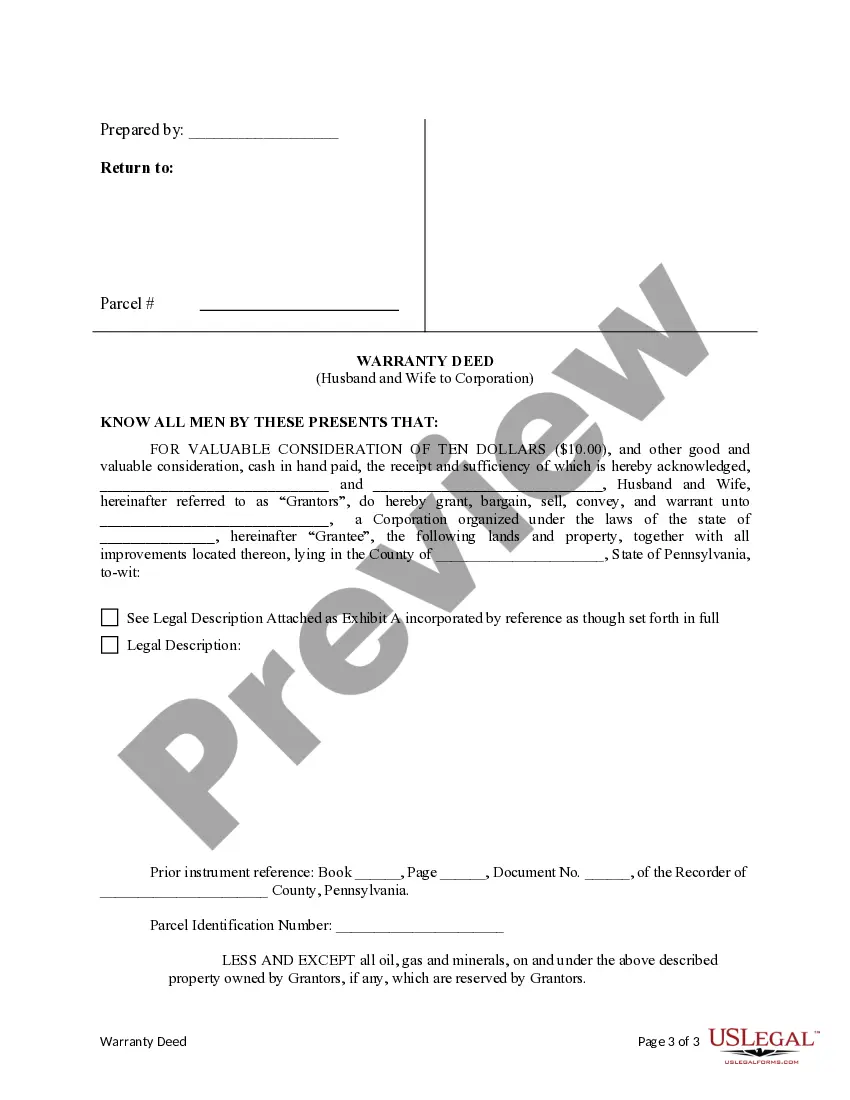

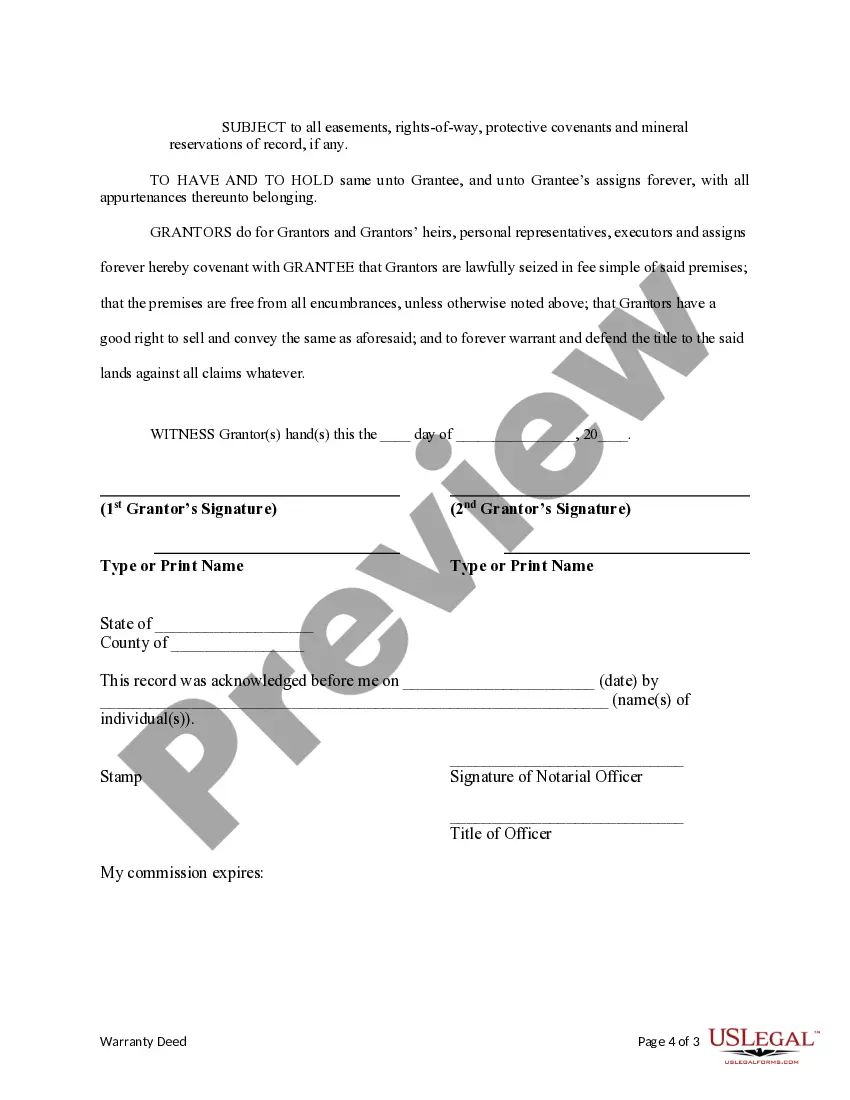

A Philadelphia Pennsylvania Warranty Deed from Husband and Wife to Corporation is a legal document that facilitates the transfer of property ownership from a married couple to a corporation. This type of deed provides a guarantee or warranty that the property being transferred is free of any encumbrances or claims, except those specifically mentioned in the deed. Keywords: Philadelphia Pennsylvania, Warranty Deed, Husband and Wife, Corporation, property ownership, transfer, legal document, guarantee, warranty, encumbrances, claims. There are different variations of Philadelphia Pennsylvania Warranty Deeds from Husband and Wife to Corporation, including: 1. General Warranty Deed: This type of deed provides the broadest form of protection for the buyer (corporation). It guarantees that the sellers (husband and wife) have clear and marketable title to the property and will defend the buyer against any future claims or disputes. 2. Special Warranty Deed: Unlike a general warranty deed, a special warranty deed provides a limited warranty to the buyer. It only guarantees that the sellers have not created any encumbrances on the property during their ownership, but does not protect the buyer against claims that might arise before their ownership. 3. Quitclaim Deed: A quitclaim deed transfers the sellers' ownership interests to the buyer without any warranties or guarantees. It simply conveys whatever interests the sellers have in the property, without implying that they have clear title or will defend the buyer against any claims. When executing a Philadelphia Pennsylvania Warranty Deed from Husband and Wife to Corporation, it is crucial to adhere to the legal requirements and procedures set forth by the state. These typically involve preparing the deed, signing it in the presence of a notary public, and recording it with the appropriate county office to establish the transfer of ownership. It is advisable to consult a qualified attorney or a title company to ensure the accurate completion of the deed and to ascertain the specific requirements and fees related to recording the deed in Philadelphia, Pennsylvania. Additionally, it is crucial to conduct a thorough title search and obtain title insurance to protect the buyer's interests against any unforeseen claims or issues with the property's ownership history. In conclusion, a Philadelphia Pennsylvania Warranty Deed from Husband and Wife to Corporation is a vital legal instrument that enables the seamless transfer of property ownership from a married couple to a corporation. The type of warranty deed used (general warranty, special warranty, or quitclaim) determines the extent of the guarantee provided to the buyer. To navigate the intricacies of the process, seeking professional legal assistance is strongly advised.

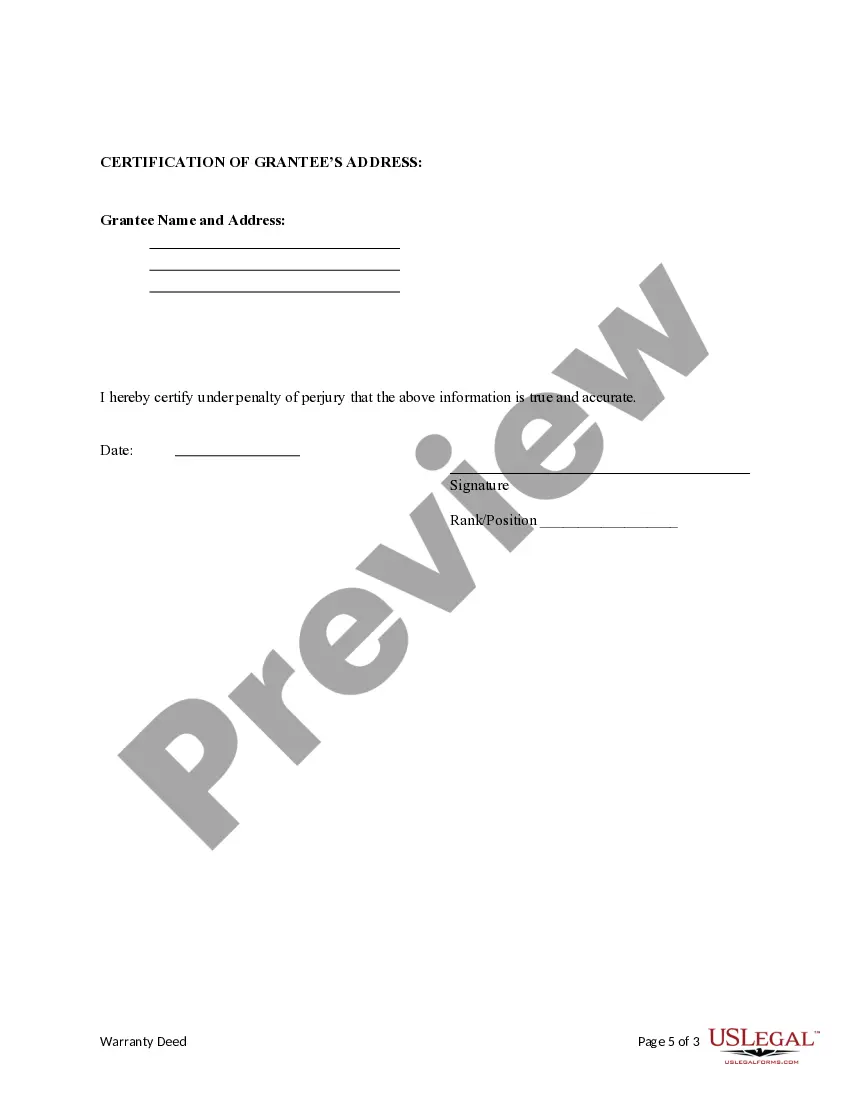

Philadelphia Pennsylvania Warranty Deed from Husband and Wife to Corporation

Description

How to fill out Philadelphia Pennsylvania Warranty Deed From Husband And Wife To Corporation?

Are you looking for a trustworthy and inexpensive legal forms supplier to get the Philadelphia Pennsylvania Warranty Deed from Husband and Wife to Corporation? US Legal Forms is your go-to solution.

No matter if you require a basic agreement to set rules for cohabitating with your partner or a package of forms to advance your separation or divorce through the court, we got you covered. Our platform offers over 85,000 up-to-date legal document templates for personal and business use. All templates that we give access to aren’t generic and frameworked in accordance with the requirements of particular state and county.

To download the document, you need to log in account, locate the required template, and hit the Download button next to it. Please keep in mind that you can download your previously purchased document templates at any time from the My Forms tab.

Is the first time you visit our website? No worries. You can set up an account with swift ease, but before that, make sure to do the following:

- Check if the Philadelphia Pennsylvania Warranty Deed from Husband and Wife to Corporation conforms to the regulations of your state and local area.

- Go through the form’s description (if available) to learn who and what the document is intended for.

- Restart the search if the template isn’t good for your legal scenario.

Now you can register your account. Then choose the subscription plan and proceed to payment. Once the payment is completed, download the Philadelphia Pennsylvania Warranty Deed from Husband and Wife to Corporation in any available file format. You can return to the website when you need and redownload the document free of charge.

Finding up-to-date legal forms has never been easier. Give US Legal Forms a go now, and forget about wasting hours researching legal papers online for good.