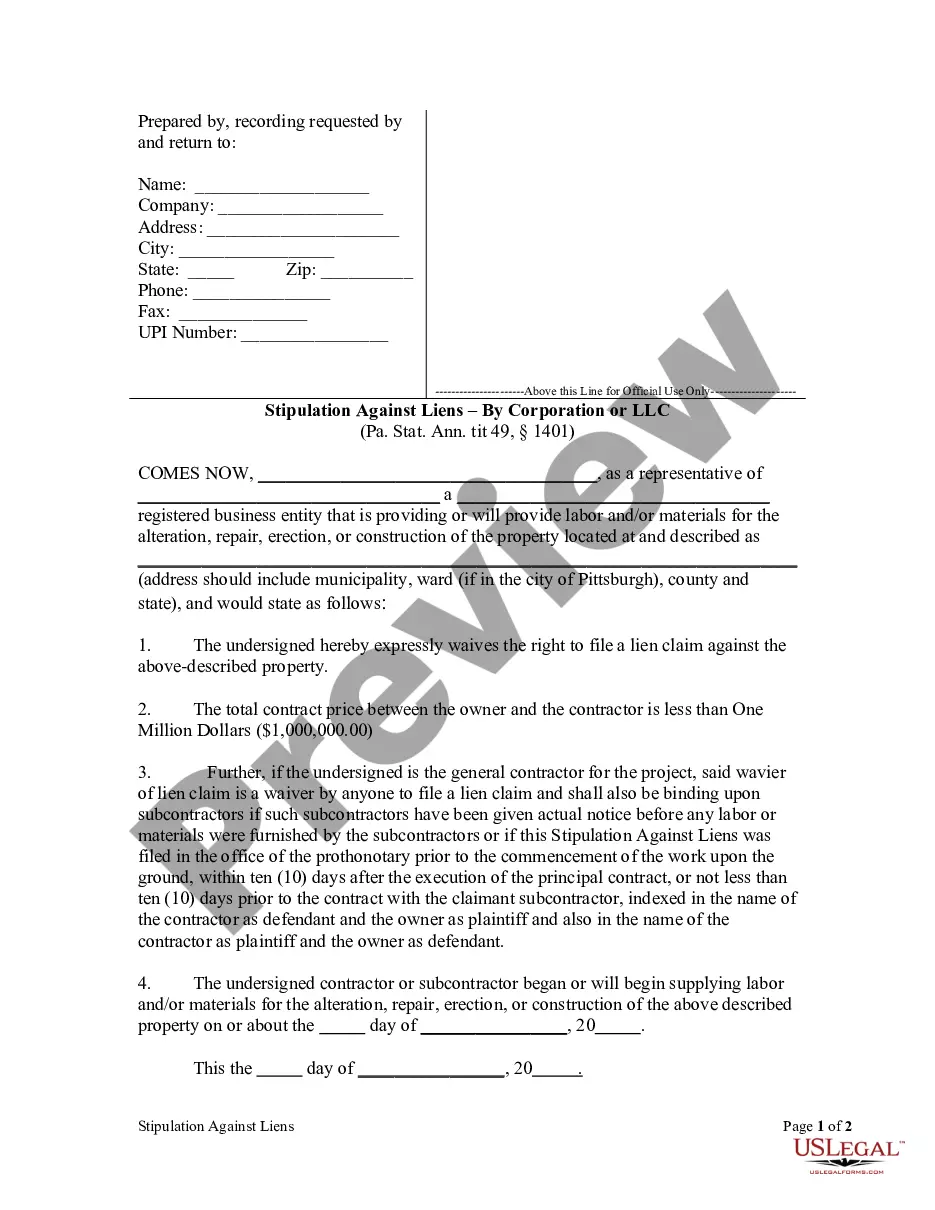

Pennsylvania is unusual among States in that it allows a contractor or subcontractor to issue a written waiver to the property owner in which the contractor or subcontractor waives all rights to claim a lien. In fact, with proper notice a contractor may even waive the rights of a subcontractor to claim a lien.

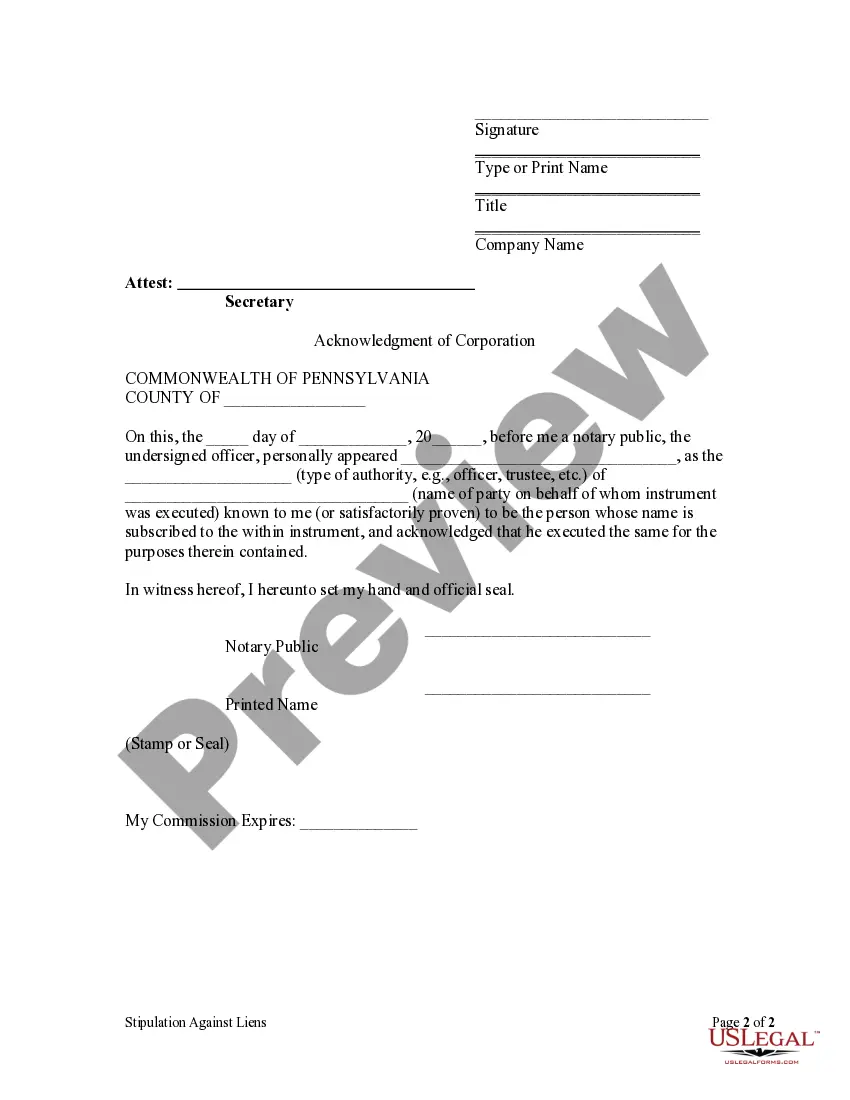

Allegheny Pennsylvania Waiver of Lien by Corporation or LLC is a legal document used by corporations or limited liability companies (LCS) when working on construction projects in Allegheny County, Pennsylvania. This waiver serves as proof that the corporation or LLC has received full payment for the work they have completed, thereby waiving their right to place a lien on the property. This document is crucial for contractors, subcontractors, material suppliers, and other construction industry professionals who want to ensure timely payment and protect their rights. By signing this waiver, the corporation or LLC acknowledges that they have been paid in full for the services or materials provided, agreeing not to assert their right to place a lien on the property. Keywords: Allegheny Pennsylvania, waiver of lien, corporation, LLC, construction projects, payment, proof, rights, contractors, subcontractors, material suppliers. There are different types of Allegheny Pennsylvania Waiver of Lien by Corporation or LLC, depending on the specific circumstances and the type of payment received: 1. Conditional Waiver: This type of waiver is used when the corporation or LLC has received a partial payment and wants to waive the lien rights only to the extent of that partial payment. It protects the interests of both parties until the remaining balance is paid. 2. Unconditional Waiver: This waiver is typically used when the corporation or LLC has received the full payment owed to them. By signing this waiver, they acknowledge the receipt of full payment and relinquish any lien rights they may have had. 3. Progress Payment Waiver: This type of waiver is used when payment for the work completed is made in installments. The corporation or LLC can sign a progress payment waiver for each partial payment received, ensuring continuous payment flow throughout the project. 4. Final Payment Waiver: When the project reaches its end and the final payment is made, the corporation or LLC may sign a final payment waiver. This document confirms that all amounts owed for the completed work have been received, finalizing the financial aspect of the project. It is important to note that although waiving the lien rights can be beneficial in terms of immediate payment, care should be taken to ensure that one's payment is secured and risks are minimized. Seeking legal advice before signing any waivers is advisable to understand the implications fully. Keywords: Conditional waiver, unconditional waiver, progress payment waiver, final payment waiver, payment, partial payment, full payment, installments, financial aspect, legal advice, risks.Allegheny Pennsylvania Waiver of Lien by Corporation or LLC is a legal document used by corporations or limited liability companies (LCS) when working on construction projects in Allegheny County, Pennsylvania. This waiver serves as proof that the corporation or LLC has received full payment for the work they have completed, thereby waiving their right to place a lien on the property. This document is crucial for contractors, subcontractors, material suppliers, and other construction industry professionals who want to ensure timely payment and protect their rights. By signing this waiver, the corporation or LLC acknowledges that they have been paid in full for the services or materials provided, agreeing not to assert their right to place a lien on the property. Keywords: Allegheny Pennsylvania, waiver of lien, corporation, LLC, construction projects, payment, proof, rights, contractors, subcontractors, material suppliers. There are different types of Allegheny Pennsylvania Waiver of Lien by Corporation or LLC, depending on the specific circumstances and the type of payment received: 1. Conditional Waiver: This type of waiver is used when the corporation or LLC has received a partial payment and wants to waive the lien rights only to the extent of that partial payment. It protects the interests of both parties until the remaining balance is paid. 2. Unconditional Waiver: This waiver is typically used when the corporation or LLC has received the full payment owed to them. By signing this waiver, they acknowledge the receipt of full payment and relinquish any lien rights they may have had. 3. Progress Payment Waiver: This type of waiver is used when payment for the work completed is made in installments. The corporation or LLC can sign a progress payment waiver for each partial payment received, ensuring continuous payment flow throughout the project. 4. Final Payment Waiver: When the project reaches its end and the final payment is made, the corporation or LLC may sign a final payment waiver. This document confirms that all amounts owed for the completed work have been received, finalizing the financial aspect of the project. It is important to note that although waiving the lien rights can be beneficial in terms of immediate payment, care should be taken to ensure that one's payment is secured and risks are minimized. Seeking legal advice before signing any waivers is advisable to understand the implications fully. Keywords: Conditional waiver, unconditional waiver, progress payment waiver, final payment waiver, payment, partial payment, full payment, installments, financial aspect, legal advice, risks.