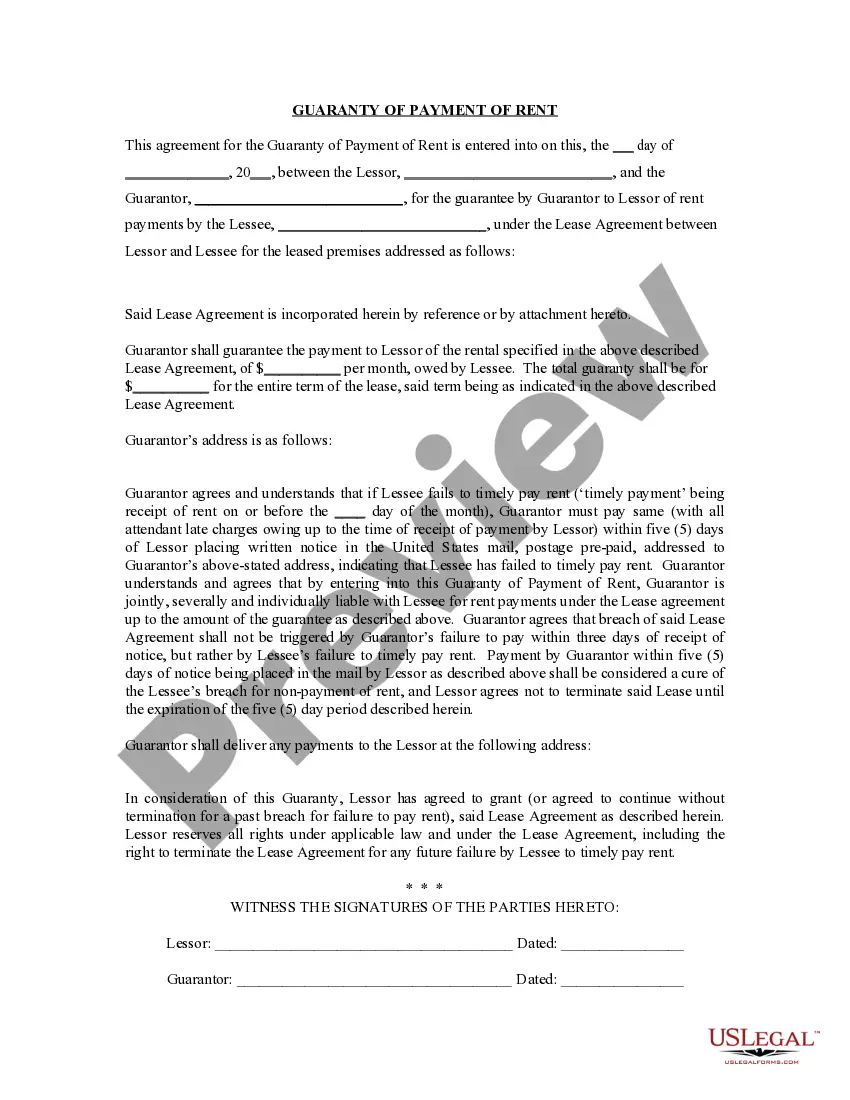

A guaranty is a contract under which one person agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so. Usually, the party receiving the guaranty will first try to collect or obtain performance from the debtor before trying to collect from the one making the guaranty (guarantor). Allegheny Pennsylvania Guaranty or Guarantee of Payment of Rent is a legal contract that provides assurance for the payment of rent in the Allegheny County, Pennsylvania region. Landlords may require tenants to provide a rent guarantee to minimize financial risks associated with non-payment or default on their rental obligations. This guarantee serves as a safeguard to ensure that the landlord will receive the due rent in a timely manner. The primary purpose of Allegheny Pennsylvania Guaranty or Guarantee of Payment of Rent is to protect the landlord's interest and maintain a steady rental income stream. This contract establishes a legally binding agreement between the tenant, guarantor, and the landlord. It stipulates the commitments, rights, and responsibilities of each party involved. There are different types of Allegheny Pennsylvania Guaranty or Guarantee of Payment of Rent, which include: 1. Individual Guaranty: In this type of guarantee, an individual, usually a friend or family member of the tenant, agrees to personally guarantee the payment of rent. The guarantor's assets and creditworthiness may be assessed to determine their ability to fulfill the financial obligations in case the tenant defaults. 2. Corporate Guaranty: This form of guarantee involves a corporation or business entity taking responsibility for the tenant's rent payments. The corporation's financial stability and creditworthiness play a crucial role in determining their eligibility to stand as a guarantor. 3. Letter of Credit: Rather than relying on a person or entity as a guarantor, a letter of credit is a financial instrument issued by a bank or financial institution to guarantee the tenant's rent payment. If the tenant fails to pay, the landlord can draw on the letter of credit to recover the unpaid rent. 4. Cash Security Deposit: While not a traditional guarantee, landlords in Allegheny Pennsylvania may also require tenants to provide a significant cash security deposit. This deposit can be used as an alternative means to cover unpaid rent or any damages caused by the tenant. Landlords in Allegheny Pennsylvania may choose the type of guarantee that best suits their needs and perceived level of risk. Each type offers varying levels of protection and potential consequences in case of default. It is essential for both tenants and guarantors to thoroughly understand the terms and conditions outlined in the Allegheny Pennsylvania Guaranty or Guarantee of Payment of Rent to ensure compliance and avoid any legal complications.

Allegheny Pennsylvania Guaranty or Guarantee of Payment of Rent is a legal contract that provides assurance for the payment of rent in the Allegheny County, Pennsylvania region. Landlords may require tenants to provide a rent guarantee to minimize financial risks associated with non-payment or default on their rental obligations. This guarantee serves as a safeguard to ensure that the landlord will receive the due rent in a timely manner. The primary purpose of Allegheny Pennsylvania Guaranty or Guarantee of Payment of Rent is to protect the landlord's interest and maintain a steady rental income stream. This contract establishes a legally binding agreement between the tenant, guarantor, and the landlord. It stipulates the commitments, rights, and responsibilities of each party involved. There are different types of Allegheny Pennsylvania Guaranty or Guarantee of Payment of Rent, which include: 1. Individual Guaranty: In this type of guarantee, an individual, usually a friend or family member of the tenant, agrees to personally guarantee the payment of rent. The guarantor's assets and creditworthiness may be assessed to determine their ability to fulfill the financial obligations in case the tenant defaults. 2. Corporate Guaranty: This form of guarantee involves a corporation or business entity taking responsibility for the tenant's rent payments. The corporation's financial stability and creditworthiness play a crucial role in determining their eligibility to stand as a guarantor. 3. Letter of Credit: Rather than relying on a person or entity as a guarantor, a letter of credit is a financial instrument issued by a bank or financial institution to guarantee the tenant's rent payment. If the tenant fails to pay, the landlord can draw on the letter of credit to recover the unpaid rent. 4. Cash Security Deposit: While not a traditional guarantee, landlords in Allegheny Pennsylvania may also require tenants to provide a significant cash security deposit. This deposit can be used as an alternative means to cover unpaid rent or any damages caused by the tenant. Landlords in Allegheny Pennsylvania may choose the type of guarantee that best suits their needs and perceived level of risk. Each type offers varying levels of protection and potential consequences in case of default. It is essential for both tenants and guarantors to thoroughly understand the terms and conditions outlined in the Allegheny Pennsylvania Guaranty or Guarantee of Payment of Rent to ensure compliance and avoid any legal complications.