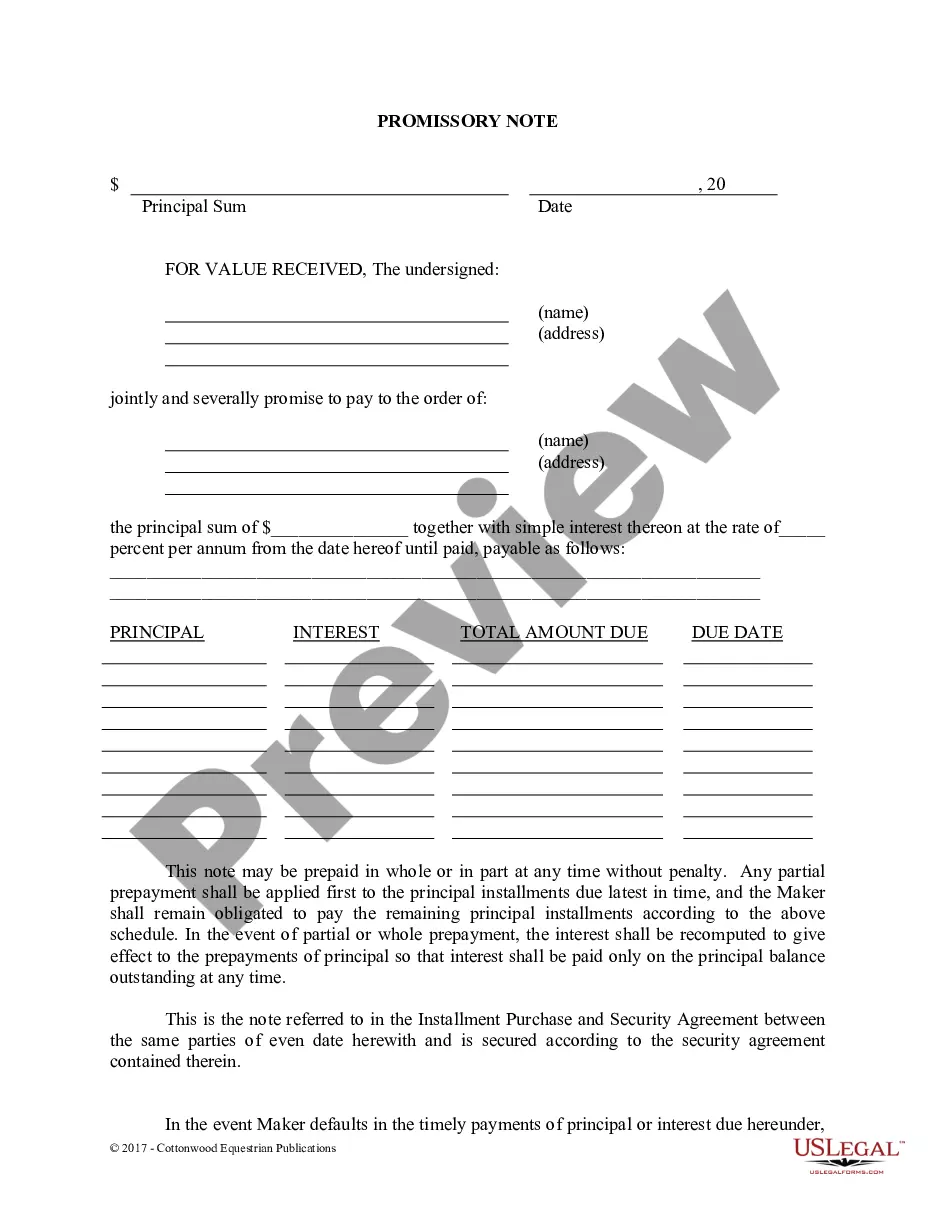

A Philadelphia Pennsylvania Promissory Note — Horse Equine Form is a legal document used in the state of Pennsylvania to outline the terms and conditions of a loan or financing agreement between two parties in the horse or equine industry. This document serves as a written promise that the borrower will repay the lender the agreed-upon amount of money within a specific timeframe along with any accrued interest. In Philadelphia, Pennsylvania, there are various types of Promissory Note — Horse Equine Forms available to suit different situations and requirements. Some commonly used forms include: 1. Promissory Note for Horse Purchase: This form is used when a buyer needs financial assistance to purchase a horse. It outlines the loan amount, repayment terms, interest rate, and any additional conditions agreed upon between the buyer and lender. 2. Promissory Note for Equine Services: This form is utilized when a horse owner seeks financial assistance to cover expenses related to equine services such as veterinary care, training, boarding, or transportation. The document lays out the loan specifics and obligations of the borrower. 3. Promissory Note for Breeding Agreements: This form comes into play when a breeder requires financial support for breeding operations. It establishes the loan amount, repayment schedule, and any specific terms related to breeding rights, mare care, or stallion services. 4. Promissory Note for Horse Equipment: This form is used when a horse owner or equine business needs financing for purchasing or leasing horse-related equipment such as saddles, trailers, or grooming tools. It outlines the details of the loan agreement and the responsibilities of the borrower. 5. Promissory Note for Equine Facility Construction: This form is specifically designed for financing the construction or renovation of equine facilities like barns, arenas, or fencing. It includes the loan amount, repayment terms, and any collateral or guarantor requirements. Philadelphia Pennsylvania Promissory Note — Horse Equine Forms are crucial for establishing a clear understanding between the lender and borrower. These legal documents protect the rights and obligations of both parties and help mitigate any potential disputes or situations that may arise during the loan tenure. It is important to consult with an attorney or legal professional to ensure the promissory note complies with Pennsylvania state laws and accurately reflects the intent and terms of the loan agreement.

Philadelphia Pennsylvania Promissory Note - Horse Equine Forms

Description

How to fill out Philadelphia Pennsylvania Promissory Note - Horse Equine Forms?

If you are looking for a valid form, it’s difficult to choose a better place than the US Legal Forms website – one of the most extensive libraries on the web. Here you can get a large number of templates for company and personal purposes by types and regions, or key phrases. Using our high-quality search function, getting the newest Philadelphia Pennsylvania Promissory Note - Horse Equine Forms is as easy as 1-2-3. Additionally, the relevance of every file is confirmed by a team of professional attorneys that on a regular basis check the templates on our platform and update them in accordance with the newest state and county requirements.

If you already know about our system and have an account, all you need to receive the Philadelphia Pennsylvania Promissory Note - Horse Equine Forms is to log in to your user profile and click the Download button.

If you utilize US Legal Forms for the first time, just follow the instructions listed below:

- Make sure you have chosen the sample you want. Look at its description and make use of the Preview option to see its content. If it doesn’t meet your requirements, utilize the Search field near the top of the screen to get the needed file.

- Affirm your selection. Click the Buy now button. Following that, choose your preferred subscription plan and provide credentials to sign up for an account.

- Make the financial transaction. Utilize your credit card or PayPal account to finish the registration procedure.

- Receive the template. Indicate the file format and save it to your system.

- Make modifications. Fill out, modify, print, and sign the obtained Philadelphia Pennsylvania Promissory Note - Horse Equine Forms.

Every single template you add to your user profile does not have an expiration date and is yours permanently. You always have the ability to gain access to them via the My Forms menu, so if you want to get an extra duplicate for enhancing or printing, you can come back and download it once again whenever you want.

Make use of the US Legal Forms professional library to gain access to the Philadelphia Pennsylvania Promissory Note - Horse Equine Forms you were looking for and a large number of other professional and state-specific samples on one platform!