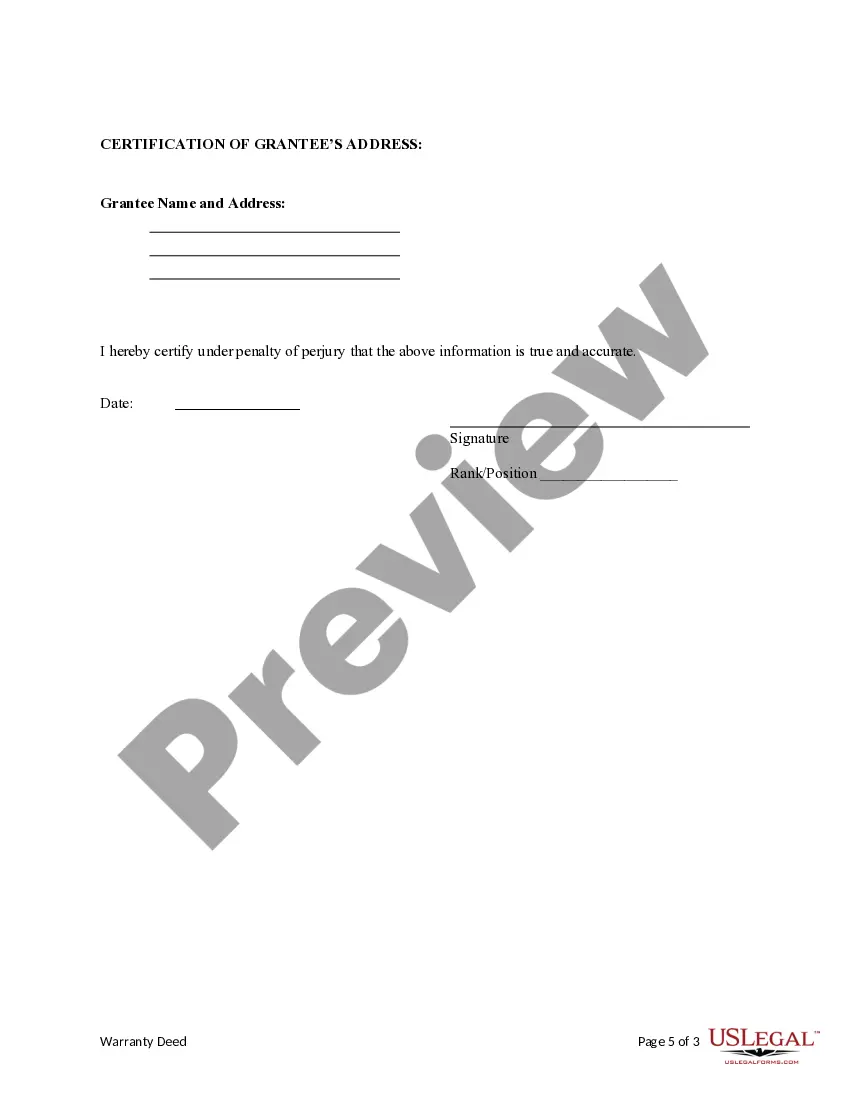

This form is a Warranty Deed where the Grantors are Husband and Wife and the Grantee is a Trust. Grantors convey and warrant the described property to Trustee of the Grantee. This deed complies with all state statutory laws.

Allentown, Pennsylvania Husband and Wife to a Trust: A Comprehensive Guide In Allentown, Pennsylvania, a husband and wife can create a trust together to manage their assets and ensure the smooth transfer of their estate upon their passing. This legal arrangement not only allows couples to protect their assets but also provides numerous benefits in terms of estate planning, tax efficiency, and avoiding probate. A husband and wife trust, commonly known as a joint revocable living trust, is a popular estate planning tool used by couples in Allentown. This type of trust is versatile, allowing spouses to manage their assets jointly during their lifetime, while also ensuring a seamless transfer of assets to their beneficiaries upon the death of either spouse. Key Benefits of an Allentown, Pennsylvania Husband and Wife to a Trust: 1. Avoids probate: One of the primary advantages is the avoidance of the probate process, which can be time-consuming and costly. The trust allows for the immediate transfer of assets to beneficiaries upon the death of the first spouse, seamlessly bypassing probate court. 2. Privacy: Unlike a will, which becomes public record during probate, a trust offers enhanced privacy. Allentown couples can keep their financial affairs confidential by transferring assets into the trust. 3. Incapacity planning: The trust provides provisions for managing the couple's assets and affairs in case of incapacity. If one spouse becomes mentally or physically unable to handle financial matters, the other spouse, as the co-trustee, can seamlessly step in and manage the trust without court interference or the need for a power of attorney. 4. Flexibility and control: Allentown spouses have the flexibility to modify or revoke the trust during their lifetime as circumstances change. They can add or remove assets, change beneficiaries or trustees, and even modify the terms of distribution, all without any court involvement. Variations of Allentown, Pennsylvania Husband and Wife to a Trust: 1. Special Needs Trust: If a couple has a child or dependent with special needs, they can establish a special needs trust within their joint trust. This trust allows them to provide financially for their loved one without jeopardizing their eligibility for government benefits. 2. Marital Trust: Couples with significant assets may choose to establish a marital trust as part of their joint trust. A marital trust ensures that the surviving spouse receives income from the trust during their lifetime but also ensures that the remaining assets pass to the chosen beneficiaries, typically the couple's children, upon the death of both spouses. 3. Credit Shelter Trust: Also known as a bypass trust, a credit shelter trust allows couples to take full advantage of their estate tax exemptions. By utilizing this trust structure, couples can potentially minimize estate taxes while still passing on their assets to their intended heirs. In conclusion, an Allentown, Pennsylvania Husband and Wife to a Trust is a powerful tool for married couples looking to efficiently manage and protect their assets, streamline estate planning, and reduce the burden on their loved ones. By exploring different types of trusts, such as special needs trusts, marital trusts, and credit shelter trusts, couples can tailor their trust to best suit their unique financial and familial needs. Collaborating with a knowledgeable estate planning attorney will ensure that all necessary legal requirements are met and that the trust is appropriately drafted to achieve the desired goals.