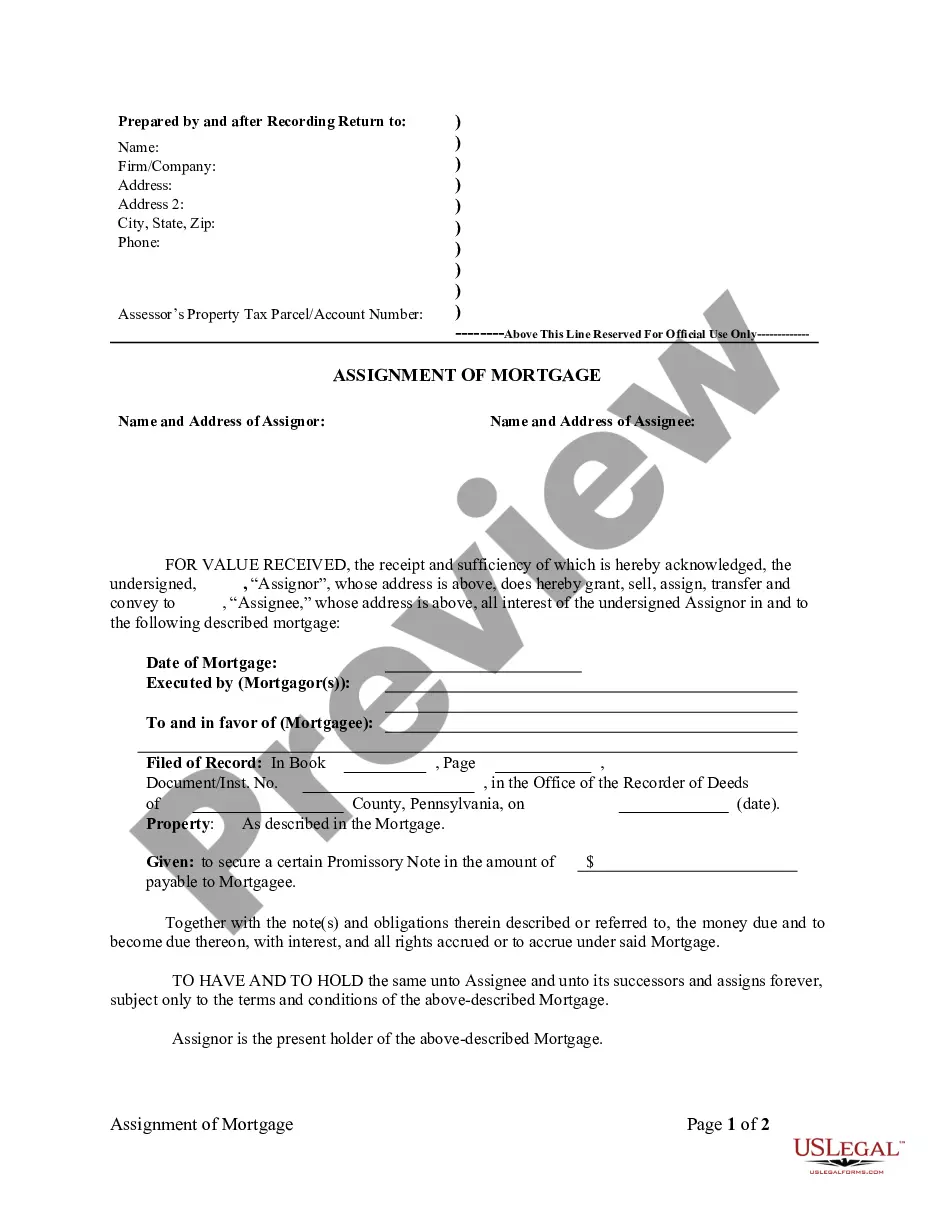

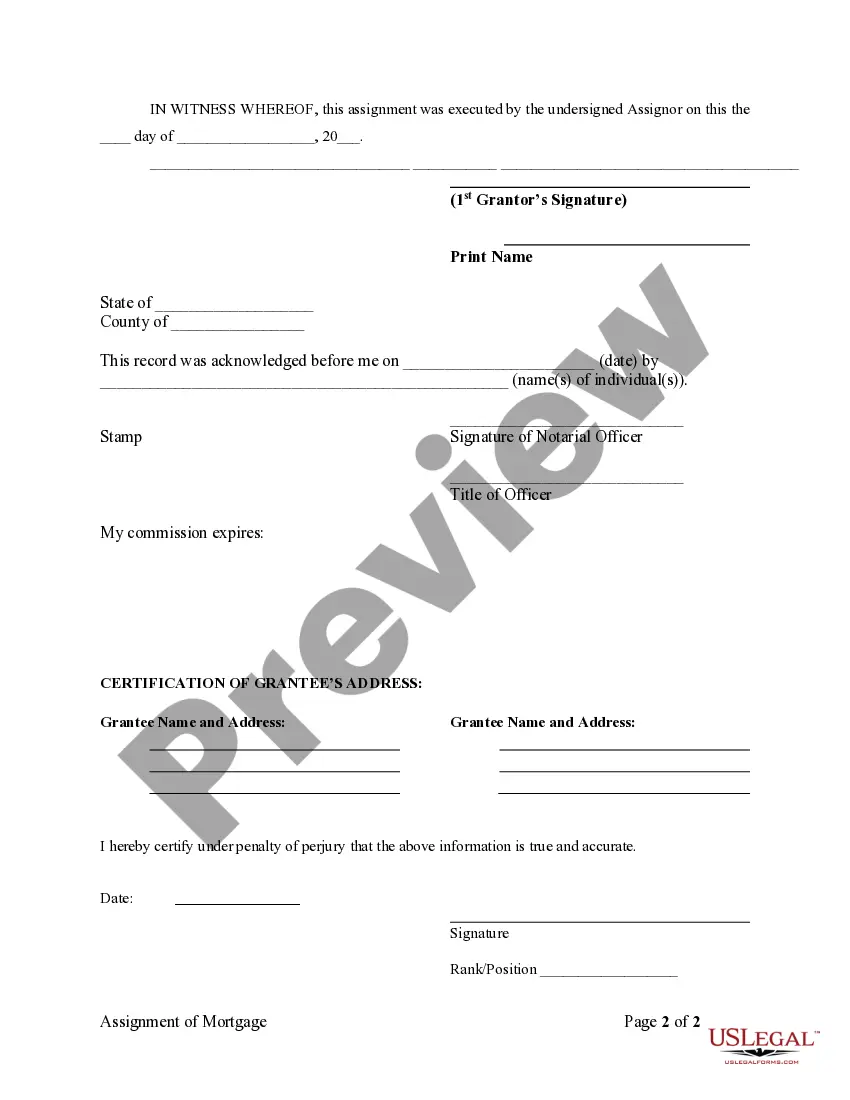

Title: Understanding Allentown Pennsylvania Assignment of Mortgage by Individual Mortgage Holder Introduction: In Allentown, Pennsylvania, the Assignment of Mortgage by Individual Mortgage Holder is a legal process in which a mortgage holder transfers their interest in a mortgage to another individual or entity. This transfer can occur for various reasons, such as the sale of the mortgage, refinancing, or a change in ownership. Let's delve into the details regarding this process and explore any variations within this assignment. 1. Allentown Pennsylvania Assignment of Mortgage by Individual Mortgage Holder: The Allentown Pennsylvania Assignment of Mortgage by Individual Mortgage Holder refers to the transfer of a mortgage from one individual mortgage holder to another. This process allows the original mortgage holder (assignor) to assign their rights and interests in the mortgage to a new individual (assignee). 2. Types of Allentown Pennsylvania Assignment of Mortgage by Individual Mortgage Holder: a. Sale Assignment: A Sale Assignment occurs when an individual mortgage holder decides to sell their mortgage to a new buyer. This type of assignment commonly takes place when the mortgage holder is in need of immediate funds or wishes to invest in other ventures. b. Refinancing Assignment: A Refinancing Assignment happens when a mortgage holder decides to refinance their mortgage with another lender. This assignment transfers the existing mortgage to the new lender, providing the mortgage holder with more favorable terms, such as lower interest rates or extended repayment periods. c. Change in Ownership Assignment: In cases where the mortgage holder experiences a change in ownership, they may assign the mortgage to the new owner. This commonly occurs during property transfers, such as inheritances or divorces, where the ownership of the mortgage needs to be legally transferred to the appropriate individual. 3. Importance of Allentown Pennsylvania Assignment of Mortgage by Individual Mortgage Holder: The Assignment of Mortgage serves as a crucial legal document, as it ensures transparency, legitimacy, and a clear chain of ownership for the mortgage. This process protects all parties involved, including the mortgage holder, the assignee, and potential future lien holders. 4. Steps involved in Allentown Pennsylvania Assignment of Mortgage by Individual Mortgage Holder: a. Preparation of Assignment Document: The assignor must draft an Assignment of Mortgage document, clearly outlining the transfer of the mortgage and its terms. b. Consent and Notice: Consent from the assignee and written notice to the borrower (mortgagor) are essential steps in the assignment process. The assignee must agree to take responsibility for the mortgage, and the mortgagor must be informed about the transfer of rights. c. Recording of Documents: It is crucial to file the Assignment of Mortgage document with the county recorder's office to make it an official public record. This ensures that the transfer is legally recognized and visible to any future interested parties. Conclusion: The Allentown Pennsylvania Assignment of Mortgage by Individual Mortgage Holder is a significant legal process that facilitates the transfer of mortgage rights between individuals. Whether it involves a sale, refinancing, or a change in ownership, this assignment ensures transparency and protection for all parties involved. Understanding the different types and the steps involved in this assignment process can expedite property transactions and mitigate potential risks.

Allentown Pennsylvania Assignment of Mortgage by Individual Mortgage Holder

Description

How to fill out Allentown Pennsylvania Assignment Of Mortgage By Individual Mortgage Holder?

Locating verified templates specific to your local laws can be challenging unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both individual and professional needs and any real-life scenarios. All the documents are properly categorized by area of usage and jurisdiction areas, so locating the Allentown Pennsylvania Assignment of Mortgage by Individual Mortgage Holder gets as quick and easy as ABC.

For everyone already familiar with our catalogue and has used it before, getting the Allentown Pennsylvania Assignment of Mortgage by Individual Mortgage Holder takes just a couple of clicks. All you need to do is log in to your account, choose the document, and click Download to save it on your device. This process will take just a couple of additional actions to complete for new users.

Adhere to the guidelines below to get started with the most extensive online form library:

- Look at the Preview mode and form description. Make sure you’ve chosen the right one that meets your requirements and fully corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you see any inconsistency, utilize the Search tab above to get the correct one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and select the subscription plan you prefer. You should create an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the subscription.

- Download the Allentown Pennsylvania Assignment of Mortgage by Individual Mortgage Holder. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Take advantage of the US Legal Forms library to always have essential document templates for any demands just at your hand!