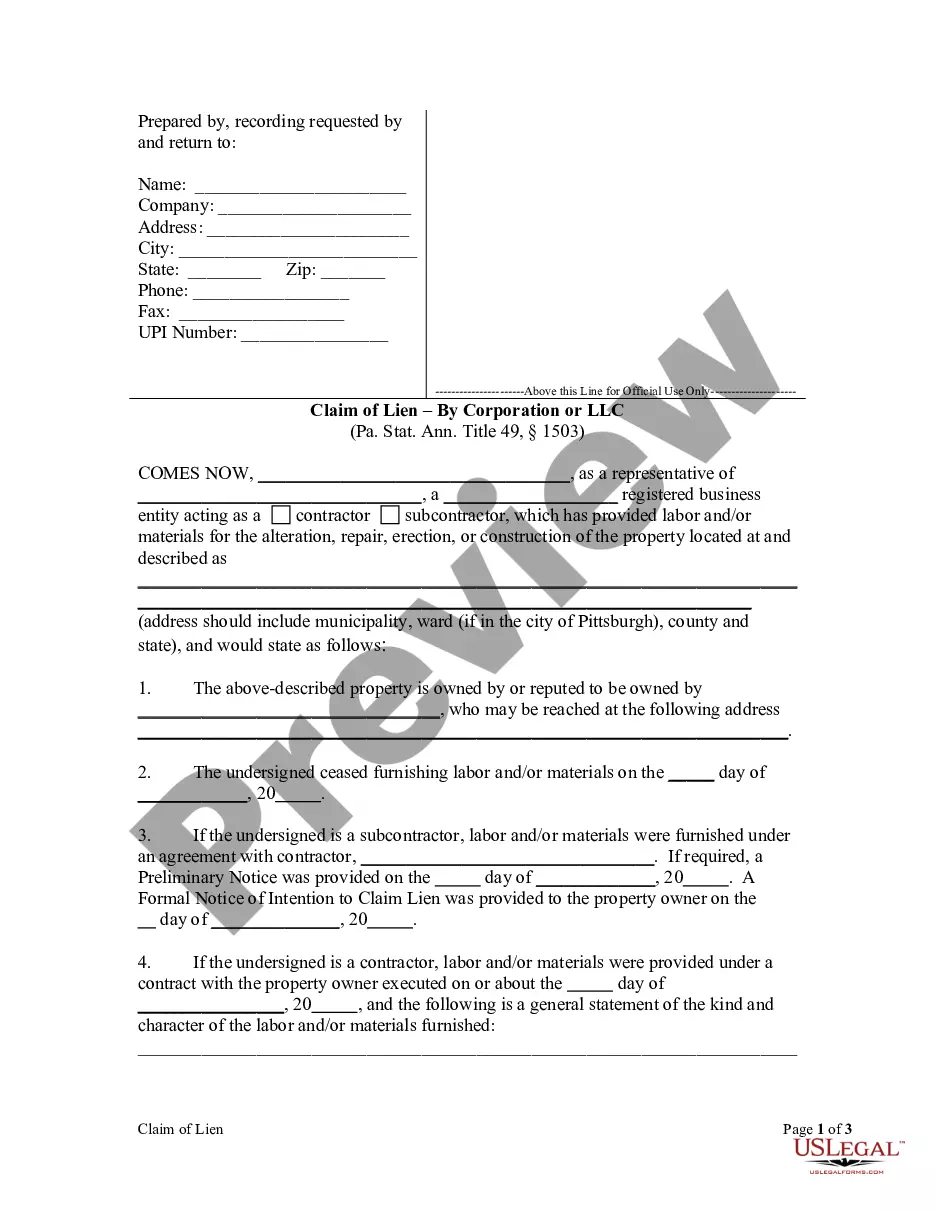

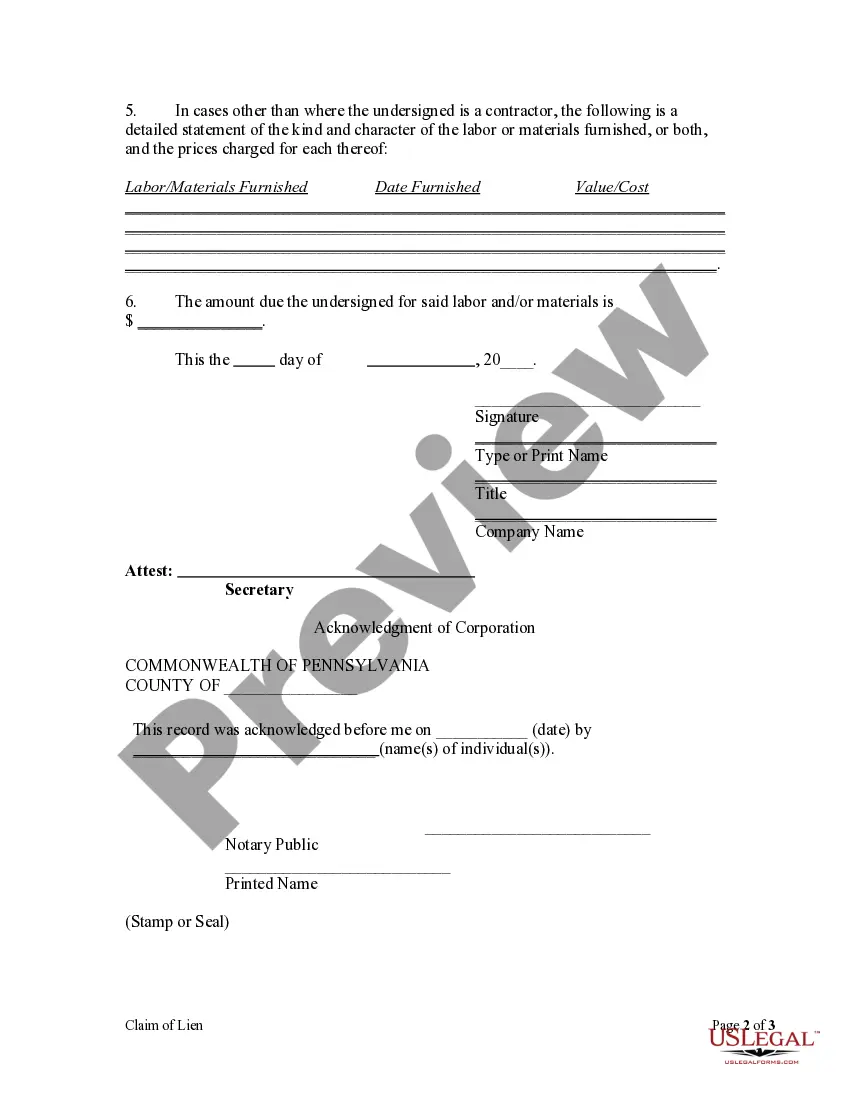

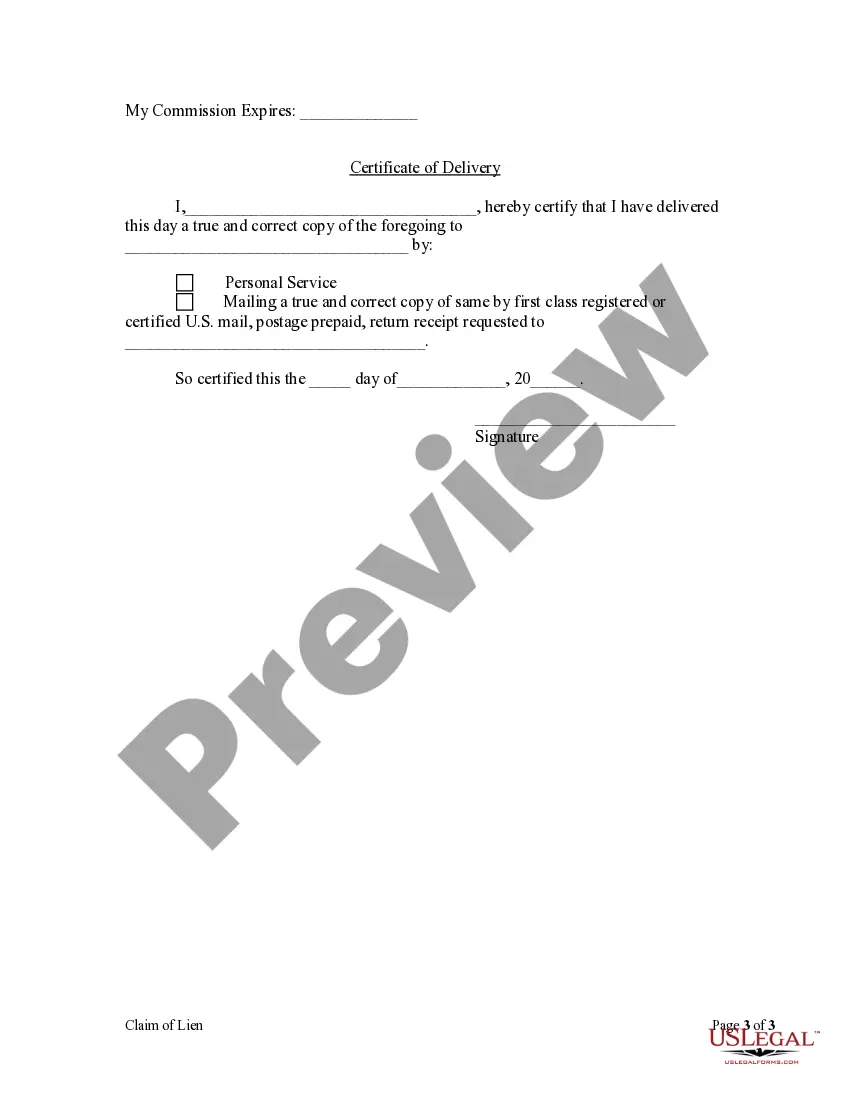

To perfect a lien in Pennsylvania, a contractor or subcontractor must file a lien claim with the prothonotary of the county in which the property is situated, within four (4) months after the completion of work. A notice of this filing must be served upon the property owner within (1) month of filing and an affidavit of said service must be filed within twenty (20) days of service.

Allegheny Pennsylvania Lien Claim by Corporation

Description

How to fill out Pennsylvania Lien Claim By Corporation?

If you have previously used our service, Log In to your account and download the Allegheny Pennsylvania Lien Claim by Corporation or LLC to your device by clicking the Download button. Ensure your subscription is active. If it is not, renew it according to your payment arrangement.

If this is your initial encounter with our service, follow these straightforward steps to acquire your document.

You have continuous access to every document you have purchased: you can find it in your profile under the My documents menu whenever you wish to reuse it. Leverage the US Legal Forms service to effectively find and store any template for your personal or professional requirements!

- Ensure you’ve located the correct document. Browse the description and utilize the Preview feature, if available, to verify if it fulfills your requirements. If it does not suit you, use the Search tab above to find the suitable one.

- Purchase the template. Click the Buy Now button and choose a monthly or yearly subscription plan.

- Create an account and complete a payment. Enter your credit card information or select the PayPal option to finalize the purchase.

- Obtain your Allegheny Pennsylvania Lien Claim by Corporation or LLC. Choose the file format for your document and save it to your device.

- Finalize your document. Print it out or utilize professional online editors to complete and sign it electronically.

Form popularity

FAQ

Yes, you can file a lien on your own in Pennsylvania, but it requires careful attention to legal requirements. You must draft the lien claim appropriately and submit it properly to the county's prothonotary office. Also, ensure you have sufficient documentation to support your claim. If you want to simplify the process, using services like US Legal Forms can provide the necessary templates and guidance to help you through.

In Pennsylvania, several entities can put a lien on a property, including creditors, contractors, or government agencies. For example, unpaid mechanics may file a mechanic's lien, while the state can impose tax liens for unpaid taxes. It’s essential to understand who holds the right to file a lien, as it can affect property ownership and financial obligations. Seeking assistance from professionals can help you navigate these situations.

To find out if there is a lien on a property in Pennsylvania, you can conduct a title search through the county’s prothonotary office. Online databases also provide access to public records where liens are listed. Additionally, you may check with title companies or real estate professionals who can assist in navigating these records. Being informed about any existing liens is crucial for a solid investment.

To file a lien in Pennsylvania, you need to prepare a lien claim document and submit it to the county’s prothonotary office. The document must include specific information about the debt and the parties involved. It is essential to follow Pennsylvania’s guidelines to ensure the lien is enforceable. Utilizing tools from US Legal Forms can streamline this process and ensure compliance.

To file a lien in Pennsylvania, you must first gather necessary documentation, including contracts and proof of debt. Next, you will need to fill out the appropriate forms and file them with the local county recorder’s office. This process solidifies your Allegheny Pennsylvania Lien Claim by Corporation. Utilizing services like US Legal Forms can streamline the paperwork and ensure your filing is accurate and compliant.

The three primary types of liens include consensual liens, statutory liens, and judgment liens. Consensual liens are created through an agreement, such as a mortgage, while statutory liens arise from laws without any agreement. Judgment liens result from court actions against a debtor. Knowing the types of liens can aid in understanding your options for making an Allegheny Pennsylvania Lien Claim by Corporation.

A notice of intent to lien in Pennsylvania serves as a preliminary notification that a lien will be filed. It is an important step in the process of enforcing your Allegheny Pennsylvania Lien Claim by Corporation. This notice informs the property owner of your intentions and allows them an opportunity to resolve any outstanding debts before a lien is officially recorded. This process can help ensure that disputes are managed efficiently.

Lien durations can vary, but typically, a lien in Rhode Island lasts for ten years. However, you can extend a lien by filing an extension before the original lien expires. Understanding the timeline of your Allegheny Pennsylvania Lien Claim by Corporation is crucial for maintaining your legal rights. If you have questions about specific durations, consulting an expert can provide clarity.

Filing a lien in Pennsylvania can typically take one to two weeks, depending on the workload of the county office. In Allegheny, you can expedite the process by ensuring all paperwork is complete and correctly submitted. Remember, promptness is crucial in protecting your interest in an Allegheny Pennsylvania lien claim by corporation. Using online filing options can also speed up your submission.

In Pennsylvania, lien waivers do not generally need to be notarized to be valid, but notarization can add an extra layer of authenticity. It's essential to check the specific requirements for Allegheny and follow any local regulations. While it's often unnecessary, having a notarized waiver may assist in preventing disputes by providing additional proof of authenticity.