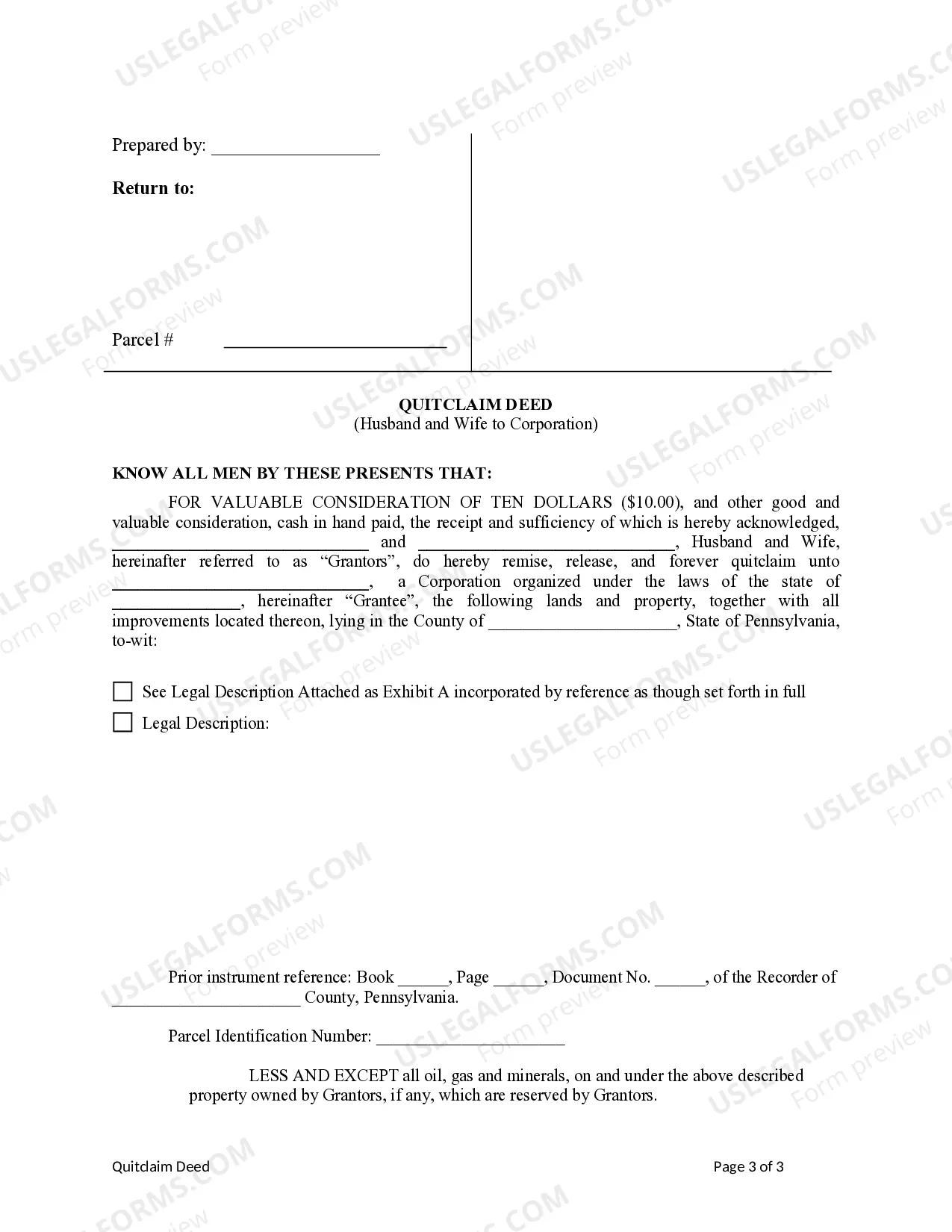

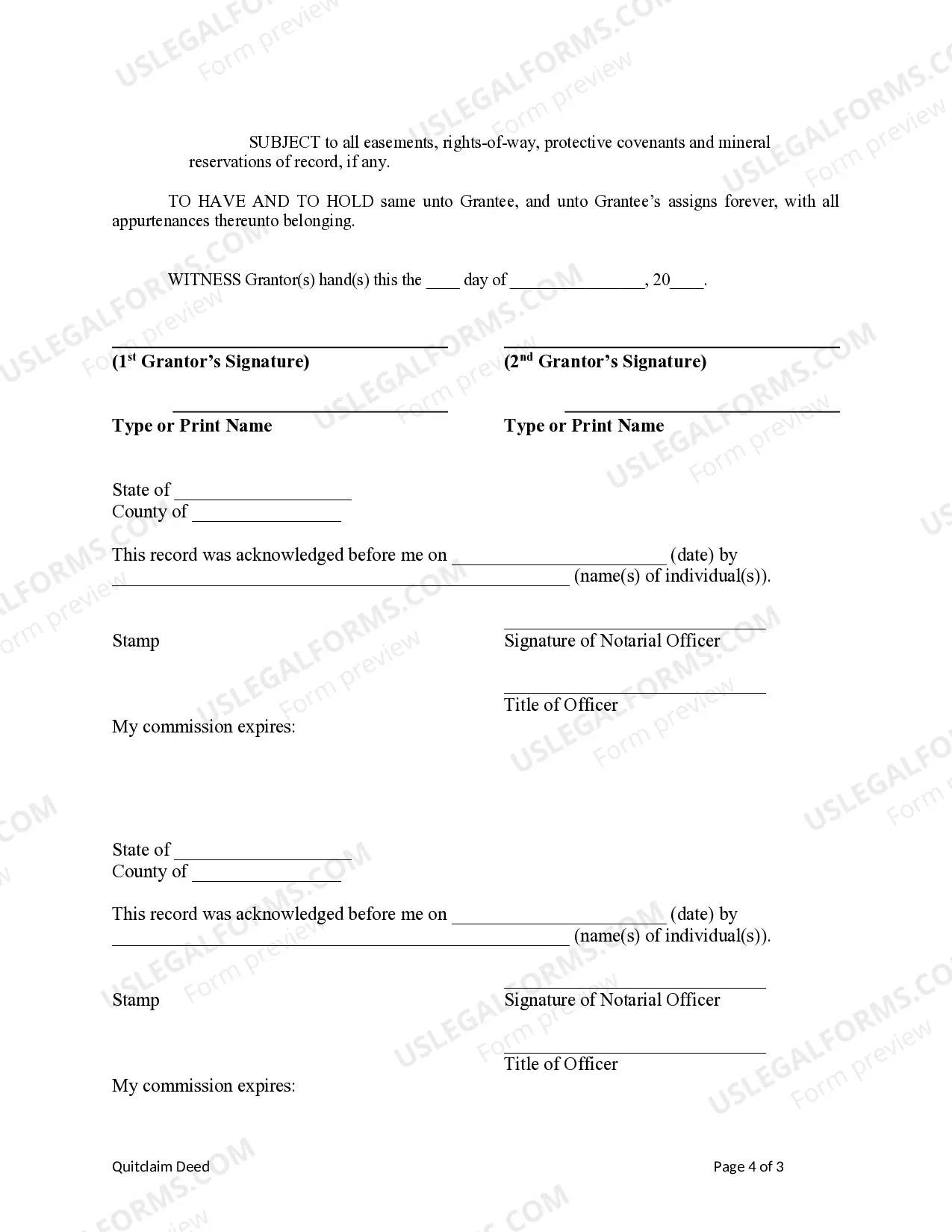

Title: Allegheny Pennsylvania Quitclaim Deed from Husband and Wife to Corporation: A Comprehensive Guide and Types Introduction: In Allegheny, Pennsylvania, a Quitclaim Deed is a legal document commonly used to transfer a property's ownership interest from a husband and wife to a corporation. This detailed description aims to provide an in-depth understanding of Allegheny Pennsylvania Quitclaim Deeds from Husband and Wife to Corporation, including its purpose, legal requirements, and potential types. Key Content: 1. What is a Quitclaim Deed? A Quitclaim Deed is a legal instrument used to transfer ownership interest where the seller (granter) releases their rights and claims to the buyer (grantee). In the case of Allegheny Pennsylvania Quitclaim Deeds from Husband and Wife to Corporation, it involves transferring property ownership from a couple to a corporation. 2. Purpose and Benefits: — Asset Protection: Transferring property from individuals to a corporation can protect personal assets from potential legal or financial liabilities. — Tax Planning: Corporations may have different tax advantages than individuals, allowing for potential tax savings or efficient tax planning. — Business Entity Formation: By transferring property to a corporation, individuals can establish a distinct legal entity for conducting business operations. 3. Legal Requirements and Considerations: — Consent: The husband and wife must be willing and consent to transferring property ownership to the corporation. — Valid Consideration: A consideration, often in the form of money or other valuable assets, must exchange hands for the Quitclaim Deed to be valid. — Notarization: The Quitclaim Deed should be notarized to ensure its legality and authentication. — Recording: The executed deed must be properly filed with the Allegheny County Recorder of Deeds for public record and to establish the corporation's legal ownership. Types of Allegheny Pennsylvania Quitclaim Deeds from Husband and Wife to Corporation: 1. General Quitclaim Deed: This type of Quitclaim Deed transfers the property from the husband and wife to the corporation without specifying any conditions or warranties. It implies that the transfer is made "as is." 2. Special Warranty Quitclaim Deed: In this case, the husband and wife warrant that they have not done anything to harm the title of the property during their ownership. However, it does not guarantee against any previous defects or encumbrances. 3. Trust Quitclaim Deed: If the property being transferred is held in a trust by the husband and wife, this type of Quitclaim Deed allows for a seamless transfer of the property from the trust to the corporation. Conclusion: In Allegheny, Pennsylvania, a Quitclaim Deed from Husband and Wife to Corporation plays a crucial role in transferring property ownership. Understanding the purpose, legal requirements, and available types of Quitclaim Deeds helps ensure a smooth and legally compliant transfer. It is advisable to consult with a qualified attorney or legal professional experienced in real estate law to navigate the intricacies of executing such deeds effectively.

Allegheny Pennsylvania Quitclaim Deed from Husband and Wife to Corporation

Description

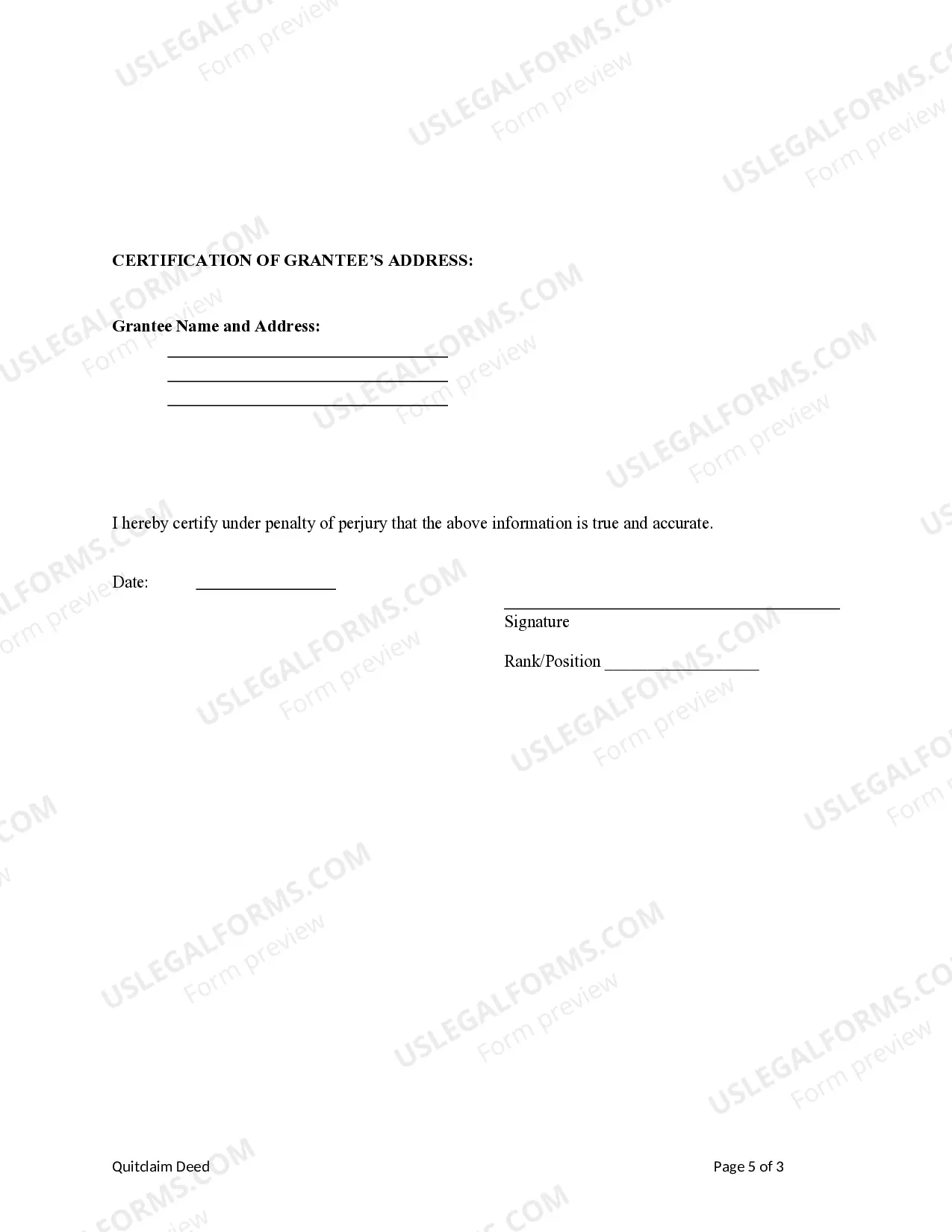

How to fill out Allegheny Pennsylvania Quitclaim Deed From Husband And Wife To Corporation?

Locating verified templates specific to your local regulations can be challenging unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both personal and professional needs and any real-life situations. All the documents are properly categorized by area of usage and jurisdiction areas, so locating the Allegheny Pennsylvania Quitclaim Deed from Husband and Wife to Corporation gets as quick and easy as ABC.

For everyone already familiar with our catalogue and has used it before, obtaining the Allegheny Pennsylvania Quitclaim Deed from Husband and Wife to Corporation takes just a couple of clicks. All you need to do is log in to your account, select the document, and click Download to save it on your device. This process will take just a few more steps to complete for new users.

Adhere to the guidelines below to get started with the most extensive online form collection:

- Check the Preview mode and form description. Make certain you’ve chosen the right one that meets your needs and totally corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you find any inconsistency, use the Search tab above to find the right one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and choose the subscription plan you prefer. You should sign up for an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the service.

- Download the Allegheny Pennsylvania Quitclaim Deed from Husband and Wife to Corporation. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Benefit from the US Legal Forms library to always have essential document templates for any needs just at your hand!