Title: Understanding Philadelphia Pennsylvania Assignment of Mortgage by Corporate Mortgage Holder Keywords: Philadelphia Pennsylvania, Assignment of Mortgage, Corporate Mortgage Holder, Types Introduction: In Philadelphia, Pennsylvania, the process of Assignment of Mortgage by a Corporate Mortgage Holder is an essential component of the real estate market. This legal document enables the transfer of mortgage interests from one lender or institution to another. This article aims to provide a detailed description of this process, its significance, and any variations or types associated with it in Philadelphia. 1. Definition and Significance: The Assignment of Mortgage refers to the act of transferring a mortgage from the current mortgage holder, in this case, a corporate entity, to another lender or service. This transfer allows the new lender to assume all rights, responsibilities, and benefits associated with the mortgage loan. It is a crucial procedure in the mortgage industry as mortgages are often bought and sold among financial institutions. 2. Process of Assignment of Mortgage: The Philadelphia Pennsylvania Assignment of Mortgage by Corporate Mortgage Holder typically involves the following steps: a. Identification of the Corporate Mortgage Holder: Firstly, the current mortgage holder, which is a corporate entity, must be clearly identified. b. Agreement between Parties: Both the Corporate Mortgage Holder and the new lender or service must agree to the transfer of the mortgage. This agreement is often documented in a written contract or an Assignment of Mortgage document. c. Legal Documentation: The legal documentation required for the Assignment of Mortgage includes recording the transfer with the Philadelphia County Recorder of Deeds along with the necessary paperwork, such as the promissory note and mortgage document. d. Notification to Borrower: The Borrower is then notified of the transfer of their mortgage, informing them that their payments should be redirected to the new lender or service. 3. Types of Philadelphia Pennsylvania Assignment of Mortgage by Corporate Mortgage Holder: While the basic process described above remains the same, there can be various types or variations of Assignment of Mortgage in Philadelphia. These may include: a. Full Assignment: The Corporate Mortgage Holder transfers the entire mortgage along with all rights and obligations to the new lender. b. Partial Assignment: In some cases, only a portion of the mortgage may be assigned, allowing the Corporate Mortgage Holder to retain some interest in the loan. c. Assignment with Recourse: This type of Assignment of Mortgage can include an obligation on the Corporate Mortgage Holder to repurchase the mortgage under certain conditions or if specific issues arise. d. Assignment without Recourse: In this scenario, the new lender assumes all risk and responsibility associated with the mortgage, without recourse to the Corporate Mortgage Holder. Conclusion: The Philadelphia Pennsylvania Assignment of Mortgage by Corporate Mortgage Holder is a critical process in the real estate and mortgage industry. Understanding this process, its steps, and the variations in different types of assignments ensures transparency and clarity during the mortgage transfer. Whether it is a full or partial assignment, with or without recourse, the ultimate goal is to facilitate the seamless transfer of mortgage interests between corporate entities, ensuring proper documentation and notification to the borrower.

Philadelphia Pennsylvania Assignment of Mortgage by Corporate Mortgage Holder

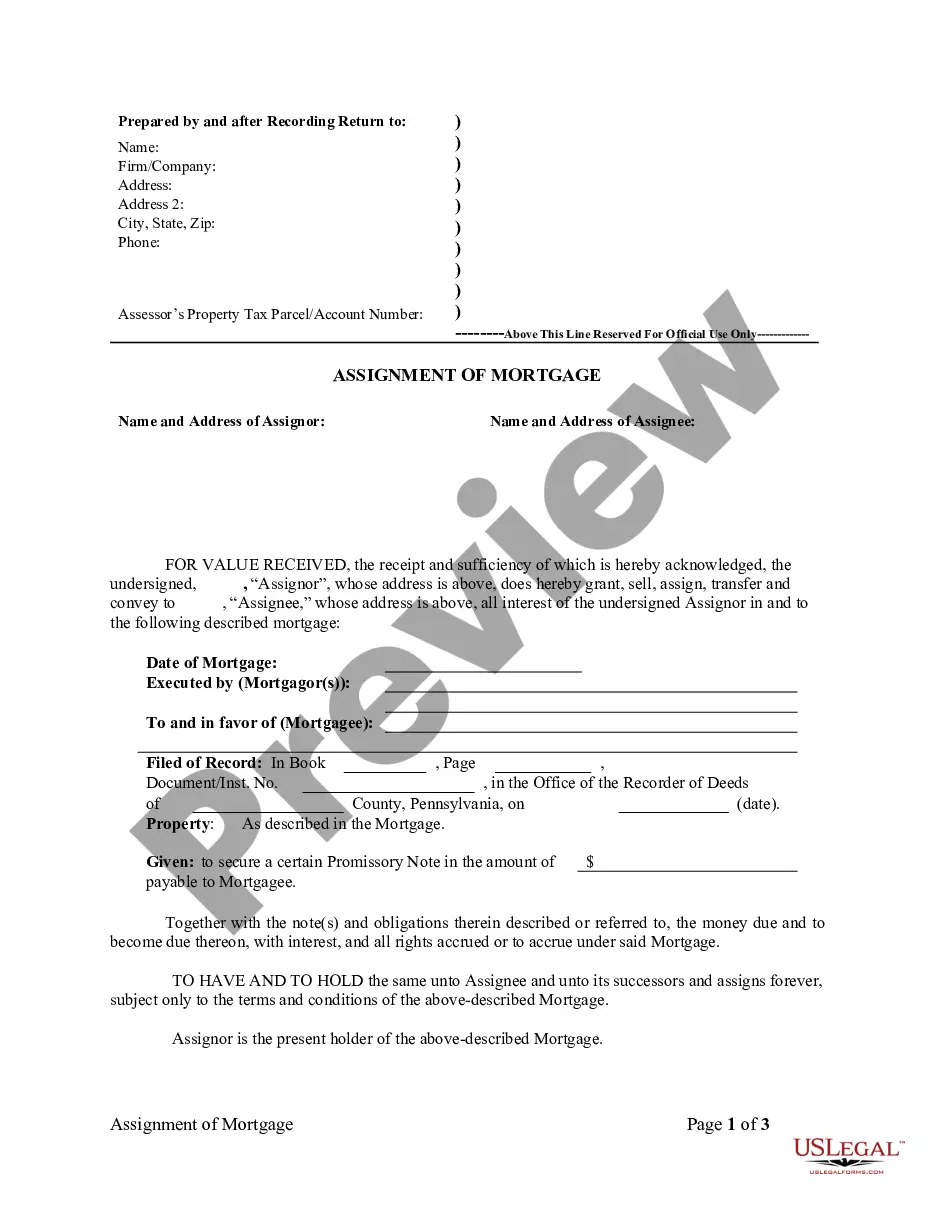

Description

How to fill out Philadelphia Pennsylvania Assignment Of Mortgage By Corporate Mortgage Holder?

Locating verified templates specific to your local laws can be challenging unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both individual and professional needs and any real-life scenarios. All the documents are properly categorized by area of usage and jurisdiction areas, so searching for the Philadelphia Pennsylvania Assignment of Mortgage by Corporate Mortgage Holder gets as quick and easy as ABC.

For everyone already acquainted with our catalogue and has used it before, getting the Philadelphia Pennsylvania Assignment of Mortgage by Corporate Mortgage Holder takes just a couple of clicks. All you need to do is log in to your account, opt for the document, and click Download to save it on your device. This process will take just a couple of additional steps to make for new users.

Adhere to the guidelines below to get started with the most extensive online form library:

- Look at the Preview mode and form description. Make sure you’ve chosen the correct one that meets your needs and fully corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you see any inconsistency, utilize the Search tab above to obtain the right one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and choose the subscription plan you prefer. You should register an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the subscription.

- Download the Philadelphia Pennsylvania Assignment of Mortgage by Corporate Mortgage Holder. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Take advantage of the US Legal Forms library to always have essential document templates for any needs just at your hand!