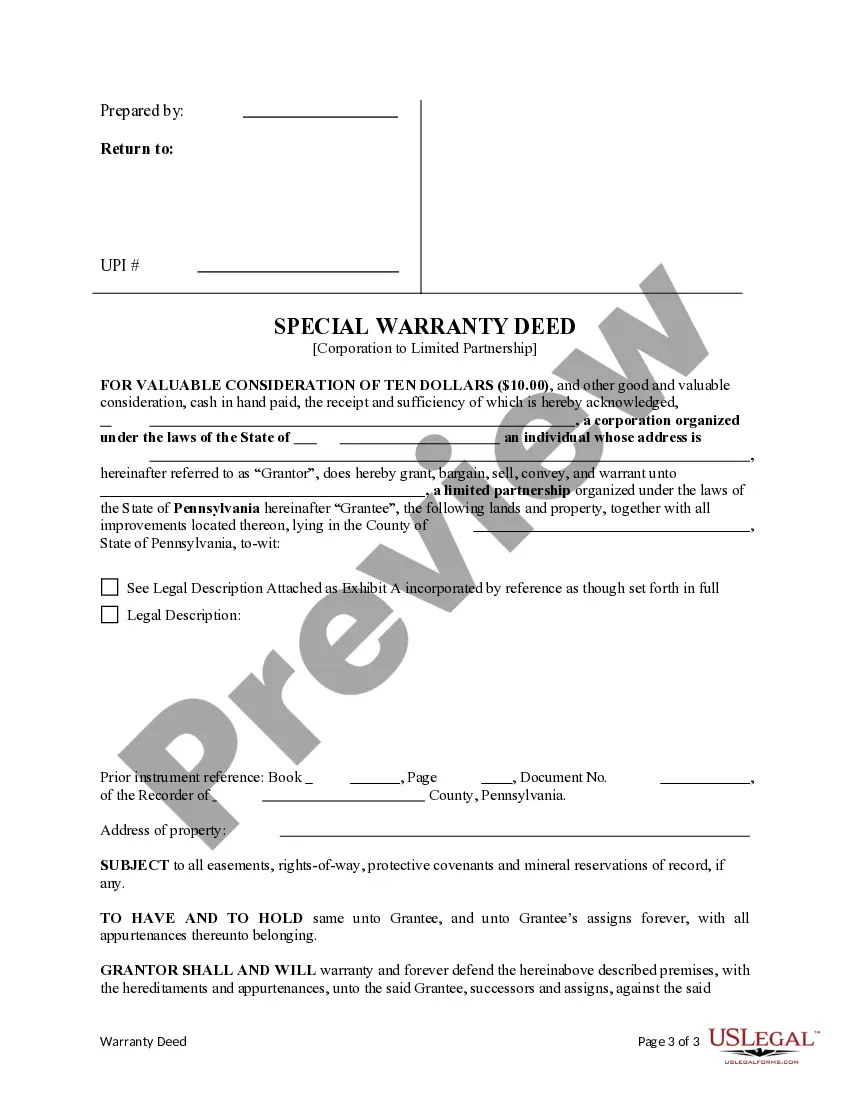

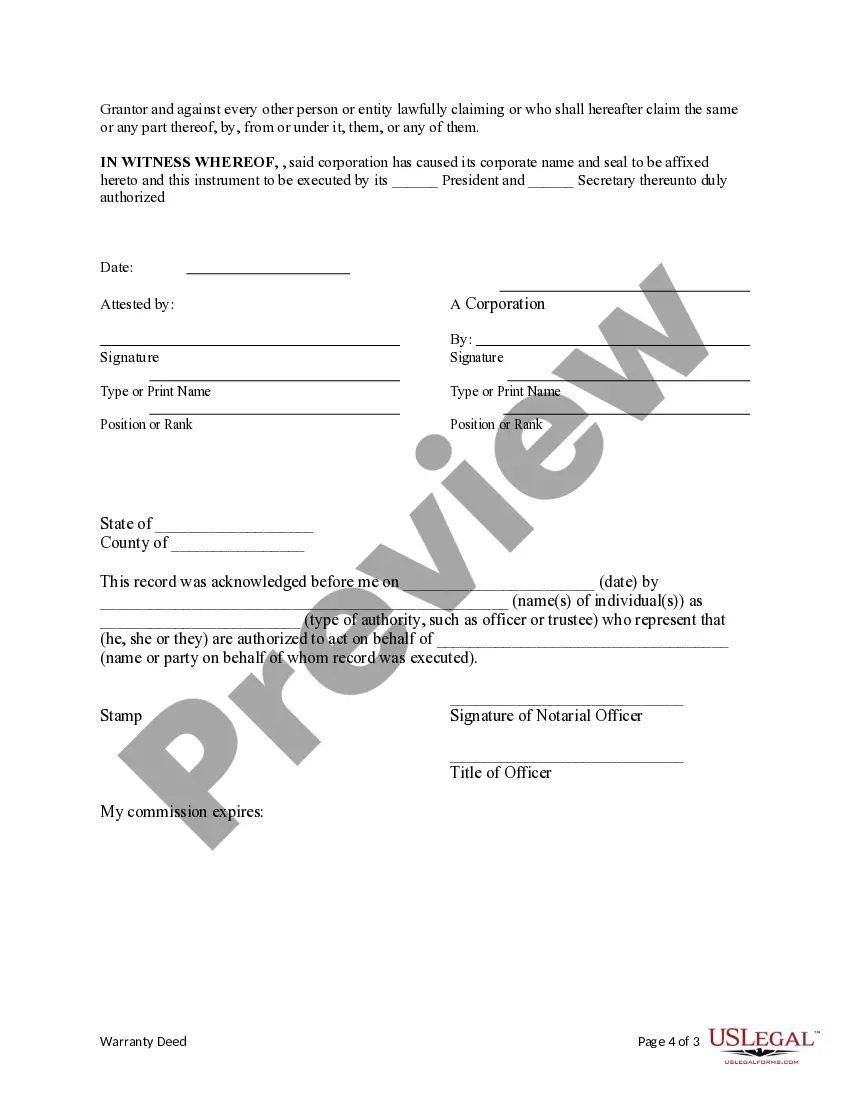

This form is a Special Warranty Deed where the Grantor is a corporation and the Grantee is a limited partnership. Grantor conveys and specially warrants the described property to the Grantee. The Grantor only warrants and will defend the property only as to claims of persons claiming by, through or under Grantor, but not otherwise. This deed complies with all state statutory laws.

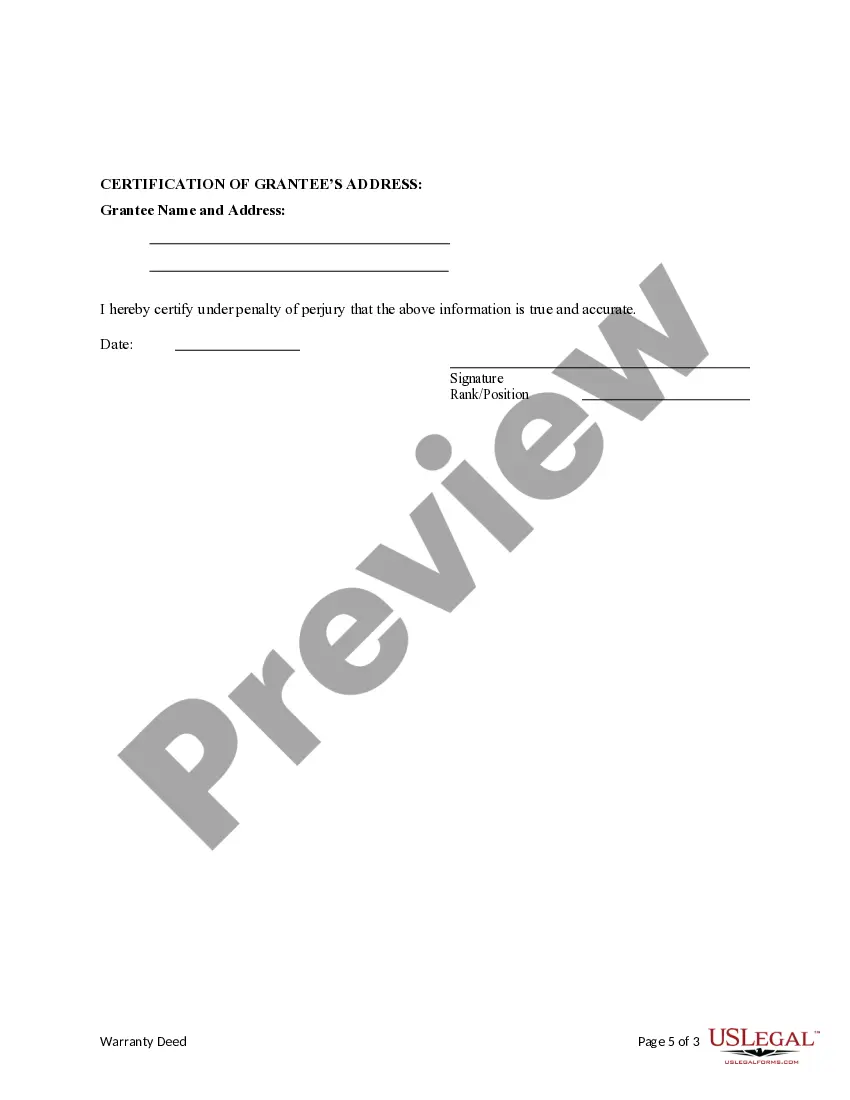

A Philadelphia Pennsylvania Special Warranty Deed from Corporation to Limited Partnership is a legal document used to transfer ownership of real estate from a corporation to a limited partnership. This type of deed provides certain assurances and warranties to the limited partnership regarding the condition of the property being transferred. It is crucial to understand the various types of Special Warranty Deeds that exist under Philadelphia Pennsylvania law. One variation of the Philadelphia Pennsylvania Special Warranty Deed from Corporation to Limited Partnership is the General Special Warranty Deed. This type of deed guarantees that the corporation, as the granter, will defend the title against any claims that arise during their period of ownership. However, it only covers claims or defects that occurred during the time the corporation owned the property. Another version is the Limited Special Warranty Deed, which provides a narrower form of protection. This deed guarantees that the corporation will defend the title only against claims that arise from their actions or omissions during their period of ownership. It does not cover any claims or defects that were present before the corporation acquired the property. The Philadelphia Pennsylvania Special Warranty Deed from Corporation to Limited Partnership typically includes specific information about the parties involved, such as the names and addresses of the corporation and the limited partnership. It also identifies the property being transferred by providing an accurate legal description, including metes and bounds, lot numbers, or any other relevant information that properly identifies the land. In addition, the deed includes a statement of consideration, which indicates the monetary value or other valuable consideration exchanged between the corporation and the limited partnership. This consideration solidifies the transaction and makes it legally enforceable. Furthermore, the Special Warranty Deed should contain language explicitly stating that the corporation is conveying the property with limited warranties. This language demonstrates to the limited partnership that the corporation will defend against any claims, liens, or encumbrances that arose solely during its ownership. As with any legal document, it is strongly advised to consult with an attorney experienced in real estate law to ensure accuracy and compliance with Philadelphia Pennsylvania regulations when drafting or executing a Special Warranty Deed from Corporation to Limited Partnership.A Philadelphia Pennsylvania Special Warranty Deed from Corporation to Limited Partnership is a legal document used to transfer ownership of real estate from a corporation to a limited partnership. This type of deed provides certain assurances and warranties to the limited partnership regarding the condition of the property being transferred. It is crucial to understand the various types of Special Warranty Deeds that exist under Philadelphia Pennsylvania law. One variation of the Philadelphia Pennsylvania Special Warranty Deed from Corporation to Limited Partnership is the General Special Warranty Deed. This type of deed guarantees that the corporation, as the granter, will defend the title against any claims that arise during their period of ownership. However, it only covers claims or defects that occurred during the time the corporation owned the property. Another version is the Limited Special Warranty Deed, which provides a narrower form of protection. This deed guarantees that the corporation will defend the title only against claims that arise from their actions or omissions during their period of ownership. It does not cover any claims or defects that were present before the corporation acquired the property. The Philadelphia Pennsylvania Special Warranty Deed from Corporation to Limited Partnership typically includes specific information about the parties involved, such as the names and addresses of the corporation and the limited partnership. It also identifies the property being transferred by providing an accurate legal description, including metes and bounds, lot numbers, or any other relevant information that properly identifies the land. In addition, the deed includes a statement of consideration, which indicates the monetary value or other valuable consideration exchanged between the corporation and the limited partnership. This consideration solidifies the transaction and makes it legally enforceable. Furthermore, the Special Warranty Deed should contain language explicitly stating that the corporation is conveying the property with limited warranties. This language demonstrates to the limited partnership that the corporation will defend against any claims, liens, or encumbrances that arose solely during its ownership. As with any legal document, it is strongly advised to consult with an attorney experienced in real estate law to ensure accuracy and compliance with Philadelphia Pennsylvania regulations when drafting or executing a Special Warranty Deed from Corporation to Limited Partnership.