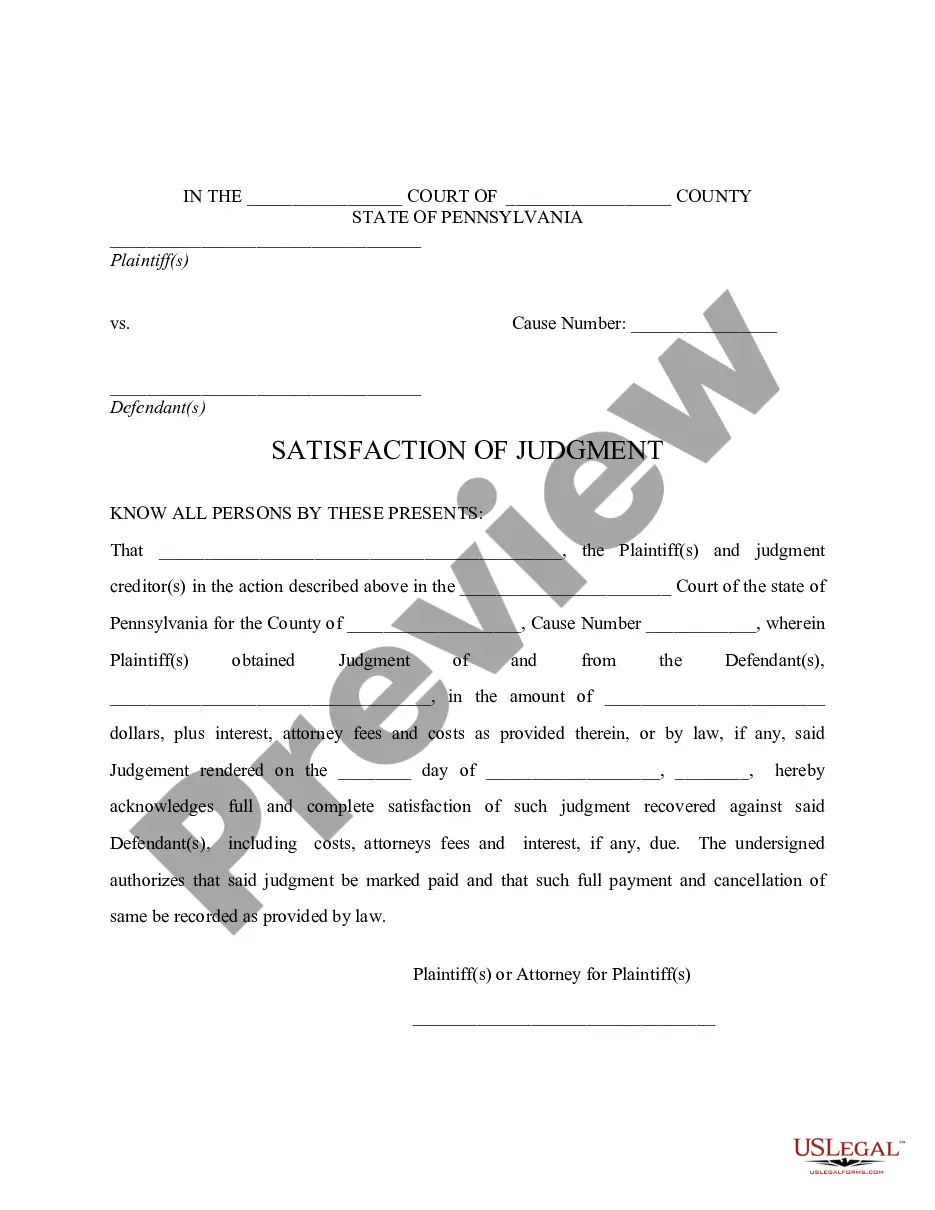

Allegheny Pennsylvania Satisfaction of Judgment

Description

How to fill out Pennsylvania Satisfaction Of Judgment?

If you are looking for an applicable template, it's impossible to select a more suitable place than the US Legal Forms site – one of the largest collections on the web.

Here you can discover numerous forms for business and personal purposes categorized by types and regions, or keywords.

With our top-notch search feature, locating the latest Allegheny Pennsylvania Satisfaction of Judgment is as simple as 1-2-3.

Finalize the acquisition. Use your credit card or PayPal account to finish the registration process.

Obtain the template. Choose the format and download it to your device.

- Moreover, the validity of each document is verified by a team of experienced attorneys who routinely review the templates on our site and update them according to the most recent state and county laws.

- If you are already familiar with our site and possess a registered account, all you need to do to obtain the Allegheny Pennsylvania Satisfaction of Judgment is to Log In to your account and hit the Download button.

- If you are using US Legal Forms for the first time, simply read the guidelines outlined below.

- Ensure you have opened the sample you desire. Review its description and use the Preview option to examine its contents. If it does not suit your requirements, utilize the Search bar at the top of the page to locate the correct document.

- Affirm your choice. Click the Buy now button. Then, select your preferred subscription plan and enter your information to create an account.

Form popularity

FAQ

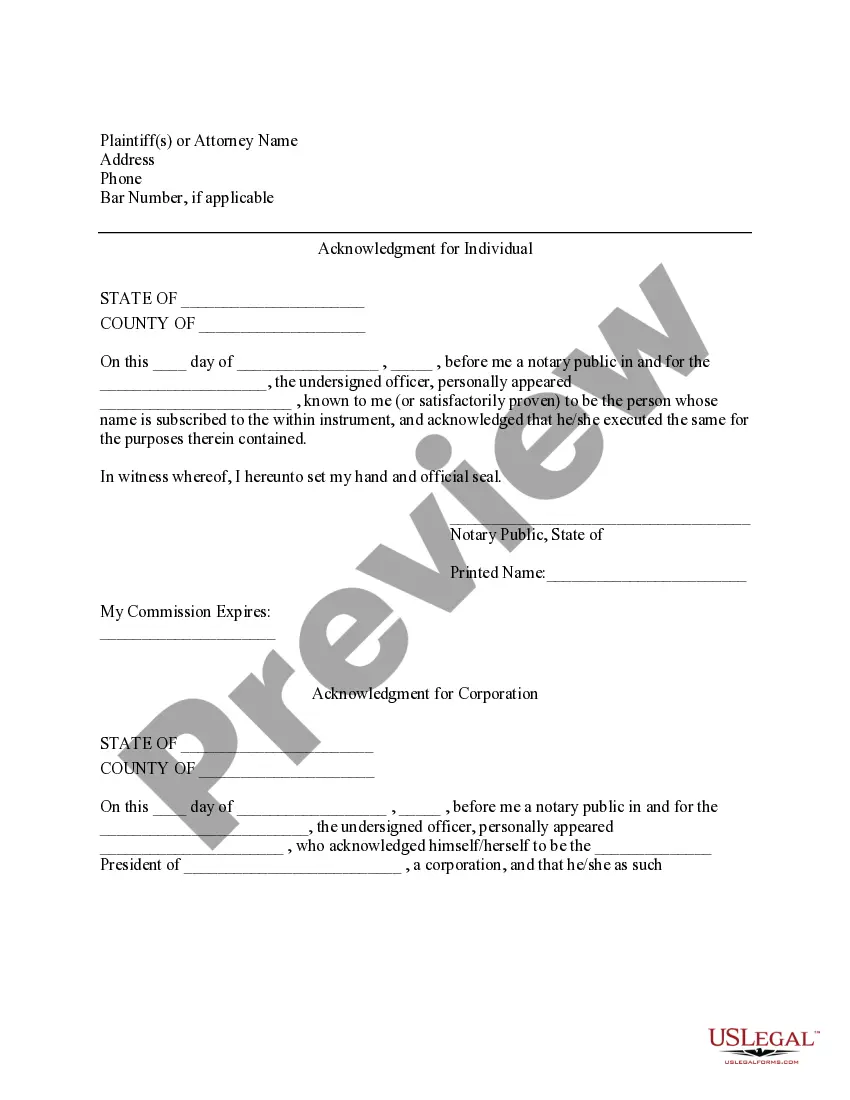

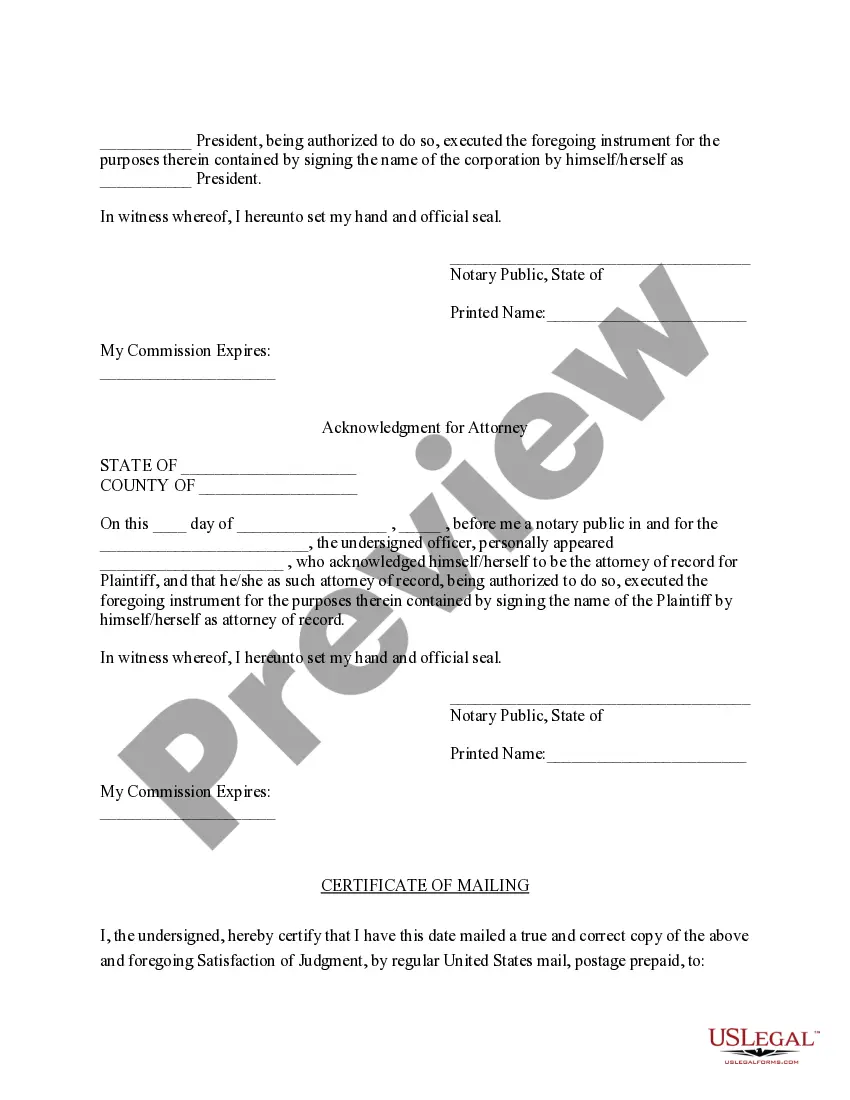

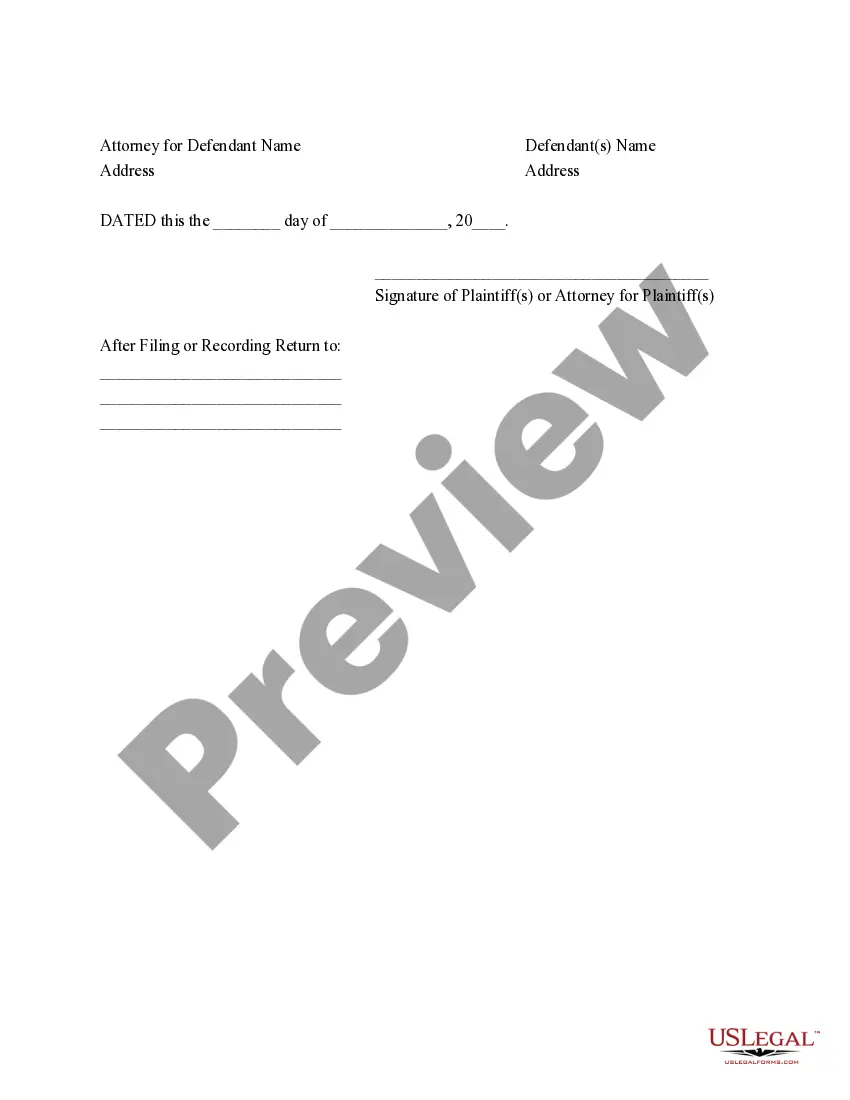

Filing an acknowledgment of satisfaction of judgment involves drafting a legal document that affirms the judgment has been resolved. This document must be signed and submitted to the court, along with any applicable fees. Utilizing the services of platforms like US Legal Forms can make this process easier, ensuring you correctly file for your Allegheny Pennsylvania Satisfaction of Judgment with all necessary details.

To file a satisfaction of judgment in Pennsylvania, you must complete the necessary court forms available at your local courthouse or online. After filling out the forms, submit them along with any required fees to the court where the judgment was issued. This process is a key step in achieving Allegheny Pennsylvania Satisfaction of Judgment, enabling you to officially clear your legal obligations.

You can determine if a judgment has been satisfied by checking with the court where the judgment was issued. Typically, you can obtain this information online or by contacting the court clerk directly. Once you confirm the status, you can move forward with the Allegheny Pennsylvania Satisfaction of Judgment process to ensure that your records reflect this important detail.

To remove a satisfied judgment from your credit report, you first need to ensure that the judgment has been officially marked as satisfied in your local court. Once verified, you can request your credit reporting agency to update your report to reflect this status. Remember, the Allegheny Pennsylvania Satisfaction of Judgment process is crucial as it demonstrates that you have fulfilled the required payments, and a timely request will help you regain creditworthiness.

In Pennsylvania, a judgment can generally be collected for up to 20 years, provided that it is renewed before the expiration. This period allows creditors time to collect debts through various means, including garnishment and asset seizure. Being informed about the timeline for the Allegheny Pennsylvania Satisfaction of Judgment can empower you in managing your financial obligations. Utilizing resources from uslegalforms can help you navigate these timelines effectively.

Enforcing a judgment in Pennsylvania requires a series of steps to collect the debts owed. Typically, the judgment creditor can seek a writ of execution, which allows them to seize the debtor's assets or wages. Understanding the process for the Allegheny Pennsylvania Satisfaction of Judgment is crucial for successfully reclaiming owed amounts. Using services like uslegalforms can provide you with the necessary tools and guidance for proper enforcement.

In Pennsylvania, not paying a judgment does not automatically lead to jail time. However, failure to respond to court orders related to the judgment may result in contempt of court charges, which can lead to imprisonment. It's important to understand your rights and obligations regarding the Allegheny Pennsylvania Satisfaction of Judgment. To avoid complications, seeking legal advice or resources, such as those provided by uslegalforms, can be beneficial.

To enforce a judgment in Pennsylvania, begin by obtaining a certified copy of the judgment from the court. You can then file this judgment with the Clerk of Courts in the county where the debtor resides or where the property is located. Once filed, you may proceed with collection methods like wage garnishment or property liens. Utilizing resources like US Legal Forms can streamline the process of obtaining the necessary documents for an Allegheny Pennsylvania Satisfaction of Judgment.

A judgment can significantly impact your credit score, potentially lowering it by many points. This adverse effect can stay on your credit report for up to seven years, making it harder to secure loans or favorable interest rates. If you secure a satisfaction of judgment, you can help mitigate the negative impact on your credit over time. Platforms like USLegalForms can assist you in understanding the steps to take after a judgment to improve your financial standing.

Negotiating a settlement after a judgment involves communicating with the creditor to discuss potential payment options. You might offer a lump sum or a payment plan that they find acceptable. Keep in mind that many creditors are open to negotiating, especially if they believe receiving part of the debt is better than pursuing further legal action. Using resources like USLegalForms can help you prepare for negotiations and understand your rights.