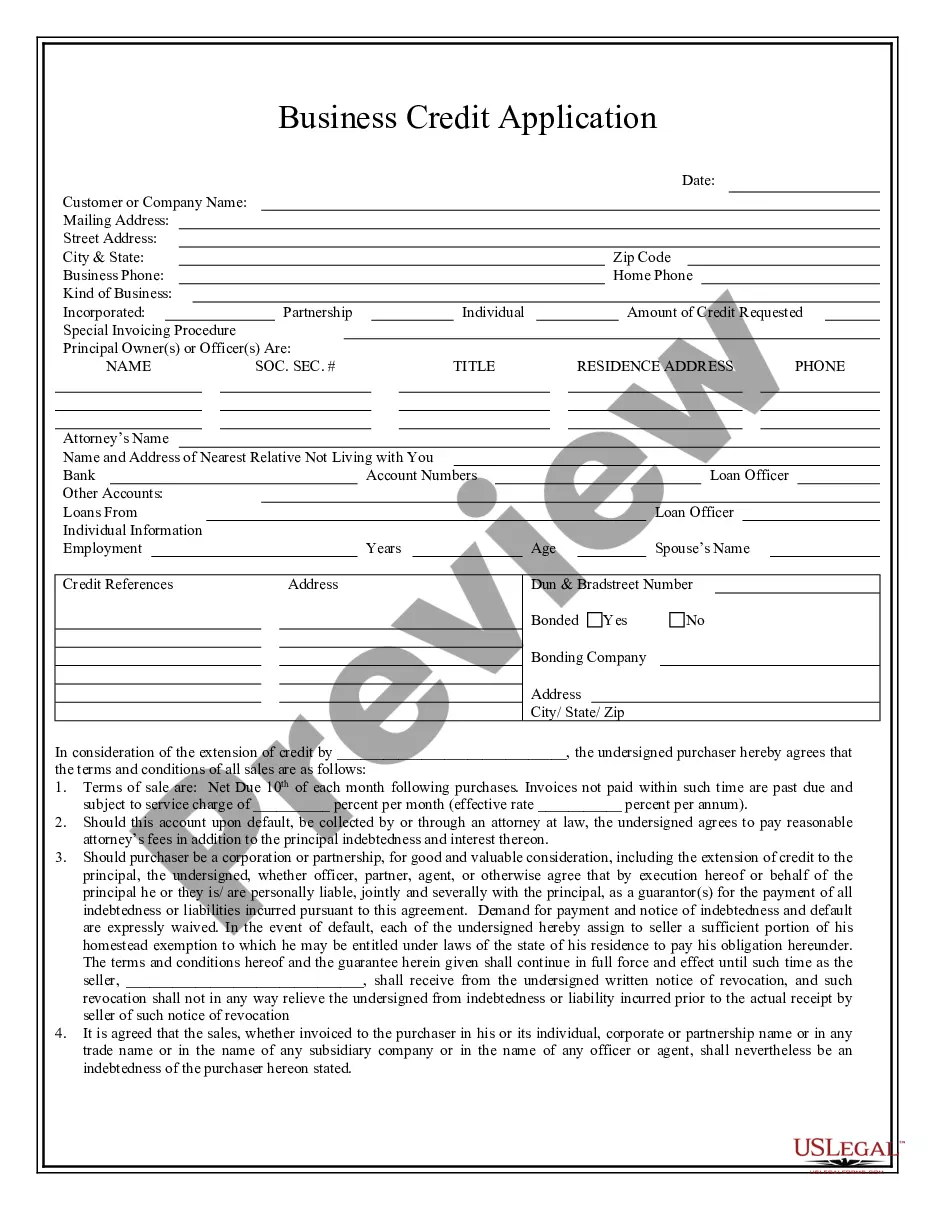

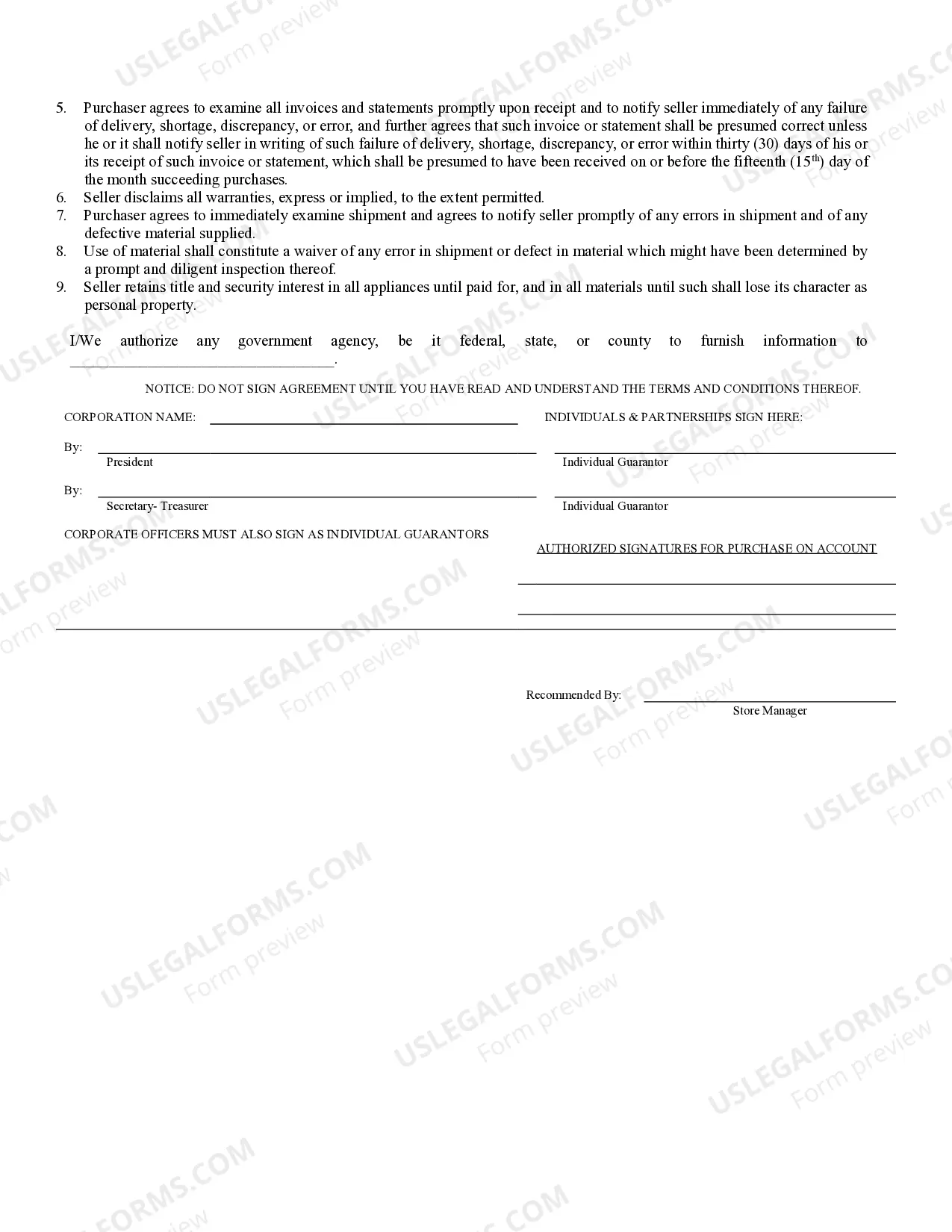

Allentown Pennsylvania Business Credit Application is a comprehensive form that local businesses in Allentown, Pennsylvania can complete to apply for credit or financing options from various lenders or financial institutions. This application allows businesses to seek financial assistance to support their growth, expansion, working capital needs, or other specific requirements. Keywords: Allentown Pennsylvania, business credit application, credit, financing, local businesses, lenders, financial institutions, financial assistance, growth, expansion, working capital, requirements. Different types of Allentown Pennsylvania Business Credit Applications may include: 1. Traditional Business Credit Application: This type of application typically asks for general information about the business, such as business name, address, legal structure, ownership details, industry classification, and specific financial details like annual revenue, bank statements, and tax returns. 2. Small Business Administration (SBA) Loan Application: Allentown businesses can opt for SBA loans, which require a separate application process. This application focuses on the business's eligibility for SBA loans, including criteria such as the nature of the business, industry classification, previous financial performance, collateral, and a detailed business plan. 3. Vendor or Supplier Credit Application: If a local business in Allentown aims to establish credit terms with suppliers or vendors, they might be required to complete a credit application specific to the supplier or vendor. This application typically emphasizes the business's payment history, trade references, and other relevant financial information. 4. Line of Credit Application: Allentown businesses seeking a line of credit from a financial institution or lender will be required to fill out this type of credit application. It focuses on the credit limit requested, intended use of the funds, business financials, collateral, personal guarantees, and any other relevant information that establishes creditworthiness. 5. Business Credit Card Application: For businesses looking to obtain a business credit card, a separate credit card application is required. This application might require business details, owner information, financial statements, personal guarantees, and other factors depending on the credit card issuer's requirements. Regardless of the specific type, all Allentown Pennsylvania Business Credit Applications generally aim to assess the creditworthiness and financial stability of local businesses, enabling lenders and financial institutions to make informed decisions about approving credit or financial support.

Allentown Pennsylvania Business Credit Application

Description

How to fill out Allentown Pennsylvania Business Credit Application?

Locating verified templates specific to your local laws can be challenging unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both personal and professional needs and any real-life scenarios. All the documents are properly categorized by area of usage and jurisdiction areas, so locating the Allentown Pennsylvania Business Credit Application becomes as quick and easy as ABC.

For everyone already acquainted with our library and has used it before, getting the Allentown Pennsylvania Business Credit Application takes just a few clicks. All you need to do is log in to your account, select the document, and click Download to save it on your device. This process will take just a few more actions to make for new users.

Follow the guidelines below to get started with the most extensive online form catalogue:

- Look at the Preview mode and form description. Make sure you’ve picked the right one that meets your requirements and fully corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you find any inconsistency, utilize the Search tab above to find the right one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and select the subscription plan you prefer. You should register an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the subscription.

- Download the Allentown Pennsylvania Business Credit Application. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Take advantage of the US Legal Forms library to always have essential document templates for any demands just at your hand!