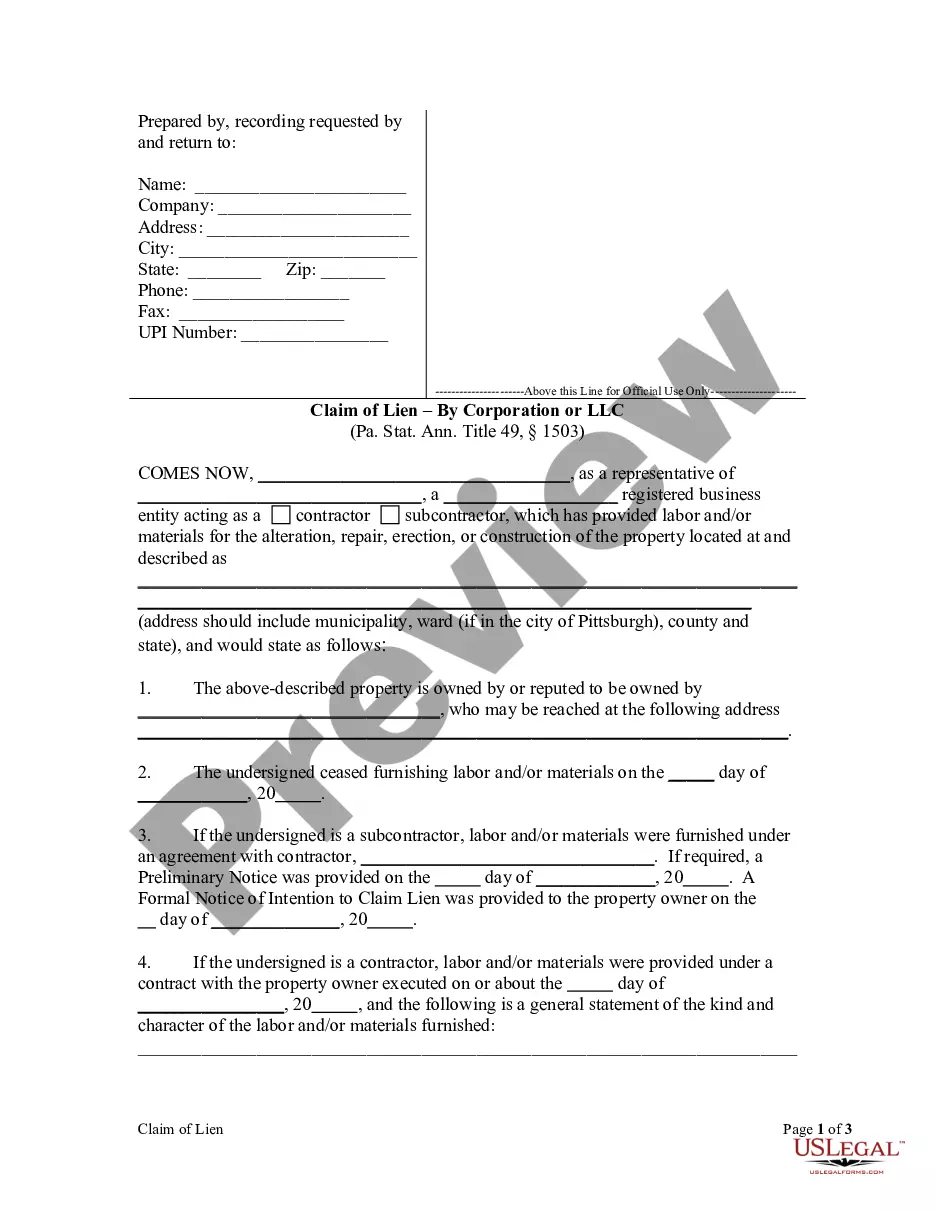

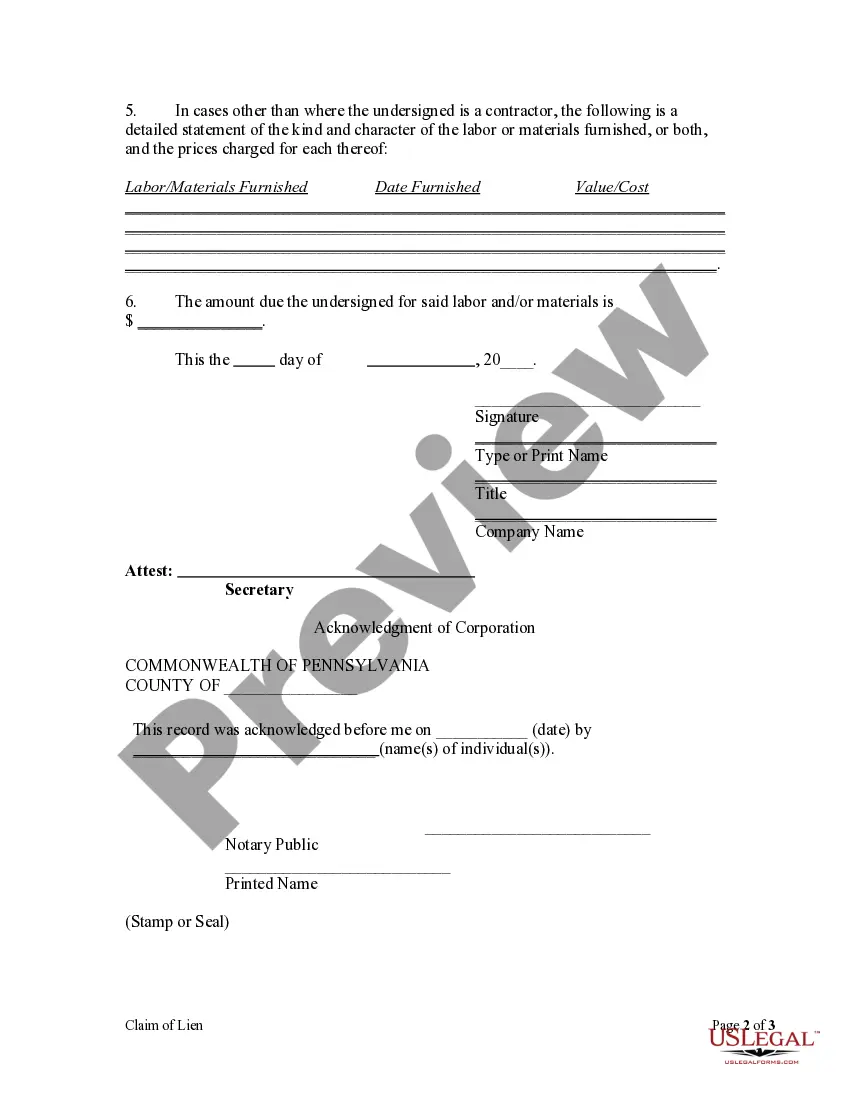

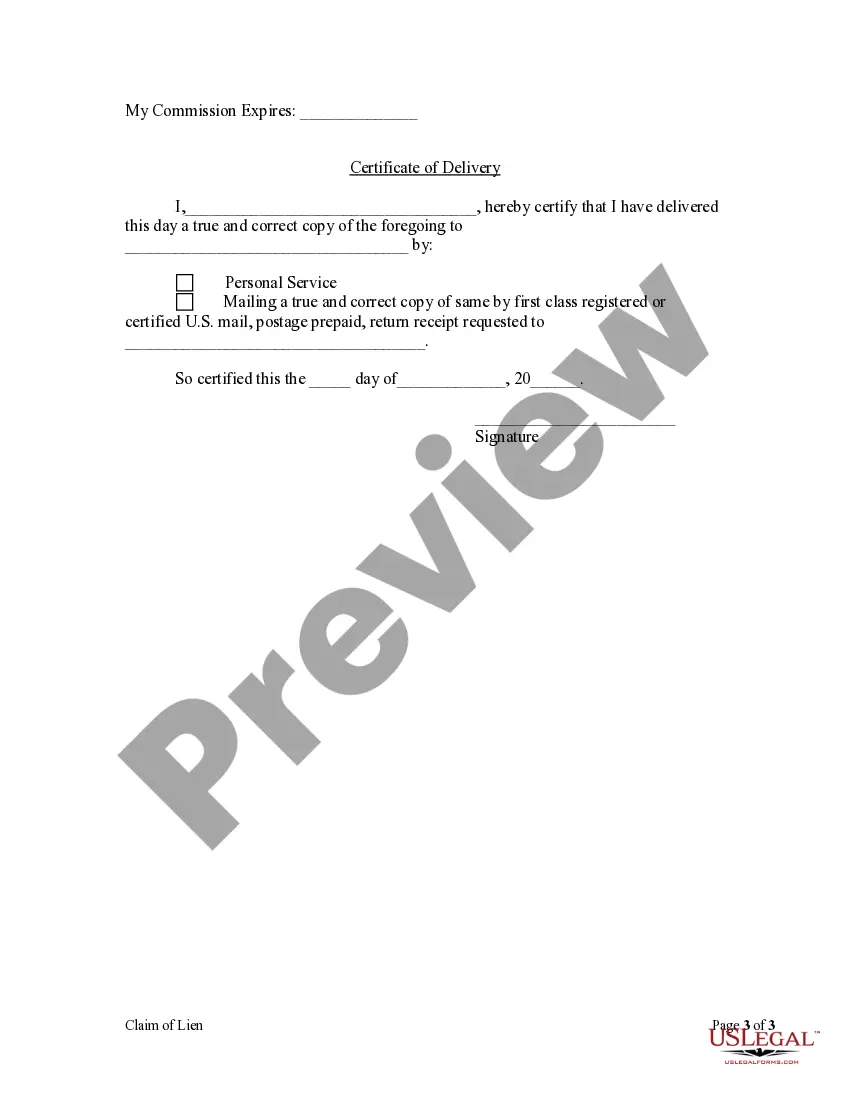

To perfect a lien in Pennsylvania, a contractor or subcontractor must file a lien claim with the prothonotary of the county in which the property is situated, within four (4) months after the completion of work. A notice of this filing must be served upon the property owner within (1) month of filing and an affidavit of said service must be filed within twenty (20) days of service.

Philadelphia Pennsylvania Lien Claim by Corporation or LLC refers to the legal process through which a corporation or limited liability company (LLC) in Philadelphia can file a claim against a property for the recovery of unpaid debts, services, or materials provided. This claim establishes a legal hold on the property, preventing its sale or transfer until the debt is settled. In Philadelphia, there are two main types of lien claims that corporations or LCS can file: 1. Mechanic's Lien: A mechanic's lien is filed by contractors, subcontractors, suppliers, or anyone involved in construction or property improvement projects. This type of lien allows the claimant to recover payment for the labor, materials, or services provided. It's commonly used when a property owner fails to pay for construction work or improvements. 2. Material man's Lien (Supplier's Lien): A material man's lien is filed by suppliers or vendors who have provided materials to a property but haven't been paid. This lien allows the claimant to seek payment for the materials supplied, such as construction materials, fixtures, equipment, or other goods. To file a lien claim in Philadelphia, corporations or LCS must follow a specific process. It begins by preparing a Notice of Intent to File a Lien with detailed information about the property, the claimant, and the amount owed. This notice must be properly served to the property owner, tenant, and any other interested parties. Once the Notice of Intent to File a Lien is served, the claimant has the option to proceed with filing a formal lien claim in the Philadelphia County Court of Common Pleas. This written claim must contain the necessary details, including the nature of the debt, the services or materials provided, and the amount claimed. The claimant must also record the lien with the Philadelphia County Recorder of Deeds Office. After filing the lien claim, the claimant has a limited time to enforce the lien through legal proceedings if the debt remains unpaid. The claimant can initiate a lawsuit to have the property sold at a judicial sale (also known as a sheriff's sale) to recover the debt amount. It is important to note that filing a lien claim requires compliance with specific legal requirements and deadlines. It is recommended to consult with an experienced attorney specializing in construction or real estate law to ensure proper procedures are followed. In summary, Philadelphia Pennsylvania Lien Claim by Corporation or LLC refers to the legal process through which a corporation or LLC can file a claim against a property for unpaid debts. The two main types of lien claims are mechanic's lien and material man's lien. Proper compliance with legal requirements and deadlines is essential to protect the claimant's rights and chances of recovering the debt.Philadelphia Pennsylvania Lien Claim by Corporation or LLC refers to the legal process through which a corporation or limited liability company (LLC) in Philadelphia can file a claim against a property for the recovery of unpaid debts, services, or materials provided. This claim establishes a legal hold on the property, preventing its sale or transfer until the debt is settled. In Philadelphia, there are two main types of lien claims that corporations or LCS can file: 1. Mechanic's Lien: A mechanic's lien is filed by contractors, subcontractors, suppliers, or anyone involved in construction or property improvement projects. This type of lien allows the claimant to recover payment for the labor, materials, or services provided. It's commonly used when a property owner fails to pay for construction work or improvements. 2. Material man's Lien (Supplier's Lien): A material man's lien is filed by suppliers or vendors who have provided materials to a property but haven't been paid. This lien allows the claimant to seek payment for the materials supplied, such as construction materials, fixtures, equipment, or other goods. To file a lien claim in Philadelphia, corporations or LCS must follow a specific process. It begins by preparing a Notice of Intent to File a Lien with detailed information about the property, the claimant, and the amount owed. This notice must be properly served to the property owner, tenant, and any other interested parties. Once the Notice of Intent to File a Lien is served, the claimant has the option to proceed with filing a formal lien claim in the Philadelphia County Court of Common Pleas. This written claim must contain the necessary details, including the nature of the debt, the services or materials provided, and the amount claimed. The claimant must also record the lien with the Philadelphia County Recorder of Deeds Office. After filing the lien claim, the claimant has a limited time to enforce the lien through legal proceedings if the debt remains unpaid. The claimant can initiate a lawsuit to have the property sold at a judicial sale (also known as a sheriff's sale) to recover the debt amount. It is important to note that filing a lien claim requires compliance with specific legal requirements and deadlines. It is recommended to consult with an experienced attorney specializing in construction or real estate law to ensure proper procedures are followed. In summary, Philadelphia Pennsylvania Lien Claim by Corporation or LLC refers to the legal process through which a corporation or LLC can file a claim against a property for unpaid debts. The two main types of lien claims are mechanic's lien and material man's lien. Proper compliance with legal requirements and deadlines is essential to protect the claimant's rights and chances of recovering the debt.