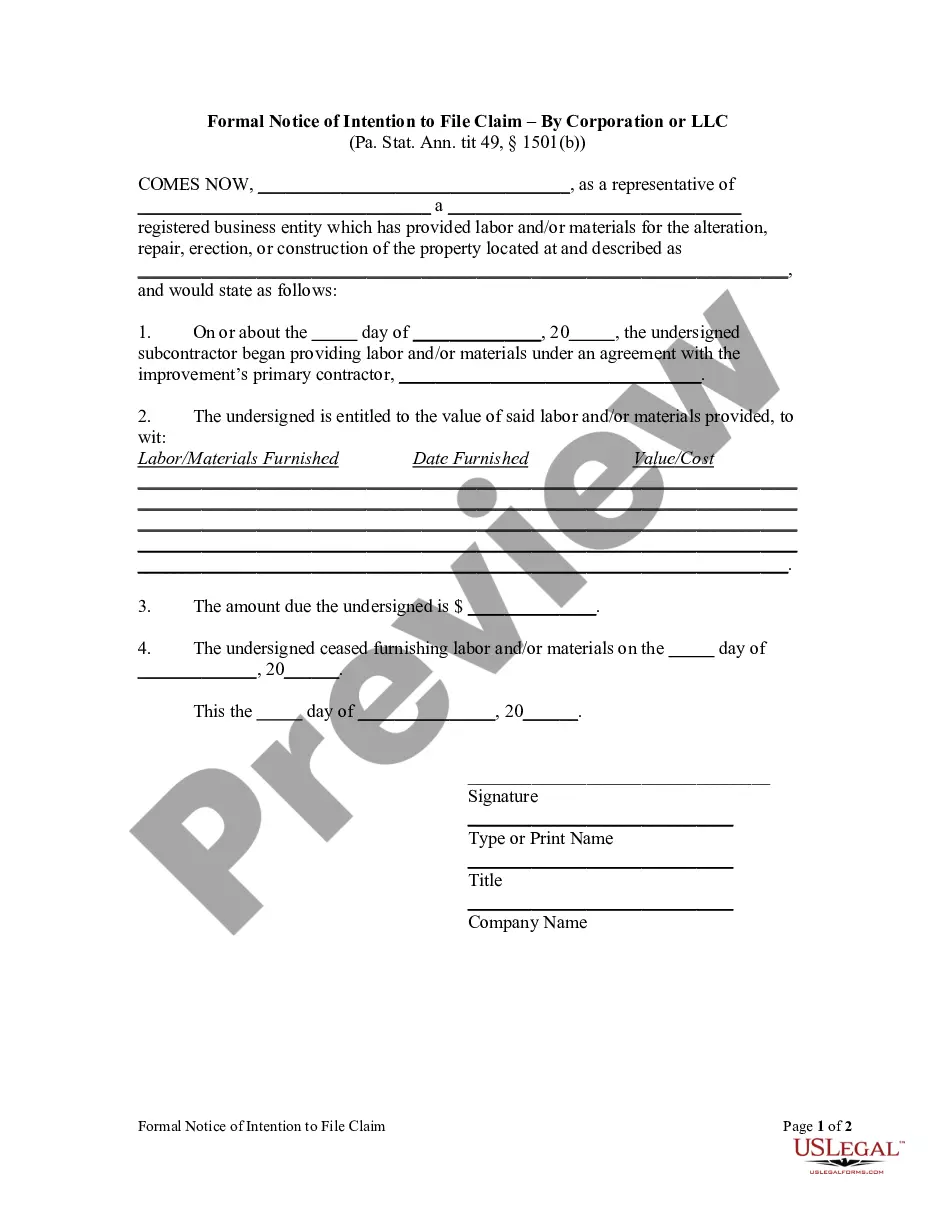

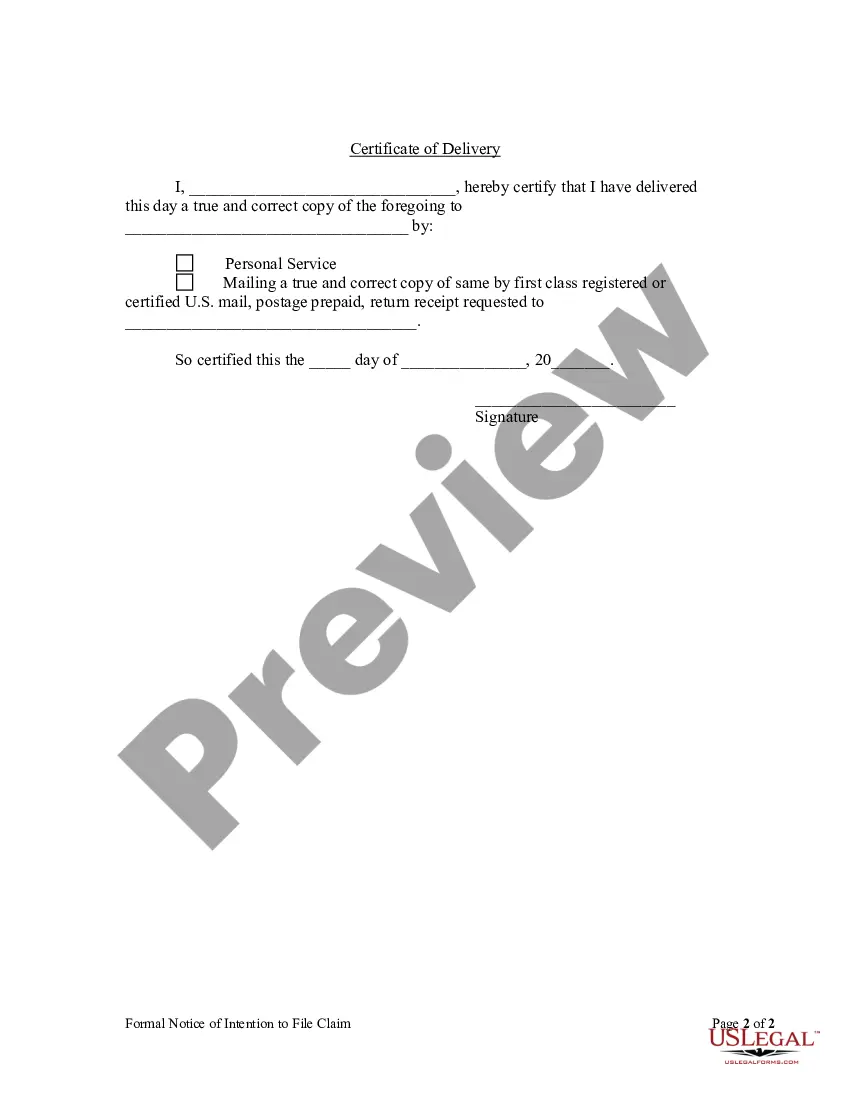

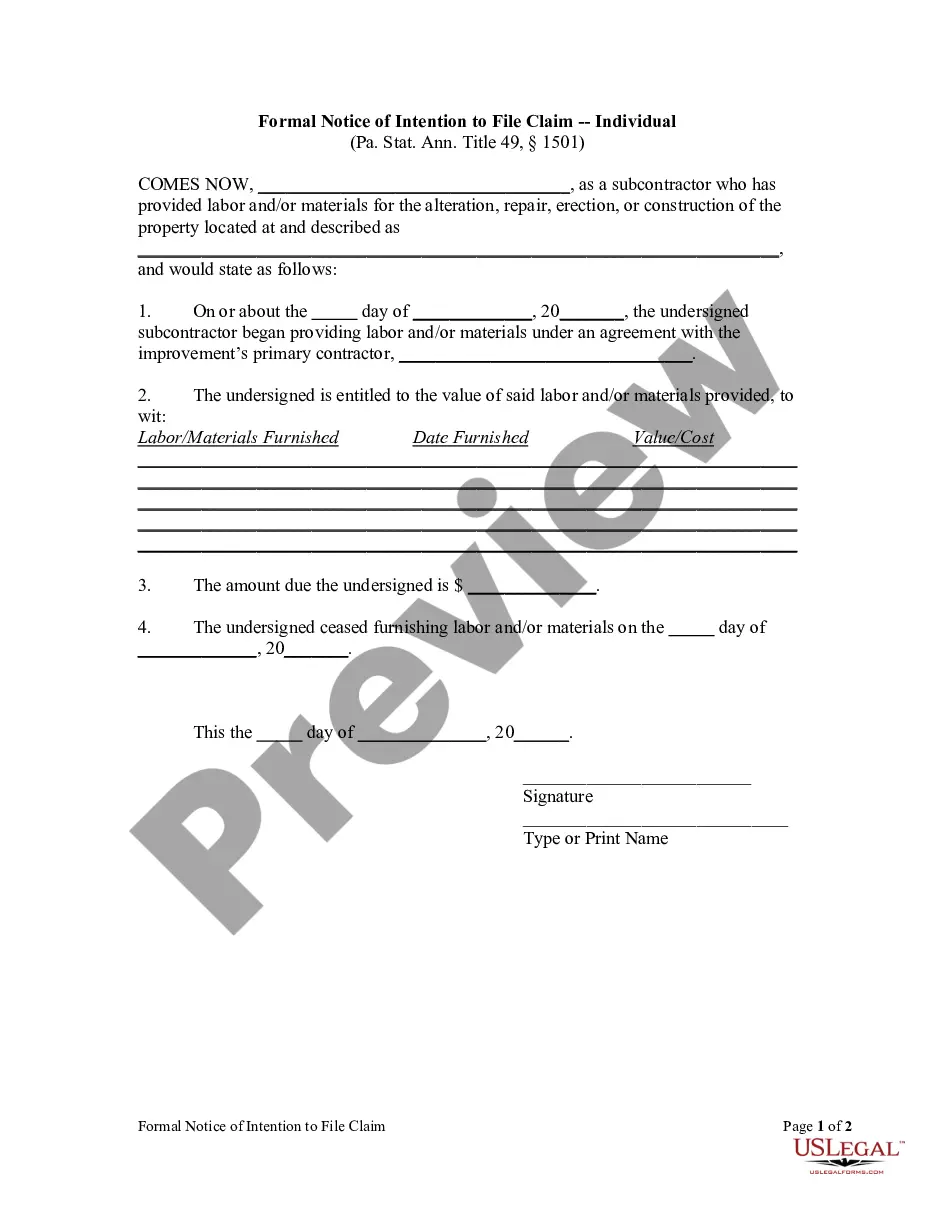

A subcontractor who provides labor and/or material for the alteration and repair of property is required to provide the owner with a Preliminary Notice of Intent to Claim Lien. However, regardless of whether the subcontractor is required to provide a preliminary notice, a subcontractor is ALSO required to provide the property owner with a Formal Notice of Intention to Claim Lien. A Formal Notice must be provided at least thirty (30) days before a lien claim is filed and must be served on the property owner in person, or on his agent, or by first class, registered or certified mail.

Philadelphia Pennsylvania Formal Notice of Intent to File Lien by Corporation

Description

How to fill out Pennsylvania Formal Notice Of Intent To File Lien By Corporation?

We consistently strive to reduce or avert legal harm when handling intricate legal or financial issues.

To accomplish this, we enlist attorney services that are typically very expensive.

Nevertheless, not all legal issues are highly complicated.

The majority can be managed independently.

Take advantage of US Legal Forms whenever you need to obtain and download the Philadelphia Pennsylvania Formal Notice of Intent to File Lien by Corporation or LLC or any other document swiftly and securely.

- US Legal Forms is an online repository of current DIY legal documents encompassing everything from wills and powers of attorney to articles of incorporation and petitions for dissolution.

- Our collection empowers you to take control of your affairs independent of legal counsel.

- We offer access to legal document templates that are not always readily available to the public.

- Our templates are tailored to specific states and regions, greatly simplifying the search process.

Form popularity

FAQ

In Pennsylvania, lien waivers typically do not need to be notarized unless specifically stated in a contract. However, having a notarized lien waiver can add an extra layer of protection for both parties involved. It is advisable to consult with legal experts or use resources like US Legal Forms to ensure compliance with local regulations. This precaution can help endorse the validity of the waiver while reducing future disputes.

To write a lien letter, start with a clear description of the services rendered or materials provided. State the amount due and include a deadline for payment, emphasizing the potential filing of a lien. Using the Philadelphia Pennsylvania Formal Notice of Intent to File Lien by Corporation template can streamline this process, ensuring comprehensive information is included. This clarity helps in communicating the importance of resolving the matter promptly.

Writing a legal letter of intent requires clarity and precision. Begin by clearly stating your intent and the purpose of the letter. In the case of a Philadelphia Pennsylvania Formal Notice of Intent to File Lien by Corporation, include details such as the nature of the debt, the amount owed, and a deadline for payment. This approach ensures the recipient understands the seriousness of the situation and the subsequent steps that may follow.

A letter of intent to file a lien is a formal document that notifies a party about an impending lien on their property. This notice is essential in the process of securing payment for services provided or materials delivered. In the context of the Philadelphia Pennsylvania Formal Notice of Intent to File Lien by Corporation, it serves as a warning that legal action may follow if payment remains unpaid. Understanding this document can protect your rights and interests.

A Philadelphia Pennsylvania Formal Notice of Intent to File Lien by Corporation serves as a formal declaration that a corporation intends to file a lien on a property due to unpaid debts or obligations. This notice notifies property owners of the impending action and provides them an opportunity to address the underlying issue. Understanding this notice is crucial for both property owners and corporations, as it lays the groundwork for the formal steps that will follow if the debt remains unresolved. Utilizing US Legal Forms can help you accurately prepare this notice, ensuring compliance with state regulations and protecting your rights.

You can obtain a lien release form through various legal sources, including online platforms that specialize in legal documents. Websites like uslegalforms provide templates that are tailored to your state's requirements, including those for Pennsylvania. A properly filled lien release form is important after debts have been settled, especially following the issuance of a Philadelphia Pennsylvania Formal Notice of Intent to File Lien by Corporation.

Yes, you can file a lien on your own in Pennsylvania, as long as you follow the legal requirements and procedures. This includes preparing the lien claim and filing it in the appropriate office. However, utilizing tools or resources like the Philadelphia Pennsylvania Formal Notice of Intent to File Lien by Corporation can simplify this process and ensure you understand all necessary steps.

To write a letter of intent for a lien, start by including all relevant information such as the parties involved, a description of the debt, and the property in question. Be clear and concise about your intention to file a lien and include a deadline for payment. Utilizing the Philadelphia Pennsylvania Formal Notice of Intent to File Lien by Corporation can provide a solid framework for this letter.

Filing a lien in Pennsylvania requires specific steps, including drafting a lien claim and gathering all necessary documentation, such as invoices and contracts. You must then file this information in the appropriate county office. Using the Philadelphia Pennsylvania Formal Notice of Intent to File Lien by Corporation will guide you through these steps efficiently.

To file a lien in Pennsylvania, you'll need to prepare and submit a legal document known as a lien claim. This involves completing the appropriate forms and including evidence of the debt owed. You can utilize the Philadelphia Pennsylvania Formal Notice of Intent to File Lien by Corporation to kick-start this process and ensure compliance with state regulations.