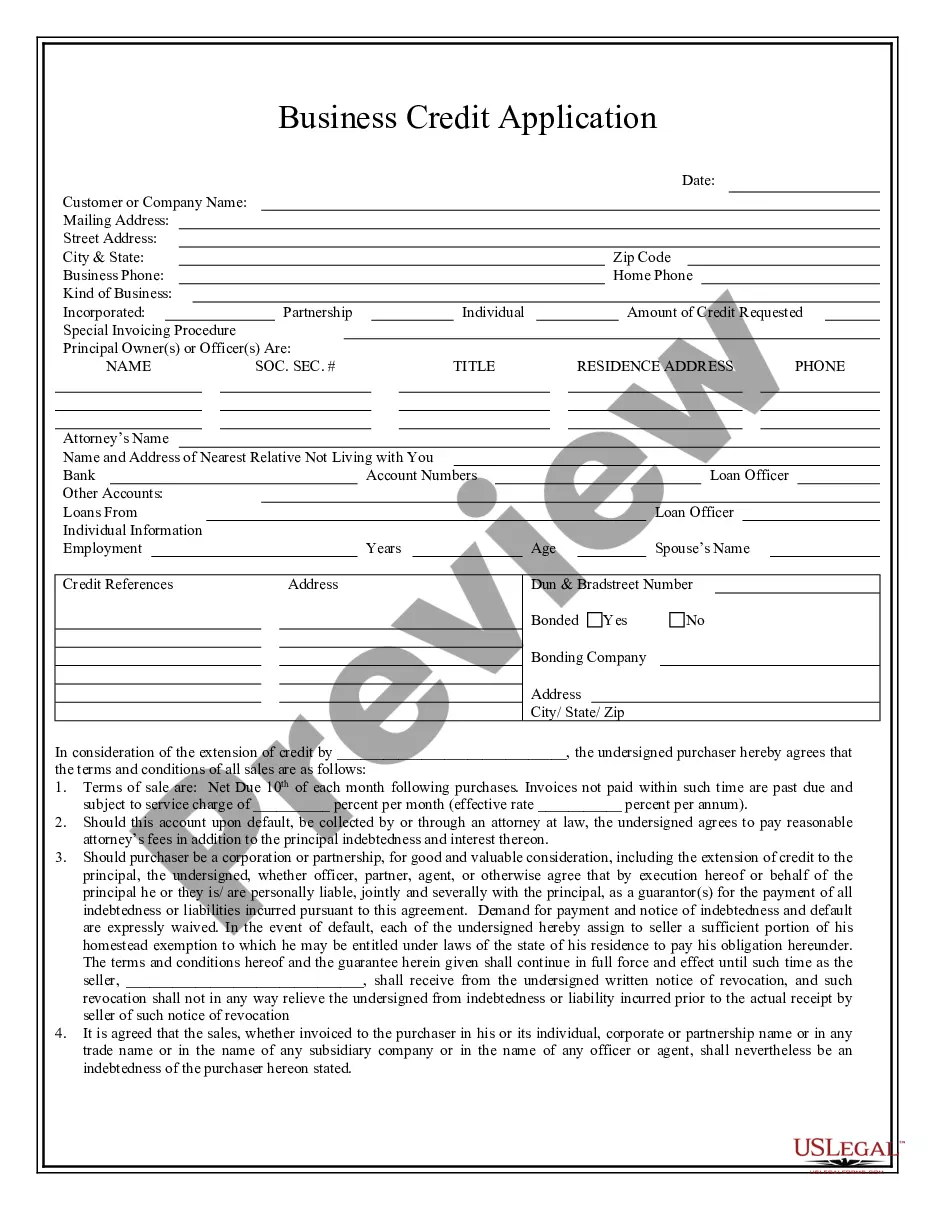

Philadelphia Pennsylvania Business Credit Application

Description

How to fill out Pennsylvania Business Credit Application?

If you have previously used our service, Log In to your account and obtain the Philadelphia Pennsylvania Business Credit Application on your device by clicking the Download button. Ensure your subscription is active. If not, renew it according to your payment plan.

If this is your initial encounter with our service, follow these straightforward steps to acquire your file.

You have uninterrupted access to every document you have purchased: you can locate it in your profile under the My documents menu whenever you wish to use it again. Utilize the US Legal Forms service to quickly find and download any template for your personal or business needs!

- Ensure you’ve found the correct document. Review the description and utilize the Preview option, if available, to verify its suitability. If it doesn’t meet your requirements, use the Search tab above to find the right one.

- Purchase the template. Hit the Buy Now button and select a monthly or yearly subscription plan.

- Establish an account and complete a payment. Input your credit card information or select the PayPal option to finalize the transaction.

- Obtain your Philadelphia Pennsylvania Business Credit Application. Choose the file format for your document and save it on your device.

- Fill out your sample. Print it or utilize professional online editors to complete and sign it electronically.

Form popularity

FAQ

To obtain business credit with your new LLC, start by registering your business and obtaining a federal EIN. Next, complete a Philadelphia Pennsylvania Business Credit Application with potential lenders. Open a business bank account, and establish trade lines with suppliers who report to credit bureaus. This approach will help you build a positive credit history, making it easier to access financing in the future.

While different lenders have varying requirements, a personal credit score of at least 650 is often preferred for securing business credit. When you submit a Philadelphia Pennsylvania Business Credit Application, lenders will assess your personal credit history to evaluate risk. It's crucial to monitor your credit score and address any issues before applying. Having a solid personal credit score can open doors for better financing options for your LLC.

A new LLC can establish credit by opening accounts in the business's name and ensuring timely payments. Completing a Philadelphia Pennsylvania Business Credit Application can facilitate this process. Additionally, building relationships with suppliers and vendors who report to credit bureaus can enhance your business credit profile. Over time, consistent, responsible financial management will strengthen your creditworthiness.

Yes, a new LLC can obtain a business credit card. This process typically involves submitting a Philadelphia Pennsylvania Business Credit Application that includes the business’s information and a personal guarantee from the owners. Keep in mind that credit card issuers may assess your personal credit score during approval, especially since the business is newly formed. Choosing the right card can help build your business credit over time.

Filing business taxes in Pennsylvania involves several steps, but it can be done online for convenience. You should gather all necessary financial documents and register your business with the Pennsylvania Department of Revenue. Utilizing platforms like USLegalForms can enhance your experience as you tackle state tax requirements and apply for a Philadelphia Pennsylvania Business Credit Application, ensuring you meet all obligations seamlessly.

Yes, you can file your Pennsylvania estimated taxes online. This approach allows you to efficiently manage your tax obligations throughout the year. Using platforms like USLegalForms, you can prepare and submit your estimated tax payments while also exploring options for a Philadelphia Pennsylvania Business Credit Application. This makes tracking your finances easier and more organized.

Filing the Philadelphia Business Income and Receipts Tax (BIRT) online is straightforward. You will need to create an account on the Philadelphia Department of Revenue website. From there, you can submit your BIRT online and check on the status of your Philadelphia Pennsylvania Business Credit Application. This process saves time and reduces the chances of errors in your tax submission.

Yes, you can file your Pennsylvania local taxes online. Many residents and businesses in Philadelphia find online filing to be convenient and efficient. By using the right platforms, such as USLegalForms, you can easily manage your tax filings while also applying for a Philadelphia Pennsylvania Business Credit Application. Online services streamline the process and provide you with the necessary tools for submitting your local tax forms.

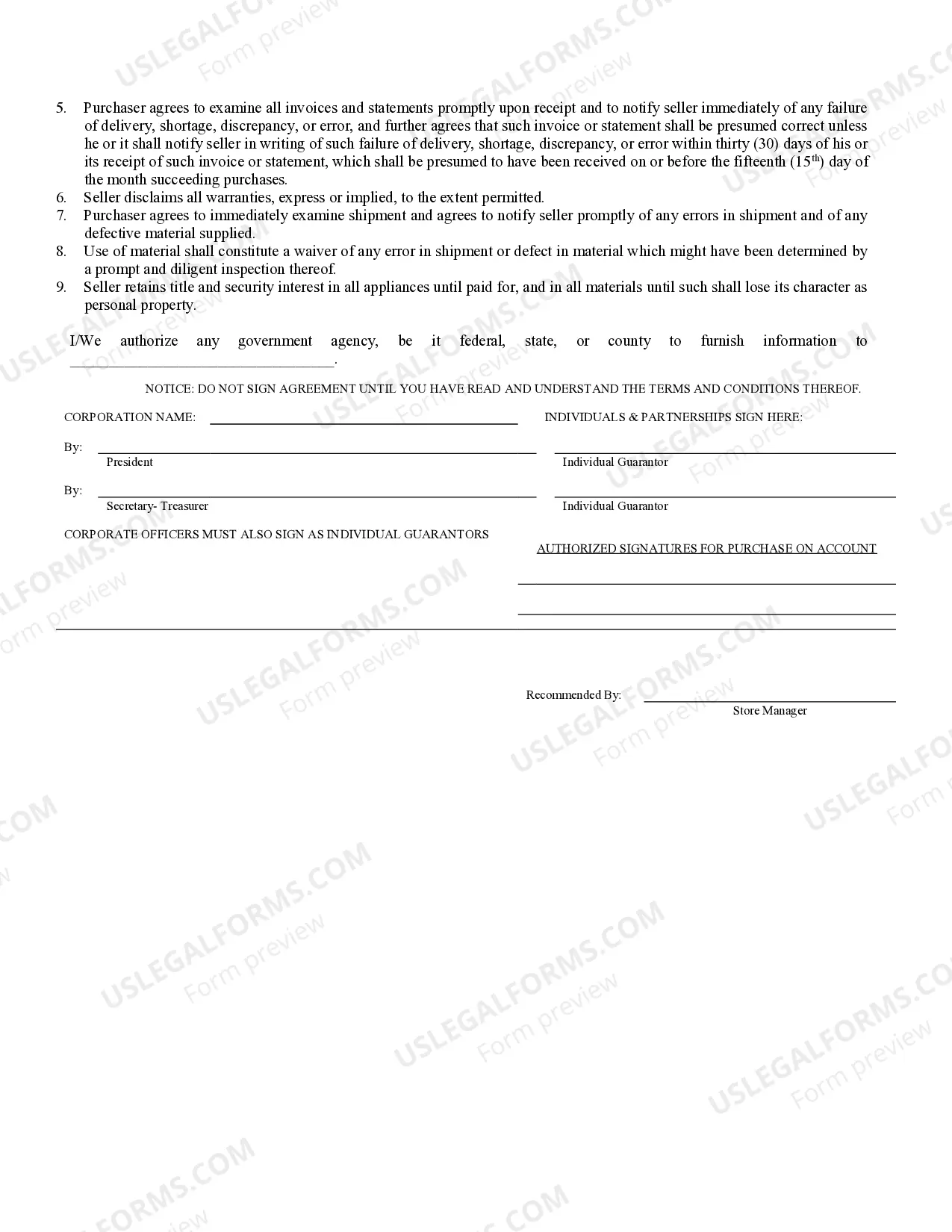

A business credit application is a document that a business uses to request credit from lenders or suppliers. This application includes essential information such as the business's financial history, contact details, and credit needs. Completing a thorough Philadelphia Pennsylvania Business Credit Application can enhance your chances of securing funding. This process supports your business growth by establishing a solid credit foundation, which is vital for future financial transactions.

In Philadelphia, any individual or entity that conducts business within the city limits is subject to business tax. This includes corporations, partnerships, and sole proprietorships. It's important to understand the specific tax obligations for your business type to remain compliant. Utilizing a Philadelphia Pennsylvania Business Credit Application can help you manage your finances and streamline your tax responsibilities.