Philadelphia Pennsylvania Quitclaim Deed from Husband and Wife to Corporation

Description

How to fill out Pennsylvania Quitclaim Deed From Husband And Wife To Corporation?

Regardless of societal or occupational rank, filling out legal documentation is a regrettable requirement in the modern professional landscape.

It is frequently nearly impossible for someone without legal training to create such documents from scratch, primarily due to the complex terminology and legal nuances associated with them.

This is where US Legal Forms can come to the rescue.

Confirm that the form you selected is appropriate for your region since the regulations of one state or area may not apply in another.

Review the documentation and skim through a brief outline (if available) of the circumstances for which the document can be utilized.

- Our service offers an extensive repository of over 85,000 pre-made, state-specific forms that are applicable for nearly any legal situation.

- US Legal Forms also acts as a valuable asset for associates or legal advisors who aspire to enhance their efficiency with our DIY documents.

- Whether you seek the Philadelphia Pennsylvania Quitclaim Deed from Husband and Wife to Corporation or any other form that will be recognized in your locality, US Legal Forms has everything readily available.

- Here’s how to swiftly obtain the Philadelphia Pennsylvania Quitclaim Deed from Husband and Wife to Corporation using our trustworthy platform.

- If you are already a member, you can simply Log In to your account to access the necessary form.

- If you are new to our database, follow these instructions before securing the Philadelphia Pennsylvania Quitclaim Deed from Husband and Wife to Corporation.

Form popularity

FAQ

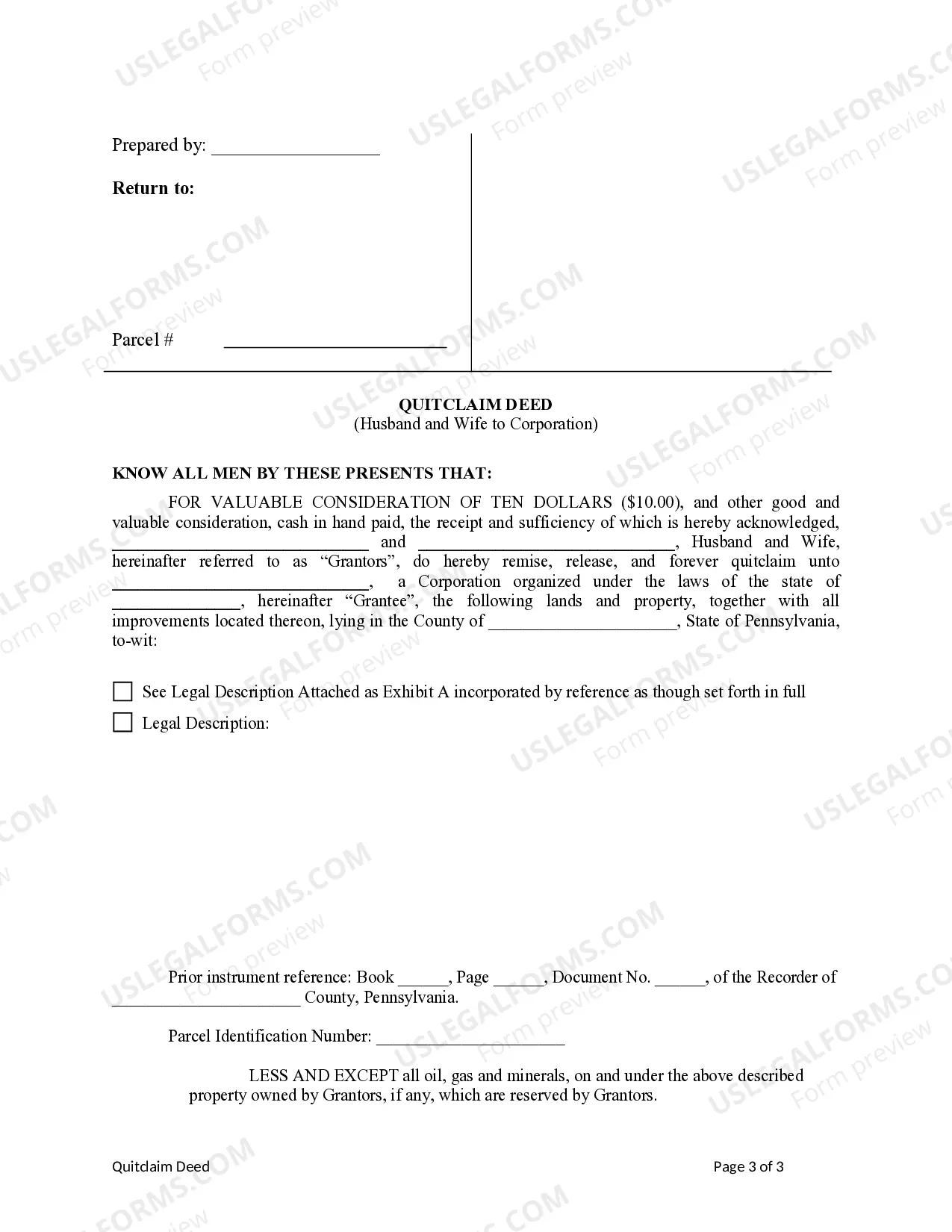

Quitclaim deeds are often used in scenarios where ownership is being transferred without a sale, such as between family members or in divorce settlements. The Philadelphia Pennsylvania Quitclaim Deed from Husband and Wife to Corporation is particularly common when couples wish to transfer property to a business entity for tax or liability purposes. Utilizing quitclaim deeds helps simplify these transitions while maintaining clear ownership transfer.

Yes, a Philadelphia Pennsylvania Quitclaim Deed from Husband and Wife to Corporation can override a will regarding property ownership. Once a quitclaim deed is executed and recorded, it takes precedence over any wishes laid out in a will about that specific property. This highlights the importance of understanding how deeds function and ensuring your estate plans align with your intent.

One major disadvantage of the Philadelphia Pennsylvania Quitclaim Deed from Husband and Wife to Corporation is that it provides no guarantee of the title's quality. This means if there are existing liens or claims against the property, the new owner assumes those risks without any recourse. Additionally, this type of deed does not include warranties, leaving the grantee unprotected against potential disputes over property ownership.

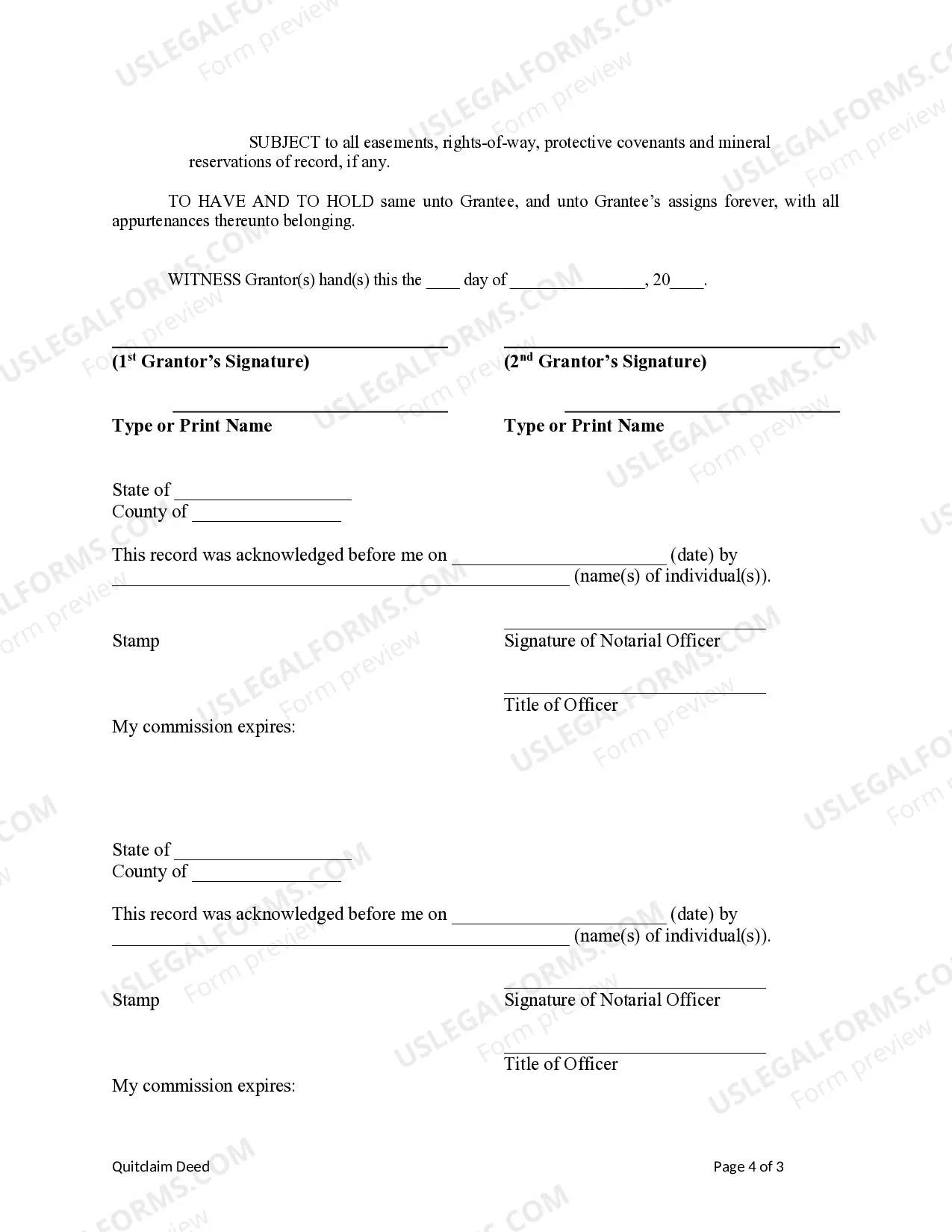

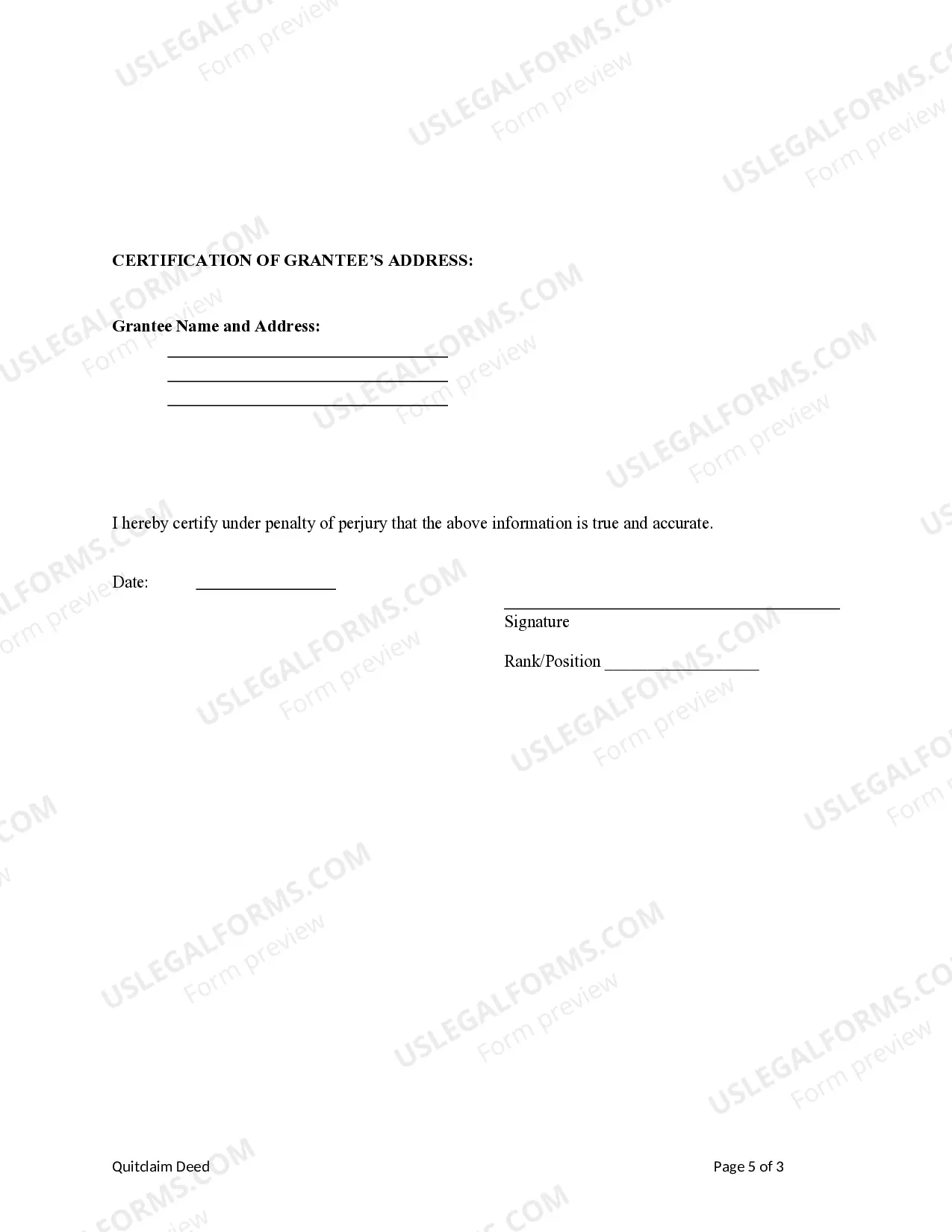

To transfer a property deed in Pennsylvania, you'll start by deciding which type of deed best suits your needs, such as a Philadelphia Pennsylvania Quitclaim Deed from Husband and Wife to Corporation. Begin by filling out the relevant deed form with accurate property information. After signing the deed in front of a notary, you need to record it at the local recorder’s office. Utilizing services like USLegalForms can streamline this process and ensure all legal requirements are met.

In Pennsylvania, adding your spouse to a deed can be accomplished using a Philadelphia Pennsylvania Quitclaim Deed from Husband and Wife to Corporation. First, you need to obtain the current deed and ensure all necessary information is accurate. Then, complete the quitclaim deed form, include both spouses' names, and sign it in front of a notary. Finally, record the newly signed deed with the Philadelphia Department of Records to finalize the process.

Transferring a deed from personal ownership to an LLC requires a quitclaim deed. By executing a Philadelphia Pennsylvania Quitclaim Deed from Husband and Wife to Corporation, you formalize the transfer of property to your LLC. Make sure to follow your state’s regulations and consider consulting a professional to ensure compliance and protection of your interests.

Filling out a quitclaim deed to add your spouse involves specific steps. First, you need to clearly state the names of both parties as well as the legal description of the property. When utilizing a Philadelphia Pennsylvania Quitclaim Deed from Husband and Wife to Corporation, make sure to follow your state’s requirements and consider using platforms like US Legal Forms to obtain the correct documentation and instructions for the process.

A quitclaim deed is a legal document that allows one spouse to transfer their interest in a property to the other. In the case of a Philadelphia Pennsylvania Quitclaim Deed from Husband and Wife to Corporation, this deed ensures clarity of ownership without the complexities of a warranty deed. It’s essential to understand that a quitclaim deed doesn’t guarantee the transferor’s ownership; it merely conveys whatever interest the transferor holds.

Yes, adding a spouse to a deed can be seen as a gift, especially in the context of property ownership. When you transfer property to your spouse using a Philadelphia Pennsylvania Quitclaim Deed from Husband and Wife to Corporation, the value of the property may be considered part of your marital assets. You should consult a tax professional to understand any potential tax implications associated with this transfer.

A spouse may choose to execute a quitclaim deed for several reasons, including simplifying ownership transfer or clarifying property rights. It is beneficial in cases of divorce, estate planning, or when one spouse wants to convey their interest to a corporation. By using a quitclaim deed, both parties can avoid potential legal disputes regarding property ownership. This is especially relevant in a Philadelphia Pennsylvania Quitclaim Deed from Husband and Wife to Corporation, where clear ownership is essential for business operations.