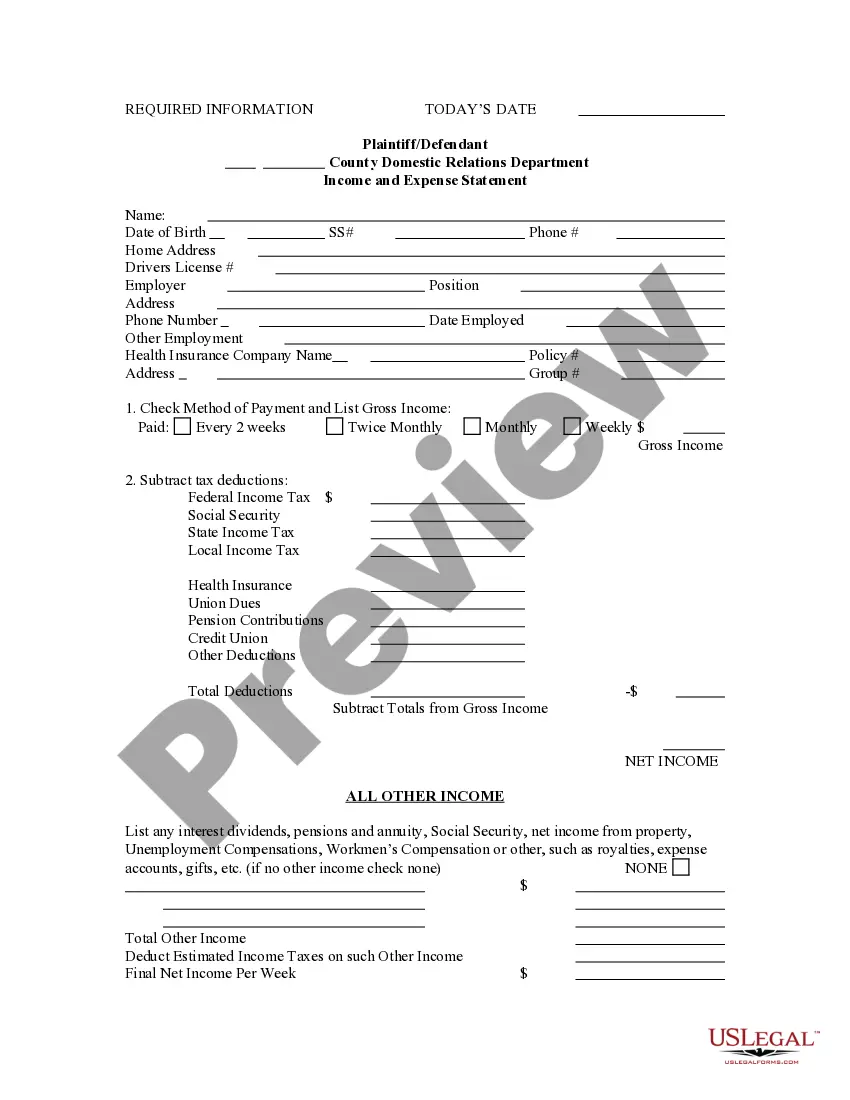

This is an Income and Expense Statement, to be used in causes of action where children are involved. This form provides the Court with basic information regarding employment, health insurance and the income and expenses of the parties.

The Allentown Pennsylvania Income and Expense Statement provides a comprehensive overview of an individual or organization's financial activities within the Allentown area. This statement serves as a reliable source of information, detailing the income earned and expenses incurred during a specific period. It plays a pivotal role in tracking financial performance, evaluating profitability, and making informed decisions regarding financial strategies. Keywords: Allentown Pennsylvania, income and expense statement, financial activities, income earned, expenses incurred, financial performance, profitability, financial strategies. There are various types of Allentown Pennsylvania Income and Expense Statements, each serving specific purposes based on the entity's nature: 1. Personal Income and Expense Statement: This statement focuses on an individual's income and expenses in Allentown, Pennsylvania. It includes sources of income such as salaries, bonuses, rental income, and dividends, along with expenses like housing, transportation, utilities, and entertainment. 2. Business Income and Expense Statement: Designed for businesses operating in Allentown, this statement provides insights into an organization's revenue sources and operational expenses. It highlights sales revenue, cost of goods sold, operating expenses (such as salaries, rent, utilities, and advertising), taxes, and net income. 3. Property Income and Expense Statement: Commonly used by property owners or real estate investors, this statement presents income and expenses associated with properties in Allentown. It covers rental income, property management fees, property taxes, mortgage payments, maintenance costs, and insurance expenses. 4. Nonprofit Income and Expense Statement: Tailored for nonprofit organizations in Allentown, this statement showcases funding sources (e.g., donations, grants, fundraising), program expenses, administrative expenses, fundraising costs, and overall net income or loss. 5. Municipal Income and Expense Statement: Pertaining to the local government entities in Allentown, this statement reveals revenue sources like taxes, fines, fees, and grants. It also outlines expenses related to public services, infrastructure, education, public safety, and administrative costs. Overall, these variations of Allentown Pennsylvania Income and Expense Statements provide critical financial insights, enabling individuals, businesses, and organizations to assess their financial health, make informed decisions, and plan effectively for the future.