A security deposit is a payment required by a landlord from a tenant to cover the expenses of any repairs of damages to the premises greater than normal "wear and tear." Everyday usage is normal wear and tear, but excess damage is a debated definition. A security deposit is not the same as rent. It is money that actually belongs to the tenant but is held by the landlord for tenant-caused damages and sometimes past-due rent. Without the agreement of the landlord, a security deposit may not legally be used as the last month's rent.

Laws vary by state, but some states place a limit on the amount of a security deposit that a landlord may charge. Some states also regulate where residential security deposits must be kept and when interest payments on the security deposits must be made to the tenant. State laws also define the time period after the tenant vacates within which the deposit must be returned to the tenant.

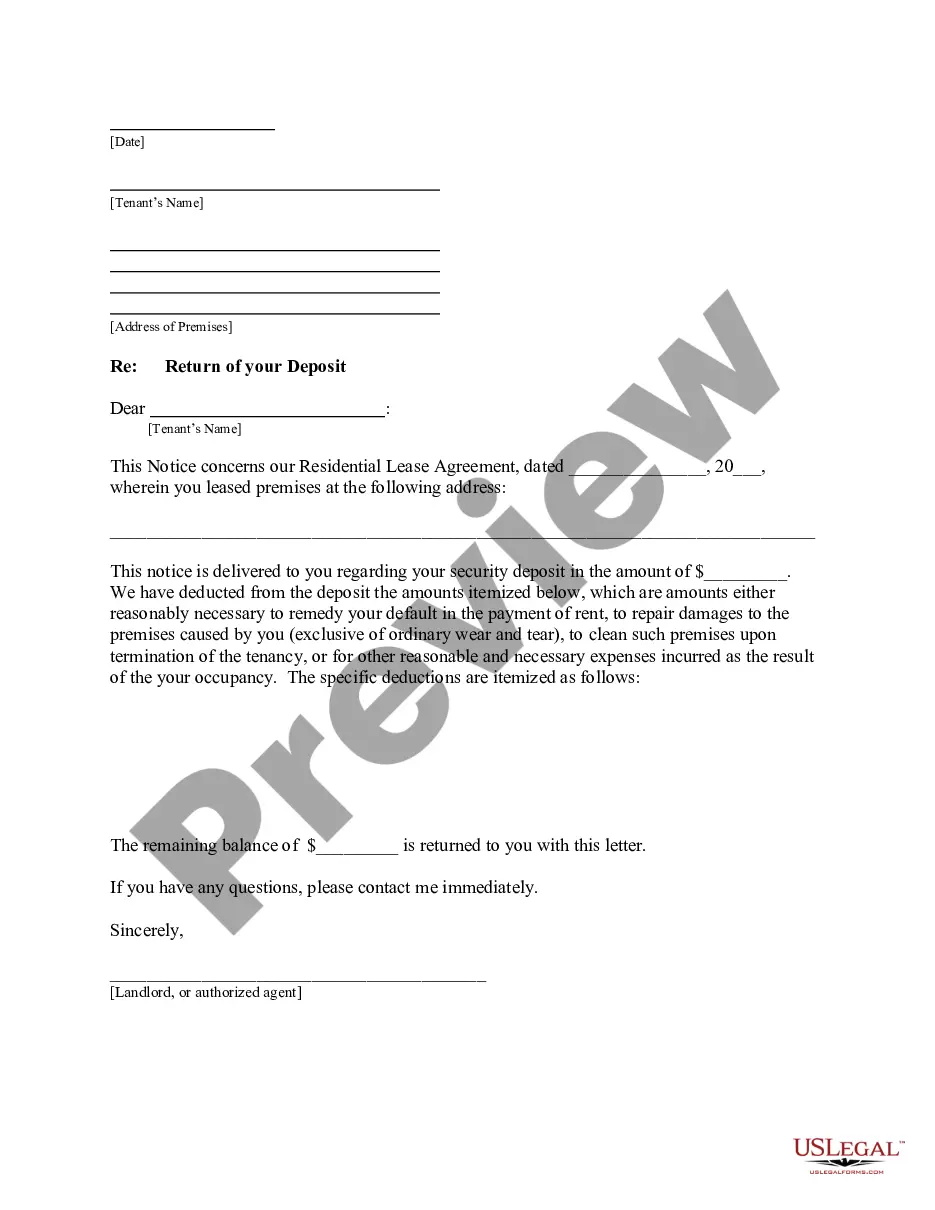

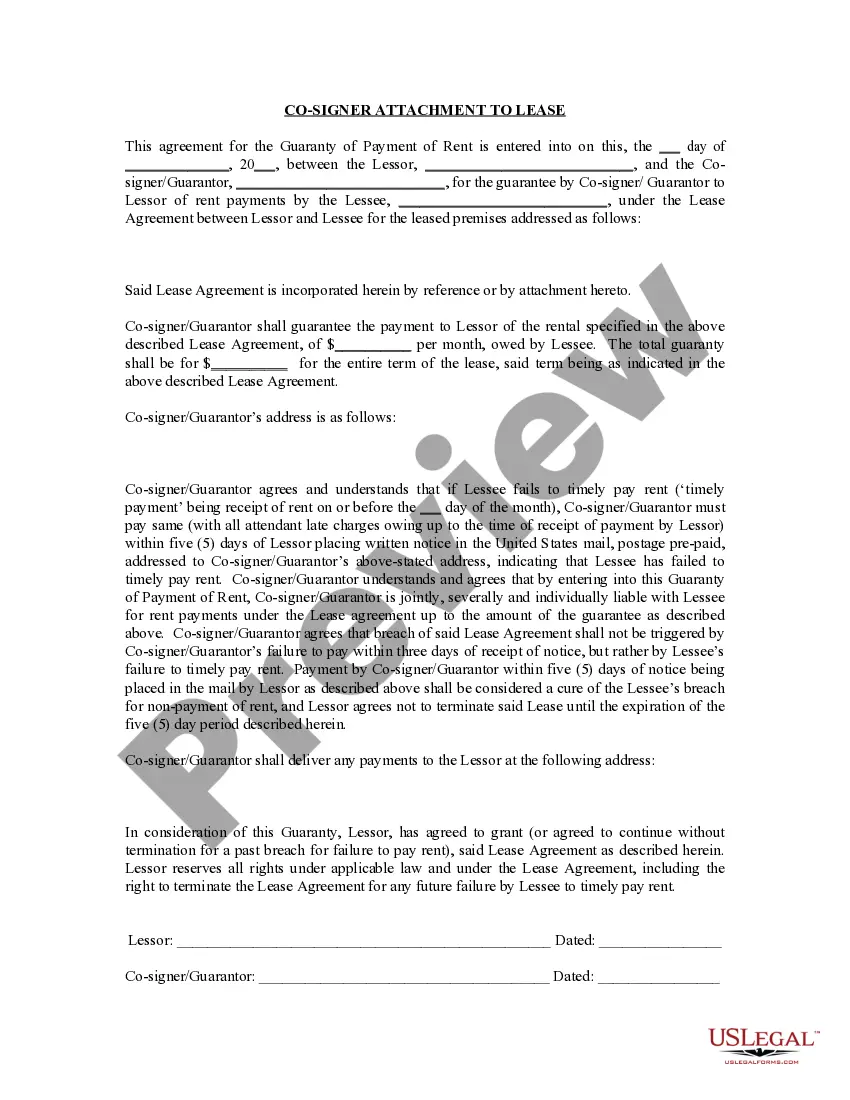

Title: Philadelphia, Pennsylvania Letter from Landlord to Tenant Returning Security Deposit Less Deductions: Comprehensive Guide Introduction: The purpose of this comprehensive guide is to outline the necessary details and components of a Philadelphia, Pennsylvania letter from a landlord to a tenant returning a security deposit less deductions. We will cover the essential sections of the letter, including its purpose, required information, legal obligations, common deductions, and any specific variations that may exist within Philadelphia. 1. Purpose of the Letter: This section will explain the main objective of issuing a letter returning security deposit less deductions, highlighting the aim of providing transparency and resolving any outstanding financial matters between landlords and tenants. 2. Required Information: This section shall emphasize the necessary details that must be included in the letter, such as tenant and landlord names, property address, lease dates, security deposit amount, and the date of the return letter. Providing this vital information ensures clarity and accuracy in the communication process. 3. Legal Obligations: In this section, we will delve into the specific legal obligations imposed on landlords in Philadelphia, Pennsylvania, regarding the return of security deposits to tenants. This may include adherence to local ordinances, statutes, regulations, or rental laws set forth by the relevant authorities. 4. Common Deductions: Here, we will dive into the various deductible expenses that landlords might consider when returning the security deposit to the tenant. Examples may include unpaid rent, cleaning fees, repairs beyond normal wear and tear, or unpaid utilities. By providing specific deductibles, landlords can demonstrate transparency in their decision-making process. 5. Philadelphia-specific Considerations: If there are any unique requirements or variations specific to Philadelphia, this section will shed light on such circumstances. This could include specific documentation, time-sensitive requirements, or additional deductions allowed by Philadelphia rental regulations. It is crucial for landlords and tenants to be aware of these city-specific considerations. Additional Philadelphia, Pennsylvania Letter Types: a. Philadelphia Letter from Landlord to Tenant Returning Security Deposit in Full: This specific type of letter is issued when the tenant's security deposit is returned without any deductions. It will have a different content structure and intent from a letter that outlines deductions. b. Philadelphia Letter from Landlord to Tenant Indicating Partial Deductions: In cases where only a portion of the security deposit is returned to the tenant due to deductions, this letter will outline the specific reasons for the deductions and provide an itemized breakdown of the costs involved. Conclusion: By using this comprehensive guide, landlords in Philadelphia, Pennsylvania can construct a well-informed and legally compliant letter when returning a security deposit less deductions to their tenants. Adhering to local regulations and ensuring proper communication promotes healthy landlord-tenant relationships and aids in avoiding conflicts related to security deposits.