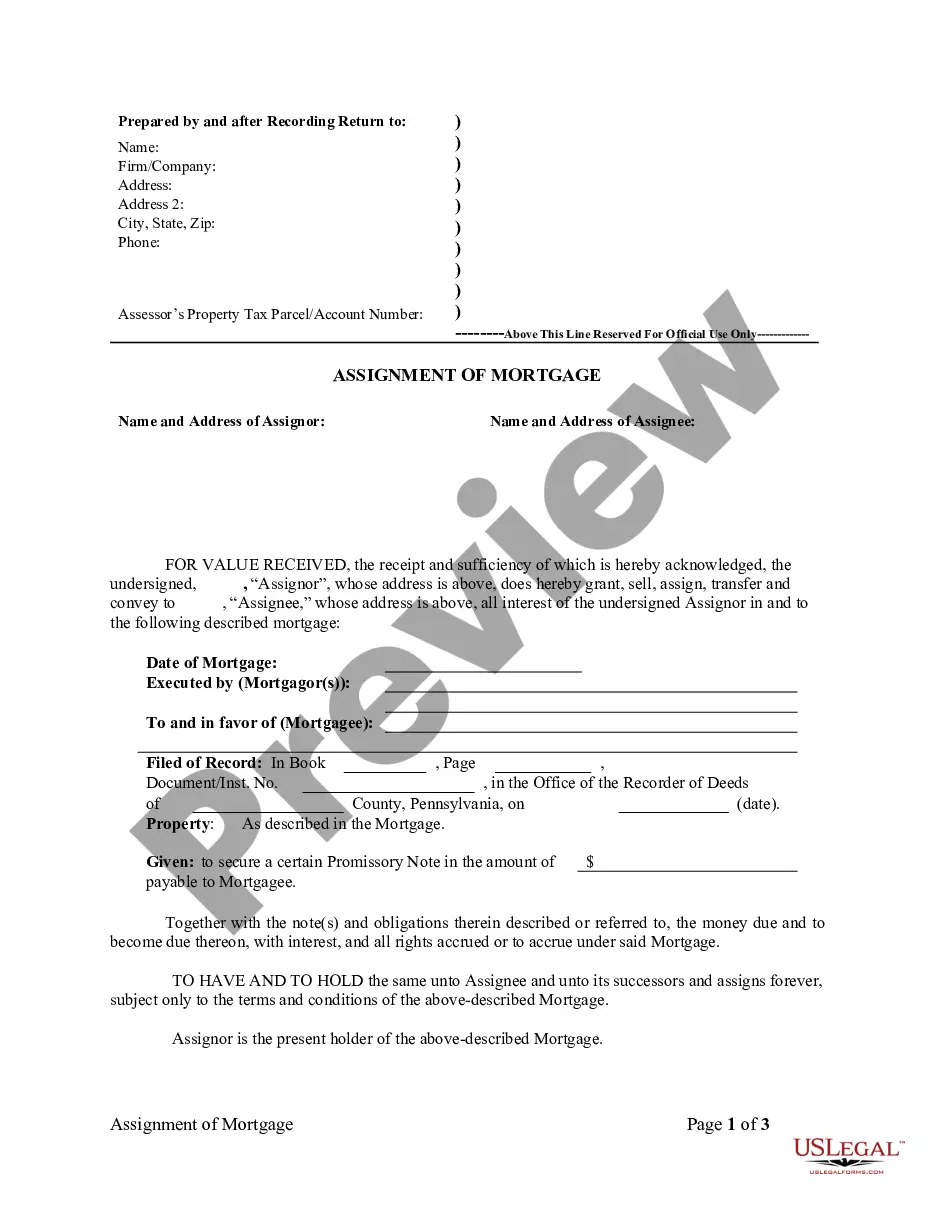

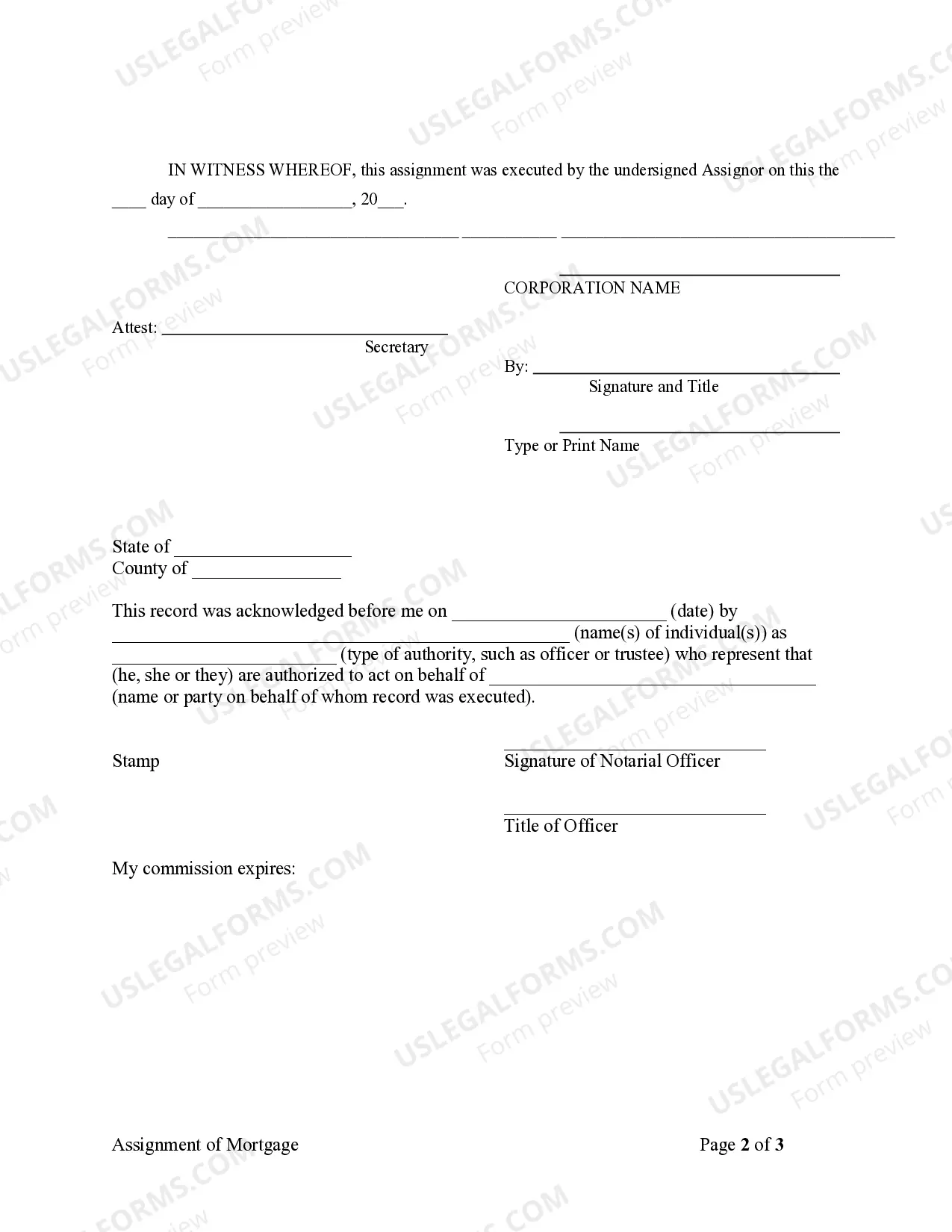

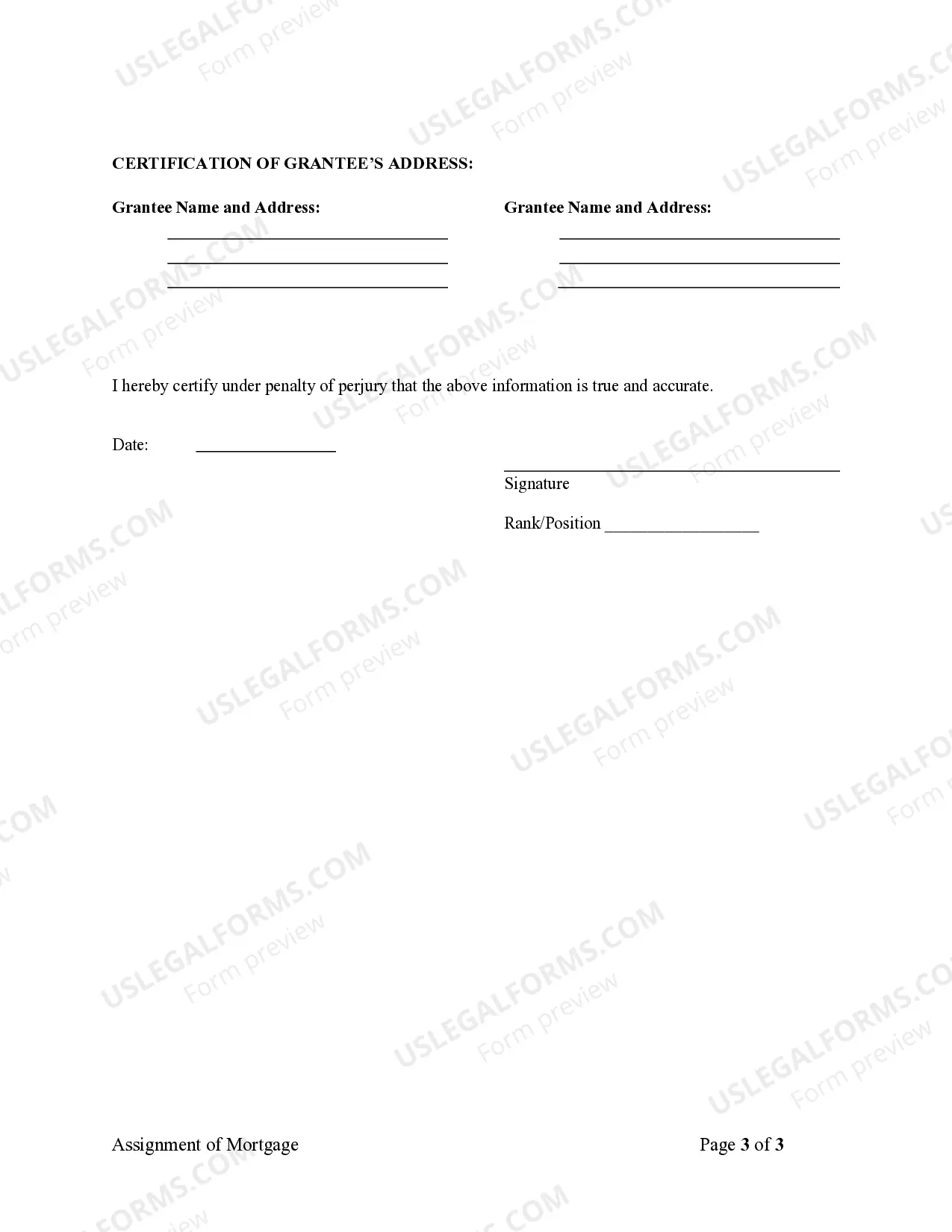

Allegheny Pennsylvania Assignment of Mortgage by Corporate Mortgage Holder is a legal document that transfers the rights and obligations of a mortgage from one corporate mortgage holder to another in Allegheny County, Pennsylvania. This assignment typically occurs when there is a change in ownership or servicing of a mortgage loan. The Allegheny Pennsylvania Assignment of Mortgage by Corporate Mortgage Holder is an essential part of the mortgage loan transfer process. It ensures that the new corporate mortgage holder has the authority to collect payments, enforce the terms of the mortgage, and foreclose on the property if necessary. There are different types of Allegheny Pennsylvania Assignment of Mortgage by Corporate Mortgage Holder, which are categorized based on the circumstances of the transfer: 1. Mortgage Assignment as a result of a corporate merger or acquisition: This occurs when one corporate mortgage holder acquires another, leading to a transfer of all mortgage loans held by the acquired company. The Assignment of Mortgage document is necessary to record this transfer of ownership. 2. Mortgage Assignment due to loan servicing transfer: Sometimes, the company responsible for collecting mortgage payments and handling customer service (loan servicing) changes. In this case, the current corporate mortgage holder assigns the mortgage to the new servicing company. The Assignment of Mortgage document is crucial for establishing the new servicing relationship. 3. Mortgage Assignment during the sale of a mortgage-backed security: Mortgage-backed securities are investment vehicles backed by pools of mortgage loans. When these securities are sold to different investors or institutions, mortgages need to be assigned to the new owners. The Allegheny Pennsylvania Assignment of Mortgage by Corporate Mortgage Holder is used to document this transfer of ownership. 4. Mortgage Assignment when a loan is sold in the secondary market: Mortgage loans are often sold in the secondary market to investors or government-sponsored entities such as Fannie Mae and Freddie Mac. The corporate mortgage holder assigns the mortgage to the new buyer, and the Assignment of Mortgage document serves as proof of the transfer. It is crucial to execute the Allegheny Pennsylvania Assignment of Mortgage by Corporate Mortgage Holder accurately and in compliance with all legal requirements to ensure that the mortgage transfer is legally valid. This document should clearly identify the parties involved, state the loan details, reference the original mortgage agreement, and include any necessary endorsements or exhibits. In conclusion, the Allegheny Pennsylvania Assignment of Mortgage by Corporate Mortgage Holder is a legal document that facilitates the transfer of mortgage rights and obligations from one corporate mortgage holder to another. It ensures compliance with legal requirements and enables the new holder to enforce the terms of the mortgage. Understanding the different types of assignments allows for a clearer understanding of the specific circumstances of the transfer.

Allegheny Pennsylvania Assignment of Mortgage by Corporate Mortgage Holder

Description

How to fill out Allegheny Pennsylvania Assignment Of Mortgage By Corporate Mortgage Holder?

If you are searching for a valid form, it’s extremely hard to find a better place than the US Legal Forms site – probably the most comprehensive libraries on the internet. Here you can get a huge number of form samples for company and personal purposes by types and regions, or key phrases. With our advanced search function, discovering the most up-to-date Allegheny Pennsylvania Assignment of Mortgage by Corporate Mortgage Holder is as elementary as 1-2-3. Furthermore, the relevance of every record is confirmed by a group of skilled lawyers that on a regular basis check the templates on our website and revise them according to the most recent state and county demands.

If you already know about our system and have a registered account, all you should do to get the Allegheny Pennsylvania Assignment of Mortgage by Corporate Mortgage Holder is to log in to your user profile and click the Download option.

If you make use of US Legal Forms the very first time, just refer to the instructions below:

- Make sure you have discovered the sample you require. Read its explanation and make use of the Preview function to explore its content. If it doesn’t suit your needs, utilize the Search field near the top of the screen to find the proper file.

- Affirm your choice. Click the Buy now option. Following that, choose the preferred subscription plan and provide credentials to sign up for an account.

- Make the financial transaction. Utilize your bank card or PayPal account to finish the registration procedure.

- Obtain the template. Choose the format and download it on your device.

- Make adjustments. Fill out, modify, print, and sign the acquired Allegheny Pennsylvania Assignment of Mortgage by Corporate Mortgage Holder.

Each and every template you save in your user profile does not have an expiration date and is yours forever. You always have the ability to gain access to them via the My Forms menu, so if you want to have an additional version for modifying or creating a hard copy, you can return and export it again anytime.

Take advantage of the US Legal Forms extensive collection to get access to the Allegheny Pennsylvania Assignment of Mortgage by Corporate Mortgage Holder you were seeking and a huge number of other professional and state-specific templates on one website!