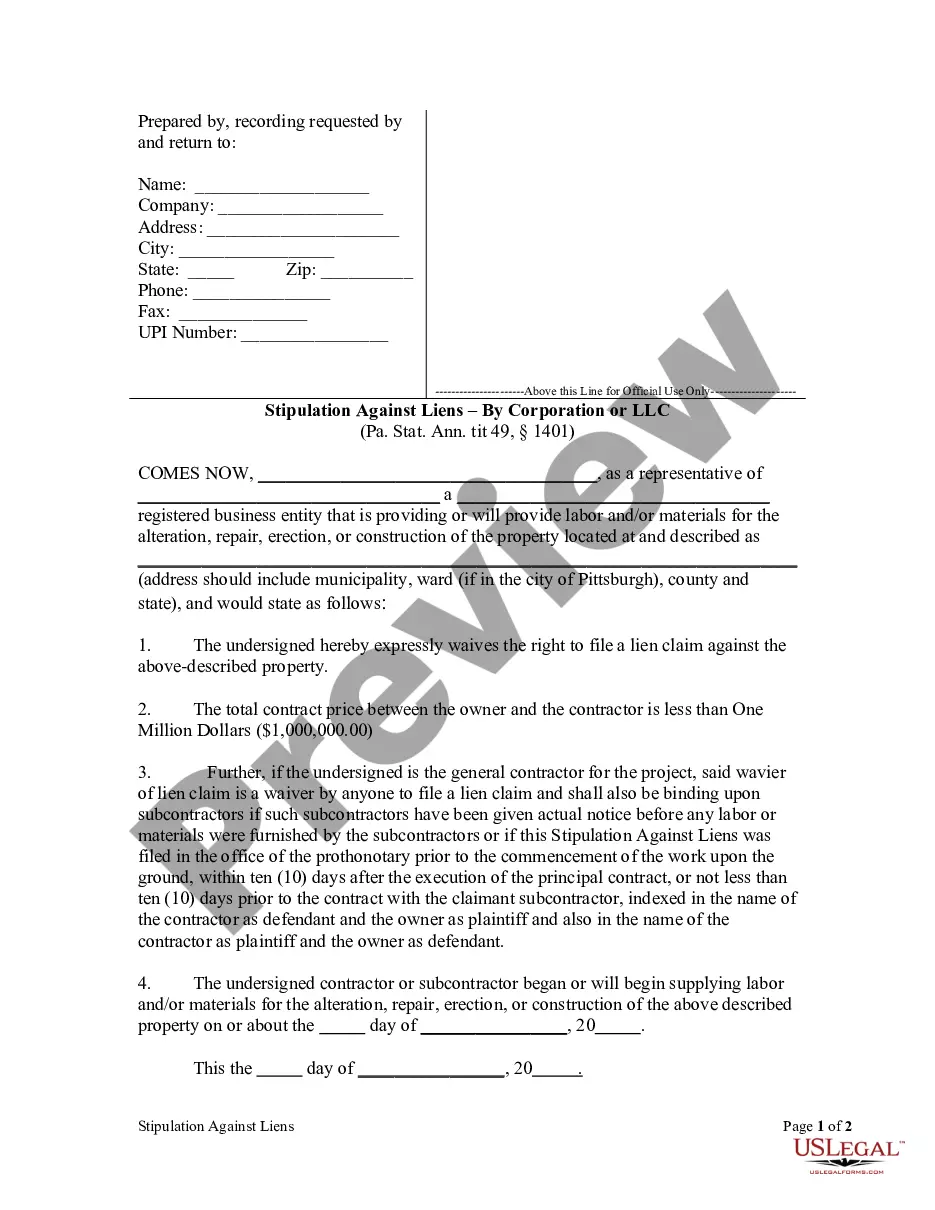

Pennsylvania is unusual among States in that it allows a contractor or subcontractor to issue a written waiver to the property owner in which the contractor or subcontractor waives all rights to claim a lien. In fact, with proper notice a contractor may even waive the rights of a subcontractor to claim a lien.

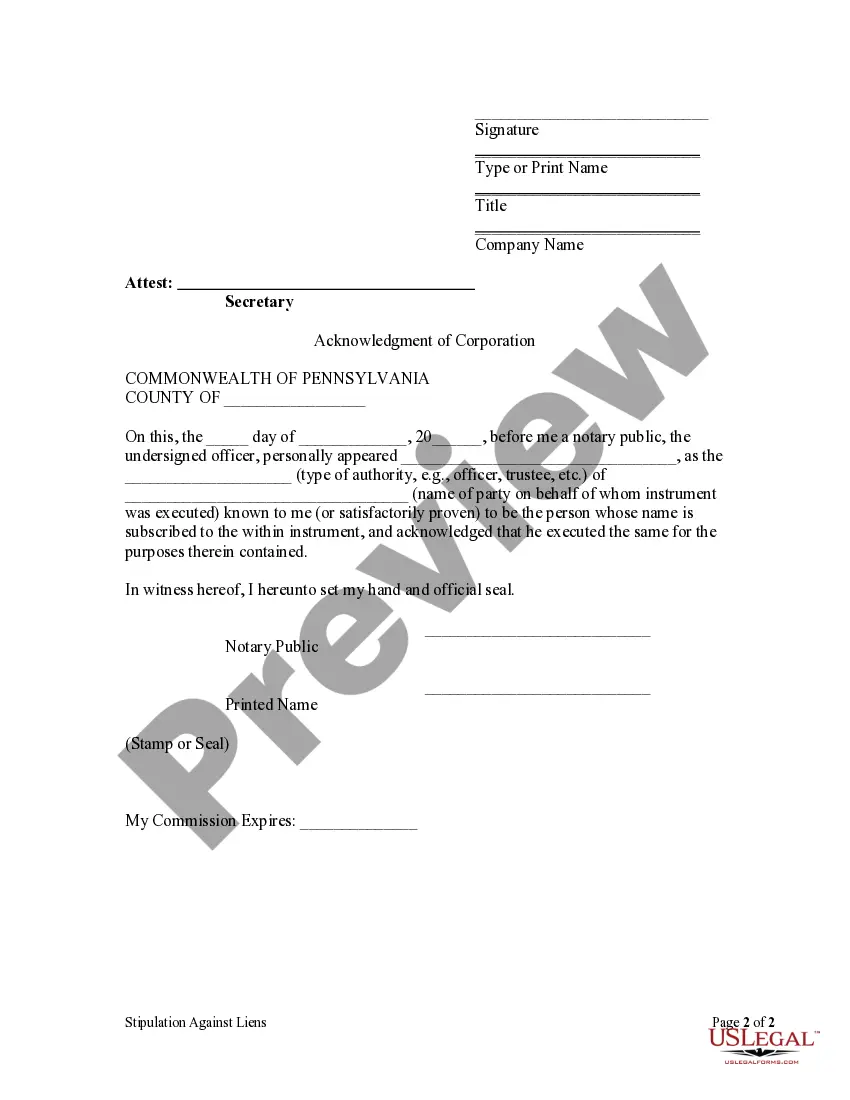

Allentown Pennsylvania Waiver of Lien by Corporation or LLC is a legal document that releases the right to place a lien on property owned by a corporation or limited liability company (LLC) in Allentown, Pennsylvania. It is an essential tool used in the construction industry to protect property owners from potential lien claims. A waiver of lien is often required by property owners before making final payments to contractors or subcontractors, ensuring that all parties involved in a construction project have been paid in full. By signing this waiver, the corporation or LLC relinquishes its right to file a lien against the property for any outstanding debts or unpaid work claims. There are different types of Allentown Pennsylvania Waiver of Lien by Corporation or LLC, namely: 1. Conditional Waiver of Lien: This type of waiver is commonly used when a payment has been received but has not yet been cleared by the bank. It states that the waiver is valid only upon the actual receipt and clearing of the payment. 2. Unconditional Waiver of Lien: This waiver is executed once the corporation or LLC has received full payment for the completed work or services. By signing this waiver, the company acknowledges that it has received the payment in full and waives its right to file a lien on the property. 3. Partial Waiver of Lien: When a project is completed in phases or has multiple components, a partial waiver of lien may be used. This type of waiver releases the corporation or LLC's lien rights for a specific portion of the work or services for which partial payment has been received. In order to ensure the validity of a waiver of lien, it is crucial to follow the correct legal procedures and include all necessary information. The document should clearly identify the parties involved, describe the property or project, specify the amount of payment received, and include the date of execution. It is important to consult with an attorney or legal professional experienced in construction law to ensure the accuracy and appropriateness of the waiver. Overall, an Allentown Pennsylvania Waiver of Lien by Corporation or LLC is a vital legal instrument that protects the interests of property owners and contractors alike, ensuring that payment issues and potential disputes are appropriately addressed in the construction industry.Allentown Pennsylvania Waiver of Lien by Corporation or LLC is a legal document that releases the right to place a lien on property owned by a corporation or limited liability company (LLC) in Allentown, Pennsylvania. It is an essential tool used in the construction industry to protect property owners from potential lien claims. A waiver of lien is often required by property owners before making final payments to contractors or subcontractors, ensuring that all parties involved in a construction project have been paid in full. By signing this waiver, the corporation or LLC relinquishes its right to file a lien against the property for any outstanding debts or unpaid work claims. There are different types of Allentown Pennsylvania Waiver of Lien by Corporation or LLC, namely: 1. Conditional Waiver of Lien: This type of waiver is commonly used when a payment has been received but has not yet been cleared by the bank. It states that the waiver is valid only upon the actual receipt and clearing of the payment. 2. Unconditional Waiver of Lien: This waiver is executed once the corporation or LLC has received full payment for the completed work or services. By signing this waiver, the company acknowledges that it has received the payment in full and waives its right to file a lien on the property. 3. Partial Waiver of Lien: When a project is completed in phases or has multiple components, a partial waiver of lien may be used. This type of waiver releases the corporation or LLC's lien rights for a specific portion of the work or services for which partial payment has been received. In order to ensure the validity of a waiver of lien, it is crucial to follow the correct legal procedures and include all necessary information. The document should clearly identify the parties involved, describe the property or project, specify the amount of payment received, and include the date of execution. It is important to consult with an attorney or legal professional experienced in construction law to ensure the accuracy and appropriateness of the waiver. Overall, an Allentown Pennsylvania Waiver of Lien by Corporation or LLC is a vital legal instrument that protects the interests of property owners and contractors alike, ensuring that payment issues and potential disputes are appropriately addressed in the construction industry.