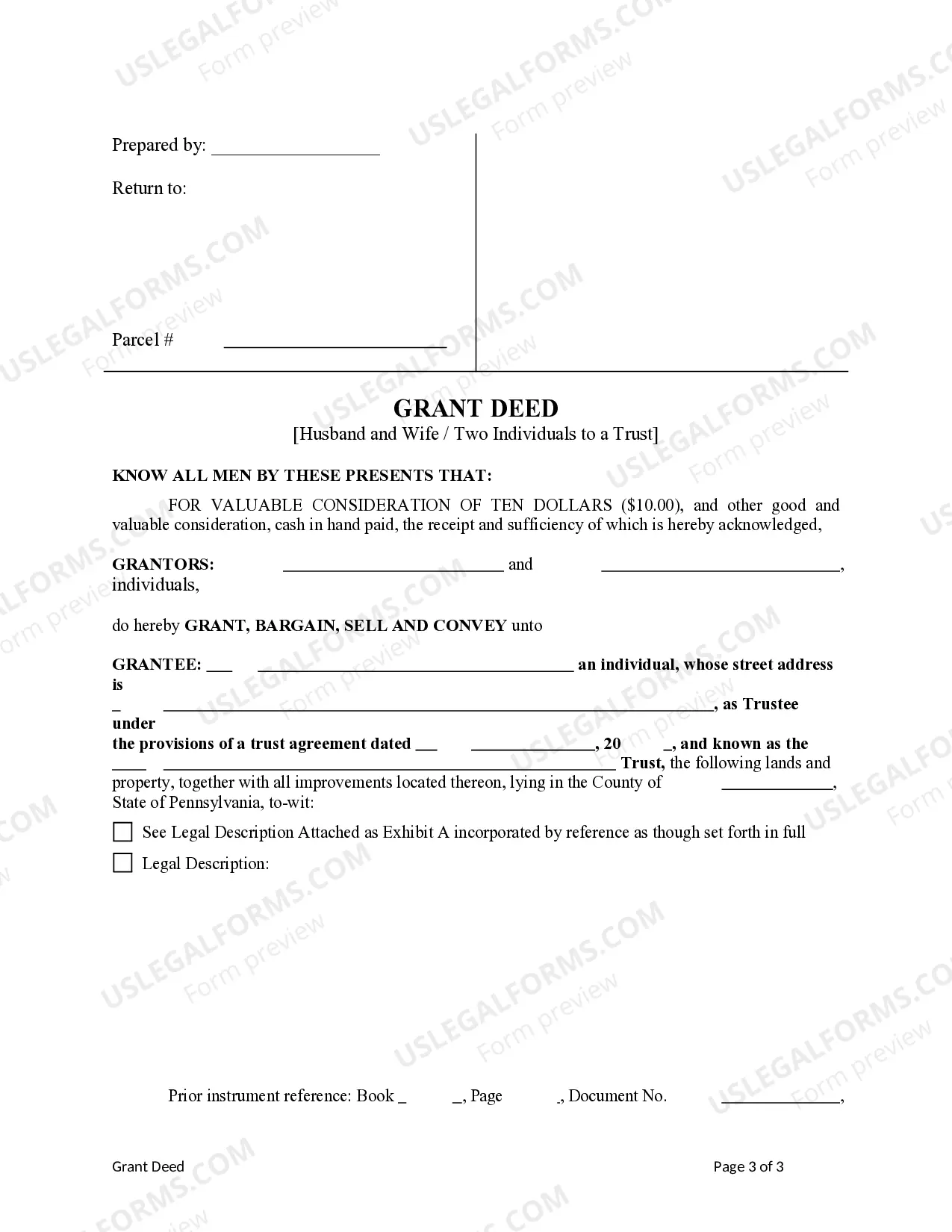

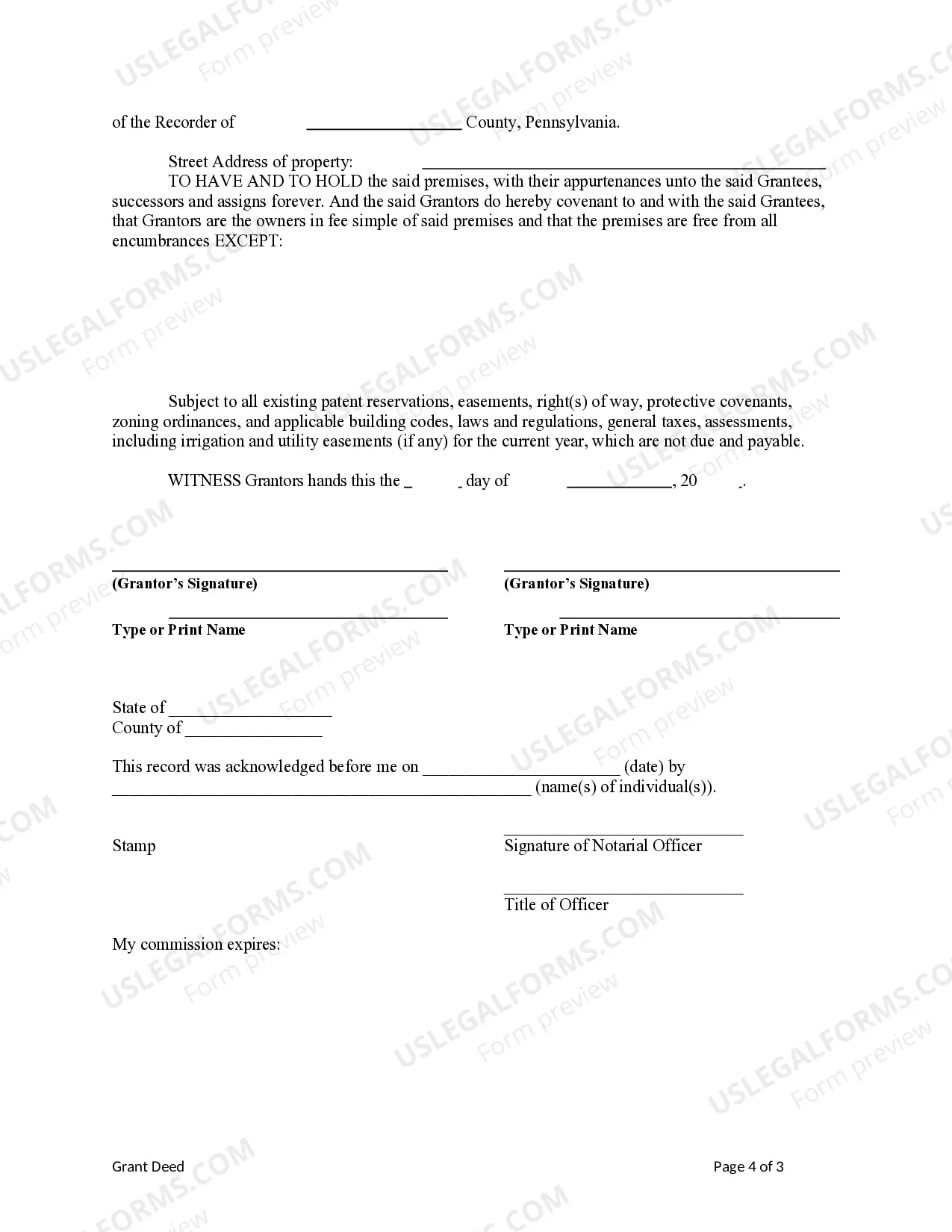

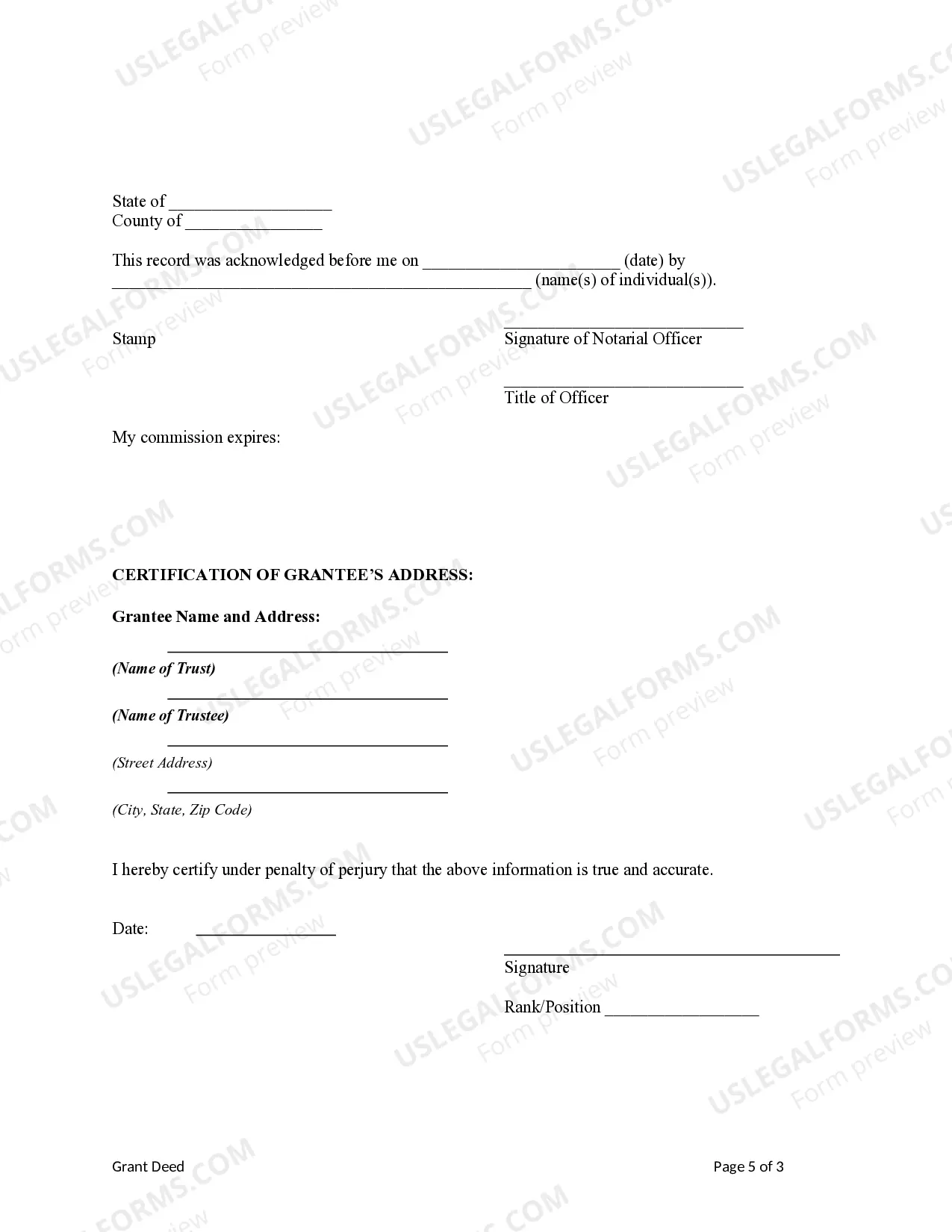

This form is a Grant Deed where the Grantors are husband and wife, or two individuals, and the Grantee is a trust. Grantors convey and grant the described property to the Grantee. This grant simply transfers the title of a property to the grantee. Included in the deed are statements verifying the property is not sold to other parties, and all encumbrances on the property are known to the grantee. Grantors affirm that (1) Grantors have the right to sell and convey the property; (2) the property has not been sold by Grantors to any party; and (3) any encumbrances or liens are noted herein. This deed complies with all state statutory laws.

Title: Understanding Allegheny Pennsylvania Grant Deed from Husband and Wife, or Two Individuals, to a Trust Introduction: Allegheny County, Pennsylvania provides a specific legal instrument known as the Grant Deed, which facilitates the transfer of real estate from a husband and wife or two individuals to a trust. This detailed description aims to shed light on the key aspects and different types of Allegheny Pennsylvania Grant Deeds, the role of trusts, and the process involved. Through an understanding of relevant keywords, let's explore this topic further. 1. What is a Grant Deed? — A Grant Deed is a legal document used to transfer ownership or interest in real property from the granter (husband and wife, or two individuals) to the grantee (the trust). — It serves as a crucial instrument for ensuring a legal and binding transfer of ownership rights. 2. Role of Trusts: — A trust refers to a legal arrangement that allows a person or entity (trustee) to hold and manage assets for the benefit of another person or group of individuals (beneficiaries). — Transferring property to a trust helps manage estate planning, asset protection, or facilitate efficient distribution after death. — The purpose of a trust deed is to formalize this transfer while providing clear instructions on how the property should be managed and distributed. 3. Different Types of Allegheny Pennsylvania Grant Deeds from Husband and Wife, or Two Individuals, to a Trust: a) Revocable Living Trust Grant Deed: — A revocable living trust grant deed transfers the property to a trust that can be amended, modified, or revoked during the lifetime of the granters. — This type of trust is commonly used for estate planning purposes, allowing flexibility and control over assets while avoiding probate. b) Irrevocable Trust Grant Deed: — An irrevocable trust grant deed transfers ownership to a trust that cannot be revoked or modified without the consent of all parties involved. — This type of trust offers enhanced asset protection and can have potential tax benefits. — Popular uses include protecting assets from creditors, planning for Medicaid eligibility, or managing charitable donations. 4. Process Involved: — Engage a real estate attorney or legal professional experienced in Allegheny County laws. — Draft or obtain the appropriate Allegheny Pennsylvania Grant Deed form, ensuring compliance with state regulations. — Clearly identify algrantersrs and the trust details, including the trustee's name. — Transfer the deed and have it recorded in the Allegheny County Recorder of Deeds office. — Pay any applicable fees and taxes associated with the transfer. Conclusion: Allegheny Pennsylvania Grant Deed from Husband and Wife, or Two Individuals, to a Trust is an integral legal document enabling the secure transfer of real estate assets to trusts for various purposes. Understanding the different types of grant deeds allows individuals to choose the appropriate option based on their specific goals and circumstances. With professional guidance, this process can ensure a smoother transition and help safeguard property rights while maximizing the potential benefits of a trust.Title: Understanding Allegheny Pennsylvania Grant Deed from Husband and Wife, or Two Individuals, to a Trust Introduction: Allegheny County, Pennsylvania provides a specific legal instrument known as the Grant Deed, which facilitates the transfer of real estate from a husband and wife or two individuals to a trust. This detailed description aims to shed light on the key aspects and different types of Allegheny Pennsylvania Grant Deeds, the role of trusts, and the process involved. Through an understanding of relevant keywords, let's explore this topic further. 1. What is a Grant Deed? — A Grant Deed is a legal document used to transfer ownership or interest in real property from the granter (husband and wife, or two individuals) to the grantee (the trust). — It serves as a crucial instrument for ensuring a legal and binding transfer of ownership rights. 2. Role of Trusts: — A trust refers to a legal arrangement that allows a person or entity (trustee) to hold and manage assets for the benefit of another person or group of individuals (beneficiaries). — Transferring property to a trust helps manage estate planning, asset protection, or facilitate efficient distribution after death. — The purpose of a trust deed is to formalize this transfer while providing clear instructions on how the property should be managed and distributed. 3. Different Types of Allegheny Pennsylvania Grant Deeds from Husband and Wife, or Two Individuals, to a Trust: a) Revocable Living Trust Grant Deed: — A revocable living trust grant deed transfers the property to a trust that can be amended, modified, or revoked during the lifetime of the granters. — This type of trust is commonly used for estate planning purposes, allowing flexibility and control over assets while avoiding probate. b) Irrevocable Trust Grant Deed: — An irrevocable trust grant deed transfers ownership to a trust that cannot be revoked or modified without the consent of all parties involved. — This type of trust offers enhanced asset protection and can have potential tax benefits. — Popular uses include protecting assets from creditors, planning for Medicaid eligibility, or managing charitable donations. 4. Process Involved: — Engage a real estate attorney or legal professional experienced in Allegheny County laws. — Draft or obtain the appropriate Allegheny Pennsylvania Grant Deed form, ensuring compliance with state regulations. — Clearly identify algrantersrs and the trust details, including the trustee's name. — Transfer the deed and have it recorded in the Allegheny County Recorder of Deeds office. — Pay any applicable fees and taxes associated with the transfer. Conclusion: Allegheny Pennsylvania Grant Deed from Husband and Wife, or Two Individuals, to a Trust is an integral legal document enabling the secure transfer of real estate assets to trusts for various purposes. Understanding the different types of grant deeds allows individuals to choose the appropriate option based on their specific goals and circumstances. With professional guidance, this process can ensure a smoother transition and help safeguard property rights while maximizing the potential benefits of a trust.