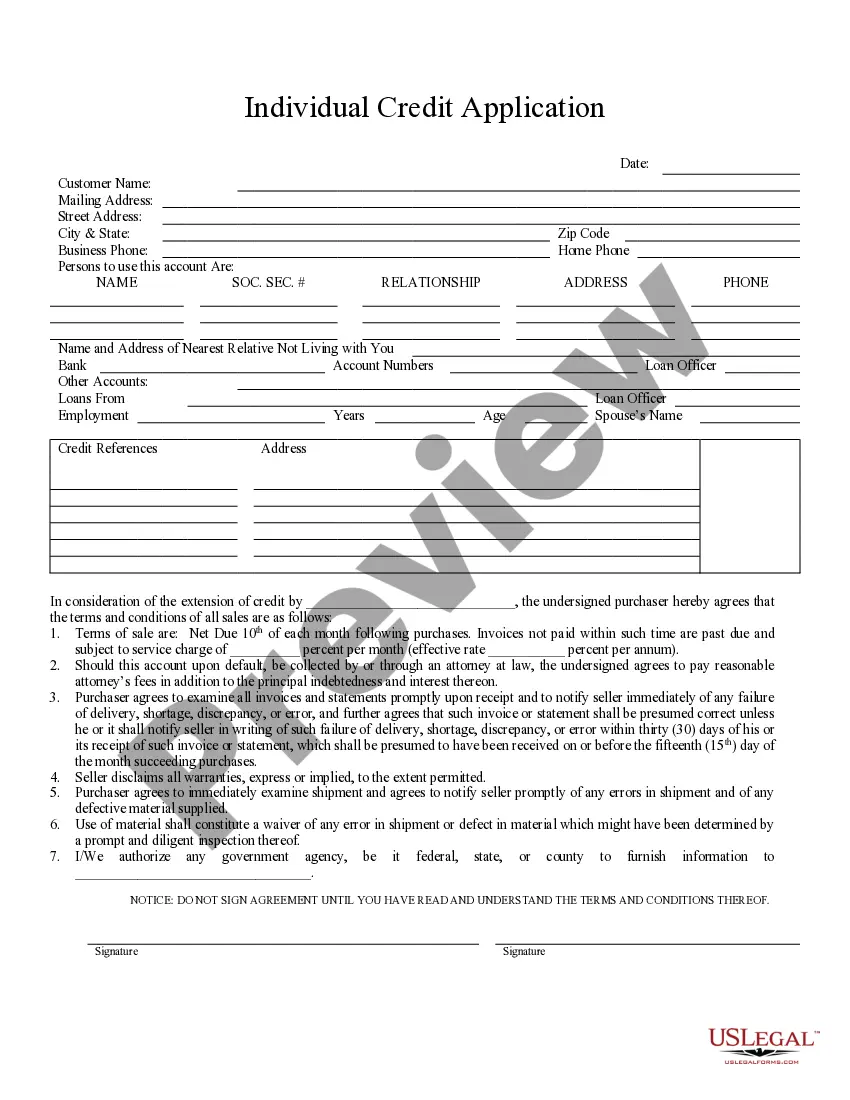

Allegheny Pennsylvania Individual Credit Application is a formal document that individuals residing in the Allegheny region of the state of Pennsylvania must complete when applying for credit. This comprehensive application is designed to gather all the necessary information required by financial institutions and lenders in order to evaluate the creditworthiness of an individual. The Allegheny Pennsylvania Individual Credit Application typically includes several sections, such as personal information, financial details, and references. In the personal information section, applicants are required to provide their full name, residential address, contact information, and social security number. This information helps lenders to identify the applicant and perform necessary background checks. The financial details section of the credit application requests information about the applicant's employment history, income, and monthly expenses. This data helps lenders assess the applicant's ability to repay the credit and determine an appropriate credit limit. Additional information may be requested to gain a comprehensive understanding of the applicant's financial situation, including details about assets, liabilities, and existing loans. In some cases, the Allegheny Pennsylvania Individual Credit Application may also request references, such as contact information for personal and professional associates who can provide character references for the applicant. These references can provide insights into the applicant's reliability and trustworthiness, further facilitating the credit evaluation process. Different types of Allegheny Pennsylvania Individual Credit Applications may exist, catering to varying credit needs and specific financial institutions. For instance, there may be separate applications for credit cards, personal loans, auto loans, mortgages, or business loans. Although the basic structure and required information remain consistent, variations among these applications are dependent on the specific requirements or criteria of each lending institution. In summary, the Allegheny Pennsylvania Individual Credit Application is a crucial document for individuals seeking credit in the Allegheny region. It gathers personal, financial, and reference information necessary for lenders to determine an individual's creditworthiness and make informed lending decisions. Whether applying for a credit card, loan, or mortgage, completing this application accurately and thoroughly is essential for a successful credit evaluation and approval process.

Allegheny Pennsylvania Individual Credit Application

Description

How to fill out Allegheny Pennsylvania Individual Credit Application?

Take advantage of the US Legal Forms and have immediate access to any form sample you require. Our beneficial platform with thousands of templates allows you to find and obtain virtually any document sample you need. It is possible to download, fill, and certify the Allegheny Pennsylvania Individual Credit Application in a few minutes instead of browsing the web for several hours seeking the right template.

Utilizing our catalog is a superb way to raise the safety of your document filing. Our professional lawyers on a regular basis review all the documents to make sure that the forms are appropriate for a particular region and compliant with new laws and polices.

How can you obtain the Allegheny Pennsylvania Individual Credit Application? If you already have a profile, just log in to the account. The Download option will appear on all the samples you look at. Additionally, you can find all the earlier saved records in the My Forms menu.

If you haven’t registered an account yet, stick to the instructions listed below:

- Find the form you require. Make certain that it is the form you were looking for: verify its title and description, and utilize the Preview feature if it is available. Otherwise, make use of the Search field to look for the needed one.

- Start the downloading process. Click Buy Now and choose the pricing plan that suits you best. Then, sign up for an account and process your order utilizing a credit card or PayPal.

- Save the file. Choose the format to get the Allegheny Pennsylvania Individual Credit Application and edit and fill, or sign it for your needs.

US Legal Forms is one of the most extensive and trustworthy form libraries on the web. Our company is always ready to assist you in any legal case, even if it is just downloading the Allegheny Pennsylvania Individual Credit Application.

Feel free to benefit from our service and make your document experience as convenient as possible!