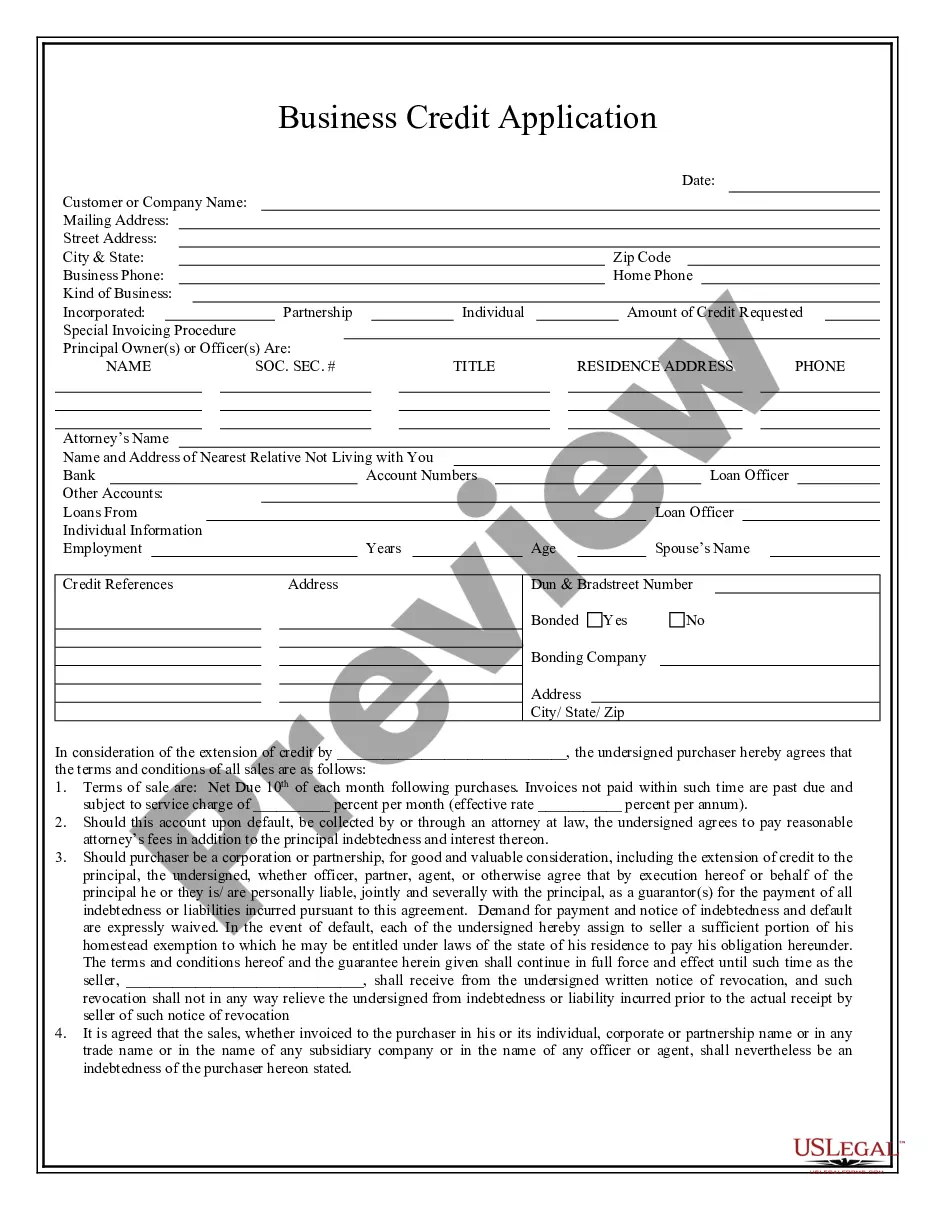

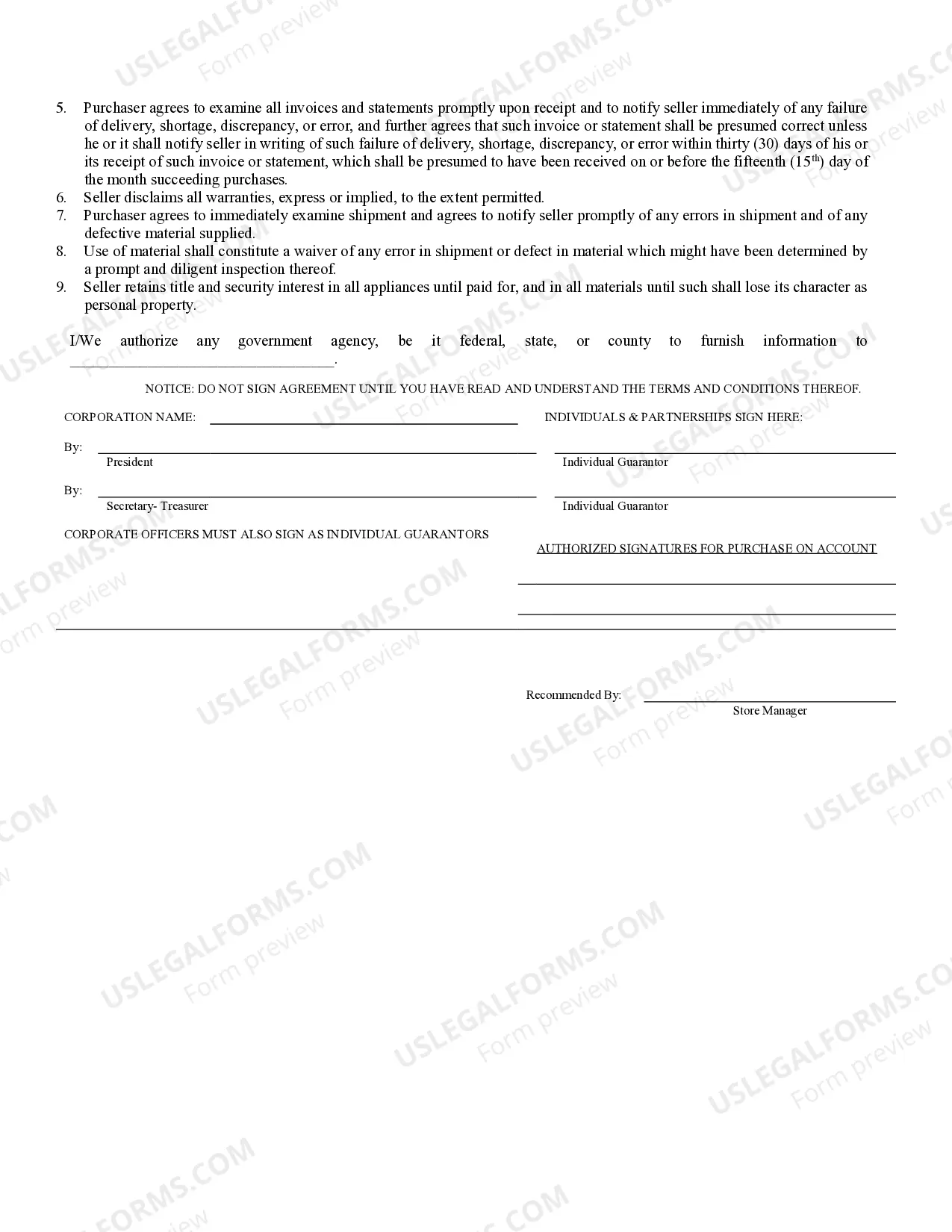

The Allegheny Pennsylvania Business Credit Application is a comprehensive and vital form that businesses in Allegheny, Pennsylvania, fill out to apply for credit facilities. This application acts as a crucial tool for both the business owner and the credit provider to assess the creditworthiness and financial stability of the applying business. It enables businesses to access financial assistance and credit options necessary for their growth and development. The Allegheny Pennsylvania Business Credit Application gathers various essential information from businesses, including contact details, business name, address, tax identification number, years in operation, legal structure, and industry type. It also asks for details about the business owner or primary contact person, such as their name, social security number, date of birth, and personal contact information. Moreover, the application requires comprehensive financial data, such as income statements, balance sheets, cash flow statements, and tax returns, to evaluate the business's financial health and repayment capacity. These documents facilitate a thorough assessment of the business's ability to honor credit commitments. To gauge the creditworthiness of the applying business, the Allegheny Pennsylvania Business Credit Application may also request information on outstanding debts, existing credit lines, bankruptcy history, and any past legal disputes relevant to the business. Different types of Allegheny Pennsylvania Business Credit Applications include: 1. Small Business Credit Application: Specifically designed for small businesses, this application streamlines the credit assessment process by focusing on relevant financial data and credit history of the business. It targets businesses with less extensive credit needs or startup ventures. 2. Corporate Credit Application: This application caters to larger corporations that require significant credit facilities. It typically involves a more comprehensive evaluation, considering the business's financial statements, credit history, and contractual agreements. 3. Line of Credit Application: Designed for businesses seeking an ongoing line of credit, this application emphasizes the business's cash flow and past credit management. It helps businesses access a predetermined credit limit that can be used whenever needed. 4. Commercial Mortgage Credit Application: For businesses aiming to secure credit for commercial real estate properties, this application focuses on the value and potential of the property, along with the business's financial standing. 5. Trade Credit Application: Geared towards businesses seeking credit from suppliers or vendors, this application highlights the business's trade history, purchase volume, and payment track record. In summary, the Allegheny Pennsylvania Business Credit Application serves as a crucial document for businesses in Allegheny, Pennsylvania, who seek credit facilities. Whether applying for small business credit, corporate credit, line of credit, commercial mortgage credit, or trade credit, providing accurate and relevant information is key to increasing the chances of credit approval.

Allegheny Pennsylvania Business Credit Application

Description

How to fill out Allegheny Pennsylvania Business Credit Application?

If you are searching for a valid form, it’s impossible to choose a more convenient place than the US Legal Forms site – one of the most considerable libraries on the internet. Here you can find a large number of form samples for company and personal purposes by categories and regions, or keywords. Using our advanced search function, getting the newest Allegheny Pennsylvania Business Credit Application is as easy as 1-2-3. Furthermore, the relevance of each file is verified by a team of expert lawyers that regularly review the templates on our platform and update them in accordance with the latest state and county regulations.

If you already know about our platform and have an account, all you need to receive the Allegheny Pennsylvania Business Credit Application is to log in to your account and click the Download option.

If you make use of US Legal Forms for the first time, just follow the guidelines listed below:

- Make sure you have found the form you require. Look at its description and use the Preview function (if available) to check its content. If it doesn’t suit your needs, use the Search field at the top of the screen to find the appropriate record.

- Affirm your choice. Select the Buy now option. Next, pick your preferred pricing plan and provide credentials to register an account.

- Process the financial transaction. Make use of your bank card or PayPal account to finish the registration procedure.

- Get the template. Indicate the format and save it to your system.

- Make modifications. Fill out, revise, print, and sign the received Allegheny Pennsylvania Business Credit Application.

Each template you save in your account does not have an expiration date and is yours permanently. It is possible to access them using the My Forms menu, so if you need to get an additional version for enhancing or creating a hard copy, you can return and save it once more anytime.

Make use of the US Legal Forms extensive library to get access to the Allegheny Pennsylvania Business Credit Application you were looking for and a large number of other professional and state-specific samples on one website!