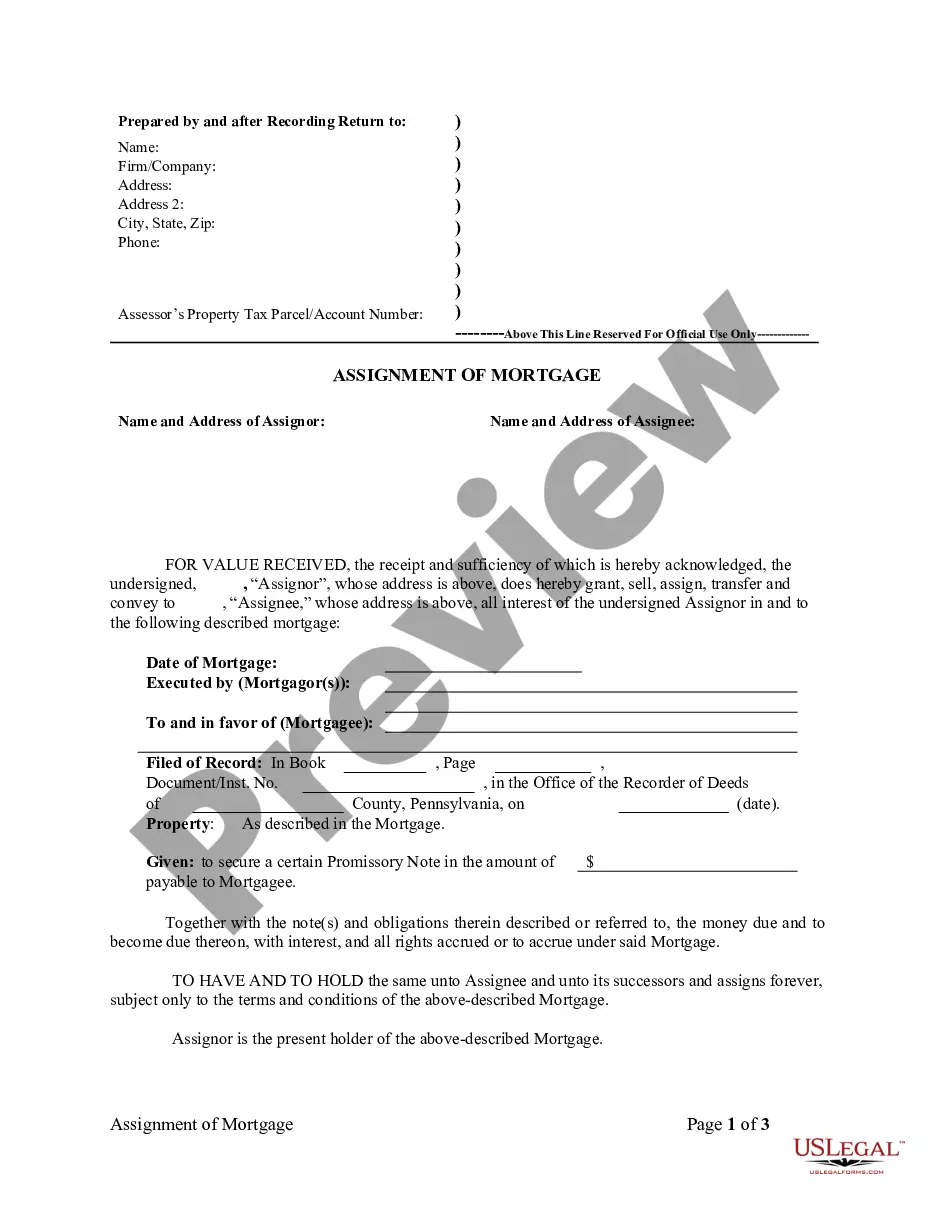

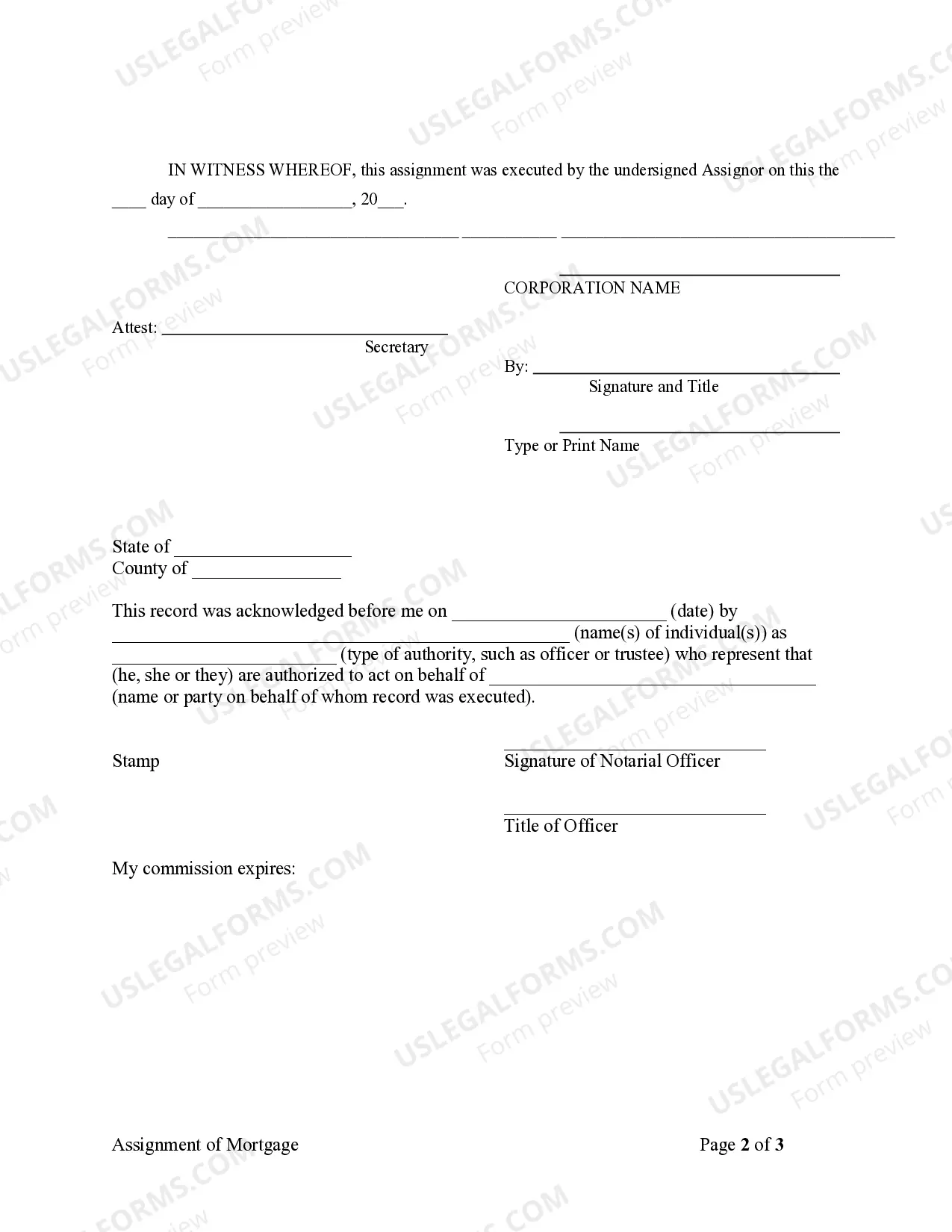

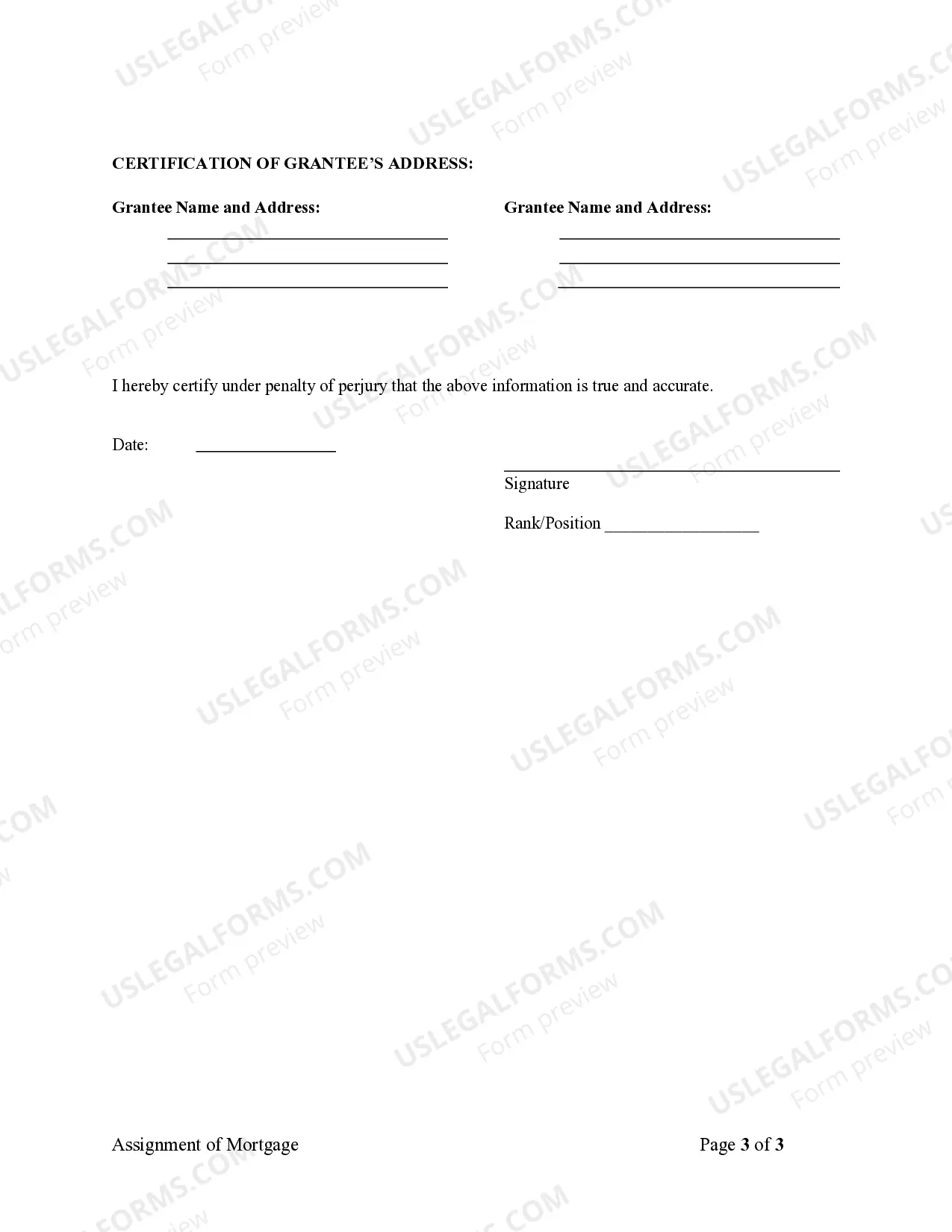

Allentown, Pennsylvania Assignment of Mortgage by Corporate Mortgage Holder: Explained in Detail Introduction: In the city of Allentown, Pennsylvania, the Assignment of Mortgage by Corporate Mortgage Holder is an essential legal document that involves the transfer of ownership rights of a mortgage from a corporate mortgage holder to another party. This document plays a vital role in real estate transactions and ensures the continuity of loan servicing. Detailed Description: 1. Definition: An Assignment of Mortgage refers to the legal process of transferring the mortgage rights and obligations from the original lender (corporate mortgage holder) to a third party, such as another financial institution or an individual investor. It enables the assignee to assume control over the mortgage, including the ability to collect payments and enforce the terms of the loan. 2. Parties Involved: The assignment involves three primary parties: — Assignor: The corporate mortgage holder who assigns the mortgage to another party. — Assignee: The entity or individual receiving the rights and responsibilities of the mortgage. — Mortgagor: The borrower who originally obtained the mortgage loan. 3. Purpose: The assignment serves various purposes: — Loan Transfer: Enables the corporate mortgage holder to transfer the mortgage rights to another entity, allowing for the sale or servicing of loans to different mortgage companies or investors. — Mortgage Servicing: Ensures that the new assignee will handle all aspects of the loan, including collecting loan payments, managing escrow accounts, and addressing customer inquiries. — Loan Modifications: Provides the assignee with the authority to modify certain terms of the mortgage, such as adjusting interest rates or extending the loan duration. 4. Types of Allentown Pennsylvania Assignment of Mortgage: Although the basic concept remains the same, there are different types of assignment of mortgage transactions in Allentown, Pennsylvania: a. Full Assignment: A full assignment transfers the entire mortgage interest, including principal, interest, and the right to enforce the mortgage. This type of assignment allows the assignee to assume all rights and obligations associated with the mortgage. b. Partial Assignment: A partial assignment transfers only a portion of the mortgage interest. The assignor may assign a specific dollar amount or a percentage of the loan balance to the assignee. In such cases, the assignor retains some rights and responsibilities while sharing them with the assignee. c. Assignment in Blank: An assignment in blank occurs when the original mortgage or deed of trust is transferred without specifying the assignee. It is often used when pooling mortgages for securitization, where the assignee is determined later. Conclusion: The Allentown Pennsylvania Assignment of Mortgage by Corporate Mortgage Holder is a crucial legal document that facilitates the transfer of mortgage rights from a corporate mortgage holder to another party. It ensures the smooth servicing of loans and enables various parties to engage in real estate transactions. Understanding the different types of assignments helps parties involved in these transactions make informed decisions.

Allentown Pennsylvania Assignment of Mortgage by Corporate Mortgage Holder

Description

How to fill out Allentown Pennsylvania Assignment Of Mortgage By Corporate Mortgage Holder?

Are you looking for a trustworthy and affordable legal forms provider to buy the Allentown Pennsylvania Assignment of Mortgage by Corporate Mortgage Holder? US Legal Forms is your go-to option.

No matter if you require a basic agreement to set rules for cohabitating with your partner or a package of documents to move your divorce through the court, we got you covered. Our website offers over 85,000 up-to-date legal document templates for personal and company use. All templates that we give access to aren’t generic and frameworked based on the requirements of separate state and area.

To download the form, you need to log in account, locate the needed form, and hit the Download button next to it. Please keep in mind that you can download your previously purchased form templates anytime from the My Forms tab.

Is the first time you visit our platform? No worries. You can set up an account with swift ease, but before that, make sure to do the following:

- Find out if the Allentown Pennsylvania Assignment of Mortgage by Corporate Mortgage Holder conforms to the regulations of your state and local area.

- Read the form’s details (if available) to find out who and what the form is intended for.

- Restart the search in case the form isn’t suitable for your legal scenario.

Now you can create your account. Then choose the subscription plan and proceed to payment. Once the payment is completed, download the Allentown Pennsylvania Assignment of Mortgage by Corporate Mortgage Holder in any available file format. You can return to the website at any time and redownload the form without any extra costs.

Finding up-to-date legal documents has never been easier. Give US Legal Forms a go today, and forget about wasting hours researching legal papers online for good.