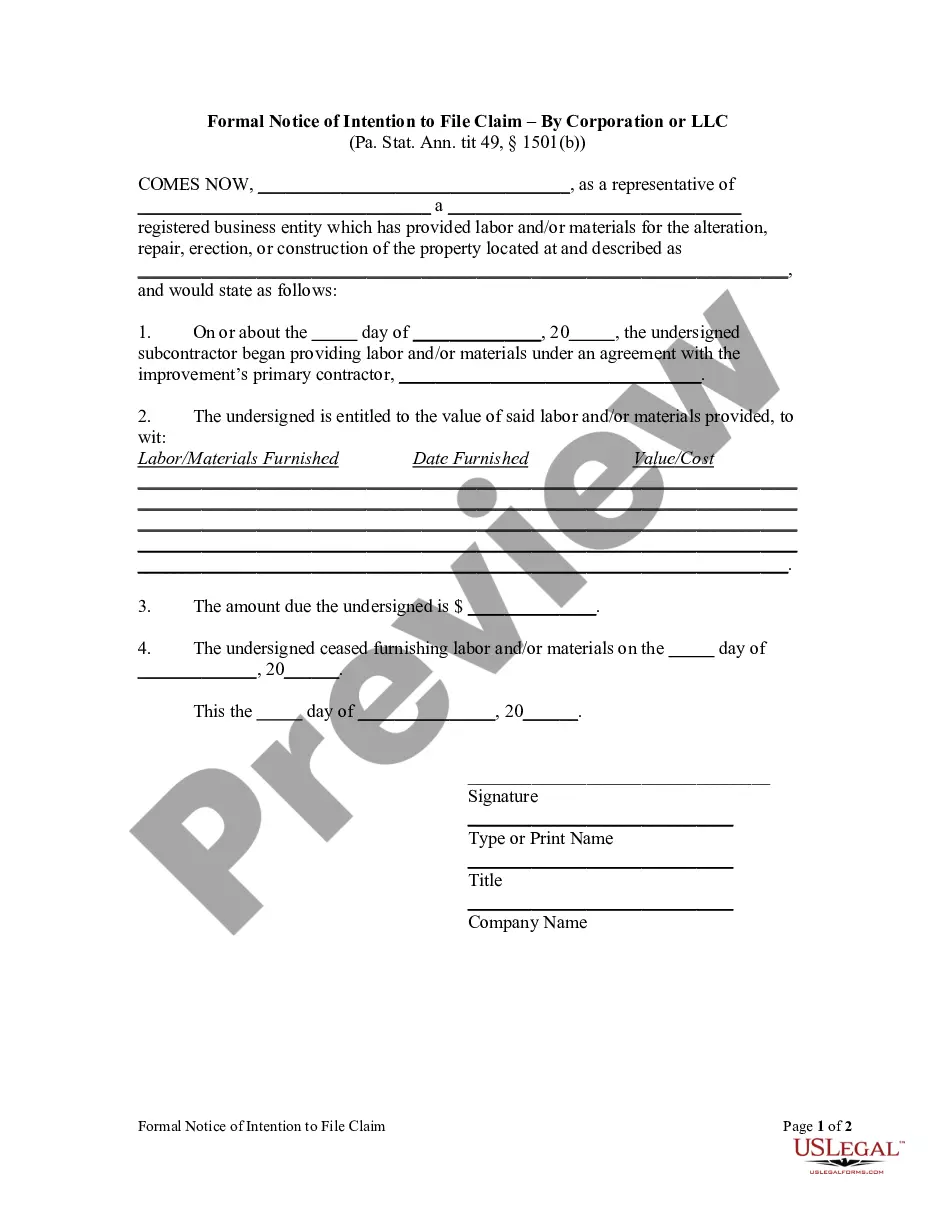

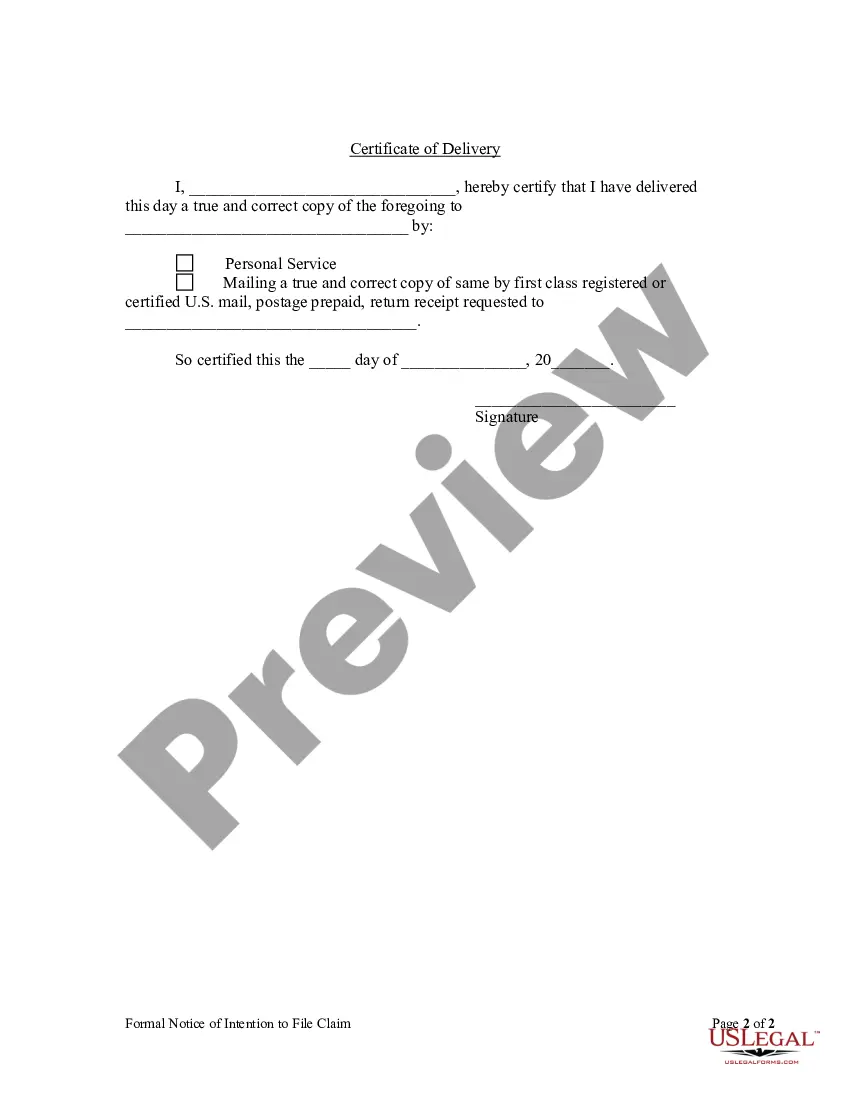

A subcontractor who provides labor and/or material for the alteration and repair of property is required to provide the owner with a Preliminary Notice of Intent to Claim Lien. However, regardless of whether the subcontractor is required to provide a preliminary notice, a subcontractor is ALSO required to provide the property owner with a Formal Notice of Intention to Claim Lien. A Formal Notice must be provided at least thirty (30) days before a lien claim is filed and must be served on the property owner in person, or on his agent, or by first class, registered or certified mail.

Allegheny Pennsylvania Formal Notice of Intent to File Lien by Corporation or LLC is a legally significant document that outlines a corporation or limited liability company's intention to file a lien against a property in Allegheny County, Pennsylvania. This formal notice is an essential step taken by a corporation or LLC seeking to protect its financial interests when a property owner fails to meet their contractual obligations or defaults on payment. The Allegheny Pennsylvania Formal Notice of Intent to File Lien by Corporation or LLC serves as a preliminary warning to the property owner that legal action will be pursued if the outstanding debt or obligations are not settled within a specified timeframe. This notice emphasizes the corporation or LLC's intention to initiate a lien against the property, securing its right to claim compensation or other remedies for the breach of agreement. Keywords: Allegheny Pennsylvania, formal notice, intent to file lien, corporation, LLC, property, contractual obligations, default, payment, preliminary warning, legal action, outstanding debt, obligations, specified timeframe, lien initiation, compensation, breach of agreement, remedies. Types of Allegheny Pennsylvania Formal Notice of Intent to File Lien by Corporation or LLC: 1. Construction Lien: This type of formal notice is generally utilized by construction companies or contractors who have provided labor, materials, or services for a project but haven't received full payment. It allows the corporation or LLC to assert its lien rights against the property to obtain the unpaid amount. 2. Mechanic's Lien: Mechanic's liens are commonly filed by contractors, subcontractors, or material suppliers who have contributed to a construction project but have not been fully compensated for their work or supplies. This formal notice serves as a warning to the property owner, giving the corporation or LLC the right to secure its interests through a lien on the property. 3. Service Lien: Service liens are applicable when a corporation or LLC has provided services to a property owner or tenant, such as maintenance, repairs, or professional services, and remains unpaid for the rendered services. This formal notice alerts the property owner about the pending lien and the consequences of non-compliance or non-payment. 4. Supplier Lien: Supplier liens are issued by corporations or LCS that supply goods, products, or materials to a property owner or contractor but have not received full payment. This formal notice alerts the property owner about the corporation or LLC's intent to file a lien against the property in order to recover the outstanding debt. In all cases, the Allegheny Pennsylvania Formal Notice of Intent to File Lien by Corporation or LLC serves as a crucial first step towards protecting the financial interests of the corporation or LLC, ensuring that they are granted a legal claim to recover the unpaid debt or seek appropriate compensation. It is vital to consult with legal professionals experienced in lien law to ensure compliance with all procedural requirements and applicable deadlines.Allegheny Pennsylvania Formal Notice of Intent to File Lien by Corporation or LLC is a legally significant document that outlines a corporation or limited liability company's intention to file a lien against a property in Allegheny County, Pennsylvania. This formal notice is an essential step taken by a corporation or LLC seeking to protect its financial interests when a property owner fails to meet their contractual obligations or defaults on payment. The Allegheny Pennsylvania Formal Notice of Intent to File Lien by Corporation or LLC serves as a preliminary warning to the property owner that legal action will be pursued if the outstanding debt or obligations are not settled within a specified timeframe. This notice emphasizes the corporation or LLC's intention to initiate a lien against the property, securing its right to claim compensation or other remedies for the breach of agreement. Keywords: Allegheny Pennsylvania, formal notice, intent to file lien, corporation, LLC, property, contractual obligations, default, payment, preliminary warning, legal action, outstanding debt, obligations, specified timeframe, lien initiation, compensation, breach of agreement, remedies. Types of Allegheny Pennsylvania Formal Notice of Intent to File Lien by Corporation or LLC: 1. Construction Lien: This type of formal notice is generally utilized by construction companies or contractors who have provided labor, materials, or services for a project but haven't received full payment. It allows the corporation or LLC to assert its lien rights against the property to obtain the unpaid amount. 2. Mechanic's Lien: Mechanic's liens are commonly filed by contractors, subcontractors, or material suppliers who have contributed to a construction project but have not been fully compensated for their work or supplies. This formal notice serves as a warning to the property owner, giving the corporation or LLC the right to secure its interests through a lien on the property. 3. Service Lien: Service liens are applicable when a corporation or LLC has provided services to a property owner or tenant, such as maintenance, repairs, or professional services, and remains unpaid for the rendered services. This formal notice alerts the property owner about the pending lien and the consequences of non-compliance or non-payment. 4. Supplier Lien: Supplier liens are issued by corporations or LCS that supply goods, products, or materials to a property owner or contractor but have not received full payment. This formal notice alerts the property owner about the corporation or LLC's intent to file a lien against the property in order to recover the outstanding debt. In all cases, the Allegheny Pennsylvania Formal Notice of Intent to File Lien by Corporation or LLC serves as a crucial first step towards protecting the financial interests of the corporation or LLC, ensuring that they are granted a legal claim to recover the unpaid debt or seek appropriate compensation. It is vital to consult with legal professionals experienced in lien law to ensure compliance with all procedural requirements and applicable deadlines.