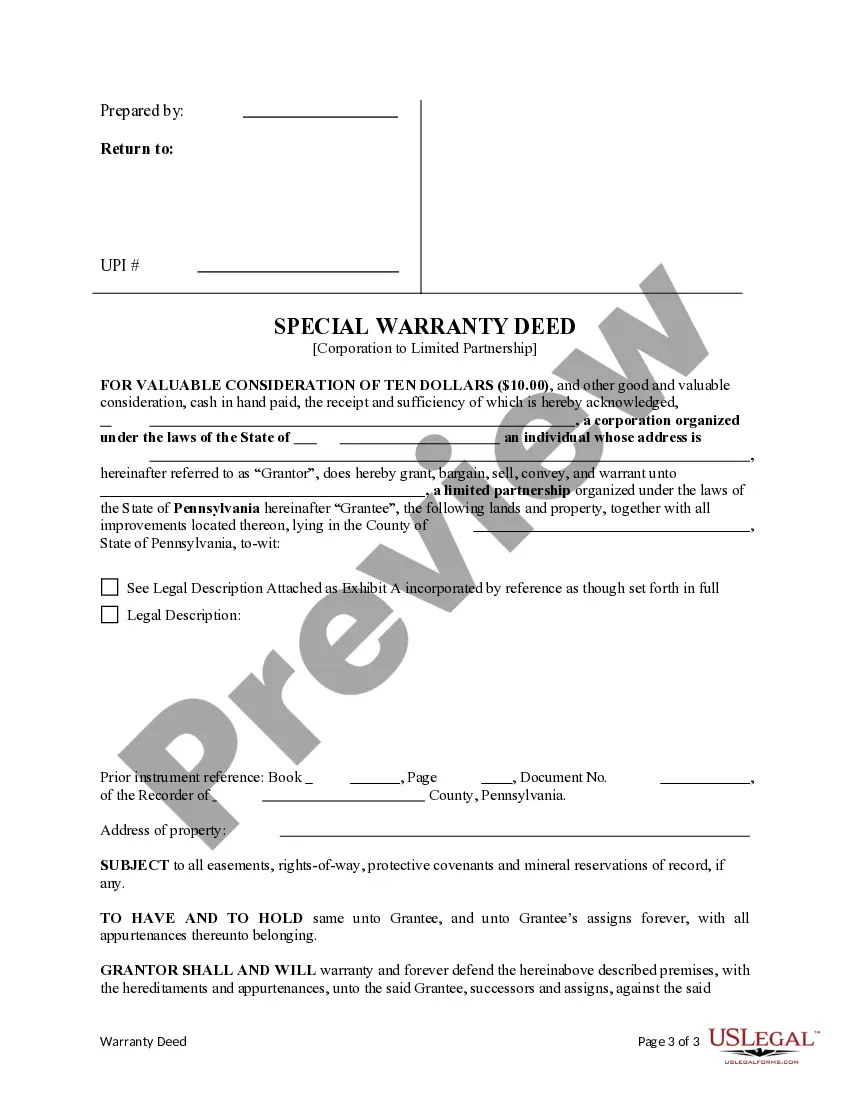

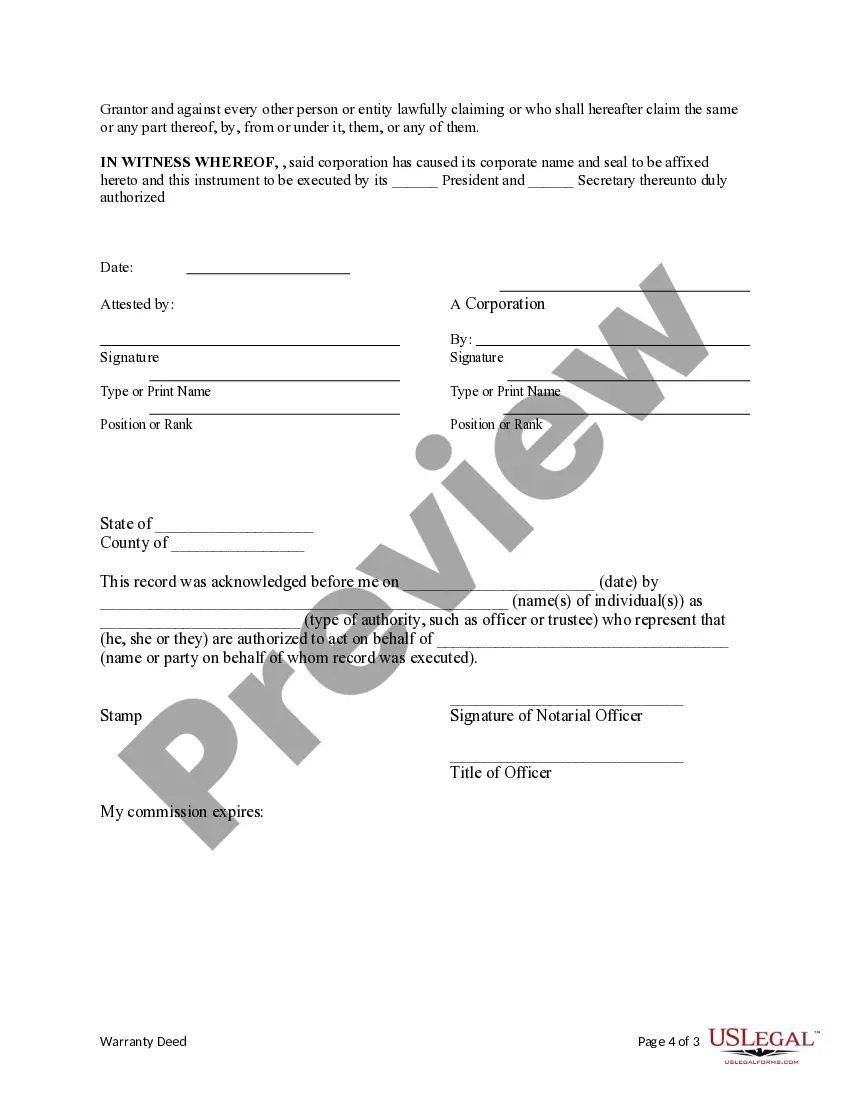

This form is a Special Warranty Deed where the Grantor is a corporation and the Grantee is a limited partnership. Grantor conveys and specially warrants the described property to the Grantee. The Grantor only warrants and will defend the property only as to claims of persons claiming by, through or under Grantor, but not otherwise. This deed complies with all state statutory laws.

Allentown, Pennsylvania, offers several types of Special Warranty Deeds from Corporation to Limited Partnership. This legal document serves as a means of transferring property ownership and provides certain protections to the limited partnership from any prior claims related to the property. It is crucial to understand the different variations of these deeds to fulfill specific requirements. The following types of Allentown Pennsylvania Special Warranty Deeds from Corporation to Limited Partnership are commonly utilized: 1. General Description: An Allentown Pennsylvania Special Warranty Deed from Corporation to Limited Partnership is a legally binding document that enables a corporation to transfer property ownership rights to a limited partnership entity. This deed ensures that the corporation warrants the property free from any encumbrances arising during its period of ownership. 2. Special Warranty Deed with Restrictions: This type of Allentown Pennsylvania Special Warranty Deed from Corporation to Limited Partnership contains additional restrictive covenants or limitations on the use of the property, which both parties must abide by. These restrictions may include limitations on building height, land use restrictions, and other specific requirements to ensure compliance with local regulations or the corporation's policies. 3. Special Warranty Deed with Right of First Refusal: In this variation of the Allentown Pennsylvania Special Warranty Deed from Corporation to Limited Partnership, the limited partnership is granted the exclusive right to purchase the property before it is offered to any third parties. This provision protects the limited partnership's interests and allows them to exercise their right to acquire the property under specified terms and conditions. 4. Special Warranty Deed with Exclusion of Liability: This type of Allentown Pennsylvania Special Warranty Deed from Corporation to Limited Partnership limits the liability of the corporation regarding any potential legal claims arising from the property's condition or prior disputes, providing further protection for the limited partnership purchasing the property. 5. Special Warranty Deed with Indemnification Clause: In this variation, the corporation agrees to indemnify the limited partnership against any financial losses or legal claims arising from third-party claims relating to the property. This clause provides an added layer of security, ensuring that the limited partnership is protected from potential legal or financial consequences. When engaging in property transactions involving a Special Warranty Deed from Corporation to Limited Partnership in Allentown, Pennsylvania, it is essential to consult with legal professionals familiar with the specific requirements and variations of these deeds to ensure compliance with all legal obligations.Allentown, Pennsylvania, offers several types of Special Warranty Deeds from Corporation to Limited Partnership. This legal document serves as a means of transferring property ownership and provides certain protections to the limited partnership from any prior claims related to the property. It is crucial to understand the different variations of these deeds to fulfill specific requirements. The following types of Allentown Pennsylvania Special Warranty Deeds from Corporation to Limited Partnership are commonly utilized: 1. General Description: An Allentown Pennsylvania Special Warranty Deed from Corporation to Limited Partnership is a legally binding document that enables a corporation to transfer property ownership rights to a limited partnership entity. This deed ensures that the corporation warrants the property free from any encumbrances arising during its period of ownership. 2. Special Warranty Deed with Restrictions: This type of Allentown Pennsylvania Special Warranty Deed from Corporation to Limited Partnership contains additional restrictive covenants or limitations on the use of the property, which both parties must abide by. These restrictions may include limitations on building height, land use restrictions, and other specific requirements to ensure compliance with local regulations or the corporation's policies. 3. Special Warranty Deed with Right of First Refusal: In this variation of the Allentown Pennsylvania Special Warranty Deed from Corporation to Limited Partnership, the limited partnership is granted the exclusive right to purchase the property before it is offered to any third parties. This provision protects the limited partnership's interests and allows them to exercise their right to acquire the property under specified terms and conditions. 4. Special Warranty Deed with Exclusion of Liability: This type of Allentown Pennsylvania Special Warranty Deed from Corporation to Limited Partnership limits the liability of the corporation regarding any potential legal claims arising from the property's condition or prior disputes, providing further protection for the limited partnership purchasing the property. 5. Special Warranty Deed with Indemnification Clause: In this variation, the corporation agrees to indemnify the limited partnership against any financial losses or legal claims arising from third-party claims relating to the property. This clause provides an added layer of security, ensuring that the limited partnership is protected from potential legal or financial consequences. When engaging in property transactions involving a Special Warranty Deed from Corporation to Limited Partnership in Allentown, Pennsylvania, it is essential to consult with legal professionals familiar with the specific requirements and variations of these deeds to ensure compliance with all legal obligations.