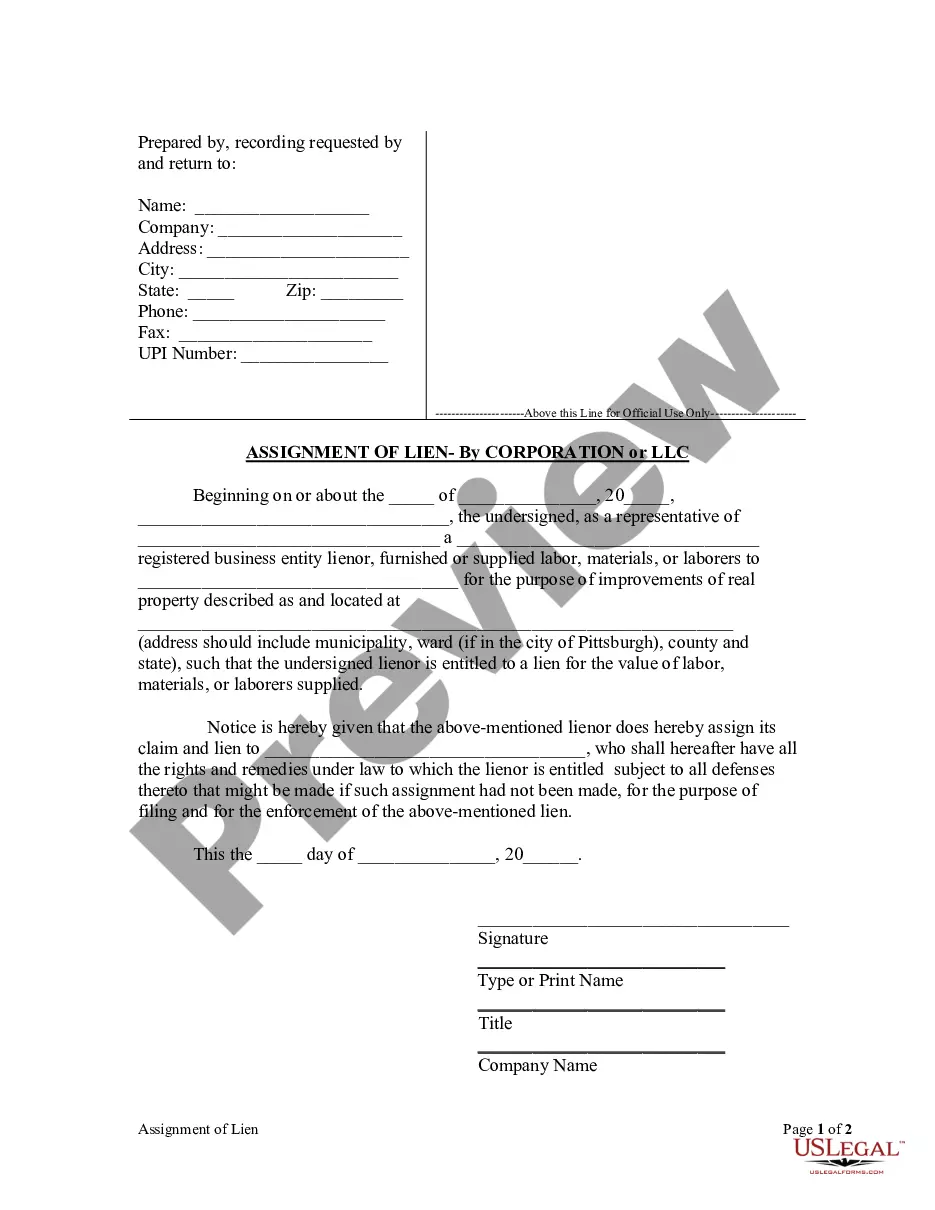

This Assignment of Lien form is for use by a corporate lienor who furnished or supplied labor, materials, or laborers for the purpose of improvements to real property to provide notice that the lienor assigns the lienor's claim and lien for the value of labor, materials, or laborers supplied to a designated person who shall have all the rights and remedies under law to which the lienor is entitled subject to all defenses thereto that might be made if such assignment had not been made, for the purpose of filing and for the enforcement of the lien.

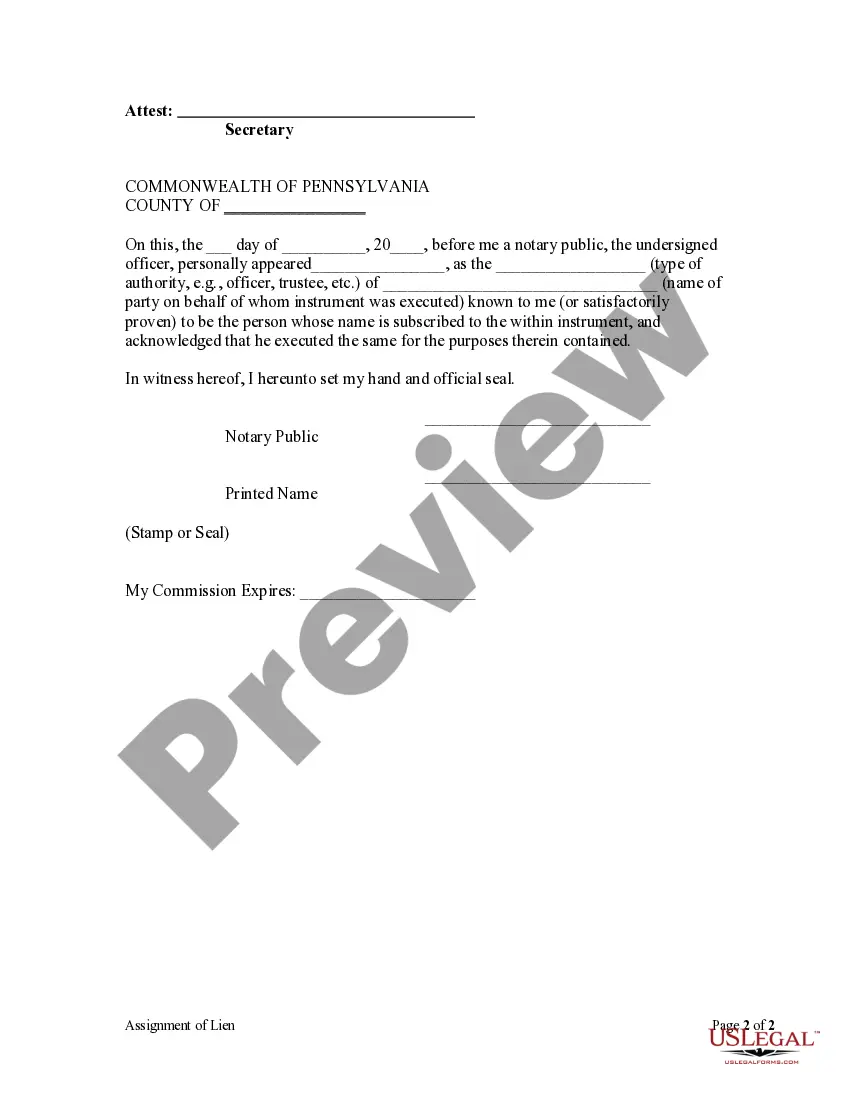

Philadelphia, Pennsylvania is known for its rich history, vibrant culture, and thriving business environment. Within this bustling city, the Assignment of Lien — Corporation or LLC serves as a crucial legal mechanism for both corporations and limited liability companies (LCS) to transfer their interests in a lien. An Assignment of Lien refers to the voluntary transfer of a legal claim or interest in property to another party. It is often used when the original holder of a lien wants to pass on their rights, obligations, and responsibilities related to that lien to a third party. In Philadelphia, this process applies to both corporations and LCS, which are two common types of businesses operating in the city. 1. Assignment of Lien — Corporation: When a corporation in Philadelphia wants to assign a lien to another party, such as another corporation or individual, it must adhere to the necessary legal procedures. This assignment typically requires a written agreement between the assigning corporation and the assignee, detailing the terms and conditions of the transfer. The corporation must ensure that it has the authority to assign the lien and obtain any required approvals from its board of directors or shareholders. 2. Assignment of Lien — Limited Liability Company (LLC): Similar to corporations, LCS in Philadelphia also have the ability to assign a lien to another entity. An LLC may choose to transfer its lien rights either to another LLC, a corporation, or an individual. Just like corporations, an assignment of lien by an LLC requires proper documentation, including a written agreement that specifies the terms and conditions of the transfer. The LLC must ensure it has the necessary authorization to assign the lien as per its operating agreement and obtain any required approvals from its members. It is important to note that the Assignment of Lien — Corporation or LLC process in Philadelphia may have additional requirements or documentation specific to the city or state. This process can be complex and should always be handled with the assistance of legal professionals well-versed in Philadelphia and Pennsylvania laws. In summary, the Assignment of Lien — Corporation or LLC in Philadelphia, Pennsylvania, facilitates the transfer of lien rights from one entity to another. Both corporations and LCS can utilize this legal mechanism to assign their liens to another corporation, LLC, or individual. Adhering to the relevant legal procedures and documentation ensures a smooth and valid assignment of lien within the city.Philadelphia, Pennsylvania is known for its rich history, vibrant culture, and thriving business environment. Within this bustling city, the Assignment of Lien — Corporation or LLC serves as a crucial legal mechanism for both corporations and limited liability companies (LCS) to transfer their interests in a lien. An Assignment of Lien refers to the voluntary transfer of a legal claim or interest in property to another party. It is often used when the original holder of a lien wants to pass on their rights, obligations, and responsibilities related to that lien to a third party. In Philadelphia, this process applies to both corporations and LCS, which are two common types of businesses operating in the city. 1. Assignment of Lien — Corporation: When a corporation in Philadelphia wants to assign a lien to another party, such as another corporation or individual, it must adhere to the necessary legal procedures. This assignment typically requires a written agreement between the assigning corporation and the assignee, detailing the terms and conditions of the transfer. The corporation must ensure that it has the authority to assign the lien and obtain any required approvals from its board of directors or shareholders. 2. Assignment of Lien — Limited Liability Company (LLC): Similar to corporations, LCS in Philadelphia also have the ability to assign a lien to another entity. An LLC may choose to transfer its lien rights either to another LLC, a corporation, or an individual. Just like corporations, an assignment of lien by an LLC requires proper documentation, including a written agreement that specifies the terms and conditions of the transfer. The LLC must ensure it has the necessary authorization to assign the lien as per its operating agreement and obtain any required approvals from its members. It is important to note that the Assignment of Lien — Corporation or LLC process in Philadelphia may have additional requirements or documentation specific to the city or state. This process can be complex and should always be handled with the assistance of legal professionals well-versed in Philadelphia and Pennsylvania laws. In summary, the Assignment of Lien — Corporation or LLC in Philadelphia, Pennsylvania, facilitates the transfer of lien rights from one entity to another. Both corporations and LCS can utilize this legal mechanism to assign their liens to another corporation, LLC, or individual. Adhering to the relevant legal procedures and documentation ensures a smooth and valid assignment of lien within the city.