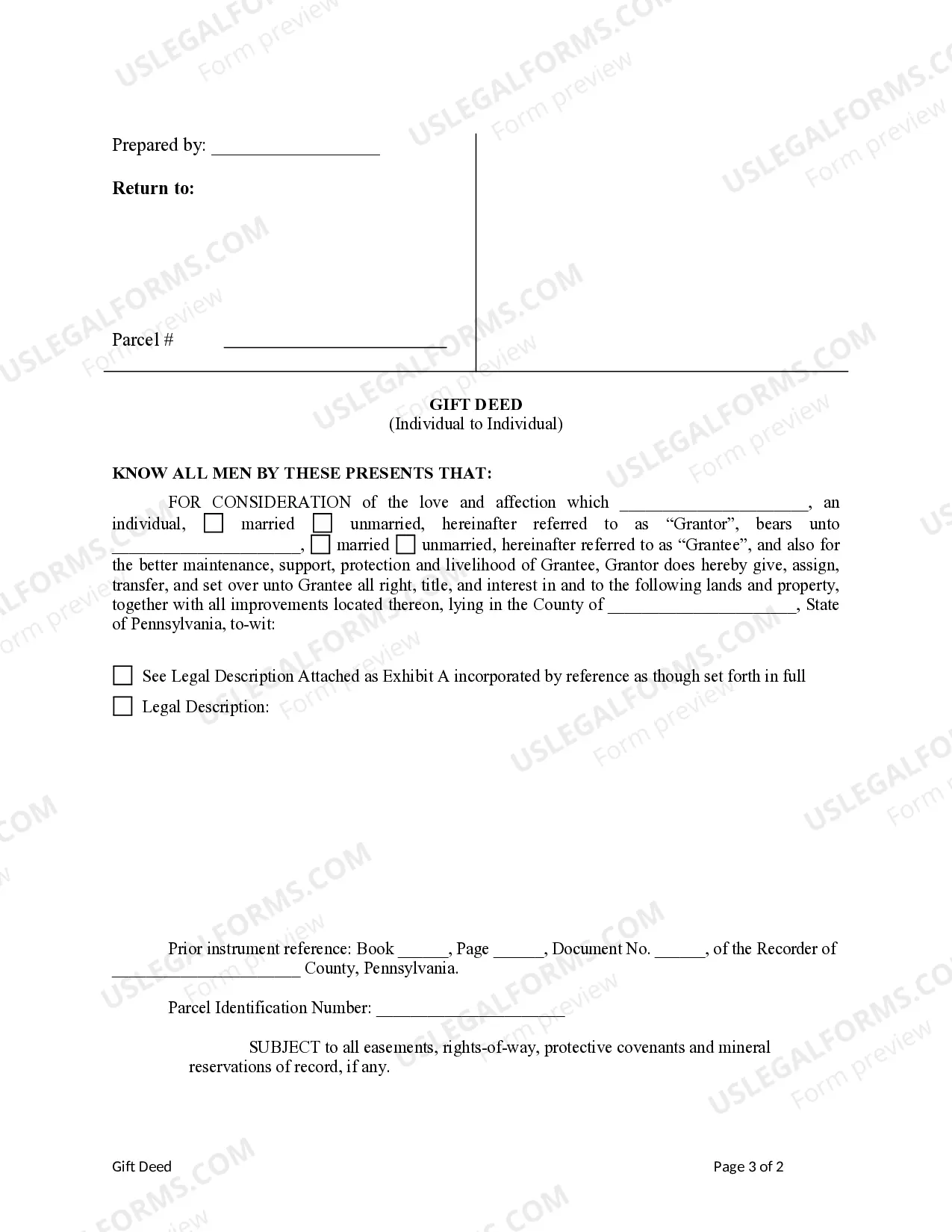

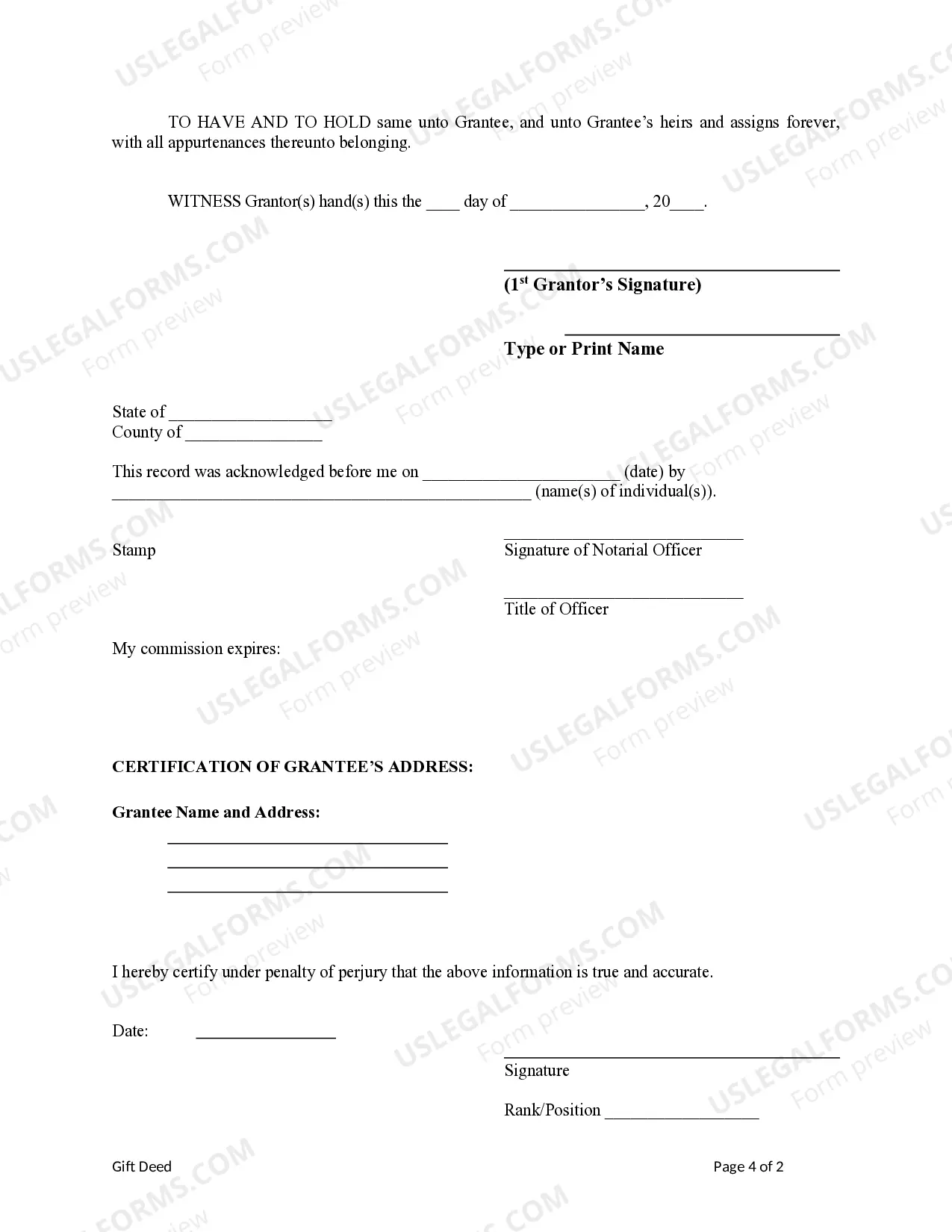

Title: Understanding Allentown Pennsylvania Gift Deed for Individual to Individual: A Comprehensive Overview Keywords: Allentown Pennsylvania, Gift Deed, Individual to Individual, types Introduction: In Allentown, Pennsylvania, a Gift Deed is a legal document used when an individual willingly transfers ownership of real estate or personal property to another individual without any monetary exchange. This detailed description provides an extensive overview of Allentown Pennsylvania Gift Deed for Individual to Individual, including its purpose, requirements, and different types if applicable. Key Points: 1. Purpose of Allentown Pennsylvania Gift Deed: A Gift Deed allows an individual (the donor) to legally donate their property to another individual (the recipient) without payment involved. It reflects the donor's intention to pass ownership, showcasing a voluntary act of generosity or personal connection between the parties involved. 2. Requirements for Allentown Pennsylvania Gift Deed: a. Legal Capacity: Both the donor and the recipient must be legally capable of entering into a contract. b. Voluntary Intent: The transfer of ownership should be a voluntary act, demonstrating a genuine gift without the expectation of any compensation. c. Acceptance: The recipient must accept the gift with their full consent to make the transfer complete. d. Delivery: The donor should physically deliver the Gift Deed document to the recipient, signifying the transfer's official execution. 3. Additional Considerations for Allentown Pennsylvania Gift Deed: a. Recording: It is advisable to record the Gift Deed at the Recorder of Deeds office in the county where the property is located. This helps establish a public record of ownership transfer, avoiding future disputes. b. Tax Implications: Consult a tax professional to understand and comply with any applicable federal or state gift tax laws. Both the donor and recipient may have tax obligations based on the value of the transferred property. c. Comprehensive Documentation: It is crucial to ensure the Gift Deed is drafted accurately, including a legal description of the property, the recipient's name, the donor's signature, and any relevant witnesses or notary acknowledgments. Different Types of Allentown Pennsylvania Gift Deed (if applicable): 1. Real Estate Gift Deed: This type of Gift Deed is used to transfer ownership of a real estate property (such as a house or land) from an individual donor to another individual recipient in Allentown, Pennsylvania. 2. Personal Property Gift Deed: This variation applies to the transfer of personal property like vehicles, jewelry, or artwork, from one person to another in Allentown, Pennsylvania. Conclusion: Understanding the Allentown Pennsylvania Gift Deed for Individual to Individual is essential when contemplating a property or personal property gift transfer. With a clear purpose, required elements, and considerations in mind, individuals can execute a legally valid and transparent gift transfer process. Seeking legal advice to draft and finalize the Gift Deed ensures a seamless and error-free transaction, promoting peace of mind for both the donor and the recipient.

Allentown Pennsylvania Gift Deed for Individual to Individual

Description

How to fill out Pennsylvania Gift Deed For Individual To Individual?

We consistently endeavor to minimize or evade legal complications when engaging with subtle legal or financial matters.

To achieve this, we enroll in legal services that are generally exorbitant.

Nonetheless, not every legal challenge is quite intricate. A majority of them can be managed independently.

US Legal Forms is an online repository of current do-it-yourself legal documents encompassing everything from wills and power of attorneys to incorporation articles and dissolution petitions.

Simply Log In to your account and click the Get button adjacent to it. If you misplace the document, you can always retrieve it again in the My documents section. The procedure is equally simple if you’re not familiar with the platform! You can set up your account within moments. Ensure that the Allentown Pennsylvania Gift Deed for Individual to Individual complies with the laws and regulations of your state and region. Additionally, it’s vital that you review the form’s outline (if available), and if you observe any inconsistencies with what you originally intended, look for an alternate form. Once you’ve confirmed that the Allentown Pennsylvania Gift Deed for Individual to Individual meets your needs, you can choose a subscription plan and proceed with payment. Subsequently, you can download the document in any available format. For over 24 years, we’ve assisted millions by providing customizable and current legal forms. Take advantage of US Legal Forms today to conserve time and resources!

- Our collection empowers you to handle your own matters without relying on a lawyer.

- We offer access to legal document templates that may not always be readily available.

- Our templates are tailored to specific states and regions, which notably aids the search process.

- Utilize US Legal Forms whenever you wish to obtain and download the Allentown Pennsylvania Gift Deed for Individual to Individual or any other document conveniently and securely.

Form popularity

FAQ

To obtain a copy of a deed in Lehigh County, you can visit the local county recorder’s office or check their website for online services. You will need the property address or the name of the property owner to find the Allentown Pennsylvania Gift Deed for Individual to Individual. This service ensures you have the necessary documentation for your records.

To transfer property in Pennsylvania, you typically need to complete a deed, often a gift deed when transferring property without payment. The Allentown Pennsylvania Gift Deed for Individual to Individual requires both parties to sign the document and have it notarized. After that, record the deed with your local county office to make the transaction official.

You do not necessarily need a lawyer to transfer property in Pennsylvania, but having one can simplify the process. Especially when dealing with an Allentown Pennsylvania Gift Deed for Individual to Individual, a lawyer can guide you through necessary documentation and local regulations. This support helps ensure that the transfer is executed correctly and legally.

Whether it’s better to inherit a house or receive it as a gift can depend on personal circumstances. Gifting a house may provide immediate use and can avoid probate delays. However, inheriting a house might allow for stepped-up basis, potentially minimizing capital gains tax. Consider discussing your options with a legal expert to find the best path for you.

Gifting a house in Pennsylvania involves preparing a Gift Deed that details the property and both parties. Once the deed is ready, ensure it is signed, notarized, and then recorded with the local land records office. With the right tools and resources from USLegalForms, you can easily create your Gift Deed for Individual to Individual.

To add someone to your house deed in Pennsylvania, you typically need to prepare a new deed that names both you and the new person as co-owners. This is often done through a Quitclaim Deed or a Gift Deed for Individual to Individual. It is advisable to consult a legal professional or use USLegalForms to ensure the deed complies with state laws.

To legally gift a house, you must draft a Gift Deed that outlines the property details and the recipient's information. Both you and the recipient should sign the document in the presence of a notary. In Allentown, Pennsylvania, using a platform like USLegalForms can simplify the creation of your Gift Deed for Individual to Individual.

You can gift a house to someone in Pennsylvania without facing significant restrictions. The process involves creating a valid Gift Deed for Individual to Individual. This deed must be signed and notarized to ensure the transfer is recognized by the state and protect both parties involved.

Yes, someone can give you a house through a gift deed. This legal document allows the property owner to transfer ownership without any payment. In Allentown, Pennsylvania, a Gift Deed for Individual to Individual is a simple way to make this transfer legally binding and avoid potential disputes.

When using an Allentown Pennsylvania Gift Deed for Individual to Individual, it's important to consider potential disadvantages. One major concern is the possible tax implications, as the donor may face gift taxes depending on the property's value. Additionally, since a gift deed is irrevocable, the donor cannot change their mind later, which could lead to disputes among family members. Furthermore, this type of deed may not provide the same legal protections as a traditional sale, which could create complications in the future.

Interesting Questions

More info

New Brunswick Fishing License information — official site. — official site. PENNSYLVANIA The day of December in the year Two Thousand and Fifteen (2015). A tax basis can be important when deciding whether to make gifts now or transfer property at your death. Of Northampton County, Pennsylvania (Deed Book Volume 20201 Page described in a Deed recorded in the Office of the Recorder of Deeds. And Personal Property and Items of a Non-competitive Nature. Our custom baskets make a great gift for any occasion! You can even build your own box! Steve is admitted to practice in the states of Pennsylvania and Florida. Pennsylvania Fishing License information — official site. How-to and where you can purchase a PA fishing license, permit or a license gift voucher. Virginia Fishing License information — official site. NEW JERSEY The day of December in the year Two Thousand and Fifteen (2015).

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.