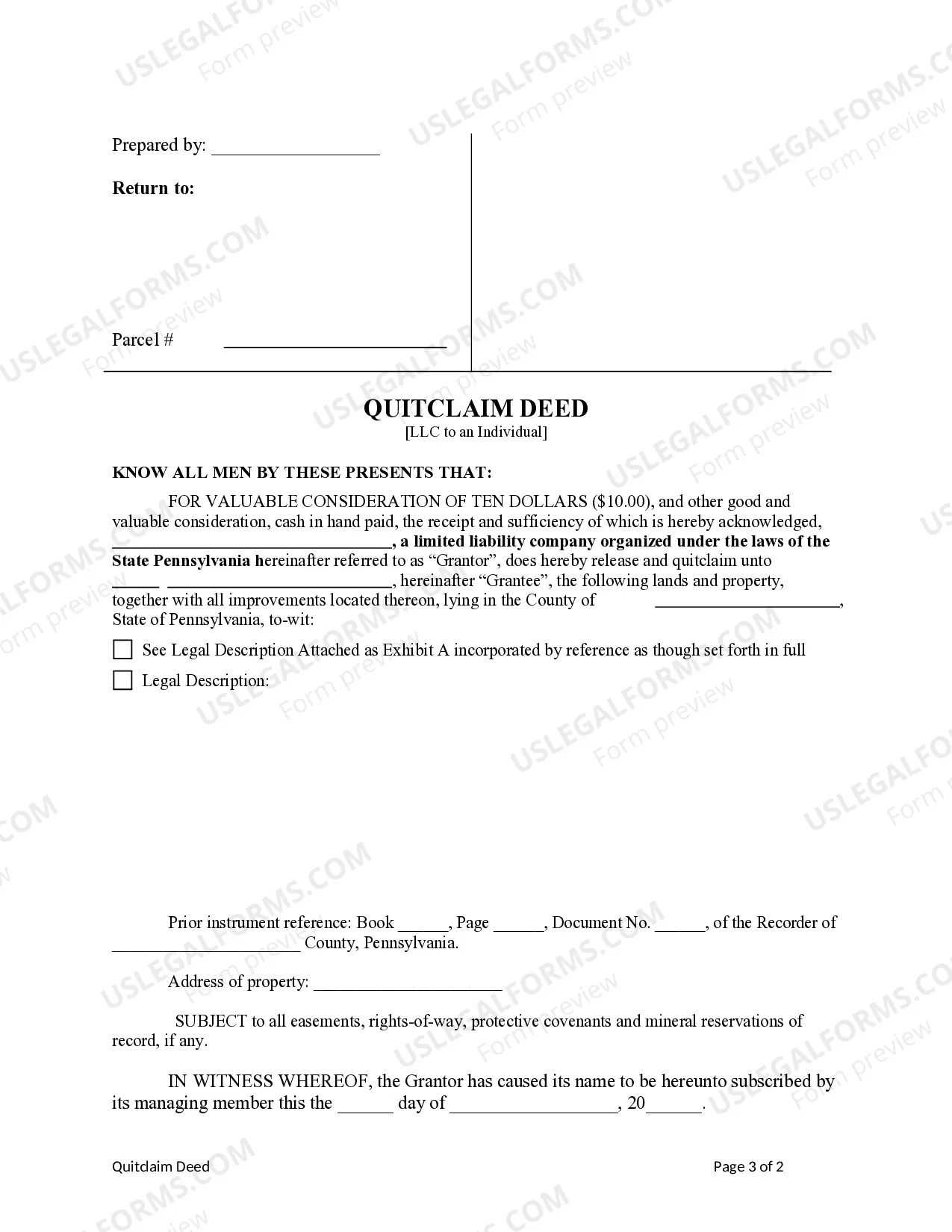

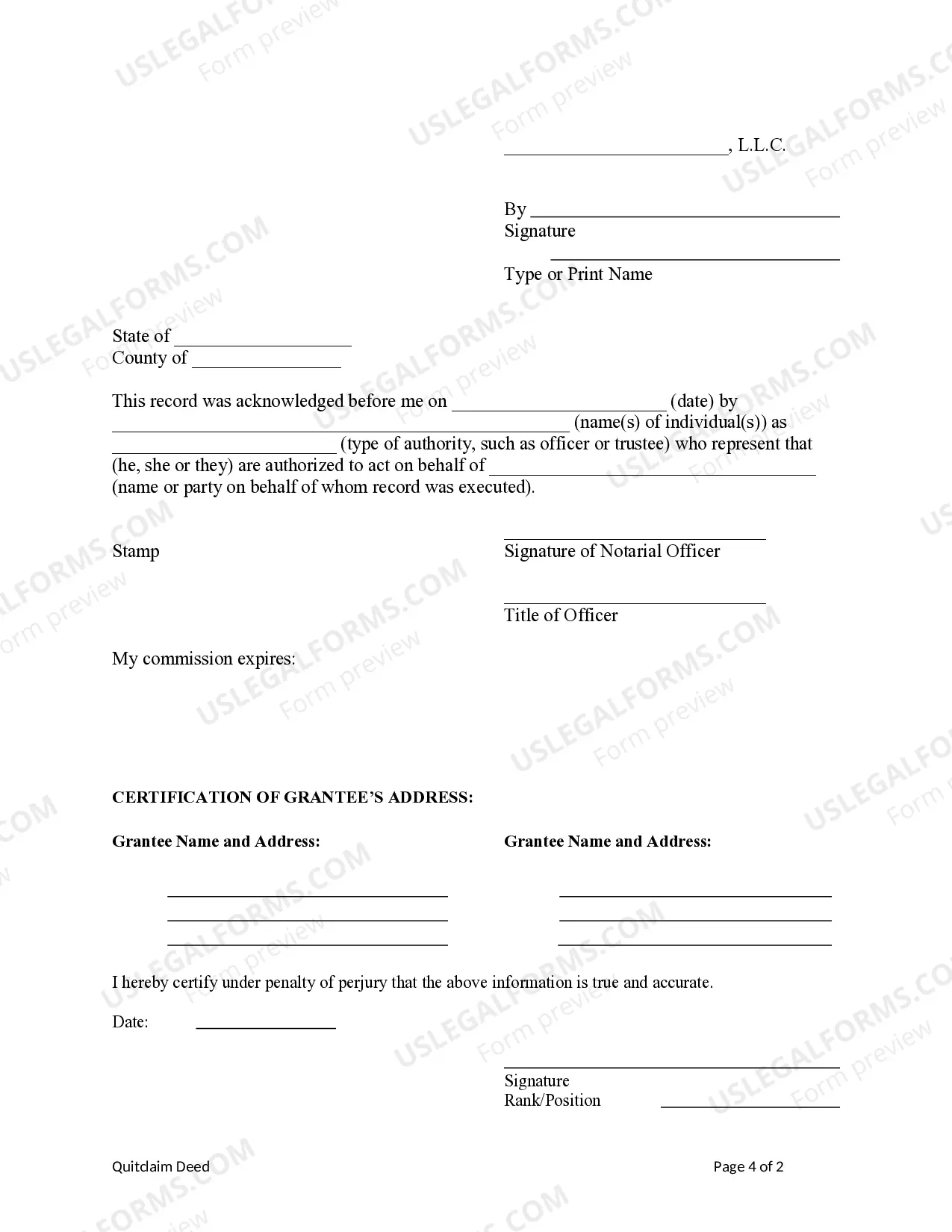

This form is a Quitclaim Deed where the Grantor is a limited liability company and the Grantee is an individual. Grantor conveys and quitclaims the described property to Grantee. This deed complies with all state statutory laws.

A Philadelphia Pennsylvania Quitclaim Deed — Limited Liability Company to an Individual refers to a legal document used to transfer property ownership from a limited liability company (LLC) to an individual in Philadelphia, Pennsylvania. This type of deed is specific to situations where an LLC is the sole or majority owner of a property and wants to convey it to a single individual. The Quitclaim Deed is a commonly used legal instrument in real estate transactions that provides a legal description of the property being transferred. It outlines the terms and conditions of the transfer, releasing any rights, claims, or interest the LLC may have in the property to the individual acquiring it. By executing a Quitclaim Deed, the LLC relinquishes all ownership rights without making any warranties or guarantees regarding the property. This means that the individual receiving the property assumes all risks associated with it and cannot hold the LLC accountable for any issues or defects that may exist. In Philadelphia, there may be various types of Quitclaim Deeds used to transfer property ownership from an LLC to an individual. These can vary based on specific circumstances and legal requirements. Some possible types of Quitclaim Deeds for such transfers include: 1. Single-Member LLC to an Individual Quitclaim Deed: This type of deed is used when the property is owned by a single-member LLC, and the owner wants to convey it to an individual. 2. Majority-Member LLC to an Individual Quitclaim Deed: If a property is owned by an LLC with multiple members, but the majority owner wants to transfer their interest to an individual, this deed may be used to facilitate the transfer. 3. Partial Ownership Transfer Quitclaim Deed: In certain situations, an LLC may choose to transfer only a portion of its ownership interest to an individual. A specific quitclaim deed can be drafted to outline the details and specify the percentage or portion being transferred. It's crucial to engage the services of a qualified real estate attorney or professional knowledgeable in Philadelphia's real estate laws to ensure the correct type of Quitclaim Deed is used and all legal requirements are met. Additionally, parties involved in such transactions should conduct thorough due diligence, including a title search and property inspection, to safeguard against any potential issues or disputes related to the property being transferred.