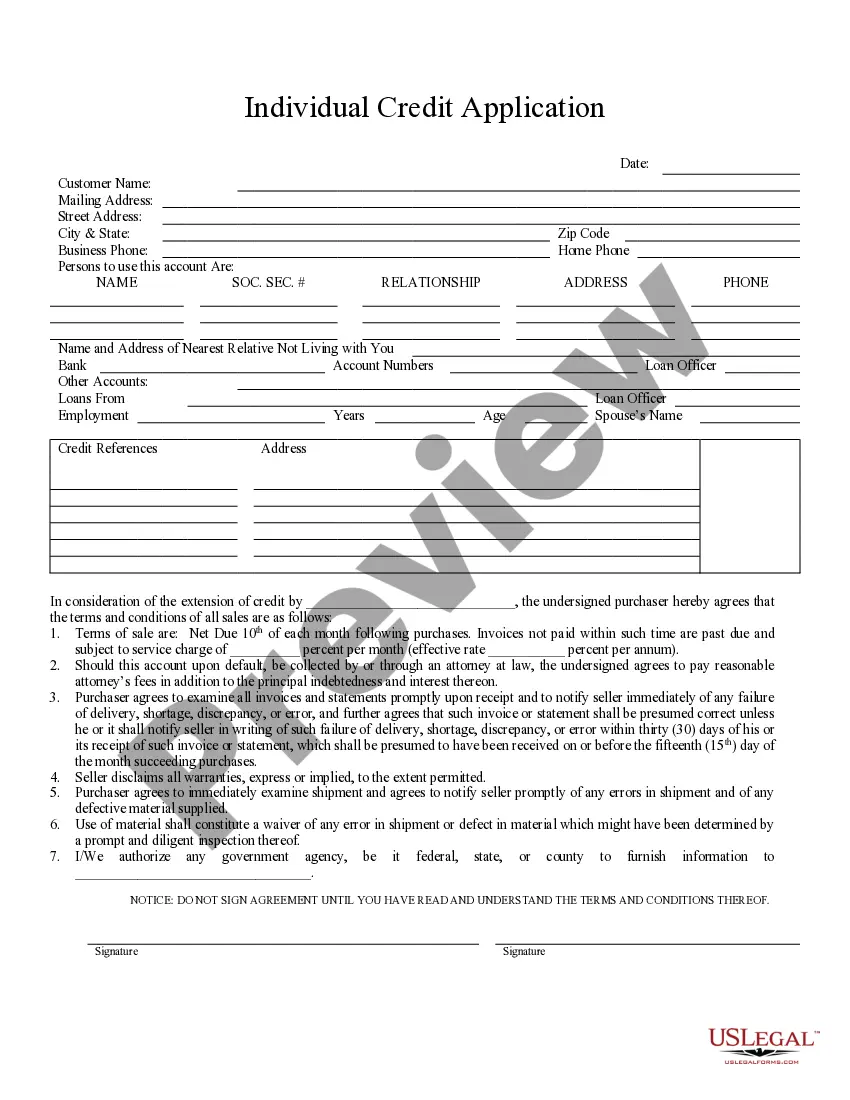

Allentown, Pennsylvania Individual Credit Application is a comprehensive and necessary form used by individuals residing in Allentown, Pennsylvania, to apply for credit from various financial institutions. This document enables individuals to seek loans, credit cards, mortgages, or other forms of credit to meet their financial needs. The Allentown Pennsylvania Individual Credit Application helps lenders assess the applicant's creditworthiness, which includes factors such as credit history, income, employment status, and outstanding debts. Key phrases and keywords: 1. Allentown, Pennsylvania: The specific location for which the credit application is intended. 2. Individual credit application: Refers to an application for credit specifically designed for individuals, not businesses or organizations. 3. Credit application: The document utilized by individuals to request credit from financial institutions. 4. Loans: A form of credit typically used for large expenses such as purchasing a car or financing a home. 5. Credit cards: A commonly used form of credit that allows individuals to make purchases on credit and repay later. 6. Mortgages: A type of loan specifically used for purchasing real estate, typically with a long repayment period. 7. Creditworthiness: The assessment of an applicant's ability to repay the borrowed funds on time. 8. Credit history: Refers to an individual's past credit records, including loans, payment history, defaults, and any outstanding debts. 9. Income: The overall earnings of an individual or household, which often plays a vital role in determining credit eligibility. 10. Employment status: The current working situation of an individual, such as full-time, part-time, self-employed, or unemployed. 11. Outstanding debts: Any existing liabilities and financial obligations an applicant has, such as existing loans, credit card balances, or unpaid bills. Different types of Allentown Pennsylvania Individual Credit Applications may include: 1. Personal loan application: Specifically used for obtaining personal loans, which can be utilized for various purposes like debt consolidation, medical expenses, or vacation plans. 2. Credit card application: Specifically used for applying for credit cards, which offer individuals a revolving line of credit for everyday purchases. 3. Mortgage application: Intended for individuals seeking mortgage loans to finance the purchase of residential properties. 4. Auto loan application: Designed for individuals interested in securing loans for purchasing vehicles, including cars, trucks, or motorcycles. 5. Student loan application: Specifically designed to assist students in obtaining financial aid for educational purposes, covering tuition fees, books, and other related expenses. By utilizing the appropriate Allentown Pennsylvania Individual Credit Application based on their specific credit needs, individuals can initiate the process of securing the required funds and achieving their financial goals.

Allentown Pennsylvania Individual Credit Application

Description

How to fill out Allentown Pennsylvania Individual Credit Application?

If you are looking for a relevant form template, it’s impossible to choose a better service than the US Legal Forms website – probably the most extensive libraries on the web. Here you can find thousands of form samples for organization and personal purposes by types and states, or key phrases. With our advanced search function, getting the most up-to-date Allentown Pennsylvania Individual Credit Application is as easy as 1-2-3. Moreover, the relevance of every record is proved by a team of expert attorneys that regularly review the templates on our website and update them according to the latest state and county demands.

If you already know about our system and have an account, all you need to get the Allentown Pennsylvania Individual Credit Application is to log in to your profile and click the Download option.

If you use US Legal Forms the very first time, just follow the instructions below:

- Make sure you have found the sample you want. Look at its information and utilize the Preview function (if available) to see its content. If it doesn’t meet your needs, utilize the Search option near the top of the screen to get the proper document.

- Affirm your choice. Click the Buy now option. Following that, select the preferred pricing plan and provide credentials to sign up for an account.

- Process the purchase. Use your bank card or PayPal account to complete the registration procedure.

- Get the form. Pick the file format and save it to your system.

- Make modifications. Fill out, modify, print, and sign the obtained Allentown Pennsylvania Individual Credit Application.

Each and every form you save in your profile has no expiration date and is yours permanently. It is possible to access them using the My Forms menu, so if you want to have an additional copy for editing or printing, feel free to return and save it again anytime.

Make use of the US Legal Forms professional catalogue to get access to the Allentown Pennsylvania Individual Credit Application you were seeking and thousands of other professional and state-specific templates on one website!