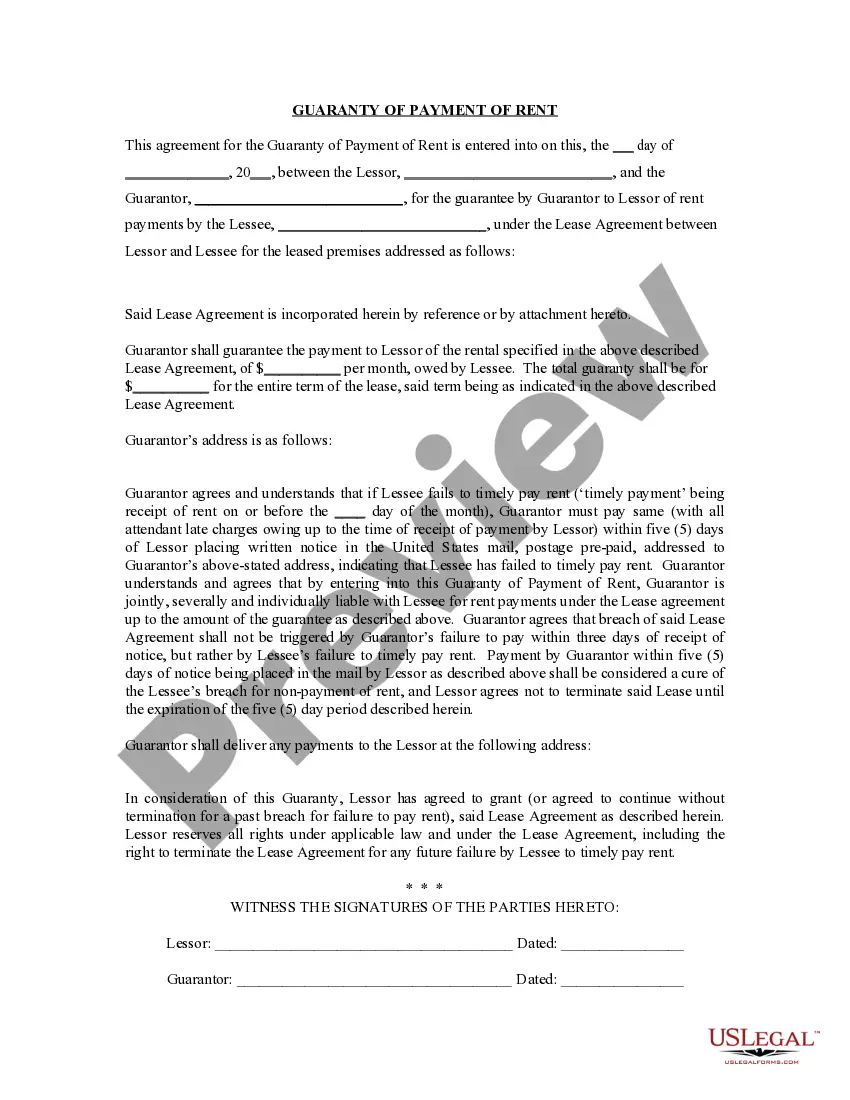

A guaranty is a contract under which one person agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so. Usually, the party receiving the guaranty will first try to collect or obtain performance from the debtor before trying to collect from the one making the guaranty (guarantor).

The Pittsburgh Pennsylvania Guaranty or Guarantee of Payment of Rent is a legal agreement that offers protection to landlords by ensuring the payment of rent even in cases when the tenant defaults. This type of guarantee provides a financial safety net for landlords by holding someone else accountable for the rent payment if the tenant cannot meet their obligations. There are different types of Pittsburgh Pennsylvania Guaranty or Guarantee of Payment of Rent, including: 1. Individual Guarantor: This type of guarantee involves an individual who agrees to be personally responsible for paying the rent if the tenant fails to do so. The individual guarantor usually undergoes a rigorous screening process to evaluate their financial stability and ability to fulfill the obligations. 2. Corporate Guarantor: A corporate guarantor, typically a business entity, guarantees the payment of rent on behalf of the tenant. This type of guarantee is commonly utilized when the tenant is a company or organization and aims to provide extra assurance to the landlord. 3. Parental Guarantor: In some cases, especially when dealing with young adults or students who may not have established credit history or income stability, a parental guarantor steps in. This guarantee involves a parent or guardian who agrees to assume the responsibility of paying the rent if the tenant defaults. The Pittsburgh Pennsylvania Guaranty or Guarantee of Payment of Rent is a legally binding agreement that outlines the obligations and liabilities of the guarantor. It typically includes details such as the duration of the guarantee, the amount of rent covered, and any conditions that may release the guarantor from their responsibilities, such as the tenant fulfilling certain obligations or terminating the lease agreement. Landlords often require a guarantee of payment of rent to minimize financial risks associated with renting their properties. This guarantee acts as a form of insurance, safeguarding landlords against potential loss of income caused by tenants' inability or unwillingness to pay rent. It offers peace of mind and financial security, ensuring a smooth rental experience for landlords in Pittsburgh, Pennsylvania.