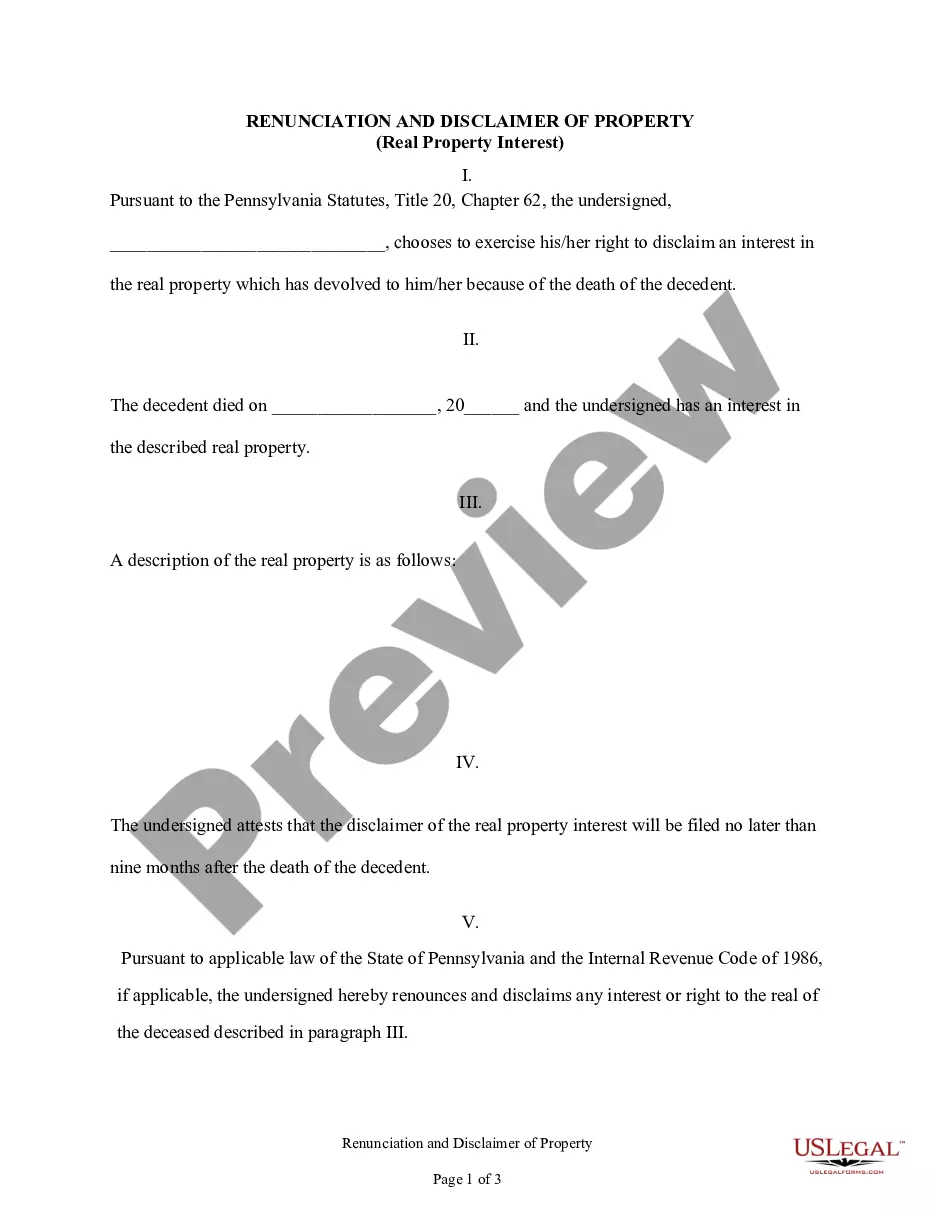

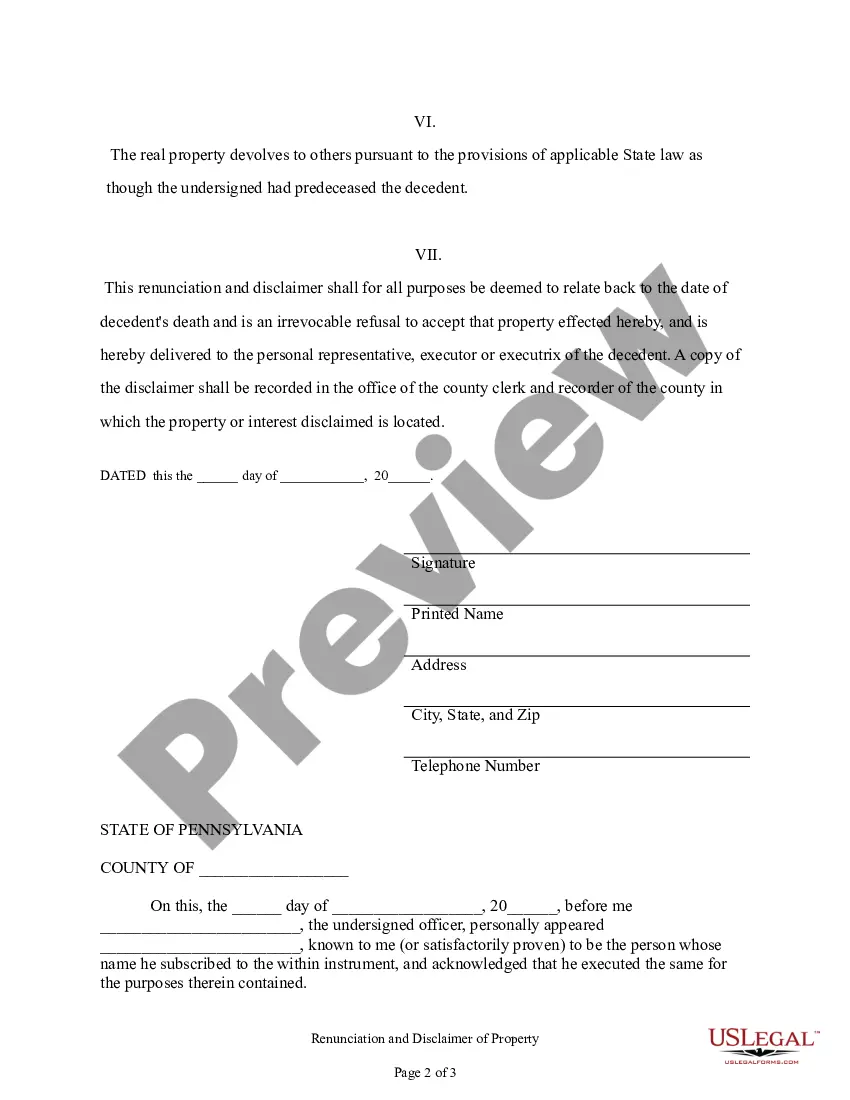

The Allegheny Pennsylvania Renunciation and Disclaimer of Real Property Interest is a legal document used in the state of Pennsylvania to officially renounce or disclaim any interest or claim one may have in a real property. This document is commonly used when an individual or entity wishes to waive their rights, ownership, or potential inheritance of a specific real estate asset. By filing the Allegheny Pennsylvania Renunciation and Disclaimer of Real Property Interest, the renounced voluntarily releases any legal right or entitlement to the property in question. This legally binding document ensures that the renounced's interests are no longer associated with the real property, protecting the rights of other potential beneficiaries or interested parties. There are different types of Allegheny Pennsylvania Renunciation and Disclaimer of Real Property Interest, depending on the particular situation: 1. Individual Renunciation and Disclaimer: This involves a person voluntarily giving up their rights and interest to a real property. This type of renunciation may occur when an individual feels it is in their best interest to no longer be associated with the property, whether due to personal preferences or financial considerations. 2. Trustee Renunciation and Disclaimer: In some cases, a trustee or executor of a trust or estate may decide to relinquish their interest in a real property. This allows the trustee to remove themselves from any further responsibility or liability associated with the property. 3. Beneficiary Renunciation and Disclaimer: When a beneficiary of an estate or trust decides to forgo their right to inherit a specific real property, they can file a renunciation and disclaimer. This relinquishment can occur if the beneficiary believes that accepting the property may have negative implications, such as tax burdens or maintenance costs. 4. Corporate Entity Renunciation and Disclaimer: Corporations or business entities can also renounce their interest in a real property through this legal document. This could happen if a company no longer wishes to possess the property due to strategic changes, financial constraints, or any other relevant factors. It is important to note that each type of Allegheny Pennsylvania Renunciation and Disclaimer of Real Property Interest must adhere to the state's legal requirements and should be filed with the county recorder or clerk's office to be recognized as legally binding. Consultation with a qualified attorney is highly recommended ensuring compliance with all necessary regulations and to navigate the process effectively.

Allegheny Pennsylvania Renunciation And Disclaimer of Real Property Interest

Description

How to fill out Allegheny Pennsylvania Renunciation And Disclaimer Of Real Property Interest?

Getting verified templates specific to your local laws can be challenging unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both personal and professional needs and any real-life scenarios. All the documents are properly categorized by area of usage and jurisdiction areas, so searching for the Allegheny Pennsylvania Renunciation And Disclaimer of Real Property Interest gets as quick and easy as ABC.

For everyone already familiar with our catalogue and has used it before, getting the Allegheny Pennsylvania Renunciation And Disclaimer of Real Property Interest takes just a few clicks. All you need to do is log in to your account, choose the document, and click Download to save it on your device. This process will take just a couple of more steps to complete for new users.

Follow the guidelines below to get started with the most extensive online form collection:

- Check the Preview mode and form description. Make sure you’ve picked the right one that meets your requirements and fully corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you see any inconsistency, utilize the Search tab above to get the correct one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and select the subscription plan you prefer. You should create an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the service.

- Download the Allegheny Pennsylvania Renunciation And Disclaimer of Real Property Interest. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Take advantage of the US Legal Forms library to always have essential document templates for any demands just at your hand!