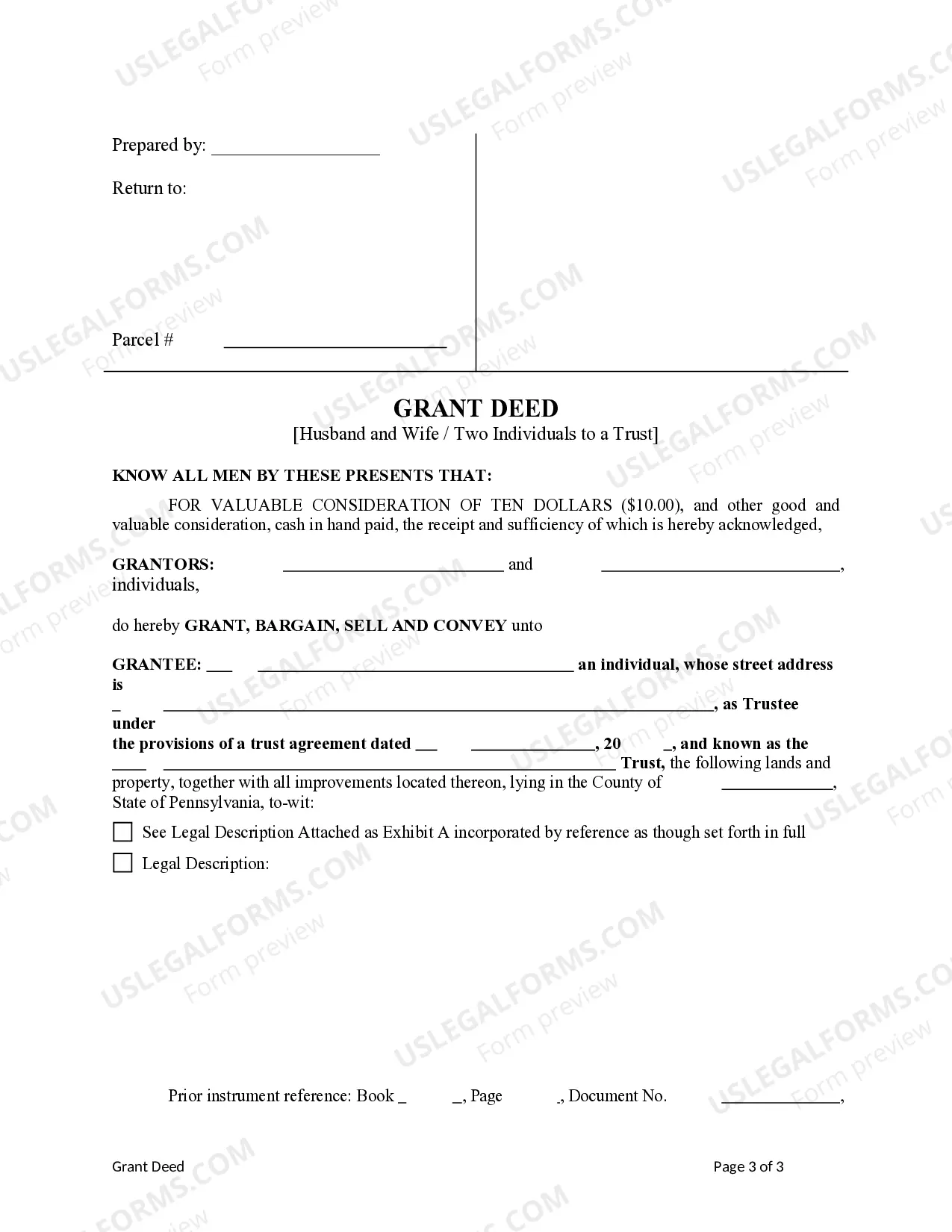

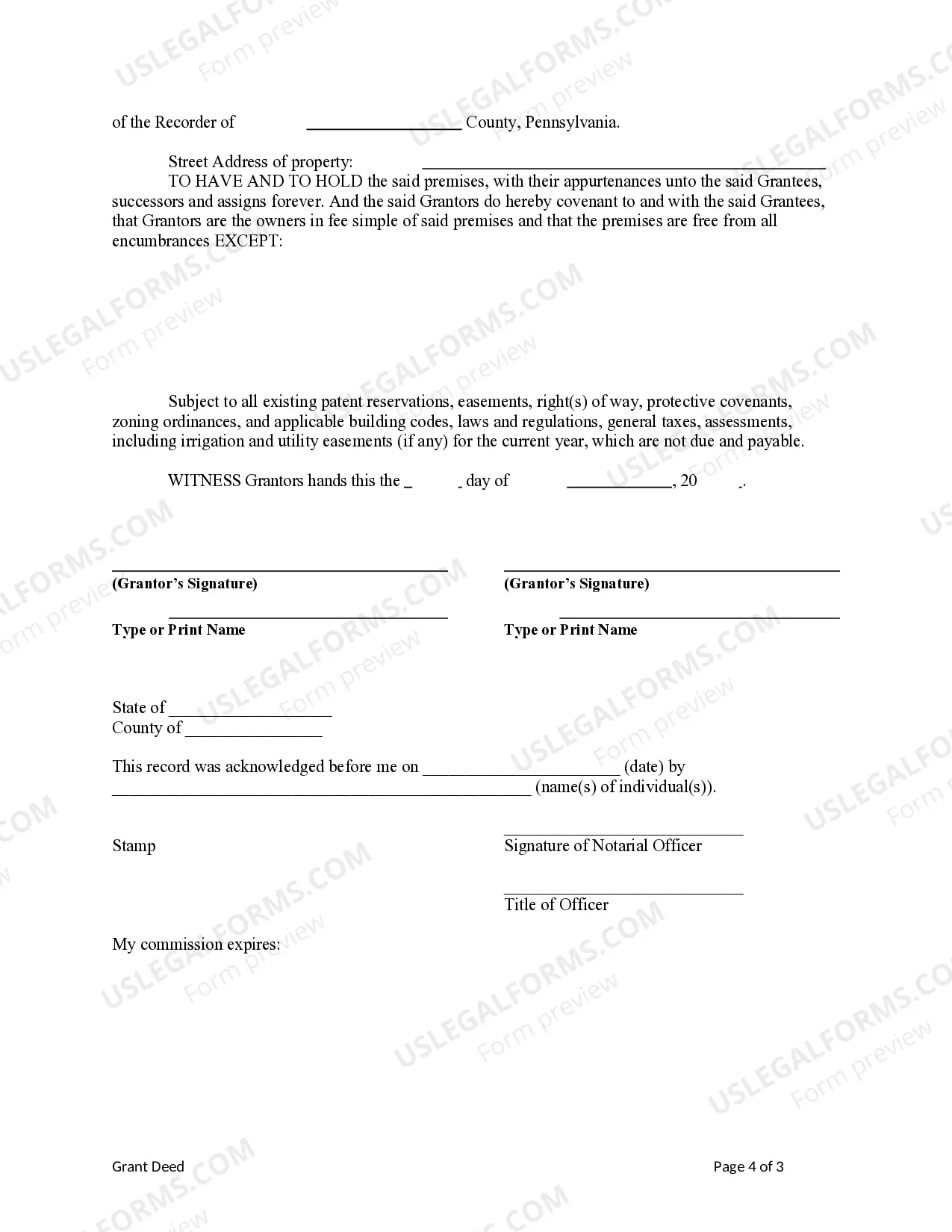

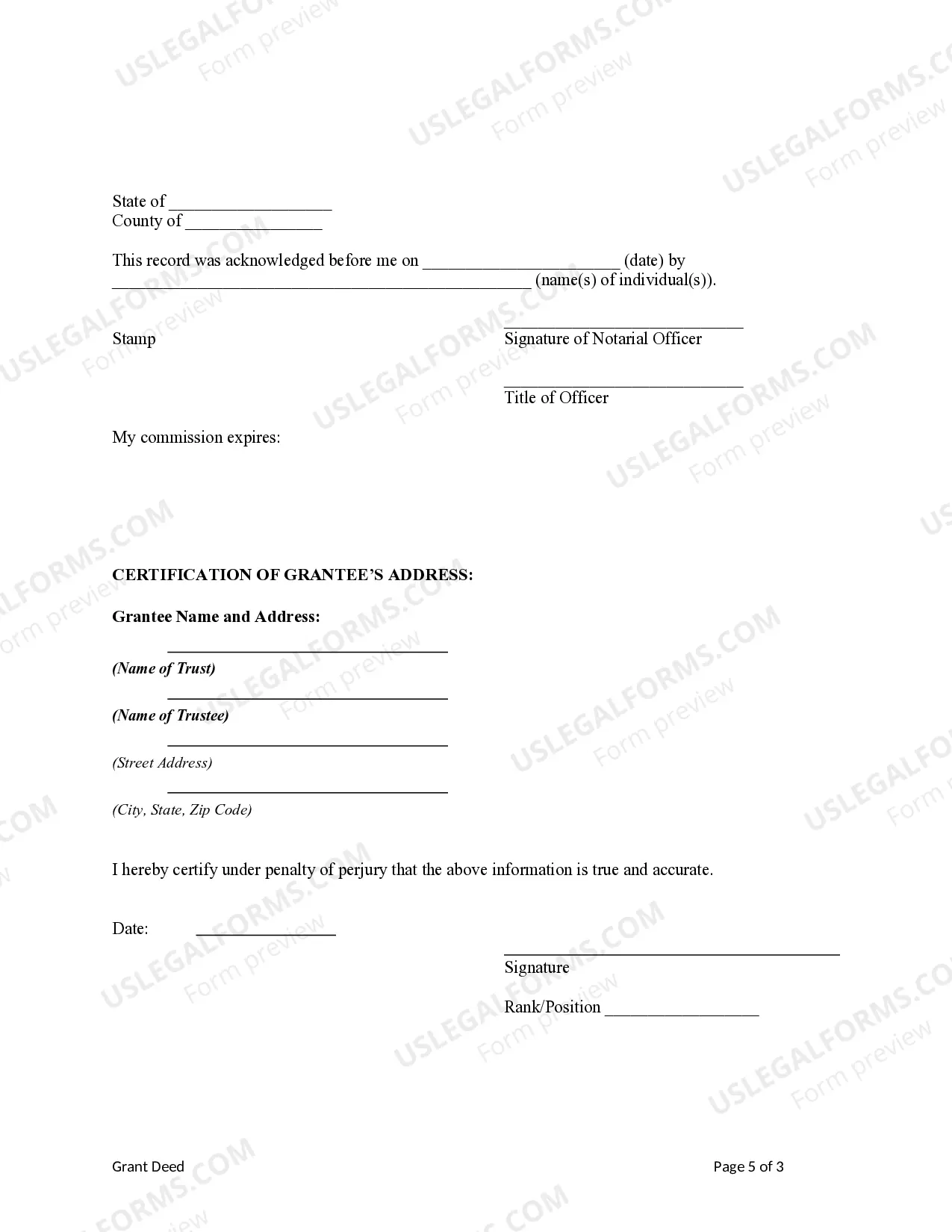

This form is a Grant Deed where the Grantors are husband and wife, or two individuals, and the Grantee is a trust. Grantors convey and grant the described property to the Grantee. This grant simply transfers the title of a property to the grantee. Included in the deed are statements verifying the property is not sold to other parties, and all encumbrances on the property are known to the grantee. Grantors affirm that (1) Grantors have the right to sell and convey the property; (2) the property has not been sold by Grantors to any party; and (3) any encumbrances or liens are noted herein. This deed complies with all state statutory laws.

A Grant Deed from Husband and Wife, or two Individuals, to a Trust is a legal document that allows property owners in Allentown, Pennsylvania, to transfer ownership of their property to a trust. This type of deed serves as a means to protect the property, as well as to organize its management and distribution in accordance with the owners' wishes. When drafting a Grant Deed from Husband and Wife, or two Individuals, to a Trust in Allentown, Pennsylvania, it is important to include key elements to ensure its validity and compliance with local laws. These elements may include the legal description of the property being transferred, the names of the granters (husband and wife or two individuals), the precise name of the trust, and the terms of the transfer. There are different variations of Grant Deeds from Husband and Wife, or two Individuals, to a Trust, which may serve different purposes. For instance: 1. Revocable Living Trust Grant Deed: This type of grant deed is commonly used when property owners wish to transfer ownership of their property into a revocable living trust, where they act as trustees during their lifetime. This arrangement allows them to maintain control over the property and make amendments or revoke the trust as they see fit. 2. Irrevocable Trust Grant Deed: An irrevocable trust grant deed is utilized when property owners want to transfer ownership of their property to an irrevocable trust. Once the property is transferred, the owners cannot amend or revoke the trust, and it becomes subject to the terms and conditions outlined in the trust agreement. 3. Special Needs Trust Grant Deed: Property owners who have a family member with special needs may opt for a special needs trust grant deed. This type of deed ensures that the property is held in trust for the benefit of the individual with special needs, while also safeguarding their eligibility for government benefits. In Allentown, Pennsylvania, it is crucial to follow the local procedures and requirements for executing a Grant Deed from Husband and Wife, or two Individuals, to a Trust. Typically, these deeds must be notarized and filed with the appropriate county authority, such as the Office of the Recorder of Deeds. In conclusion, a Grant Deed from Husband and Wife, or two Individuals, to a Trust in Allentown, Pennsylvania, allows property owners to transfer ownership of their property to a trust, providing protection and ensuring proper management and distribution. Different variations of this deed, such as the revocable living trust grant deed, irrevocable trust grant deed, and special needs trust grant deed, cater to specific purposes. However, it is essential to seek professional guidance and adhere to local regulations when drafting and executing such deeds.A Grant Deed from Husband and Wife, or two Individuals, to a Trust is a legal document that allows property owners in Allentown, Pennsylvania, to transfer ownership of their property to a trust. This type of deed serves as a means to protect the property, as well as to organize its management and distribution in accordance with the owners' wishes. When drafting a Grant Deed from Husband and Wife, or two Individuals, to a Trust in Allentown, Pennsylvania, it is important to include key elements to ensure its validity and compliance with local laws. These elements may include the legal description of the property being transferred, the names of the granters (husband and wife or two individuals), the precise name of the trust, and the terms of the transfer. There are different variations of Grant Deeds from Husband and Wife, or two Individuals, to a Trust, which may serve different purposes. For instance: 1. Revocable Living Trust Grant Deed: This type of grant deed is commonly used when property owners wish to transfer ownership of their property into a revocable living trust, where they act as trustees during their lifetime. This arrangement allows them to maintain control over the property and make amendments or revoke the trust as they see fit. 2. Irrevocable Trust Grant Deed: An irrevocable trust grant deed is utilized when property owners want to transfer ownership of their property to an irrevocable trust. Once the property is transferred, the owners cannot amend or revoke the trust, and it becomes subject to the terms and conditions outlined in the trust agreement. 3. Special Needs Trust Grant Deed: Property owners who have a family member with special needs may opt for a special needs trust grant deed. This type of deed ensures that the property is held in trust for the benefit of the individual with special needs, while also safeguarding their eligibility for government benefits. In Allentown, Pennsylvania, it is crucial to follow the local procedures and requirements for executing a Grant Deed from Husband and Wife, or two Individuals, to a Trust. Typically, these deeds must be notarized and filed with the appropriate county authority, such as the Office of the Recorder of Deeds. In conclusion, a Grant Deed from Husband and Wife, or two Individuals, to a Trust in Allentown, Pennsylvania, allows property owners to transfer ownership of their property to a trust, providing protection and ensuring proper management and distribution. Different variations of this deed, such as the revocable living trust grant deed, irrevocable trust grant deed, and special needs trust grant deed, cater to specific purposes. However, it is essential to seek professional guidance and adhere to local regulations when drafting and executing such deeds.