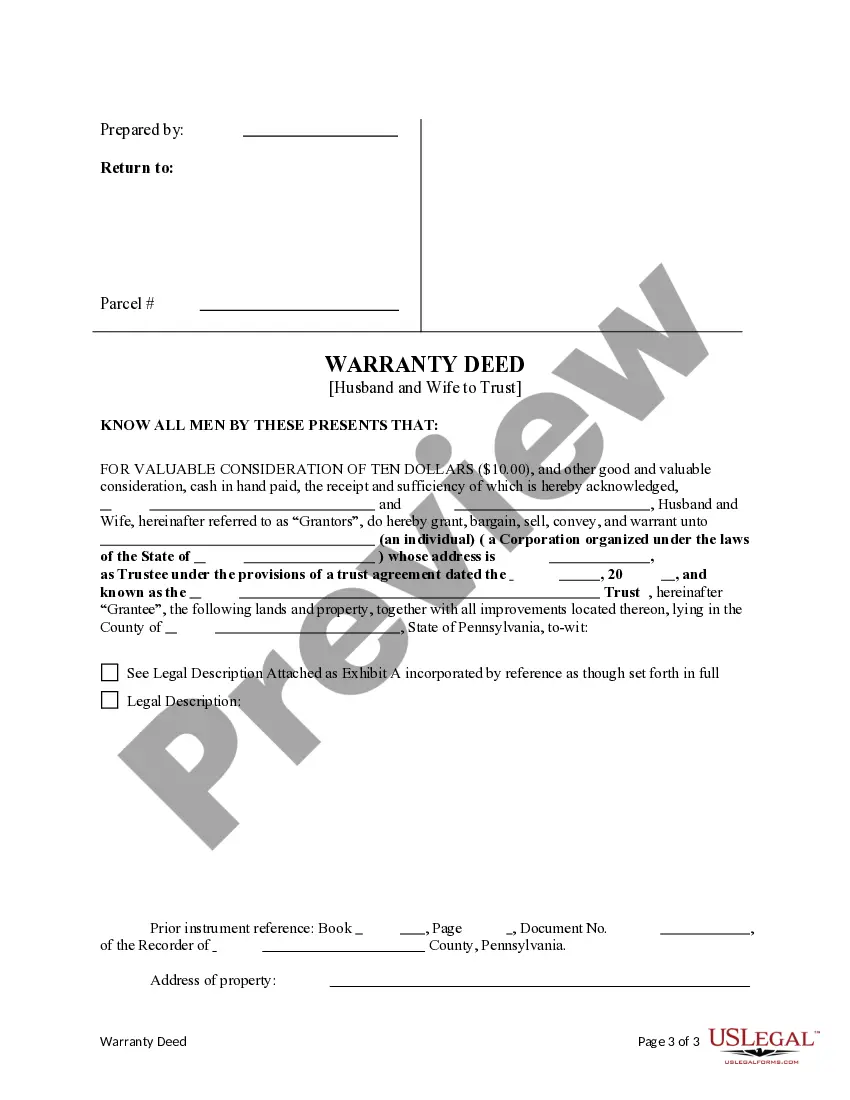

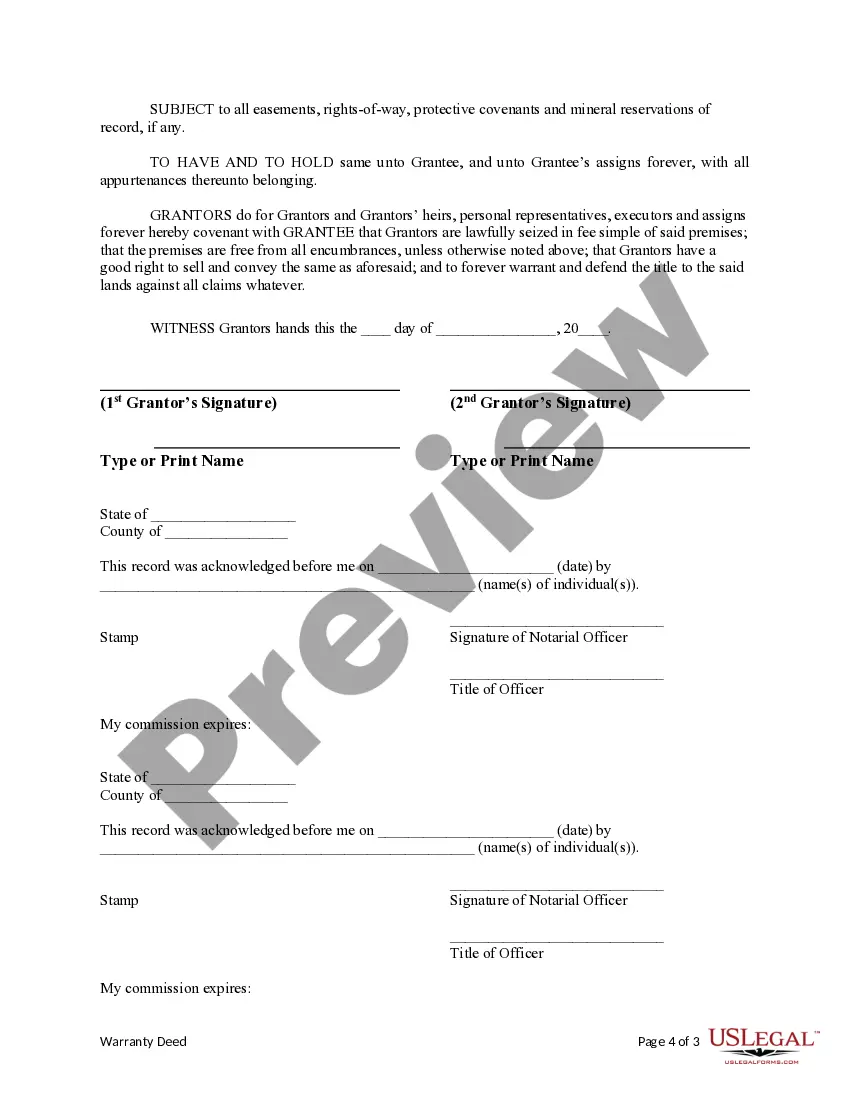

This form is a Warranty Deed where the Grantors are Husband and Wife and the Grantee is a Trust. Grantors convey and warrant the described property to Trustee of the Grantee. This deed complies with all state statutory laws.

Philadelphia Pennsylvania Husband and Wife to a Trust: A Comprehensive Guide to Establishing a Trust Introduction: Philadelphia, Pennsylvania is famed for its rich history, vibrant culture, and strong communities. For married couples residing in the city, establishing a trust can be an effective way to manage and protect their assets. This detailed description aims to provide a comprehensive guide to understanding the concept of a Husband and Wife to a Trust in Philadelphia, Pennsylvania, along with various types of trusts available. What is a Trust? A trust is a legal arrangement where one party, called the granter, transfers assets to another party, known as the trustee, who holds and manages those assets for the benefit of a third party, known as the beneficiary. In the case of a Husband and Wife to a Trust, both spouses create and fund the trust, taking advantage of unique benefits tailored for married couples. Benefits of a Husband and Wife to a Trust in Philadelphia: 1. Asset Protection: Marital assets held in a Husband and Wife to a Trust can be protected from potential creditors and legal claims, providing a secure financial future for the married couple. 2. Tax Advantages: Certain types of Husband and Wife to a Trust may offer tax benefits, such as minimizing estate taxes upon the death of the granters. 3. Avoiding Probate: Establishing a trust allows assets to bypass the probate process, ensuring a smoother transition of wealth to the beneficiaries and reducing administrative costs. 4. Control and Flexibility: Couples can maintain control over their assets by specifying the terms and conditions of the trust, including how assets are distributed among beneficiaries. Types of Husband and Wife to a Trust: 1. Revocable Living Trust: A popular choice for many couples, this trust allows both spouses to retain control over their assets during their lifetime. It can be modified or revoked if circumstances change, providing flexibility and ease of administration. 2. Irrevocable Trust: This trust type cannot be changed or revoked once established, offering enhanced asset protection. Couples who wish to protect assets from potential creditors and estate taxes may consider this option. 3. Marital Deduction Trust: Also known as a qualified terminable interest property (TIP) trust, this type of trust ensures financial support for the surviving spouse while allowing the granter to determine how assets will be distributed after both spouses pass away. 4. Charitable Remainder Trust: Ideal for couples passionate about philanthropy, a charitable remainder trust allows the couple to donate assets to a charitable organization while receiving tax benefits. The remaining assets are then distributed to beneficiaries after the trust ends. Conclusion: Establishing a Husband and Wife to a Trust in Philadelphia, Pennsylvania offers numerous benefits, including asset protection, tax advantages, and efficient wealth transfer. The different types of trusts available cater to varying goals, whether it is maintaining control over assets, ensuring financial security for heirs, or supporting charitable causes. To navigate these complexities and choose the most suitable trust structure, consulting with an experienced estate planning attorney is highly recommended. By proactively securing financial stability through a trust, married couples can provide for their loved ones, protect their assets, and leave a lasting legacy.