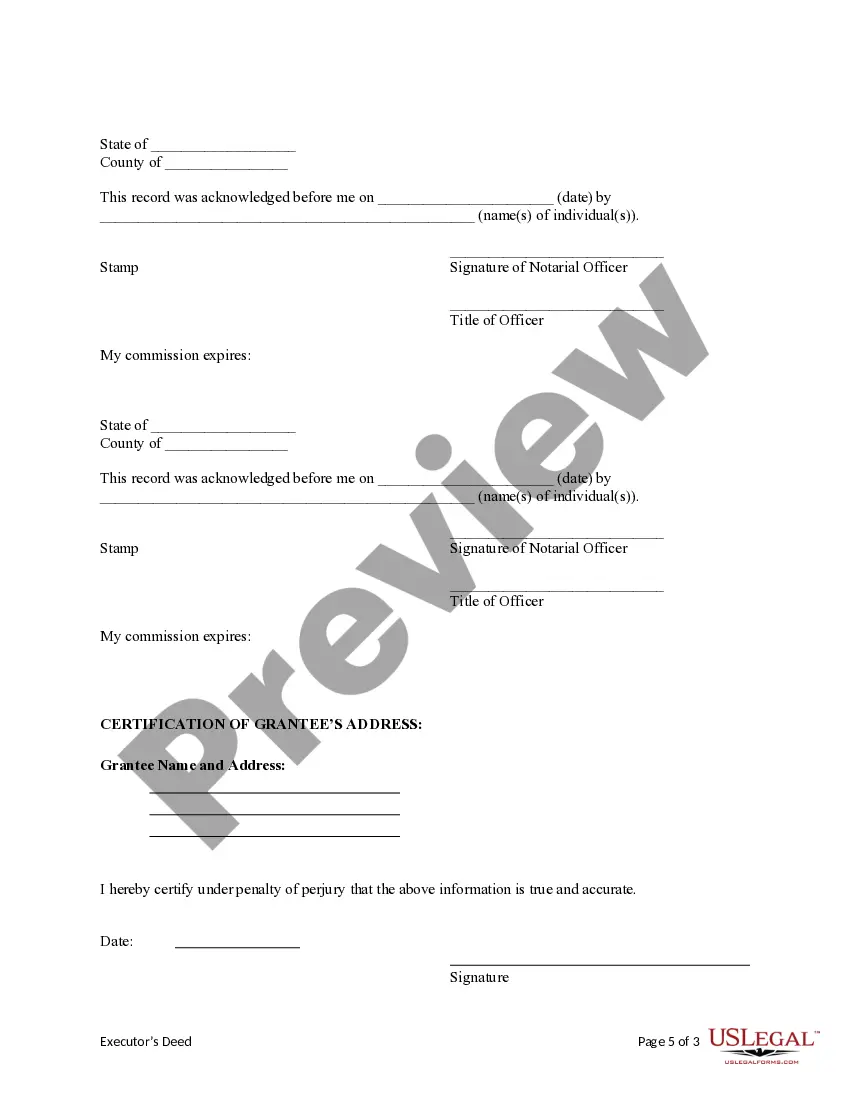

This deed, or deed-related form, is for use in property transactions in the designated state. This document, a sample Executor's Deed, can be used in the transfer process or related task. Adapt the language to fit your circumstances.

A Pittsburgh Pennsylvania Executor's Deed — Co-Executors to Two or More Grantees is a legal document used to transfer property from the estate of a deceased person to two or more beneficiaries, known as grantees. This type of deed is typically used in cases where multiple individuals are appointed as co-executors of the estate. The Pittsburgh Pennsylvania Executor's Deed — Co-Executors to Two or More Grantees is an important document that outlines the transfer of ownership rights and responsibilities. It provides a detailed description of the property being transferred, including its legal description, tax identification number, and any encumbrances or liens. Some relevant keywords for a Pittsburgh Pennsylvania Executor's Deed — Co-Executors to Two or More Grantees include: 1. Pittsburgh Pennsylvania estate administration: This refers to the process of handling the legal and financial affairs of a deceased person, including the distribution of their assets. 2. Co-executors: These are individuals appointed by the deceased person's will or by a court to act as the personal representatives of the estate. They are responsible for managing the estate's assets and ensuring that the deceased person's wishes are carried out. 3. Grantees: These are the individuals who will receive ownership of the property being transferred through the executor's deed. They are typically named in the deceased person's will or determined by the court if there is no will. 4. Property transfer: This refers to the legal process of transferring ownership of real estate from one party to another. In the case of a Pittsburgh Pennsylvania Executor's Deed, the transfer is made from the estate of the deceased person to the co-executors and grantees. 5. Legal description: This describes the specific boundaries and characteristics of the property being transferred. It includes details such as the property's dimensions, location, and any easements or restrictions that may affect its use. 6. Tax identification number: This is a unique number assigned to a property by the local taxing authority. It is used for identification and tax purposes and is typically included in the executor's deed. 7. Encumbrances or liens: These are any legal claims or restrictions on the property being transferred. Examples include mortgages, unpaid taxes, or judgments. The executor's deed should indicate if the property is subject to any encumbrances or liens. Different variations of the Pittsburgh Pennsylvania Executor's Deed — Co-Executors to Two or More Grantees may include specific clauses or provisions based on the particular circumstances of the estate. Some common types of executor's deeds may include those with co-executors who are siblings, spouses, or other family members, as well as those involving multiple properties or unique estate situations. In summary, a Pittsburgh Pennsylvania Executor's Deed — Co-Executors to Two or More Grantees is a legal document that facilitates the transfer of property from a deceased person's estate to multiple beneficiaries. It is crucial to consult an attorney experienced in estate administration to ensure all legal requirements are met when executing this deed.A Pittsburgh Pennsylvania Executor's Deed — Co-Executors to Two or More Grantees is a legal document used to transfer property from the estate of a deceased person to two or more beneficiaries, known as grantees. This type of deed is typically used in cases where multiple individuals are appointed as co-executors of the estate. The Pittsburgh Pennsylvania Executor's Deed — Co-Executors to Two or More Grantees is an important document that outlines the transfer of ownership rights and responsibilities. It provides a detailed description of the property being transferred, including its legal description, tax identification number, and any encumbrances or liens. Some relevant keywords for a Pittsburgh Pennsylvania Executor's Deed — Co-Executors to Two or More Grantees include: 1. Pittsburgh Pennsylvania estate administration: This refers to the process of handling the legal and financial affairs of a deceased person, including the distribution of their assets. 2. Co-executors: These are individuals appointed by the deceased person's will or by a court to act as the personal representatives of the estate. They are responsible for managing the estate's assets and ensuring that the deceased person's wishes are carried out. 3. Grantees: These are the individuals who will receive ownership of the property being transferred through the executor's deed. They are typically named in the deceased person's will or determined by the court if there is no will. 4. Property transfer: This refers to the legal process of transferring ownership of real estate from one party to another. In the case of a Pittsburgh Pennsylvania Executor's Deed, the transfer is made from the estate of the deceased person to the co-executors and grantees. 5. Legal description: This describes the specific boundaries and characteristics of the property being transferred. It includes details such as the property's dimensions, location, and any easements or restrictions that may affect its use. 6. Tax identification number: This is a unique number assigned to a property by the local taxing authority. It is used for identification and tax purposes and is typically included in the executor's deed. 7. Encumbrances or liens: These are any legal claims or restrictions on the property being transferred. Examples include mortgages, unpaid taxes, or judgments. The executor's deed should indicate if the property is subject to any encumbrances or liens. Different variations of the Pittsburgh Pennsylvania Executor's Deed — Co-Executors to Two or More Grantees may include specific clauses or provisions based on the particular circumstances of the estate. Some common types of executor's deeds may include those with co-executors who are siblings, spouses, or other family members, as well as those involving multiple properties or unique estate situations. In summary, a Pittsburgh Pennsylvania Executor's Deed — Co-Executors to Two or More Grantees is a legal document that facilitates the transfer of property from a deceased person's estate to multiple beneficiaries. It is crucial to consult an attorney experienced in estate administration to ensure all legal requirements are met when executing this deed.